Merger and acquisition (M&A) activity showed strength in the global engineering and construction industry during the third quarter of 2011, driven by sustained strategic investor activity and the return of financial investors to the market, especially in the mega deals arena, according to Engineering growth, a quarterly analysis of M&A activity in the global engineering and construction industry by PwC US.

“Strategic investors continued to dominate deal volume in the third quarter of 2011, but we also saw financial investors make a strong comeback to lead mega deal activity. Three of the five mega deals had targets in the engineering segment, suggesting an increasing attractiveness in this area, which could indicate growth in the construction segment, as the two sectors are closely-related,” said H. Kent Goetjen, U.S. engineering and construction leader with PwC. “The strength in M&A activity shows that despite financial uncertainty in global markets, engineering and construction companies with solid balance sheets have opportunities to capitalize on good growth prospects in emerging markets.”

In the third quarter of 2011, there were 44 announced deals worth $50 million or more, totaling $18.5 billion, compared to 38 transactions with $14.3 billion in the same period of 2010. Five mega deals, or transactions worth more than $1 billion, accounted for more than $10.3 billion and 55 percent of overall third quarter M&A value. Average deal value remained unchanged at $400 million.

According to PwC, strategic investors represented 61 percent of overall third quarter engineering and construction deal volume, as companies took advantage of strong balance sheets to explore growth opportunities through acquisitions. Meanwhile, financial investors also continued their slow, but steady return, contributing the remaining 39 percent of deals, including all five mega deals. “Increasing activity suggests that financial investors are starting to see value in the current market and view the engineering and construction sector favorably,” added Goetjen.

Targets and acquirers in the Asia and Oceania region continued to be a major driver for engineering and construction deal activity in the third quarter of 2011, representing 24 transactions worth $8.1 billion. “Expectations for greater growth rates, more stable economic performance, and increasingly stronger corporate balance sheets of companies in the Asia and Oceania countries suggest that M&A activity in the region should continue to grow in the quarters to come,” noted Jonathan Hook, global engineering and construction leader at PwC.

Despite an increase in cross-border transactions due to a resurging interest in globalization, global domestic deals continued to generate the most activity in the third quarter of 2011, representing 54 percent of all deals. China was the most active country overall, with six cross-border and four domestic deals, while Malaysia also surfaced as a major player, generating three domestic deals.

“The financial strengthening of companies in China and Malaysia, along with their understanding of the local business environment and greater growth opportunities are likely to continue driving domestic transactions in these emerging markets,” said Hook. “However, despite a spike in deal volume, acquiring local companies in China has not become easier as regulations dictate government approval of deals and the majority of private Chinese enterprises are of a relatively small and young nature.”

Dealmakers in North America and the U.K. and Eurozone region increased contribution to engineering and construction M&A activity in the third quarter of 2011. According to PwC, as these developed markets’ economies continue to recover, the volume and value of future deals in these regions should increase incrementally.

The materials manufacturing segment sustained its leading position in the third quarter of 2011, making up 25 percent of deal activity, followed by the construction segment with 18 percent. Civil engineering also experienced strong and consistent growth, contributing 18 percent of deal activity and the three largest mega deals for the third quarter of 2011. BD+C

Related Stories

| Dec 29, 2014

Leo A Daly's minimally invasive approach to remote field site design [BD+C's 2014 Great Solutions Report]

For the past six years, Leo A Daly has been designing sites for remote field stations with near-zero ecological disturbance. The firm's environmentally delicate work was named a 2014 Great Solution by the editors of Building Design+Construction.

| Dec 29, 2014

Wearable job site management system allows contractors to handle deficiencies with subtle hand and finger gestures [BD+C's 2014 Great Solutions Report]

Technology combines a smartglass visual device with a motion-sensing armband to simplify field management work. The innovation was named a 2014 Great Solution by the editors of Building Design+Construction.

| Dec 29, 2014

From Ag waste to organic brick: Corn stalks reused to make construction materials [BD+C's 2014 Great Solutions Report]

Ecovative Design applies its cradle-to-cradle process to produce 10,000 organic bricks used to build a three-tower structure in Long Island City, N.Y. The demonstration project was named a 2014 Great Solution by the editors of Building Design+Construction.

| Dec 29, 2014

14 great solutions for the commercial construction market

Ideas are cheap. Solutions are what count. The latest installment in BD+C's Great Solutions series presents 14 ways AEC professionals, entrepreneurs, and other clever folk have overcome what seemed to be insoluble problems—from how to make bricks out of agricultural waste, to a new way to keep hospitals running clean during construction.

| Dec 29, 2014

HealthSpot station merges personalized healthcare with videoconferencing [BD+C's 2014 Great Solutions Report]

The HealthSpot station is an 8x5-foot, ADA-compliant mobile kiosk that lets patients access a network of board-certified physicians through interactive videoconferencing and medical devices. It was named a 2014 Great Solution by the editors of Building Design+Construction.

| Dec 28, 2014

Robots, drones, and printed buildings: The promise of automated construction

Building Teams across the globe are employing advanced robotics to simplify what is inherently a complex, messy process—construction.

BIM and Information Technology | Dec 28, 2014

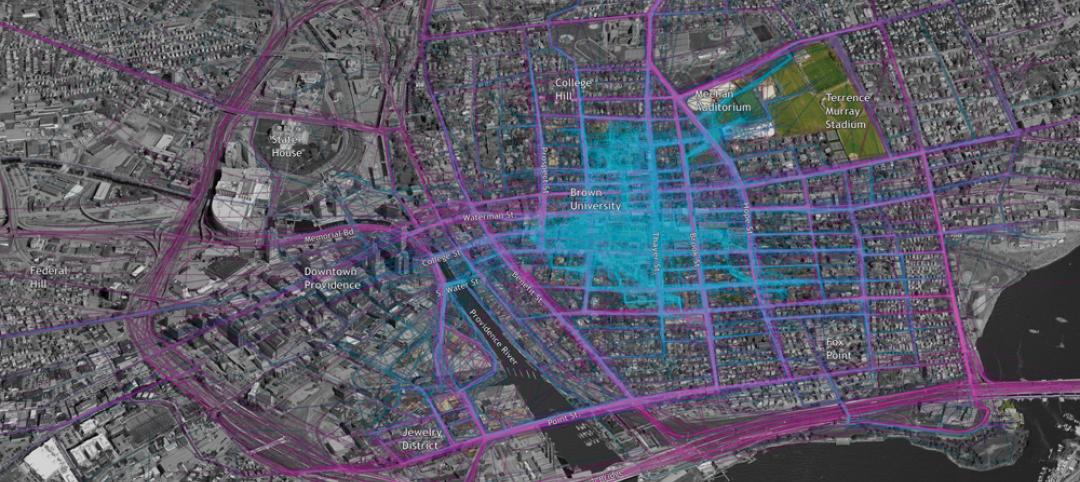

The Big Data revolution: How data-driven design is transforming project planning

There are literally hundreds of applications for deep analytics in planning and design projects, not to mention the many benefits for construction teams, building owners, and facility managers. We profile some early successful applications.

| Dec 28, 2014

AIA course: Enhancing interior comfort while improving overall building efficacy

Providing more comfortable conditions to building occupants has become a top priority in today’s interior designs. This course is worth 1.0 AIA LU/HSW.

| Dec 28, 2014

6 trends steering today's college residence halls

University students want more in a residence hall than just a place to sleep. They want a space that reflects their style of living and learning.

| Dec 28, 2014

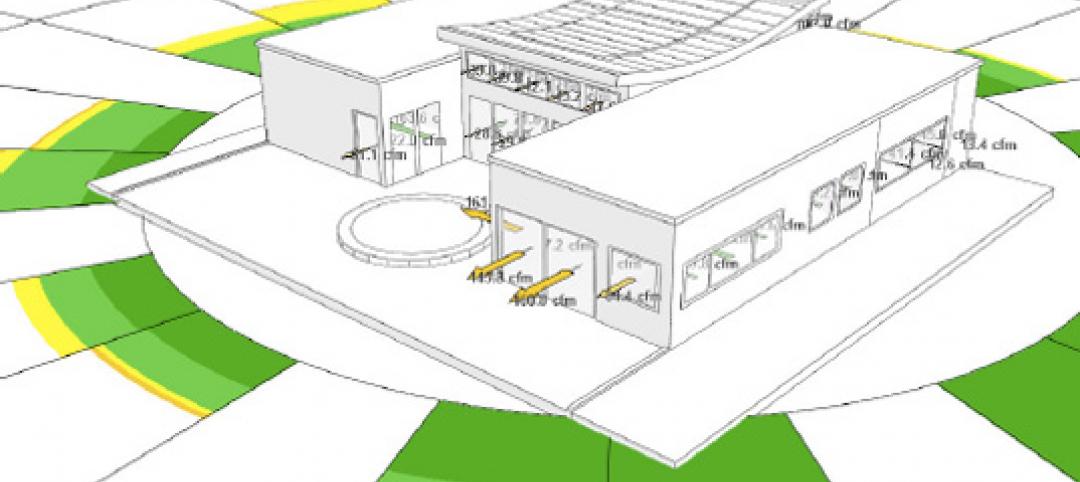

Using energy modeling to increase project value [AIA course]

This course, worth 1.0 AIA LU/HSW, explores how to increase project value through energy modeling, as well as how to conduct quick payback and net present value studies to identify which energy strategies are most viable for the project.