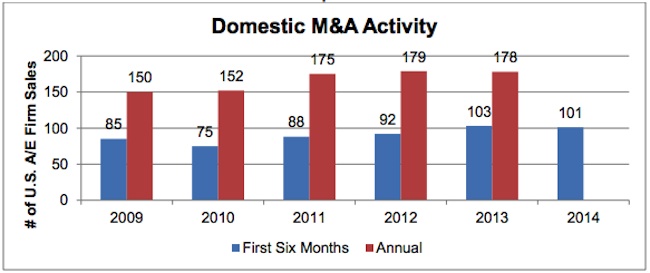

Through the first six months of 2014, Morrissey Goodale tracked 101 sales of U.S.-based architecture and engineering (AE) firms, roughly the same amount as during the first six months of 2013, and putting 2014 on pace for another strong year for domestic AE M&A activity. This positive momentum has continued into the second half of the year with AECOM’s recently announced agreement to acquire URS.

The deal is one of the most significant in the history of the AE space and creates a global firm with more than 95,000 employees. International deals, on the other hand, lagged through the first six months, with just 43 sales of internationally-based AE firms so far in 2014 compared to 54 during the first six months of 2013. Overall, activity remains strong and hot spots for dealmaking are tracking broader positive economic trends in the U.S. and abroad.

Domestic M&A Activity on Pace for Strong 2014

Domestic M&A activity through the first six months of 2014 was generally on pace with the first six months of 2013 (Graph 1, top). The pace of domestic AE industry consolidation, which accelerated coming out of the great recession in 2011 and carried forward into 2013, has remained relatively steady into 2014.

Industry firms appear to remain cautiously optimistic, with deal activity in 2014 on pace to rise to levels similar to 2012 and 2013 by year end. Firms continue to make bets on the positive economic climate in the U.S. The question will be whether this momentum continues into the back half of the year, as firms work to integrate recent acquisitions and continue to assess the U.S. market. With six months to go in the year, we anticipate domestic M&A activity to be in the 180 to 200 deal range.

Texas and California Lead States in M&A Activity

Regionally, Texas led all states in deal activity with 16 Texas-based AE firm sales through June 30, 2014 (Graph 2). Deals in the Lone Star State continue to be driven by a combination of strong economic growth and oil and gas activity. California, a perennial top state for industry dealmaking, followed with 12 firm sales. Colorado, which was among the top states for firm sales in 2013 with 11, saw seven firms based in the state sell so far in 2014. Notable among the top states was Washington, where we only observed one firm sale in all of 2013, and by comparison has produced 6 firm sales so far in 2014.

The U.K. and Canada Lead International Destinations

The United Kingdom and Canada were the top destinations for international firm sales through the first half of 2014 (Graph 3). Australia, New Zealand, and South Africa were also bright spots. With the Eurozone and BRIC countries continuing to face economic challenges, buyers looked to more stable markets for M&A opportunities.

The Megadeal is Back

On the heels of several large deals in the back half of 2013, megadeals continued into the first half of 2014. AE firms continued to seek transformational opportunities to differentiate their businesses. A few of the notable large deals so far in 2014 included:

-

AECOM’s agreement to acquire 50,000-person URS

-

AMEC’s agreement to acquire 14,000-person Foster Wheeler

-

3,000-person Conestoga-Rovers’ merger with 5,500-person GHD

-

Cardno’s acquisition of 760-person PPI Group

-

WSP Group’s acquisition of 1,700-person Focus Group

-

Parsons’ acquisition of 800-person Delcan

It remains to be seen how large scale consolidation will play out as the industry landscape continues to evolve.

Oil & Gas Driving Activity

Oil and gas has been a major driver of AE dealmaking, particularly in the U.S. Industry firms have sought to capitalize on a boom in domestic production and transportation of fossil fuels in places like Texas, Pennsylvania, Ohio, Colorado, and North Dakota. Just a few of the notable oil and gas related deals through June 30th included: Jacobs’ acquisition of Eagleton Engineering, Halff Associates’ acquisition of TriTex Technologies, Zachry’s acquisition of Commonwealth Engineering and Construction, NV5’s acquisition of AK Environmental, and GZA’s acquisition of Laurel Oil and Gas Corp.

One of the largest deals in the space was defense contractor Huntington Ingalls Industries’ acquisition of Universal Pegasus – a play to further diversify into the red hot oil and gas market.

Related Stories

Multifamily Housing | Jan 31, 2015

Production builders are still shying away from rental housing

Toll Brothers, Lennar, and Trumark are among a small group of production builders to engage in construction for rental customers.

Architects | Jan 30, 2015

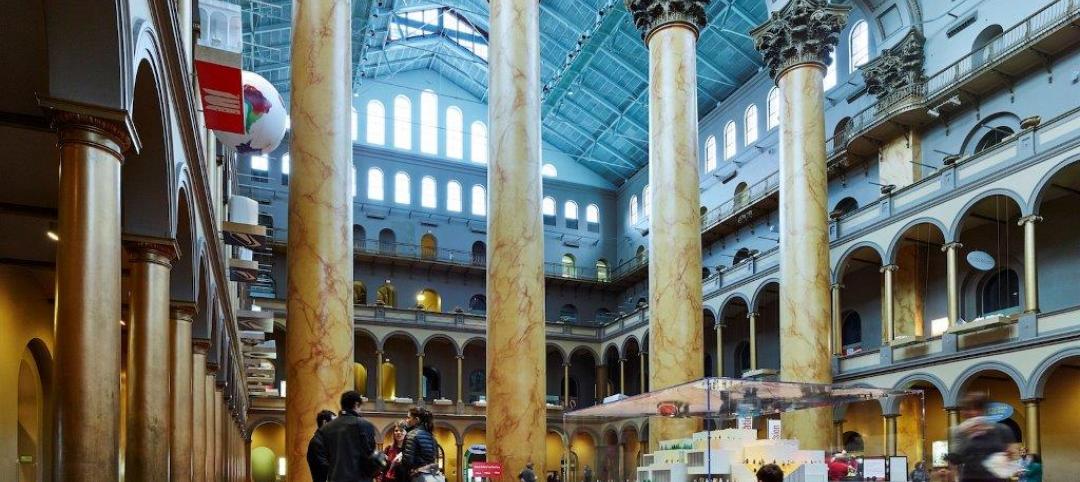

Exhibit captures 60 of Bjarke Ingels' projects — from hottest to coldest places on Earth

The Hot to Cold exhibit encompasses 60 of BIG’s recent projects captured by Iwan Baan´s masterful photography.

BIM and Information Technology | Jan 29, 2015

Lego X by Gravity elevates the toy to a digital modeling kit

With the Lego X system, users can transfer the forms they’ve created with legos into real-time digital files.

Energy Efficiency | Jan 28, 2015

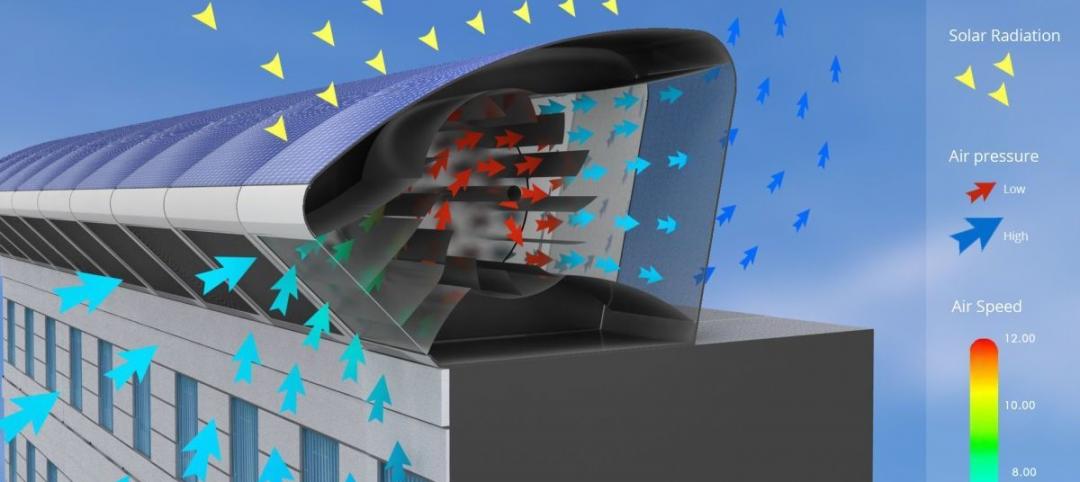

An urban wind and solar energy system that may actually work

The system was designed to take advantage of a building's air flow and generate energy even if its in the middle of a city.

Multifamily Housing | Jan 27, 2015

Multifamily construction, focused on rentals, expected to slow in the coming years

New-home purchases, which recovered strongly in 2014, indicate that homeownership might finally be making a comeback.

Office Buildings | Jan 27, 2015

London plans to build Foggo Associates' 'can of ham' building

The much delayed high-rise development at London’s 60-70 St. Mary Axe resembles a can of ham, and the project's architects are embracing the playful sobriquet.

Multifamily Housing | Jan 22, 2015

Sales of apartment buildings hit record high in 2014

Investors bet big time on demand for rental properties over homeownership in 2014, when sales of apartment buildings hit a record $110.1 billion, or nearly 15% higher than the previous year.

| Jan 22, 2015

Architecture Billings Index rebounds at end of 2014

The American Institute of Architects reported the December ABI score was 52.2, up from a mark of 50.9 in November. This score reflects an increase in design activity.

| Jan 21, 2015

From technician to rainmaker: Making the leap in your career

Many AEC firms focus on training for the hard skills of the profession, not so much for business prowess, writes BD+C's David Barista.

Modular Building | Jan 21, 2015

Chinese company 3D prints six-story multifamily building

The building components were prefabricated piece by piece using a printer that is 7 meters tall, 10 meters wide, and 40 meters long.