TOP ENGINEERING FIRMS

2012 Total Revenue ($)1 Fluor $221,231,2002 Arup $149,738,5873 Affiliated Engineers $105,503,0004 WSP USA $105,362,3525 KPFF Consulting Engineers $91,000,0006 Syska Hennessy Group $82,097,5027 Henderson Engineers $63,485,7758 Smith Seckman Reid $52,919,3129 KJWW Engineering Consultants $51,092,15410 Vanderweil Engineers $50,552,200

TOP ENGINEERING/ARCHITECTURE FIRMS

2012 Total Revenue ($)1 Jacobs Engineering Group $2,715,210,0002 AECOM Technology Corp. $1,610,390,0003 Parsons Brinckerhoff $337,900,0004 URS Corp. $314,266,7575 Buro Happold Consulting Engineers $194,220,0006 Burns & McDonnell $160,645,0007 Thornton Tomasetti $124,575,3938 Science Applications International Corp. $120,249,6869 Merrick & Co. $103,998,00010 SSOE Group $103,708,918

Read BD+C's full Giants 300 Report

Related Stories

| Sep 10, 2014

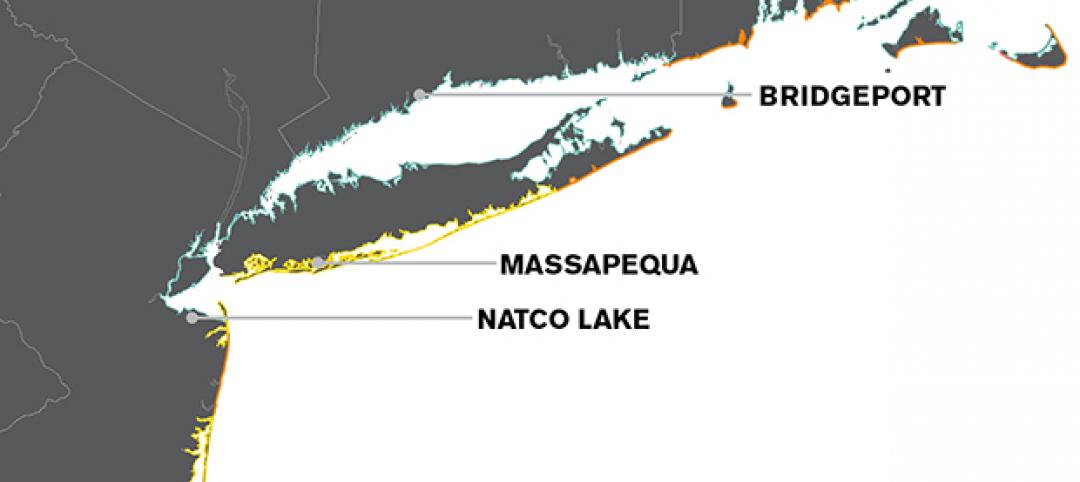

Lessons for the shore: Bolstering resilience of the built environment

Nearly 32 million people, or 28% of the East Coast's population, live in areas lying within a mile of a shore line. The good news is that municipalities are starting to take action, writes Sasaki Associates.

| Sep 9, 2014

Using Facebook to transform workplace design

As part of our ongoing studies of how building design influences human behavior in today’s social media-driven world, HOK’s workplace strategists had an idea: Leverage the power of social media to collect data about how people feel about their workplaces and the type of spaces they need to succeed.

| Sep 9, 2014

Ranked: Top religious sector AEC firms [2014 Giants 300 Report]

Brasfield & Gorrie, Gensler, and Jacobs top BD+C's rankings of the nation's largest religious sector design and construction firms, as reported in the 2014 Giants 300 Report.

| Sep 9, 2014

Take a look at the hardhat of the future

A Los Angeles-based startup added augmented reality technology to a hardhat, creating a smart helmet.

| Sep 9, 2014

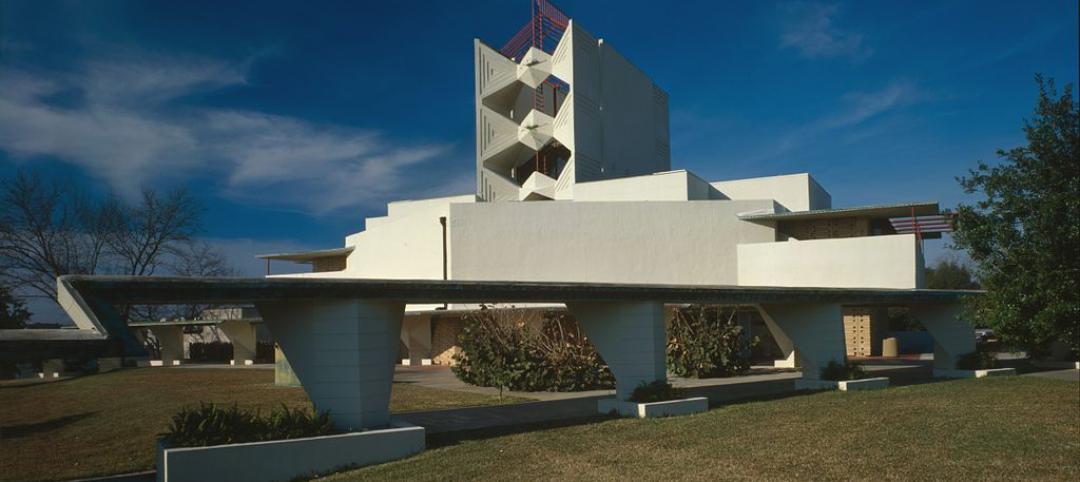

Frank Lloyd Wright's Annie Pfeiffer Chapel brought back to life using 3D printing

Restoration of the Frank Lloyd Wright-designed chapel was made possible (and affordable) thanks to 3D printing.

| Sep 8, 2014

First Look: Foster + Partners, Fernando Romero win competition for Mexico City's newest international airport

Designed to be the world’s most sustainable airport, the plan uses a single, compact terminal scheme in lieu of a cluster of buildings, offering shorter walking distances and fewer level changes, and eliminating the need for trains and tunnels.

| Sep 8, 2014

Trimble acquires Gehry Technologies, aims to create tools for linking office and job site

Trimble and Frank Gehry announced that they have entered into a strategic alliance to collaborate to transform the construction industry by further connecting the office to on-site construction technologies. As part of the alliance, Trimble has acquired Gehry Technologies.

| Sep 7, 2014

Ranked: Top state government sector AEC firms [2014 Giants 300 Report]

PCL Construction, Stantec, and AECOM head BD+C's rankings of the nation's largest state government design and construction firms, as reported in the 2014 Giants 300 Report.

| Sep 7, 2014

Hybrid healthcare: Revamping inefficient inpatient units to revenue-producing outpatient care

It's happening at community hospitals all over America: leadership teams are looking for ways to maintain margins by managing underutilized and non-revenue producing space. GS&P's David Magner explores nontraditional healthcare models.

| Sep 7, 2014

USGBC + American Chemistry Council: Unlikely partners in green building

In this new partnership, LEED will benefit from the materials expertise of ACC and its member companies. We believe this has the potential to be transformational, writes Skanska USA's President and CEO Michael McNally.