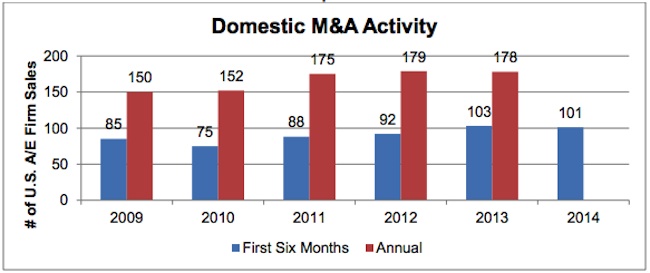

Through the first six months of 2014, Morrissey Goodale tracked 101 sales of U.S.-based architecture and engineering (AE) firms, roughly the same amount as during the first six months of 2013, and putting 2014 on pace for another strong year for domestic AE M&A activity. This positive momentum has continued into the second half of the year with AECOM’s recently announced agreement to acquire URS.

The deal is one of the most significant in the history of the AE space and creates a global firm with more than 95,000 employees. International deals, on the other hand, lagged through the first six months, with just 43 sales of internationally-based AE firms so far in 2014 compared to 54 during the first six months of 2013. Overall, activity remains strong and hot spots for dealmaking are tracking broader positive economic trends in the U.S. and abroad.

Domestic M&A Activity on Pace for Strong 2014

Domestic M&A activity through the first six months of 2014 was generally on pace with the first six months of 2013 (Graph 1, top). The pace of domestic AE industry consolidation, which accelerated coming out of the great recession in 2011 and carried forward into 2013, has remained relatively steady into 2014.

Industry firms appear to remain cautiously optimistic, with deal activity in 2014 on pace to rise to levels similar to 2012 and 2013 by year end. Firms continue to make bets on the positive economic climate in the U.S. The question will be whether this momentum continues into the back half of the year, as firms work to integrate recent acquisitions and continue to assess the U.S. market. With six months to go in the year, we anticipate domestic M&A activity to be in the 180 to 200 deal range.

Texas and California Lead States in M&A Activity

Regionally, Texas led all states in deal activity with 16 Texas-based AE firm sales through June 30, 2014 (Graph 2). Deals in the Lone Star State continue to be driven by a combination of strong economic growth and oil and gas activity. California, a perennial top state for industry dealmaking, followed with 12 firm sales. Colorado, which was among the top states for firm sales in 2013 with 11, saw seven firms based in the state sell so far in 2014. Notable among the top states was Washington, where we only observed one firm sale in all of 2013, and by comparison has produced 6 firm sales so far in 2014.

The U.K. and Canada Lead International Destinations

The United Kingdom and Canada were the top destinations for international firm sales through the first half of 2014 (Graph 3). Australia, New Zealand, and South Africa were also bright spots. With the Eurozone and BRIC countries continuing to face economic challenges, buyers looked to more stable markets for M&A opportunities.

The Megadeal is Back

On the heels of several large deals in the back half of 2013, megadeals continued into the first half of 2014. AE firms continued to seek transformational opportunities to differentiate their businesses. A few of the notable large deals so far in 2014 included:

-

AECOM’s agreement to acquire 50,000-person URS

-

AMEC’s agreement to acquire 14,000-person Foster Wheeler

-

3,000-person Conestoga-Rovers’ merger with 5,500-person GHD

-

Cardno’s acquisition of 760-person PPI Group

-

WSP Group’s acquisition of 1,700-person Focus Group

-

Parsons’ acquisition of 800-person Delcan

It remains to be seen how large scale consolidation will play out as the industry landscape continues to evolve.

Oil & Gas Driving Activity

Oil and gas has been a major driver of AE dealmaking, particularly in the U.S. Industry firms have sought to capitalize on a boom in domestic production and transportation of fossil fuels in places like Texas, Pennsylvania, Ohio, Colorado, and North Dakota. Just a few of the notable oil and gas related deals through June 30th included: Jacobs’ acquisition of Eagleton Engineering, Halff Associates’ acquisition of TriTex Technologies, Zachry’s acquisition of Commonwealth Engineering and Construction, NV5’s acquisition of AK Environmental, and GZA’s acquisition of Laurel Oil and Gas Corp.

One of the largest deals in the space was defense contractor Huntington Ingalls Industries’ acquisition of Universal Pegasus – a play to further diversify into the red hot oil and gas market.

Related Stories

| Oct 12, 2010

Owen Hall, Michigan State University, East Lansing, Mich.

27th Annual Reconstruction Awards—Silver Award. Officials at Michigan State University’s East Lansing Campus were concerned that Owen Hall, a mid-20th-century residence facility, was no longer attracting much interest from its target audience, graduate and international students.

| Oct 12, 2010

Gartner Auditorium, Cleveland Museum of Art

27th Annual Reconstruction Awards—Silver Award. Gartner Auditorium was originally designed by Marcel Breuer and completed, in 1971, as part of his Education Wing at the Cleveland Museum of Art. Despite that lofty provenance, the Gartner was never a perfect music venue.

| Oct 12, 2010

Cell and Genome Sciences Building, Farmington, Conn.

27th Annual Reconstruction Awards—Silver Award. Administrators at the University of Connecticut Health Center in Farmington didn’t think much of the 1970s building they planned to turn into the school’s Cell and Genome Sciences Building. It’s not that the former toxicology research facility was in such terrible shape, but the 117,800-sf structure had almost no windows and its interior was dark and chopped up.

| Oct 12, 2010

The Watch Factory, Waltham, Mass.

27th Annual Reconstruction Awards — Gold Award. When the Boston Watch Company opened its factory in 1854 on the banks of the Charles River in Waltham, Mass., the area was far enough away from the dust, dirt, and grime of Boston to safely assemble delicate watch parts.

| Oct 12, 2010

Cuyahoga County Soldiers’ and Sailors’ Monument, Cleveland, Ohio

27th Annual Reconstruction Awards—Gold Award. The Cuyahoga County Soldiers’ and Sailors’ Monument was dedicated on the Fourth of July, 1894, to honor the memory of the more than 9,000 Cuyahoga County veterans of the Civil War.

| Oct 12, 2010

Building 13 Naval Station, Great Lakes, Ill.

27th Annual Reconstruction Awards—Gold Award. Designed by Chicago architect Jarvis Hunt and constructed in 1903, Building 13 is one of 39 structures within the Great Lakes Historic District at Naval Station Great Lakes, Ill.

| Oct 12, 2010

Full Steam Ahead for Sustainable Power Plant

An innovative restoration turns a historic but inoperable coal-burning steam plant into a modern, energy-efficient marvel at Duke University.

| Oct 12, 2010

From ‘Plain Box’ to Community Asset

The Mid-Ohio Foodbank helps provide 55,000 meals a day to the hungry. Who would guess that it was once a nondescript mattress factory?

| Oct 11, 2010

HGA wins 25-Year Award from AIA Minnesota

HGA Architects and Engineers won a 25-Year Award from AIA Minnesota for the Willow Lake Laboratory.

| Oct 11, 2010

MBMA Releases Fire Resistance Design Guide for metal building systems

The Metal Building Manufacturers Association (MBMA) announces the release of the 2010 Fire Resistance Design Guide for Metal Building Systems. The guide provides building owners, architects, engineers, specifiers, fire marshals, building code officials, contractors, product vendors, builders and metal building manufacturers information on how to effectively meet fire resistance requirements of a project with metal building systems.