Merger and acquisition (M&A) activity showed strength in the global engineering and construction industry during the third quarter of 2011, driven by sustained strategic investor activity and the return of financial investors to the market, especially in the mega deals arena, according to Engineering growth, a quarterly analysis of M&A activity in the global engineering and construction industry by PwC US.

“Strategic investors continued to dominate deal volume in the third quarter of 2011, but we also saw financial investors make a strong comeback to lead mega deal activity. Three of the five mega deals had targets in the engineering segment, suggesting an increasing attractiveness in this area, which could indicate growth in the construction segment, as the two sectors are closely-related,” said H. Kent Goetjen, U.S. engineering and construction leader with PwC. “The strength in M&A activity shows that despite financial uncertainty in global markets, engineering and construction companies with solid balance sheets have opportunities to capitalize on good growth prospects in emerging markets.”

In the third quarter of 2011, there were 44 announced deals worth $50 million or more, totaling $18.5 billion, compared to 38 transactions with $14.3 billion in the same period of 2010. Five mega deals, or transactions worth more than $1 billion, accounted for more than $10.3 billion and 55 percent of overall third quarter M&A value. Average deal value remained unchanged at $400 million.

According to PwC, strategic investors represented 61 percent of overall third quarter engineering and construction deal volume, as companies took advantage of strong balance sheets to explore growth opportunities through acquisitions. Meanwhile, financial investors also continued their slow, but steady return, contributing the remaining 39 percent of deals, including all five mega deals. “Increasing activity suggests that financial investors are starting to see value in the current market and view the engineering and construction sector favorably,” added Goetjen.

Targets and acquirers in the Asia and Oceania region continued to be a major driver for engineering and construction deal activity in the third quarter of 2011, representing 24 transactions worth $8.1 billion. “Expectations for greater growth rates, more stable economic performance, and increasingly stronger corporate balance sheets of companies in the Asia and Oceania countries suggest that M&A activity in the region should continue to grow in the quarters to come,” noted Jonathan Hook, global engineering and construction leader at PwC.

Despite an increase in cross-border transactions due to a resurging interest in globalization, global domestic deals continued to generate the most activity in the third quarter of 2011, representing 54 percent of all deals. China was the most active country overall, with six cross-border and four domestic deals, while Malaysia also surfaced as a major player, generating three domestic deals.

“The financial strengthening of companies in China and Malaysia, along with their understanding of the local business environment and greater growth opportunities are likely to continue driving domestic transactions in these emerging markets,” said Hook. “However, despite a spike in deal volume, acquiring local companies in China has not become easier as regulations dictate government approval of deals and the majority of private Chinese enterprises are of a relatively small and young nature.”

Dealmakers in North America and the U.K. and Eurozone region increased contribution to engineering and construction M&A activity in the third quarter of 2011. According to PwC, as these developed markets’ economies continue to recover, the volume and value of future deals in these regions should increase incrementally.

The materials manufacturing segment sustained its leading position in the third quarter of 2011, making up 25 percent of deal activity, followed by the construction segment with 18 percent. Civil engineering also experienced strong and consistent growth, contributing 18 percent of deal activity and the three largest mega deals for the third quarter of 2011. BD+C

Related Stories

| Oct 1, 2014

EYP, WHR Architects merge, strengthening presence in education, healthcare, energy sectors

The merger unites 530 professionals to better address some of the most critical issues facing our nation, namely education, healthcare, and energy.

| Sep 30, 2014

The Big Room concept: Using Building Team collocation to ensure project success

Implementing collocation via the Big Room concept will remove silos, ensure a cadence for daily communication, promote collaboration, and elevate your chances for success, write CBRE Healthcare's Stephen Powell and Magnus Nilsson.

| Sep 30, 2014

USGBC, Bank of America name recipients of 2014 Affordable Green Neighborhoods Grant Program

Eleven projects have been selected for the 2014 Affordable Green Neighborhoods grant program. Each will receive $31,000 and an educational package to support their pursuit of LEED for Neighborhood Development certification.

Sponsored | | Sep 30, 2014

What are you doing to win business and improve morale?? VDC Director Kris Lengieza shares ways to do both

Bluebeam's Sasha Reed sits down with Kris Lengieza, Director of Virtual Design and Construction for Stiles Corporation, to learn how he approaches change management. SPONSORED CONTENT

Sponsored | | Sep 30, 2014

How project managers can manage technology

Not long ago, the role of a construction project manager revolved around working with people: employees, vendors, consultants, designers, subcontractors and owners. Today, project managers primarily manage information. SPONSORED CONTENT

| Sep 30, 2014

With its 'stacked volumes' scheme, 3XN wins bid to design high-rise in Sydney

By dividing the 200-meter building into five separate volumes and placing atria throughout each volume, the spaces become smaller, more intimate social environments, according to the Danish architects.

| Sep 29, 2014

Living Building vs. LEED Platinum: Comparing the first costs and savings

Skanska USA's Steve Clem breaks down the costs and benefits of various ultra-green building standards and practices.

| Sep 29, 2014

10 common deficiencies in aging healthcare facilities

VOA's Douglas King pinpoints the top issues that arise during healthcare facilities assessments, including missing fire/smoke dampers, out-of-place fire alarms, and poorly constructed doorways.

| Sep 29, 2014

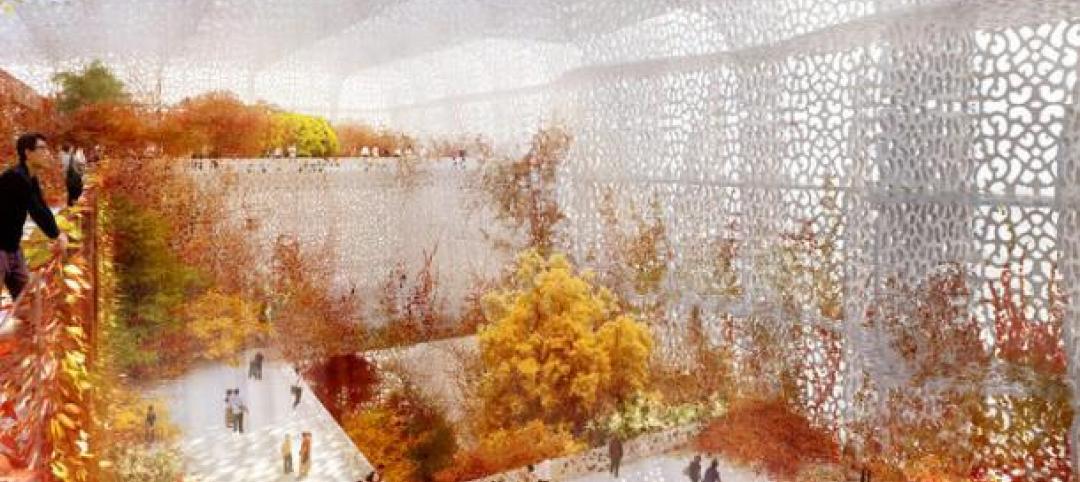

Snøhetta releases final plan for terraced central library in Calgary

The competition-winning New Central Library is now in the final design stages, after two years of community engagement on the part of design firms Snøhetta and DIALOG.

| Sep 25, 2014

Jean Nouvel unveils plans for National Art Museum of China

Of the design, Nouvel describes it as inspired by the simplicity of “a single brush stroke.”