Merger and acquisition (M&A) activity showed strength in the global engineering and construction industry during the third quarter of 2011, driven by sustained strategic investor activity and the return of financial investors to the market, especially in the mega deals arena, according to Engineering growth, a quarterly analysis of M&A activity in the global engineering and construction industry by PwC US.

“Strategic investors continued to dominate deal volume in the third quarter of 2011, but we also saw financial investors make a strong comeback to lead mega deal activity. Three of the five mega deals had targets in the engineering segment, suggesting an increasing attractiveness in this area, which could indicate growth in the construction segment, as the two sectors are closely-related,” said H. Kent Goetjen, U.S. engineering and construction leader with PwC. “The strength in M&A activity shows that despite financial uncertainty in global markets, engineering and construction companies with solid balance sheets have opportunities to capitalize on good growth prospects in emerging markets.”

In the third quarter of 2011, there were 44 announced deals worth $50 million or more, totaling $18.5 billion, compared to 38 transactions with $14.3 billion in the same period of 2010. Five mega deals, or transactions worth more than $1 billion, accounted for more than $10.3 billion and 55 percent of overall third quarter M&A value. Average deal value remained unchanged at $400 million.

According to PwC, strategic investors represented 61 percent of overall third quarter engineering and construction deal volume, as companies took advantage of strong balance sheets to explore growth opportunities through acquisitions. Meanwhile, financial investors also continued their slow, but steady return, contributing the remaining 39 percent of deals, including all five mega deals. “Increasing activity suggests that financial investors are starting to see value in the current market and view the engineering and construction sector favorably,” added Goetjen.

Targets and acquirers in the Asia and Oceania region continued to be a major driver for engineering and construction deal activity in the third quarter of 2011, representing 24 transactions worth $8.1 billion. “Expectations for greater growth rates, more stable economic performance, and increasingly stronger corporate balance sheets of companies in the Asia and Oceania countries suggest that M&A activity in the region should continue to grow in the quarters to come,” noted Jonathan Hook, global engineering and construction leader at PwC.

Despite an increase in cross-border transactions due to a resurging interest in globalization, global domestic deals continued to generate the most activity in the third quarter of 2011, representing 54 percent of all deals. China was the most active country overall, with six cross-border and four domestic deals, while Malaysia also surfaced as a major player, generating three domestic deals.

“The financial strengthening of companies in China and Malaysia, along with their understanding of the local business environment and greater growth opportunities are likely to continue driving domestic transactions in these emerging markets,” said Hook. “However, despite a spike in deal volume, acquiring local companies in China has not become easier as regulations dictate government approval of deals and the majority of private Chinese enterprises are of a relatively small and young nature.”

Dealmakers in North America and the U.K. and Eurozone region increased contribution to engineering and construction M&A activity in the third quarter of 2011. According to PwC, as these developed markets’ economies continue to recover, the volume and value of future deals in these regions should increase incrementally.

The materials manufacturing segment sustained its leading position in the third quarter of 2011, making up 25 percent of deal activity, followed by the construction segment with 18 percent. Civil engineering also experienced strong and consistent growth, contributing 18 percent of deal activity and the three largest mega deals for the third quarter of 2011. BD+C

Related Stories

Giants 400 | Nov 14, 2022

Top 55 Airport Terminal Architecture + AE Firms for 2022

Gensler, PGAL, Corgan, and HOK top the ranking of the nation's largest airport terminal architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Nov 14, 2022

4 emerging trends from BD+C's 2022 Giants 400 Report

Regenerative design, cognitive health, and jobsite robotics highlight the top trends from the 519 design and construction firms that participated in BD+C's 2022 Giants 400 Report.

Green | Nov 13, 2022

NREL report: Using photovoltaic modules with longer lifetimes is a better option than recycling

A new report from the U.S. National Renewable Energy Laboratory (NREL) says PV module lifetime extensions should be prioritized over closed-loop recycling to reduce demand for new materials.

Green | Nov 13, 2022

Global building emissions reached record levels in 2021

Carbon-dioxide emissions from building construction and operations hit an all-time high in 2021, according to the most recent data compiled by the Global Alliance for Buildings and Construction.

University Buildings | Nov 13, 2022

University of Washington opens mass timber business school building

Founders Hall at the University of Washington Foster School of Business, the first mass timber building at Seattle campus of Univ. of Washington, was recently completed. The 84,800-sf building creates a new hub for community, entrepreneurship, and innovation, according the project’s design architect LMN Architects.

Architects | Nov 10, 2022

What’s new at 173 architecture firms for 2022

More than 295 U.S. architecture and architecture-engineering (AE) firms participated in BD+C's 2022 Giants 400 survey. As part of the Giants survey process, participating firms are asked to describe their most impactful firm innovations and noteworthy company moves in the past 12 months. Here is a collection of the most compelling business and project innovations and business moves from the 2022 Architecture Giants.

Giants 400 | Nov 9, 2022

Top 30 Data Center Architecture + AE Firms for 2022

HDR, Corgan, Sheehan Nagle Hartray Architects, and Gensler top the ranking of the nation's largest data center architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Nov 8, 2022

Top 110 Sports Facility Architecture and AE Firms for 2022

Populous, HOK, Gensler, and Perkins and Will top the ranking of the nation's largest sports facility architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Industry Research | Nov 8, 2022

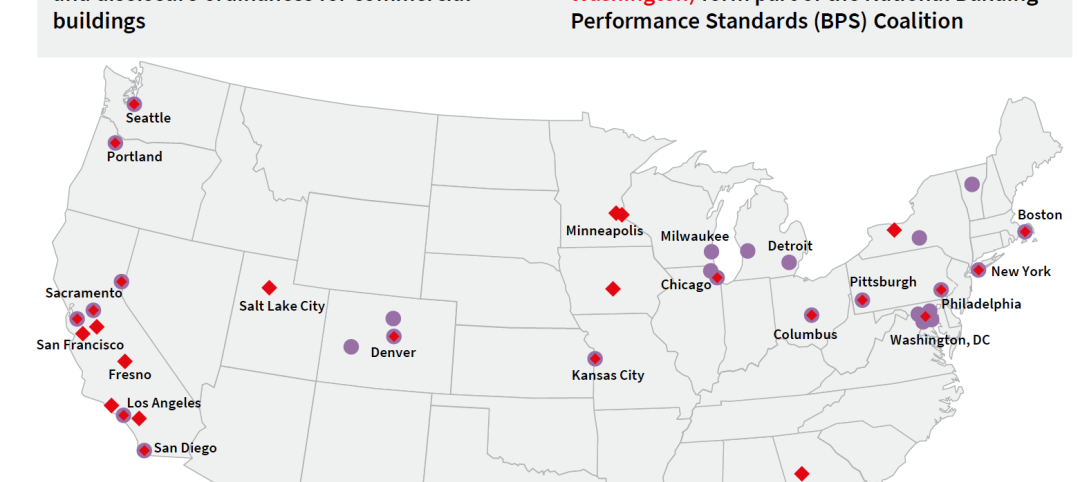

U.S. metros take the lead in decarbonizing their built environments

A new JLL report evaluates the goals and actions of 18 cities.

Hotel Facilities | Nov 8, 2022

6 hotel design trends for 2022-2023

Personalization of the hotel guest experience shapes new construction and renovation, say architects and construction experts in this sector.