This year's unusually difficult winter took its toll on construction activity. Nonetheless, first quarter spending for all the major groups was up compared to the same period in 2013.

The U.S. Census Bureau reported that total construction spending advanced 0.2% in March to $942.5 billion at a seasonally adjusted annual rate (SAAR). First quarter not seasonally adjusted (NSA) spending was 8.3% higher than the same period a year ago.

Nonresidential building construction spending fell for the fifth month in a row, down 1.0% to $298.8 billion (SAAR) in March. January and February spending were revised down by $3.3 billion and $6.4 billion, respectively, which was 1.1% and 2.1% of their respective previously reported numbers. That altered the monthly percentage change for January from +0.1% to ?0.9%. Despite the recent declines, first quarter NSA spending was 3.5% higher than in 2013.

Heavy engineering (non-building) construction spending increased 0.8% to $269.2 billion (SAAR) in March. January and February spending were revised down by $2.5 billion and $5.3 billion, respectively, which was 0.9% and 2.0% of their respective previously reported numbers. First quarter NSA spending was 4.5% higher than a year ago.

Total residential construction spending, which includes improvements, rose 0.7% in to $374.5 billion (SAAR) after inching up 0.1% in February. New residential construction spending, which excludes improvements, also increased 0.7% to $229.1 billion in March, its 30th consecutive monthly increase. First quarter NSA total residential construction spending was 16.0% higher than last year and new residential construction was 17.9% higher.

March private construction spending bounced back from February's 0.2% dip at a seasonally adjusted (SA) rate, increasing 0.5%. First quarter NSA spending was 12.5% higher than 2013 first quarter spending.

Meanwhile, public construction spending fell for the fifth consecutive month, down 0.6% in March. First quarter NSA public spending was 2.0% lower than a year ago.

The Economy

The economic data continue to indicate that the country is recovering from the harsh winter. At this point, the construction spending data are only available through March. We know that the bad weather across much of the nation extended into April and May. Thus we do not look for a quick rebound in the numbers, but continued slow improvement.

We do believe that economic activity is shaking off the winter blues and will continue to post better numbers. Employment growth is key, both as an indicator of how fast the economy is expanding and as a stimulus to further growth as newly hired workers spend their new income.

The Federal Reserve continues to ratchet down its monthly purchases of long-term assets. At the end of April, the Fed announced it would reduce its purchases of long-term assets from $55 billion per month to $45 billion per month starting in May. Prior to January, when the reduction in purchases began, the Fed was buying $85 billion of long-term assets per month. To date, the Fed's actions have led to only a relatively small increase in long-term interest rates.

Risks to the economy and construction remain. These include:

- A sustained spike in interest rates due to the Federal Reserve unwinding its asset purchase program too rapidly

- Sharp reduction in government spending in the short run

- Sovereign debt default by one or more European governments

- One or more European governments abandon the euro

- A sudden, significant increase in oil prices for a prolonged period

The probability of any one of these occurring is fairly low. Nonetheless they remain a potential negative for the economy and construction.

Two other issues will become important issues in the coming months. First, September 30 marks the end of the current federal fiscal year. At that point, appropriations for most government operations and programs expire. The appropriate action would be to have the necessary appropriation bills for the next fiscal year passed and signed into law prior to October 1. This is not a given. Appropriations for the current fiscal year did not become law until the middle of January 2014.

Second, the suspension of the debt ceiling expires in March. Prior to that, a new debt ceiling needs to be passed, the debt ceiling suspension needs to be extended, or—best of all worlds, but extremely unlikely—the debt ceiling needs to be eliminated.

Failure to deal with these issues in a timely manner will create additional uncertainty for business and the economy with negative fallout for investment and construction.

The Forecast

The Reed forecast assumes that, despite these risks, the economy grows at a moderate pace this year and next. Further, nonresidential building construction, which has been struggling of late, is forecast to gain traction and improve this year and next.

Heavy engineering (non-building) construction activity, which has shown some strength of late, is forecast to expand this year and next. Federal funding for infrastructure projects is expected to increase this year and beyond, although not by nearly the amount that is necessary to properly address the nation's aging infrastructure. The amount of funding available for public projects will greatly affect the level of infrastructure construction activity. Public-private partnerships at the state and local level will boost the amount of money available for infrastructure projects.

Total construction spending is forecast to increase 9.0% in 2014 and 11.3% in 2015, with nonresidential and heavy engineering construction gaining strength and residential construction continuing its expand.

For more from this report, including charts, click here.

Related Stories

| May 28, 2014

Moshe Safdie's twin residential towers in Singapore will be connected by 'sky pool' 38 stories in the air [slideshow]

Moshe Safdie's latest project, a pair of 38-story luxury residential towers in Singapore, will be linked by three "sky garden" bridges, including a rooftop-level bridge with a lap pool running the length between the two structures.

| May 27, 2014

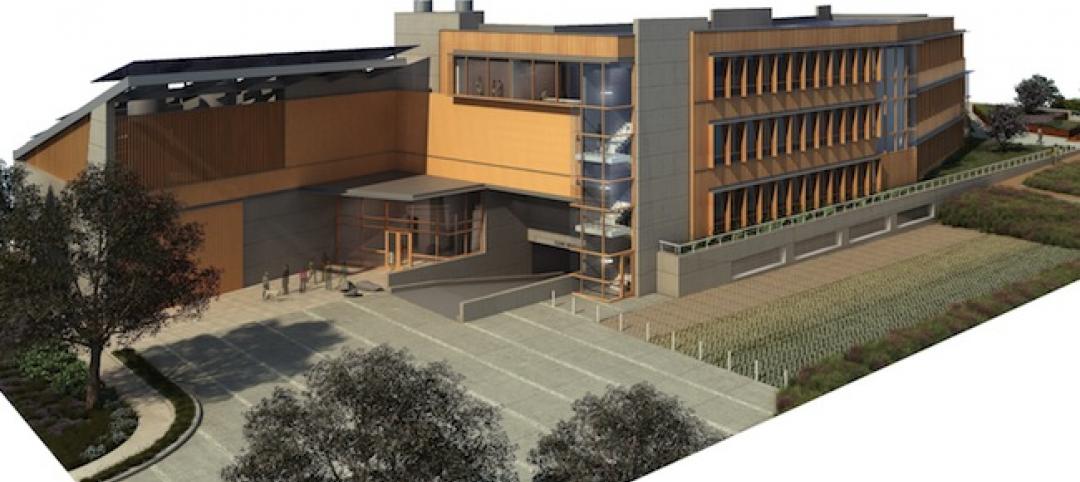

Supergreen Venter lab displayed in new walk-through video

ZGF Architects' La Jolla building for genomics pioneer J. Craig Venter and his nonprofit research organization aims to be the first net-zero energy, carbon-neutral biological lab.

| May 27, 2014

America's oldest federal public housing development gets a facelift

First opened in 1940, South Boston's Old Colony housing project had become a symbol of poor housing conditions. Now the revamped neighborhood serves as a national model for sustainable, affordable multifamily design.

| May 27, 2014

One World Trade Center cuts rents due to sluggish activity

Sluggish economy and lackluster leasing force developer The Durst Organization and the Port Authority of New York and New Jersey to reduce asking rents by nearly 10% to $69/sf.

| May 27, 2014

Fire Rated Glass contributes to open lab environment at JSNN

Openness and transparency were high priorities in the design of the Joint School of Nanoscience & Nanoengineering within the Gateway University Research Park in Greensboro, N.C. Because the facility’s nanobioelectronics clean room houses potentially explosive materials, it needed to be able to contain flames, heat, and smoke in the event of a fire. SPONSORED CONTENT

| May 27, 2014

What are your services worth?

The price, cost, and value of design services are explored in a recent Design Intelligence article authored by Scott Simpson, a senior fellow of the Design Futures Council. Value, he explains, represents the difference between “price” and “cost.” SPONSORED CONTENT

| May 27, 2014

Contractors survey reveals improving construction market

The construction industry is on the road to recovery, according to a new survey by Metal Construction News. Most metrics improved from the previous year’s survey, including a 19.4% increase in the average annual gross contracting sales volume. SPONSORED CONTENT

| May 27, 2014

How to develop a dynamic referral system

Compelling your clients to provide you with quality referrals is one of the best ways to build a successful business. Here are ways to ‘train’ your clients to make quality referrals. SPONSORED CONTENT

Sponsored | | May 27, 2014

Grim Hall opens the door to fire safety with fire-rated ceramic glass

For the renovation of Lincoln University’s Grim Hall life sciences building into a state-of-the-art computer facility, Tevebaugh Associates worked to provide students and faculty with improved life safety protection. Updating the 1925-era facility's fire-rated doors was an important component of the project.

| May 26, 2014

New Jersey data centers will manage loads with pods

The two data center facilities totaling almost 430,000 sf for owner Digital Realty Trust will use the company's TK-Flex planning module, allowing for 24 pods.