Through the first six months of 2014, Morrissey Goodale tracked 101 sales of U.S.-based architecture and engineering (AE) firms, roughly the same amount as during the first six months of 2013, and putting 2014 on pace for another strong year for domestic AE M&A activity. This positive momentum has continued into the second half of the year with AECOM’s recently announced agreement to acquire URS.

The deal is one of the most significant in the history of the AE space and creates a global firm with more than 95,000 employees. International deals, on the other hand, lagged through the first six months, with just 43 sales of internationally-based AE firms so far in 2014 compared to 54 during the first six months of 2013. Overall, activity remains strong and hot spots for dealmaking are tracking broader positive economic trends in the U.S. and abroad.

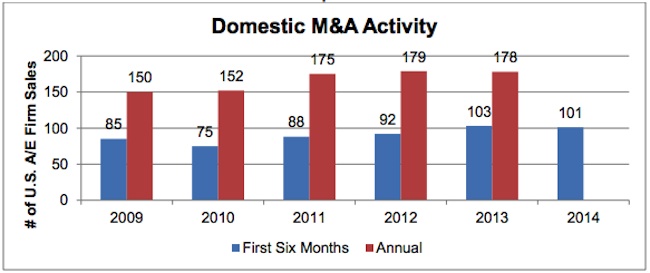

Domestic M&A Activity on Pace for Strong 2014

Domestic M&A activity through the first six months of 2014 was generally on pace with the first six months of 2013 (Graph 1, top). The pace of domestic AE industry consolidation, which accelerated coming out of the great recession in 2011 and carried forward into 2013, has remained relatively steady into 2014.

Industry firms appear to remain cautiously optimistic, with deal activity in 2014 on pace to rise to levels similar to 2012 and 2013 by year end. Firms continue to make bets on the positive economic climate in the U.S. The question will be whether this momentum continues into the back half of the year, as firms work to integrate recent acquisitions and continue to assess the U.S. market. With six months to go in the year, we anticipate domestic M&A activity to be in the 180 to 200 deal range.

Texas and California Lead States in M&A Activity

Regionally, Texas led all states in deal activity with 16 Texas-based AE firm sales through June 30, 2014 (Graph 2). Deals in the Lone Star State continue to be driven by a combination of strong economic growth and oil and gas activity. California, a perennial top state for industry dealmaking, followed with 12 firm sales. Colorado, which was among the top states for firm sales in 2013 with 11, saw seven firms based in the state sell so far in 2014. Notable among the top states was Washington, where we only observed one firm sale in all of 2013, and by comparison has produced 6 firm sales so far in 2014.

The U.K. and Canada Lead International Destinations

The United Kingdom and Canada were the top destinations for international firm sales through the first half of 2014 (Graph 3). Australia, New Zealand, and South Africa were also bright spots. With the Eurozone and BRIC countries continuing to face economic challenges, buyers looked to more stable markets for M&A opportunities.

The Megadeal is Back

On the heels of several large deals in the back half of 2013, megadeals continued into the first half of 2014. AE firms continued to seek transformational opportunities to differentiate their businesses. A few of the notable large deals so far in 2014 included:

-

AECOM’s agreement to acquire 50,000-person URS

-

AMEC’s agreement to acquire 14,000-person Foster Wheeler

-

3,000-person Conestoga-Rovers’ merger with 5,500-person GHD

-

Cardno’s acquisition of 760-person PPI Group

-

WSP Group’s acquisition of 1,700-person Focus Group

-

Parsons’ acquisition of 800-person Delcan

It remains to be seen how large scale consolidation will play out as the industry landscape continues to evolve.

Oil & Gas Driving Activity

Oil and gas has been a major driver of AE dealmaking, particularly in the U.S. Industry firms have sought to capitalize on a boom in domestic production and transportation of fossil fuels in places like Texas, Pennsylvania, Ohio, Colorado, and North Dakota. Just a few of the notable oil and gas related deals through June 30th included: Jacobs’ acquisition of Eagleton Engineering, Halff Associates’ acquisition of TriTex Technologies, Zachry’s acquisition of Commonwealth Engineering and Construction, NV5’s acquisition of AK Environmental, and GZA’s acquisition of Laurel Oil and Gas Corp.

One of the largest deals in the space was defense contractor Huntington Ingalls Industries’ acquisition of Universal Pegasus – a play to further diversify into the red hot oil and gas market.

Related Stories

Arenas | Jul 15, 2022

U. of Oregon renovation aims for ‘finest track and field facility in the world’

The renovation of the University of Oregon’s Hayward Field had the goal of creating the “finest track and field facility in the world.”

Building Team | Jul 14, 2022

ABC’s construction backlog inches lower in June; Contractor confidence falters

Associated Builders and Contractors reports today that its Construction Backlog Indicator fell 0.1 months in June and stands at 8.9 months, according to an ABC member survey conducted June 21 to July 5.

Sustainable Development | Jul 14, 2022

Designing for climate change and inclusion, with CBT Architects' Kishore Varanasi and Devanshi Purohit

Climate change is having a dramatic impact on urban design, in terms of planning, materials, occupant use, location, and the long-term effect of buildings on the environment. Joining BD+C's John Caulfield to discuss this topic are two experts from the Boston-based CBT Architects: Kishore Varanasi, a Principal and director of urban design; and Devanshi Purohit, an Associate Principal.

Multifamily Housing | Jul 14, 2022

Multifamily rents rise again in June, Yardi Matrix reports

Average U.S. multifamily rents rose another $19 in June to edge over $1,700 for the first time ever, according to the latest Yardi® Matrix Multifamily Report.

Building Team | Jul 14, 2022

Austin PBS gets a new state-of-the-art facility with three studios

Since the 1970s, Austin PBS, birthplace of the Austin City Limits TV series, has been based inside the communications building on the University of Texas campus—a space it has long outgrown.

Building Team | Jul 13, 2022

The YIMBY movement emerges as valuable advocate for affordable housing

Over the past few decades, developers grew accustomed to nothing but staunch opposition to dense affordable housing project proposals.

Energy | Jul 13, 2022

Electrification of buildings, new and old, furthers environmental responsibility and equity

It’s almost a cliché in our industry, but nonetheless: The greenest building is the one that is already built.

Building Team | Jul 13, 2022

Austin’s newest entertainment and hospitality complex has been made from repurposed shipping containers

A new entertainment and hospitality complex in Austin, The Pitch, has been made out of repurposed shipping containers.

Codes and Standards | Jul 12, 2022

USGBC sets out principles for LEED’s future

The U.S. Green Building Council recently published a report containing principles outlining how LEED will evolve.

Building Team | Jul 12, 2022

10 resource reduction measures for more efficient and sustainable biopharma facilities

Resource reduction measures are solutions that can lead to lifecycle energy and cost savings for a favorable return on investment while simultaneously improving resiliency and promoting health and wellness in your facility.