Microhospitals: Healthcare's newest patient access point

Last September, The Hospitals of Providence, a leading healthcare provider in El Paso, Texas, broke ground for a new medical campus on 10 acres in suburban Horizon City, 20 miles east of El Paso. There they will build a 40,000-sf “microhospital” to house an emergency department, a laboratory, imaging services, and 10 to 12 inpatient beds. The campus will also have 50,000 sf of office space for physicians and staff.

Learning Objectives: After reading this article, you should be able to:

- DISCUSS the business, marketing, and patient-care rationales behind most healthcare systems’ efforts to develop and build microhospitals.

- DESCRIBE the principal design and construction parameters of the 50+ microhospitals currently operating in the U.S.—square footage, number of inpatient beds, etc.

- LIST at least three patient services offered by most microhospitals in the U.S.

- COMPARE and contrast the key design and service features of microhospitals versus urgent care centers in the U.S.

Microhospitals are acute care facilities that are smaller than the typical acute care hospital. They leave complex surgeries to the big guys, but are larger and provide more comprehensive services than the typical urgent care or outpatient center. They range in size from 10,000 sf to 60,000 sf.

Microhospitals offer the full services of a hospital emergency department and have labs that provide rapid clinical diagnostics and x-ray, CT, and ultrasound imaging. According to healthcare consultant Advisory Board, microhospitals can meet up to 90% of the healthcare needs of the communities they serve. And they never close.

Like urgi-centers and outpatient clinics, microhospitals generally treat patients with low-acuity medical problems. Unlike urgent care and outpatient facilities, they have inpatient beds (typically anywhere from eight to 15) and can support overnight observation of patients who require low-acuity hospital services.

The Horizon City microhospital, which will employ 75 clinical and nonclinical staff when it opens in September, will fill a gap in the availability of hospital-level services for Horizon City (2013 population: 18,997), whose area population has ballooned 180% over the past 16 years. “Initially, we had planned to go with a freestanding ED with imaging functions, but we took a step back and concluded that wouldn’t be enough,” says Sally Hurt-Deitch, Hospitals of Providence’s Market CEO. Hospitals of Providence has plans to open at least two more microhospital facilities.

Microhospitals are the latest twist in “population health,” as healthcare systems search for ways to bring quality care to demographic markets that can’t support full-size hospitals and offer such care closer to where people live and work.

One of the nation's first microhospitals is Baptist Emergency Hospital Thousand Oaks, which opened in San Antonio in 2011. It includes private and semiprivate inpatient beds, lab testing, and imaging services. Photo: ©Michael Johnson.

“The days of us building 200,000-sf hospitals are over,” proclaims Isaac Palmer, CEO of Christus Health. Next fall, Christus will open the first microhospital in Louisiana, a 10,000-sf facility in Shreveport-Bossier with six short-stay inpatient beds. “It’s kind of a souped-up doctor’s office,” says Palmer.

“We’re moving toward microhospitals to enhance our integrated delivery network,” says Laura Hennum, Chief Strategy Officer at Dignity Health. “It’s all about population health and one-stop shopping for consumers.”

At the close of 2016, there were at least 50 microhospitals operating in the U.S., according to Environments for Health (E4H) Architecture, which has designed a dozen of them. Micros are particularly popular in parts of the Midwest and certain western states, notably Arizona, Colorado, Nevada, and Texas. Most of the microhospitals in operation or under construction are located in states that don’t have certificate of need programs aimed at controlling overbuilding of healthcare facilities.

“This is a new concept,” says Chris DiGiusto, Corporate Vice President of Ambulatory Services with Franciscan Alliance, Indianapolis. The 14-hospital system will break ground on a 20,000-sf, $12 million microhospital with 12 emergency exam rooms and eight inpatient beds next month. “It’s like a tiny house: the essentials and nothing else,” he says.

DiGiusto admits that competition entered into Franciscan’s decision to plug a micro into the larger $50 million medical complex it’s building. St. Vincent Health, a 20-hospital system, has announced plans to build eight microhospitals in central Indiana, each with eight beds. DiGiusto says that St. Vincent’s first micro “will be right in Franciscan’s [patient] catchment area.”

CHEAPER AND QUICKER TO BUILD

Hospital admissions have declined in recent years, as patients have chosen to patronize clinics in pharmacies, urgent care centers, freestanding outpatient facilities, ambulatory procedure operations, and independent emergency care centers. Microhospitals have become service bridges between EDs and hospitals, especially in markets that lack convenient patient access to large hospitals.

“Some clients look at micros as an alternative to investing huge amounts of money in larger healthcare facilities,” says Catherine Corbin, Principal and Chicago Health Practice Leader for CannonDesign, which has prepared a tactical report on “Microhospitals: Inpatient Services with Outpatient Convenience.” Corbin says that health systems also see micros as a way of “planting their flag in new communities” and expanding their services outside of urban areas.

Microhospitals have been around for at least a decade, but they’re starting to proliferate. They’re cheaper to build than giant regional hospitals, averaging between $7 million and $35 million in construction costs, with much shorter build times—about 12 to 14 months, according to AEC industry sources.

They can also bill patients at the same rate as acute care hospitals. Their reimbursement from private insurers and Medicare and Medicaid is generally higher than for freestanding EDs or urgent care, outpatient, and freestanding surgical centers.

“For a freestanding ED to get maximum reimbursement, it either needs to be tethered to the mother ship or it has to build its own hospital,” says Rod Booze, AIA, ACHA, NCARB, Principal, E4H Architecture.

Jackson Health System in Miami recently opened a 4,100-sf UHealth Jackson urgent care center, its first, in Country Walk Plaza in southeast Miami-Dade County. The system expects to have at least six urgent cares open in 2017, all cobranded with the University of Miami Health System. Barry Gross Photography.

GOING OUTSIDE THE SYSTEM

So far, most microhospitals have been developed, constructed, and operated by third-party management companies through joint-venture agreements with health systems. They can be pretty secretive about their business models and facility designs.

Embree Asset Group, Georgetown, Texas—whose partners include Indiana’s St. Vincent Health and St. Luke’s Health System, based in Kansas City, Mo.—would not identify AEC firms it has worked with. Texas-based Adeptus Health, which reportedly operates a few micros, wasn’t available for comment.

The clear leader among microhospital management companies is Emerus Holdings, Woodlands, Texas, which was launched in 2006 by a group of emergency-care physicians. At the end of 2016 Emerus was operating 22 micros with more than 1,500 employees for various healthcare systems across the country. Emerus intends to triple its complement of facilities and systems partners and quadruple the number of states in which it operates by 2020.

Emerus’s prototype delivery model can be adapted to meet the needs of specific communities and patient demographic niches, says Dudley Carpenter, the company’s Senior Vice President of Real Estate.

Emerus prefers building from the ground up, typically on three acres; the company finds “little value” in retrofitting existing buildings, he says. The nurses’ stations have been designed to optimize sightlines and accessibility. CT and x-ray rooms emphasize patient comfort. Some of its micros have staffed surgical suites with anesthesia, post-operative care, and pain control capability.

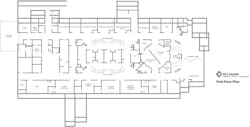

Second Floor: PhiloWilke Partnership designed this micro, which provides emergency medical care, labor and delivery services, inpatient care, and a diverse range of surgical procedures available in two state-of-the-art operating rooms. Among other comprehensive services, the facility offers on-site laboratory and radiology work. SCL was slated to open its fourth micro, in Aurora, Colo., in January. Image: Emerus Holdings.

“The bottom line comes from the square footage,” says Carpenter. “We are a hospital but it’s not a footprint with 100 or more beds. We bring that down to about 20,000 sf.” That also lessens the burden on local communities’ power and water resources, he notes.

The health systems with which Emerus partners are the “established brands” that confer legitimacy to the micros, says Carpenter. Sources at those systems respect Emerus’s track record. “Emerus is an organization that has executed microhospitals successfully,” says Hospitals of Providence’s Hurt-Deitch. “They fit our model.” She explains that micros can support the larger system without requiring the same manpower as a full-scale hospital. In some cases they can actually share staff and professionals with the acute care hospital.

Micros can also be more patient-friendly than other delivery formats. Dignity Health’s Hennum notes that the average admission-to-discharge time for all healthcare facilities in Nevada is 154 minutes; at Emerus-operated facilities, it’s less than half that: 74 minutes.

Franciscan is among the holdouts that have chosen to develop and operate microhospitals on their own. “We couldn’t get the math to work out right” by using a third-party management partner, says DiGiusto. “The margins were too thin.”

DiGiusto also wasn’t overly impressed with other micros he’s looked at. “They’re basically urgent cares open 24 hours a day with CT scanners. We didn’t think they’d meet our quality standards.”

MICROhospital OPPORTUNITIES OPENING UP FOR contractorS

Only a few AEC firms have engaged in microhospital projects. The Building Team on Franciscan’s complex, for example, includes Arc Design (architect and designer), KJWW (MEP), Crossroads Engineering (CE), Mader Design (landscape), and Tonn & Blank (GC).

Emerus has had a long-standing relationship with Houston-based architecture firm PhiloWilke Partnership. The first micro that PhiloWilke designed for Emerus was a retrofit and expansion of an 8,000-sf ED in a strip mall in Sugar Land, Texas. The facility had two inpatient rooms, eight exam rooms, a dietary department, and some imaging capability, all squeezed into 13,000 sf. That was a test run for Emerus’s first official microhospital, which opened in Tomball, Texas, in 2006.

After taking a timeout to refine its prototype and business model, Emerus built five micros in San Antonio in 2010, one of which was a converted 26,000-sf shoe store. Since then, PhiloWilke has developed several microhospital prototypes for Emerus, says Kevin TenBrook, AIA, LEED AP, a Partner at the design firm.

Emerus’s first-generation micros had a footprint of about 20,000 sf with a second floor (and sometimes a third) for office space. There was also a single-story model for tight plots. The second generation is three floors in a 13,000-sf footprint.

TenBrook says his firm’s microhospital designs for Emerus “have as much space for patients as full-size hospitals.” Over the years, PhiloWilke has been able to get construction costs down to 60% of the original prototype. It is now exploring what kind of micro could be built on a half acre.

PhiloWilke’s designs, says TenBrook, fall within the “spirit” of guidelines for hospitals put forth by the Facilities Guidelines Institute, the independent nonprofit that provides guidelines for the design of medical facilities. FGI does not have specific requirements for microhospitals and has yet to address differences between microhospitals and critical access hospitals, says FGI spokesperson Douglas Erickson.

While PhiloWilke has captured the lion’s share of Emerus’s design work, Emerus and its healthcare partners are drawing from a wide pool of contractors for microhospital construction. In Dallas, Baylor Health Care System favors Medco Construction. In San Antonio, Gilbane, Vaughn Construction, and F.A. Nunnelly have built or are building micros for other health systems. S.R. Construction and Martin Harris have been used in Las Vegas, Kiewit Building Group in Colorado, and Anderson Construction in Idaho.

Are micros a SUSTAINABLE TREND, OR just another FLASH IN THE PAN?

TenBrook is convinced that Emerus has created a viable product that “makes sense from an investment point of view.” He points to Baptist Emergency Hospital’s recently opened 38,500-sf micro at Zarzamora, in South San Antonio—once a “healthcare desert,” he claims—that has been handling twice the average patient load than was originally projected. (Depending on the market, microhospitals expect to see anywhere from 30 to 100 patients a day.)

Dignity Health plans to include medical office spaces and wellness centers in its micros and is considering leasing space for physical therapy and ambulatory surgery centers, says Hennum. Dignity will measure three variables—market demand, patient experience, and clinical outcomes—to determine whether its microhospitals are working, to decide if it will build more of them. Hennum says Dignity is looking into opening micros in California.

But healthcare construction trends come and go. It wasn’t too long ago that experts thought there were no limits to the growth of medical office buildings; in many markets, MOBs now seem passé, as patients choose other types of care facilities that fit their medical needs and tight wallets better.

Then there’s the cautionary tale of Adeptus Health, the nation’s largest ED operator, which lost $11.7 million in Q3/2016 and saw its stock price plummet by 88.4% from May 16 to $7.43 on December 22. Is Adeptus’s precipitous decline a signal that its business model, which relies heavily on non-hospital-affiliated emergency departments and on charging patients “facility fees” to cover its overhead, might not be sustainable?

(Emerus Senior Vice President Jason Jisovicz says his company has avoided Adeptus’s financial problems by using in-network services.)

There’s also no consensus about how quickly or broadly microhospitals might spread. Franciscan’s board has given DiGiusto approval to explore replicating the micro model at other Franciscan facilities: “We need to take some pressure off of our hospitals, which are regularly out of beds,” he says. But he doesn’t foresee micros having anywhere near the same growth trajectory of, say, urgent care centers. “You need special circumstances,” he says, especially regarding location: Micros only work in communities that don’t have ready access to a large acute care hospital.

CannonDesign’s Corbin says interest in microhospitals could last another five years, but she also expects states to tighten their reins on what kinds of healthcare facilities they allow. She says some investors already view the investment cycle of micros as being closer to medical office buildings (10–15 years) than full-size acute care hospitals (50 years).

PhiloWilke’s TenBrook says the only thing keeping microhospitals from becoming more mainstream is state regulations that are, in his view, “out of sync with the idea of a small hospital.” To meet one state’s code, he says, his firm had to produce a design template showing four janitors’ closets in every micro, when one or two would have been more than sufficient.

E4H’s Booze says the precariousness of the Affordable Care Act, which spurred healthcare growth over the past five years, makes predicting hazardous. He says one client in the Northeast that he would not name views microhospitals as “a growth instrument in a nongrowth market.”

Booze believes that as long as healthcare providers and private developers see micros as a real estate infill play, some day there could be up to 250 microhospitals dotting America’s countryside.

Editor's Note: This completes the reading for this course. To earn 1.0 AIA CES HSW learning units, study the article carefully and take the exam posted at www.bdcnetwork.com/HealthFacilities2017