This year's unusually difficult winter took its toll on construction activity. Nonetheless, first quarter spending for all the major groups was up compared to the same period in 2013.

The U.S. Census Bureau reported that total construction spending advanced 0.2% in March to $942.5 billion at a seasonally adjusted annual rate (SAAR). First quarter not seasonally adjusted (NSA) spending was 8.3% higher than the same period a year ago.

Nonresidential building construction spending fell for the fifth month in a row, down 1.0% to $298.8 billion (SAAR) in March. January and February spending were revised down by $3.3 billion and $6.4 billion, respectively, which was 1.1% and 2.1% of their respective previously reported numbers. That altered the monthly percentage change for January from +0.1% to ?0.9%. Despite the recent declines, first quarter NSA spending was 3.5% higher than in 2013.

Heavy engineering (non-building) construction spending increased 0.8% to $269.2 billion (SAAR) in March. January and February spending were revised down by $2.5 billion and $5.3 billion, respectively, which was 0.9% and 2.0% of their respective previously reported numbers. First quarter NSA spending was 4.5% higher than a year ago.

Total residential construction spending, which includes improvements, rose 0.7% in to $374.5 billion (SAAR) after inching up 0.1% in February. New residential construction spending, which excludes improvements, also increased 0.7% to $229.1 billion in March, its 30th consecutive monthly increase. First quarter NSA total residential construction spending was 16.0% higher than last year and new residential construction was 17.9% higher.

March private construction spending bounced back from February's 0.2% dip at a seasonally adjusted (SA) rate, increasing 0.5%. First quarter NSA spending was 12.5% higher than 2013 first quarter spending.

Meanwhile, public construction spending fell for the fifth consecutive month, down 0.6% in March. First quarter NSA public spending was 2.0% lower than a year ago.

The Economy

The economic data continue to indicate that the country is recovering from the harsh winter. At this point, the construction spending data are only available through March. We know that the bad weather across much of the nation extended into April and May. Thus we do not look for a quick rebound in the numbers, but continued slow improvement.

We do believe that economic activity is shaking off the winter blues and will continue to post better numbers. Employment growth is key, both as an indicator of how fast the economy is expanding and as a stimulus to further growth as newly hired workers spend their new income.

The Federal Reserve continues to ratchet down its monthly purchases of long-term assets. At the end of April, the Fed announced it would reduce its purchases of long-term assets from $55 billion per month to $45 billion per month starting in May. Prior to January, when the reduction in purchases began, the Fed was buying $85 billion of long-term assets per month. To date, the Fed's actions have led to only a relatively small increase in long-term interest rates.

Risks to the economy and construction remain. These include:

- A sustained spike in interest rates due to the Federal Reserve unwinding its asset purchase program too rapidly

- Sharp reduction in government spending in the short run

- Sovereign debt default by one or more European governments

- One or more European governments abandon the euro

- A sudden, significant increase in oil prices for a prolonged period

The probability of any one of these occurring is fairly low. Nonetheless they remain a potential negative for the economy and construction.

Two other issues will become important issues in the coming months. First, September 30 marks the end of the current federal fiscal year. At that point, appropriations for most government operations and programs expire. The appropriate action would be to have the necessary appropriation bills for the next fiscal year passed and signed into law prior to October 1. This is not a given. Appropriations for the current fiscal year did not become law until the middle of January 2014.

Second, the suspension of the debt ceiling expires in March. Prior to that, a new debt ceiling needs to be passed, the debt ceiling suspension needs to be extended, or—best of all worlds, but extremely unlikely—the debt ceiling needs to be eliminated.

Failure to deal with these issues in a timely manner will create additional uncertainty for business and the economy with negative fallout for investment and construction.

The Forecast

The Reed forecast assumes that, despite these risks, the economy grows at a moderate pace this year and next. Further, nonresidential building construction, which has been struggling of late, is forecast to gain traction and improve this year and next.

Heavy engineering (non-building) construction activity, which has shown some strength of late, is forecast to expand this year and next. Federal funding for infrastructure projects is expected to increase this year and beyond, although not by nearly the amount that is necessary to properly address the nation's aging infrastructure. The amount of funding available for public projects will greatly affect the level of infrastructure construction activity. Public-private partnerships at the state and local level will boost the amount of money available for infrastructure projects.

Total construction spending is forecast to increase 9.0% in 2014 and 11.3% in 2015, with nonresidential and heavy engineering construction gaining strength and residential construction continuing its expand.

For more from this report, including charts, click here.

Related Stories

| May 1, 2014

First look: Cal State San Marcos's posh student union complex

The new 89,000-sf University Student Union at CSUSM features a massive, open-air amphitheater, student activity center with a game lounge, rooftop garden and patio, and ballroom space.

| May 1, 2014

Super BIM: 7 award-winning BIM/VDC-driven projects

Thom Mayne's Perot Museum of Nature and Science and Anaheim's new intermodal center are among the 2014 AIA TAP BIM Award winners.

| May 1, 2014

Tight on space for multifamily? Check out this modular kitchen tower

The Clei Ecooking kitchen, recently rolled out at Milan's Salone de Mobile furniture fair, squeezes multiple appliances into a tiny footprint.

| May 1, 2014

Chinese spec 'world's fastest' elevators for supertall project

Hitachi Elevator Co. will build and install 95 elevators—including two that the manufacturer labels as the "world's fastest"—for the Kohn Pedersen Fox-designed Guangzhou CTF Finance Center.

| Apr 30, 2014

Visiting Beijing's massive Chaoyang Park Plaza will be like 'moving through a urban forest'

Construction work has begun on the 120,000-sm mixed-use development, which was envisioned by MAD architects as a modern, urban forest.

| Apr 29, 2014

Best of Canada: 12 projects nab nation's top architectural prize [slideshow]

The conversion of a Mies van der Rohe-designed gas station and North Vancouver City Hall are among the recently completed projects to win the 2014 Governor General's Medal in Architecture.

| Apr 29, 2014

USGBC launches real-time green building data dashboard

The online data visualization resource highlights green building data for each state and Washington, D.C.

| Apr 29, 2014

Big U in the Big Apple: New design to protect New York City's coastline

Bjarke Ingels' proposed design for the Rebuild by Design competition adapts a key design principle in ship building to improve urban flood protection.

| Apr 28, 2014

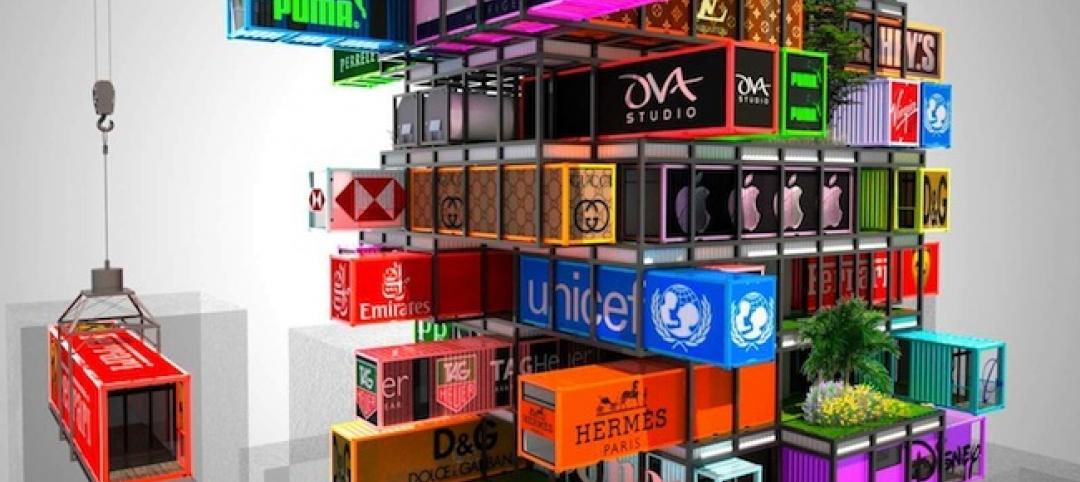

Welcome to the Hive: OVA designs wild shipping container hotel for competition

Hong Kong-based OVA envisions a shipping-container hotel, where rooms could be removed at will and designed by advertisers.

Smart Buildings | Apr 28, 2014

Cities Alive: Arup report examines latest trends in urban green spaces

From vertical farming to glowing trees (yes, glowing trees), Arup engineers imagine the future of green infrastructure in cities across the world.