Through the first six months of 2014, Morrissey Goodale tracked 101 sales of U.S.-based architecture and engineering (AE) firms, roughly the same amount as during the first six months of 2013, and putting 2014 on pace for another strong year for domestic AE M&A activity. This positive momentum has continued into the second half of the year with AECOM’s recently announced agreement to acquire URS.

The deal is one of the most significant in the history of the AE space and creates a global firm with more than 95,000 employees. International deals, on the other hand, lagged through the first six months, with just 43 sales of internationally-based AE firms so far in 2014 compared to 54 during the first six months of 2013. Overall, activity remains strong and hot spots for dealmaking are tracking broader positive economic trends in the U.S. and abroad.

Domestic M&A Activity on Pace for Strong 2014

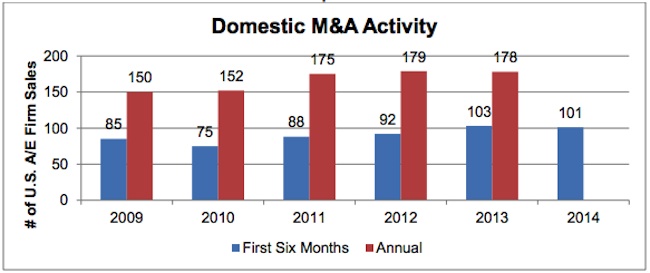

Domestic M&A activity through the first six months of 2014 was generally on pace with the first six months of 2013 (Graph 1, top). The pace of domestic AE industry consolidation, which accelerated coming out of the great recession in 2011 and carried forward into 2013, has remained relatively steady into 2014.

Industry firms appear to remain cautiously optimistic, with deal activity in 2014 on pace to rise to levels similar to 2012 and 2013 by year end. Firms continue to make bets on the positive economic climate in the U.S. The question will be whether this momentum continues into the back half of the year, as firms work to integrate recent acquisitions and continue to assess the U.S. market. With six months to go in the year, we anticipate domestic M&A activity to be in the 180 to 200 deal range.

Texas and California Lead States in M&A Activity

Regionally, Texas led all states in deal activity with 16 Texas-based AE firm sales through June 30, 2014 (Graph 2). Deals in the Lone Star State continue to be driven by a combination of strong economic growth and oil and gas activity. California, a perennial top state for industry dealmaking, followed with 12 firm sales. Colorado, which was among the top states for firm sales in 2013 with 11, saw seven firms based in the state sell so far in 2014. Notable among the top states was Washington, where we only observed one firm sale in all of 2013, and by comparison has produced 6 firm sales so far in 2014.

The U.K. and Canada Lead International Destinations

The United Kingdom and Canada were the top destinations for international firm sales through the first half of 2014 (Graph 3). Australia, New Zealand, and South Africa were also bright spots. With the Eurozone and BRIC countries continuing to face economic challenges, buyers looked to more stable markets for M&A opportunities.

The Megadeal is Back

On the heels of several large deals in the back half of 2013, megadeals continued into the first half of 2014. AE firms continued to seek transformational opportunities to differentiate their businesses. A few of the notable large deals so far in 2014 included:

-

AECOM’s agreement to acquire 50,000-person URS

-

AMEC’s agreement to acquire 14,000-person Foster Wheeler

-

3,000-person Conestoga-Rovers’ merger with 5,500-person GHD

-

Cardno’s acquisition of 760-person PPI Group

-

WSP Group’s acquisition of 1,700-person Focus Group

-

Parsons’ acquisition of 800-person Delcan

It remains to be seen how large scale consolidation will play out as the industry landscape continues to evolve.

Oil & Gas Driving Activity

Oil and gas has been a major driver of AE dealmaking, particularly in the U.S. Industry firms have sought to capitalize on a boom in domestic production and transportation of fossil fuels in places like Texas, Pennsylvania, Ohio, Colorado, and North Dakota. Just a few of the notable oil and gas related deals through June 30th included: Jacobs’ acquisition of Eagleton Engineering, Halff Associates’ acquisition of TriTex Technologies, Zachry’s acquisition of Commonwealth Engineering and Construction, NV5’s acquisition of AK Environmental, and GZA’s acquisition of Laurel Oil and Gas Corp.

One of the largest deals in the space was defense contractor Huntington Ingalls Industries’ acquisition of Universal Pegasus – a play to further diversify into the red hot oil and gas market.

Related Stories

| May 30, 2014

Riding high: L.A., Chicago working on their version of the High Line elevated park

Cities around the U.S. are taking notice of New York's highly popular High Line elevated park system. Both Chicago and Los Angeles are currently working on High Line-like projects.

| May 30, 2014

Developer will convert Dallas' storied LTV Building into mixed-use residential tower

New Orleans-based HRI Properties recently completed the purchase of one of the most storied buildings in downtown Dallas. The developer will convert the LTV Building into a mixed-use complex, with 171 hotel rooms and 186 luxury apartments.

| May 29, 2014

Turn your pen-and-paper sketches into digital drawings in seconds with this nifty gadget [video]

Funded through Kickstarter, iSketchnote uses a smart pen to instantly digitize hand-written notes and drawings.

| May 29, 2014

7 cost-effective ways to make U.S. infrastructure more resilient

Moving critical elements to higher ground and designing for longer lifespans are just some of the ways cities and governments can make infrastructure more resilient to natural disasters and climate change, writes Richard Cavallaro, President of Skanska USA Civil.

| May 29, 2014

Wood advocacy groups release 'lessons learned' report on tall wood buildings

The wood-industry advocacy group reThink Wood has released "Summary Report: Survey of International Tall Wood Buildings," with informatino from 10 mid-rise projects in Europe, Australia, and Canada.

| May 29, 2014

Five finalists, including SOM and Zaha Hadid, chosen in competition for Sweden's tallest skyscraper

In Sernecke's competition to design Sweden's tallest skyscraper, five finalists have been selected: Manuelle Gautrand Architects, Ian Simpson Architects, SOM, Wingårdhs Arkitektkontor, and Zaha Hadid Architects.

| May 29, 2014

Retail renovation trends: Omni-channel shopping, personalized experiences among top goals of new store designs

In pursuit of enhanced customer experiences, retailers are using Big Data, interactive technology, and omni-channel shopping to transform their bricks and mortar locations.

| May 28, 2014

Video Blog: How today’s construction firms are bridging the BIM gap

Turner Construction and Parsons Brinckerhoff talk about how BIM has revolutionized the way that they conduct projects, and how technology has allowed them to leverage collaboration in such a way that they can work with decentralized teams.

| May 28, 2014

KPF's dual towers in Turkey will incorporate motifs, symbols of Ottoman Empire

The two-building headquarters for Turkey’s largest and oldest financial institution, Ziraat Bank, is inspired by the country’s cultural heritage.

| May 28, 2014

B.R. Fries completes medical center focused on male health

Occupying the building’s entire second floor, the male-centric center is honeycombed with examination and consultation rooms, as well as areas for noninvasive testing.