Merger and acquisition (M&A) activity showed strength in the global engineering and construction industry during the third quarter of 2011, driven by sustained strategic investor activity and the return of financial investors to the market, especially in the mega deals arena, according to Engineering growth, a quarterly analysis of M&A activity in the global engineering and construction industry by PwC US.

“Strategic investors continued to dominate deal volume in the third quarter of 2011, but we also saw financial investors make a strong comeback to lead mega deal activity. Three of the five mega deals had targets in the engineering segment, suggesting an increasing attractiveness in this area, which could indicate growth in the construction segment, as the two sectors are closely-related,” said H. Kent Goetjen, U.S. engineering and construction leader with PwC. “The strength in M&A activity shows that despite financial uncertainty in global markets, engineering and construction companies with solid balance sheets have opportunities to capitalize on good growth prospects in emerging markets.”

In the third quarter of 2011, there were 44 announced deals worth $50 million or more, totaling $18.5 billion, compared to 38 transactions with $14.3 billion in the same period of 2010. Five mega deals, or transactions worth more than $1 billion, accounted for more than $10.3 billion and 55 percent of overall third quarter M&A value. Average deal value remained unchanged at $400 million.

According to PwC, strategic investors represented 61 percent of overall third quarter engineering and construction deal volume, as companies took advantage of strong balance sheets to explore growth opportunities through acquisitions. Meanwhile, financial investors also continued their slow, but steady return, contributing the remaining 39 percent of deals, including all five mega deals. “Increasing activity suggests that financial investors are starting to see value in the current market and view the engineering and construction sector favorably,” added Goetjen.

Targets and acquirers in the Asia and Oceania region continued to be a major driver for engineering and construction deal activity in the third quarter of 2011, representing 24 transactions worth $8.1 billion. “Expectations for greater growth rates, more stable economic performance, and increasingly stronger corporate balance sheets of companies in the Asia and Oceania countries suggest that M&A activity in the region should continue to grow in the quarters to come,” noted Jonathan Hook, global engineering and construction leader at PwC.

Despite an increase in cross-border transactions due to a resurging interest in globalization, global domestic deals continued to generate the most activity in the third quarter of 2011, representing 54 percent of all deals. China was the most active country overall, with six cross-border and four domestic deals, while Malaysia also surfaced as a major player, generating three domestic deals.

“The financial strengthening of companies in China and Malaysia, along with their understanding of the local business environment and greater growth opportunities are likely to continue driving domestic transactions in these emerging markets,” said Hook. “However, despite a spike in deal volume, acquiring local companies in China has not become easier as regulations dictate government approval of deals and the majority of private Chinese enterprises are of a relatively small and young nature.”

Dealmakers in North America and the U.K. and Eurozone region increased contribution to engineering and construction M&A activity in the third quarter of 2011. According to PwC, as these developed markets’ economies continue to recover, the volume and value of future deals in these regions should increase incrementally.

The materials manufacturing segment sustained its leading position in the third quarter of 2011, making up 25 percent of deal activity, followed by the construction segment with 18 percent. Civil engineering also experienced strong and consistent growth, contributing 18 percent of deal activity and the three largest mega deals for the third quarter of 2011. BD+C

Related Stories

Windows and Doors | Feb 28, 2024

DOE launches $2 million prize to advance cost-effective, energy-efficient commercial windows

The U.S. Department of Energy launched the American-Made Building Envelope Innovation Prize—Secondary Glazing Systems. The program will offer up to $2 million to encourage production of high-performance, cost-effective commercial windows.

AEC Innovators | Feb 28, 2024

How Suffolk Construction identifies ConTech and PropTech startups for investment, adoption

Contractor giant Suffolk Construction has invested in 27 ConTech and PropTech companies since 2019 through its Suffolk Technologies venture capital firm. Parker Mundt, Suffolk Technologies’ Vice President–Platforms, recently spoke with Building Design+Construction about his company’s investment strategy.

Performing Arts Centers | Feb 27, 2024

Frank Gehry-designed expansion of the Colburn School performing arts center set to break ground

In April, the Colburn School, an institute for music and dance education and performance, will break ground on a 100,000-sf expansion designed by architect Frank Gehry. Located in downtown Los Angeles, the performing arts center will join the neighboring Walt Disney Concert Hall and The Grand by Gehry, forming the largest concentration of Gehry-designed buildings in the world.

Construction Costs | Feb 27, 2024

Experts see construction material prices stabilizing in 2024

Gordian’s Q1 2024 Quarterly Construction Cost Insights Report brings good news: Although there are some materials whose prices have continued to show volatility, costs at a macro level are returning to a level of stability, suggesting predictable historical price escalation factors.

High-rise Construction | Feb 23, 2024

Designing a new frontier in Seattle’s urban core

Graphite Design Group shares the design for Frontier, a 540,000-sf tower in a five-block master plan for Seattle-based tech leader Amazon.

Construction Costs | Feb 22, 2024

K-12 school construction costs for 2024

Data from Gordian breaks down the average cost per square foot for four different types of K-12 school buildings (elementary schools, junior high schools, high schools, and vocational schools) across 10 U.S. cities.

MFPRO+ Special Reports | Feb 22, 2024

Crystal Lagoons: A deep dive into real estate's most extreme guest amenity

These year-round, manmade, crystal clear blue lagoons offer a groundbreaking technology with immense potential to redefine the concept of water amenities. However, navigating regulatory challenges and ensuring long-term sustainability are crucial to success with Crystal Lagoons.

Architects | Feb 21, 2024

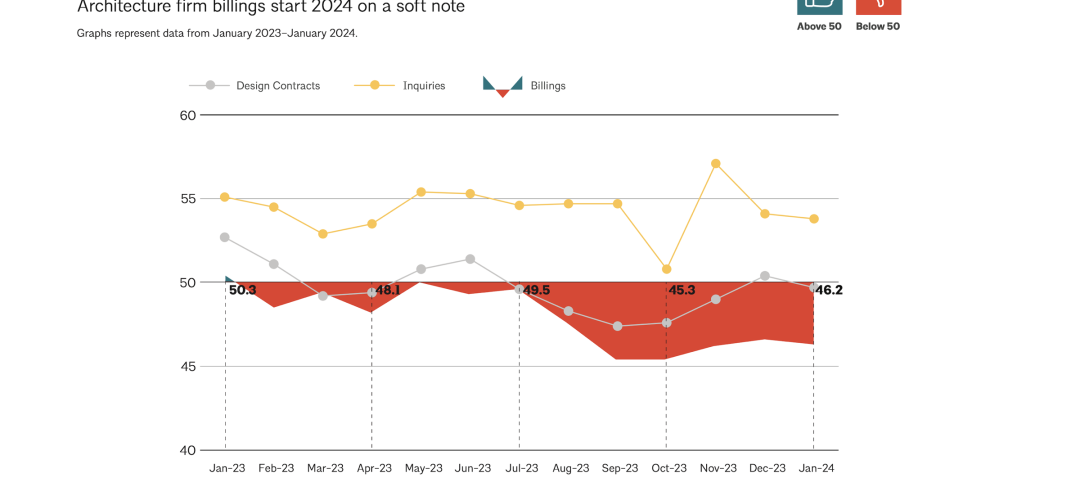

Architecture Billings Index remains in 'declining billings' state in January 2024

Architecture firm billings remained soft entering into 2024, with an AIA/Deltek Architecture Billings Index (ABI) score of 46.2 in January. Any score below 50.0 indicates decreasing business conditions.

University Buildings | Feb 21, 2024

University design to help meet the demand for health professionals

Virginia Commonwealth University is a Page client, and the Dean of the College of Health Professions took time to talk about a pressing healthcare industry need that schools—and architects—can help address.

AEC Tech | Feb 20, 2024

AI for construction: What kind of tool can artificial intelligence become for AEC teams?

Avoiding the hype and gathering good data are half the battle toward making artificial intelligence tools useful for performing design, operational, and jobsite tasks.