Merger and acquisition (M&A) activity showed strength in the global engineering and construction industry during the third quarter of 2011, driven by sustained strategic investor activity and the return of financial investors to the market, especially in the mega deals arena, according to Engineering growth, a quarterly analysis of M&A activity in the global engineering and construction industry by PwC US.

“Strategic investors continued to dominate deal volume in the third quarter of 2011, but we also saw financial investors make a strong comeback to lead mega deal activity. Three of the five mega deals had targets in the engineering segment, suggesting an increasing attractiveness in this area, which could indicate growth in the construction segment, as the two sectors are closely-related,” said H. Kent Goetjen, U.S. engineering and construction leader with PwC. “The strength in M&A activity shows that despite financial uncertainty in global markets, engineering and construction companies with solid balance sheets have opportunities to capitalize on good growth prospects in emerging markets.”

In the third quarter of 2011, there were 44 announced deals worth $50 million or more, totaling $18.5 billion, compared to 38 transactions with $14.3 billion in the same period of 2010. Five mega deals, or transactions worth more than $1 billion, accounted for more than $10.3 billion and 55 percent of overall third quarter M&A value. Average deal value remained unchanged at $400 million.

According to PwC, strategic investors represented 61 percent of overall third quarter engineering and construction deal volume, as companies took advantage of strong balance sheets to explore growth opportunities through acquisitions. Meanwhile, financial investors also continued their slow, but steady return, contributing the remaining 39 percent of deals, including all five mega deals. “Increasing activity suggests that financial investors are starting to see value in the current market and view the engineering and construction sector favorably,” added Goetjen.

Targets and acquirers in the Asia and Oceania region continued to be a major driver for engineering and construction deal activity in the third quarter of 2011, representing 24 transactions worth $8.1 billion. “Expectations for greater growth rates, more stable economic performance, and increasingly stronger corporate balance sheets of companies in the Asia and Oceania countries suggest that M&A activity in the region should continue to grow in the quarters to come,” noted Jonathan Hook, global engineering and construction leader at PwC.

Despite an increase in cross-border transactions due to a resurging interest in globalization, global domestic deals continued to generate the most activity in the third quarter of 2011, representing 54 percent of all deals. China was the most active country overall, with six cross-border and four domestic deals, while Malaysia also surfaced as a major player, generating three domestic deals.

“The financial strengthening of companies in China and Malaysia, along with their understanding of the local business environment and greater growth opportunities are likely to continue driving domestic transactions in these emerging markets,” said Hook. “However, despite a spike in deal volume, acquiring local companies in China has not become easier as regulations dictate government approval of deals and the majority of private Chinese enterprises are of a relatively small and young nature.”

Dealmakers in North America and the U.K. and Eurozone region increased contribution to engineering and construction M&A activity in the third quarter of 2011. According to PwC, as these developed markets’ economies continue to recover, the volume and value of future deals in these regions should increase incrementally.

The materials manufacturing segment sustained its leading position in the third quarter of 2011, making up 25 percent of deal activity, followed by the construction segment with 18 percent. Civil engineering also experienced strong and consistent growth, contributing 18 percent of deal activity and the three largest mega deals for the third quarter of 2011. BD+C

Related Stories

Mixed-Use | Feb 11, 2015

Developer plans to turn Eero Saarinen's Bell Labs HQ into New Urbanist town center

Designed by Eero Saarinen in the late 1950s, the two-million-sf, steel-and-glass building was one of the best-funded and successful corporate research laboratories in the world.

Architects | Feb 11, 2015

Shortlist for 2015 Mies van der Rohe Award announced

Copenhagen, Berlin, and Rotterdam are the cities where most of the shortlisted works have been built.

BIM and Information Technology | Feb 10, 2015

Google's 3D scanning camera leaves the lab

Google is said to be partnering with LG to create a version of the technology for public release sometime this year.

Steel Buildings | Feb 10, 2015

Korean researchers discover 'super steel'

The new alloy makes steel as strong as titanium.

Architects | Feb 9, 2015

The generalist architect vs. the specialist architect

The corporate world today quite often insists on hiring specialists, but the generalists have an intrinsic quality to adapt to new horizons or even cultural shifts in the market, writes SRG Partnership's Gary Harris.

Museums | Feb 9, 2015

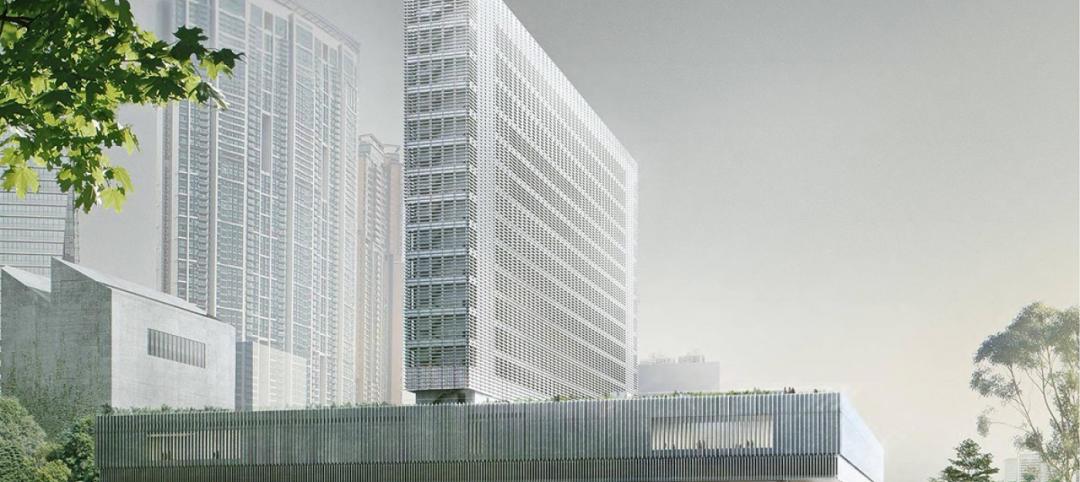

Herzog & de Meuron's M+ museum begins construction in Hong Kong

When completed, M+ will be one of the first buildings in the Foster + Partners-planned West Kowloon Cultural District.

Multifamily Housing | Feb 9, 2015

GSEs and their lenders were active on the multifamily front in 2014

Fannie Mae and Freddie Mac securitized more than $57 billion for 850,000-plus units.

BIM and Information Technology | Feb 8, 2015

BIM for safety: How to use BIM/VDC tools to prevent injuries on the job site

Gilbane, Southland Industries, Tocci, and Turner are among the firms to incorporate advanced 4D BIM safety assessment and planning on projects.

Museums | Feb 6, 2015

Tacoma Art Museum's new wing features sun screens that operate like railroad box car doors

The 16-foot-tall screens, operated by a hand wheel, roll like box car doors across the façade and interlace with a set of fixed screens.

Office Buildings | Feb 6, 2015

6 factors steering workplace design at financial services firms

Grossly underutilized space and a lack of a mobility strategy are among the trends identified by HOK based on its research of 11 top-tier financial services firms.