The impact of large, transformational deals by integrated engineers and constructors (E&C) last year will spur continued M&A activity this year, as the largest firms use acquisitions to drive growth and enter new markets, according to the latest edition of FMI’s Mergers & Acquisitions Trends.

“Large, transformational deals highlighted robust M&A activity in the E&C industry in 2014,” said Chris Daum, Senior Managing Director and Head of Investment Banking at FMI. “While there may not be as many marquee transactions thus far in 2015, M&A activity remains very high, particularly among the largest U.S. and international firms that continue to pursue acquisitions as a conduit for growth and margin expansion.”

Large, integrated E&C firms remain acquisitive in 2015 as they look to expand beyond their current maturing markets. Competition among buyers for quality firms of size in attractive growth markets is leading to favorable valuations for sellers. One material challenge that exists for buyers has been the limited number of willing sellers that are of sufficient size to be attractive—e.g., heavy civil contracting firms above $200 million and utility T&D or multi-trade industrial firms above $100 million in value.

Persistent themes in 2015

Persistent themes are shaping broader trends within the industry:

• 2014 was notable for several “mega-deals” in the E&C industry, with three deals accounting for more than $11 billion in transaction value alone. Several multibillion-dollar transactions, including AECOM’s acquisition of URS, SNC-Lavalin’s acquisition of Kentz and the merger of AMEC and Foster Wheeler, reflected the continuing convergence of engineering and construction, the pursuit of global scale by large firms and competition for “mega-projects,” which continue to proliferate.

• Firms tied to public spending remain in a “holding pattern” until spending returns to normalized levels. Most of the new construction currently taking place is in the private sector due to a lack of public spending on infrastructure, and buyers have shifted their appetites toward companies servicing the more active private sectors. Potential sellers who are heavily tied to the public sector may attract limited buyer interest until the outlook for public infrastructure spending improves.

• Interest from strategic buyers exceeds the number of quality, motivated sellers in several industry sectors, driven in part by strong interest from international buyers. The US is the most attractive growth market for international firms faced with flat or declining business in their home markets. International buyers are most interested in national or large regional general contractors, heavy civil contractors, or large specialty firms focused on power, energy and industrial infrastructure.

Varied activity by sector

The carryover of robust M&A activity from 2014 in the E&C industry is most notable among firms involved in the design, construction or maintenance of power, energy, utility and industrial infrastructure. However, building products, energy services and cleantech and specialty contractors with large service and maintenance operations continue to see increased buyer interest.

In Oil & Gas, many private equity firms pulled back from pending upstream and midstream deals in the second half of 2014. The sustained decline in the price of oil is expected to fuel an increase in distressed sales, a decline in valuation multiples and a re-emergence of strategic buyers in 2015. Those financial buyers who remain active in the market are focused on acquiring quality assets at steep discounts. The industrial sector, meanwhile, is growing faster than the overall construction market. For that reason, we expect M&A activity for industrial trade contractors to increase over the next few years. The surge in industrial projects is due to the recent availability of low natural gas prices. This has driven both new and renovation projects, spurring some contractors to look to M&A as a potential solution.

Robust international activity

Many international buyers, meanwhile, who have historically focused on traditional construction firms, are beginning to shift their attention to integrated E&C firms. Many buyers believe the integrated model provides a significant entry point into the U.S. market for firms looking to make their initial acquisition. In addition, international buyers continue to see the U.S. as an opportunity for Public-Private Partnerships (P3) projects, and an integrated platform can provide earlier access to the development of revenue-generating projects.

“While 2015 may not match the level of activity seen in 2014, M&A remains a focal point of strategy for many large domestic E&C firms,” said Daum. “Coupling that with the increased interest from international buyers should allow for a continued robust M&A market in 2015.”

FMI’s Mergers & Acquisitions Trends report can be accessed here.

Related Stories

| Jan 10, 2014

Special Report: K-12 school security in the wake of Sandy Hook

BD+C's exclusive five-part report on K-12 school security offers proven design advice, technology recommendations, and thoughtful commentary on how Building Teams can help school districts prevent, or at least mitigate, a Sandy Hook on their turf.

| Jan 10, 2014

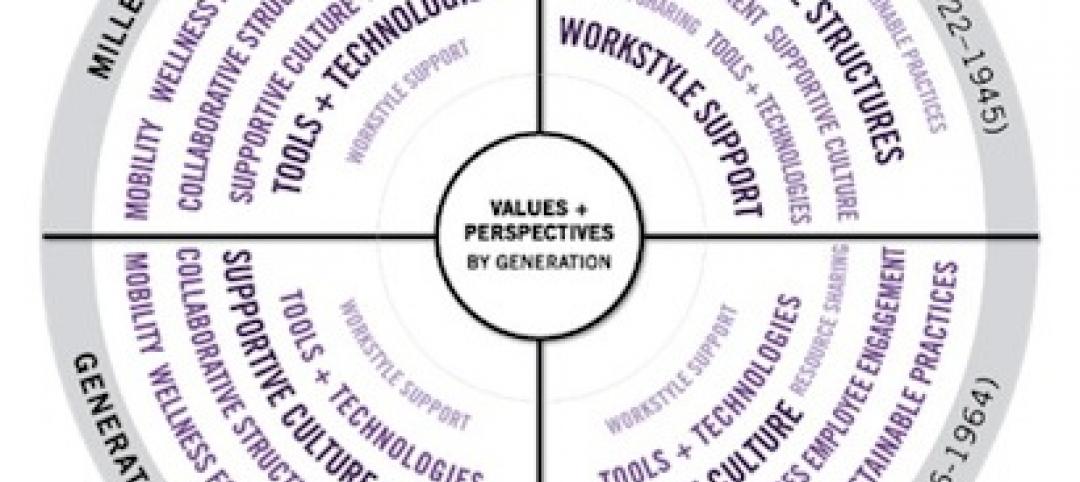

Resiliency, material health among top AEC focuses for 2014: Perkins+Will survey

Architectural giant Perkins+Will recently surveyed its staff of 1,500 design pros to forcast hot trends in the AEC field for 2014. The resulting Design + Insights Survey reflects a global perspective.

| Jan 9, 2014

How security in schools applies to other building types

Many of the principles and concepts described in our Special Report on K-12 security also apply to other building types and markets.

| Jan 9, 2014

16 recommendations on security technology to take to your K-12 clients

From facial recognition cameras to IP-based door hardware, here are key technology-related considerations you should discuss with your school district clients.

| Jan 8, 2014

Architect sentenced to a year in jail for firefighter's death

Architect Gerhard Becker was sentenced to a year in LA county jail after pleading no contest to the manslaughter of a firefighter who died while trying to contain a fire in a home the architect had designed for himself.

| Jan 7, 2014

Concrete solutions: 9 innovations for a construction essential

BD+C editors offer a roundup of new products and case studies that represent the latest breakthroughs in concrete technology.

| Jan 6, 2014

What is value engineering?

If you had to define value engineering in a single word, you might boil it down to "efficiency." That would be one word, but it wouldn’t be accurate.

| Jan 6, 2014

Green Building Initiative names Jerry Yudelson as new President

The Green Building Initiative announced today that it has named Jerry Yudelson as its president to accelerate growth of the non-profit and further leverage its green building assessment tools, including the highly recognized Green Globes rating system.

| Jan 6, 2014

An interview with Jerry Yudelson, President, The Green Building Initiative

Green building consultant Jerry Yudelson has been named President of the Green Building Initiative and the Green Globes rating program. BD+C's Robert Cassidy talks with Yudelson about his appointment and the future of Green Globes.

| Jan 3, 2014

Norman Foster proposes elevated bikeways throughout London

Called SkyCycle, the plan calls for the construction of wide, car-free decks atop the city's existing railway corridors.