This year's unusually difficult winter took its toll on construction activity. Nonetheless, first quarter spending for all the major groups was up compared to the same period in 2013.

The U.S. Census Bureau reported that total construction spending advanced 0.2% in March to $942.5 billion at a seasonally adjusted annual rate (SAAR). First quarter not seasonally adjusted (NSA) spending was 8.3% higher than the same period a year ago.

Nonresidential building construction spending fell for the fifth month in a row, down 1.0% to $298.8 billion (SAAR) in March. January and February spending were revised down by $3.3 billion and $6.4 billion, respectively, which was 1.1% and 2.1% of their respective previously reported numbers. That altered the monthly percentage change for January from +0.1% to ?0.9%. Despite the recent declines, first quarter NSA spending was 3.5% higher than in 2013.

Heavy engineering (non-building) construction spending increased 0.8% to $269.2 billion (SAAR) in March. January and February spending were revised down by $2.5 billion and $5.3 billion, respectively, which was 0.9% and 2.0% of their respective previously reported numbers. First quarter NSA spending was 4.5% higher than a year ago.

Total residential construction spending, which includes improvements, rose 0.7% in to $374.5 billion (SAAR) after inching up 0.1% in February. New residential construction spending, which excludes improvements, also increased 0.7% to $229.1 billion in March, its 30th consecutive monthly increase. First quarter NSA total residential construction spending was 16.0% higher than last year and new residential construction was 17.9% higher.

March private construction spending bounced back from February's 0.2% dip at a seasonally adjusted (SA) rate, increasing 0.5%. First quarter NSA spending was 12.5% higher than 2013 first quarter spending.

Meanwhile, public construction spending fell for the fifth consecutive month, down 0.6% in March. First quarter NSA public spending was 2.0% lower than a year ago.

The Economy

The economic data continue to indicate that the country is recovering from the harsh winter. At this point, the construction spending data are only available through March. We know that the bad weather across much of the nation extended into April and May. Thus we do not look for a quick rebound in the numbers, but continued slow improvement.

We do believe that economic activity is shaking off the winter blues and will continue to post better numbers. Employment growth is key, both as an indicator of how fast the economy is expanding and as a stimulus to further growth as newly hired workers spend their new income.

The Federal Reserve continues to ratchet down its monthly purchases of long-term assets. At the end of April, the Fed announced it would reduce its purchases of long-term assets from $55 billion per month to $45 billion per month starting in May. Prior to January, when the reduction in purchases began, the Fed was buying $85 billion of long-term assets per month. To date, the Fed's actions have led to only a relatively small increase in long-term interest rates.

Risks to the economy and construction remain. These include:

- A sustained spike in interest rates due to the Federal Reserve unwinding its asset purchase program too rapidly

- Sharp reduction in government spending in the short run

- Sovereign debt default by one or more European governments

- One or more European governments abandon the euro

- A sudden, significant increase in oil prices for a prolonged period

The probability of any one of these occurring is fairly low. Nonetheless they remain a potential negative for the economy and construction.

Two other issues will become important issues in the coming months. First, September 30 marks the end of the current federal fiscal year. At that point, appropriations for most government operations and programs expire. The appropriate action would be to have the necessary appropriation bills for the next fiscal year passed and signed into law prior to October 1. This is not a given. Appropriations for the current fiscal year did not become law until the middle of January 2014.

Second, the suspension of the debt ceiling expires in March. Prior to that, a new debt ceiling needs to be passed, the debt ceiling suspension needs to be extended, or—best of all worlds, but extremely unlikely—the debt ceiling needs to be eliminated.

Failure to deal with these issues in a timely manner will create additional uncertainty for business and the economy with negative fallout for investment and construction.

The Forecast

The Reed forecast assumes that, despite these risks, the economy grows at a moderate pace this year and next. Further, nonresidential building construction, which has been struggling of late, is forecast to gain traction and improve this year and next.

Heavy engineering (non-building) construction activity, which has shown some strength of late, is forecast to expand this year and next. Federal funding for infrastructure projects is expected to increase this year and beyond, although not by nearly the amount that is necessary to properly address the nation's aging infrastructure. The amount of funding available for public projects will greatly affect the level of infrastructure construction activity. Public-private partnerships at the state and local level will boost the amount of money available for infrastructure projects.

Total construction spending is forecast to increase 9.0% in 2014 and 11.3% in 2015, with nonresidential and heavy engineering construction gaining strength and residential construction continuing its expand.

For more from this report, including charts, click here.

Related Stories

| Nov 25, 2014

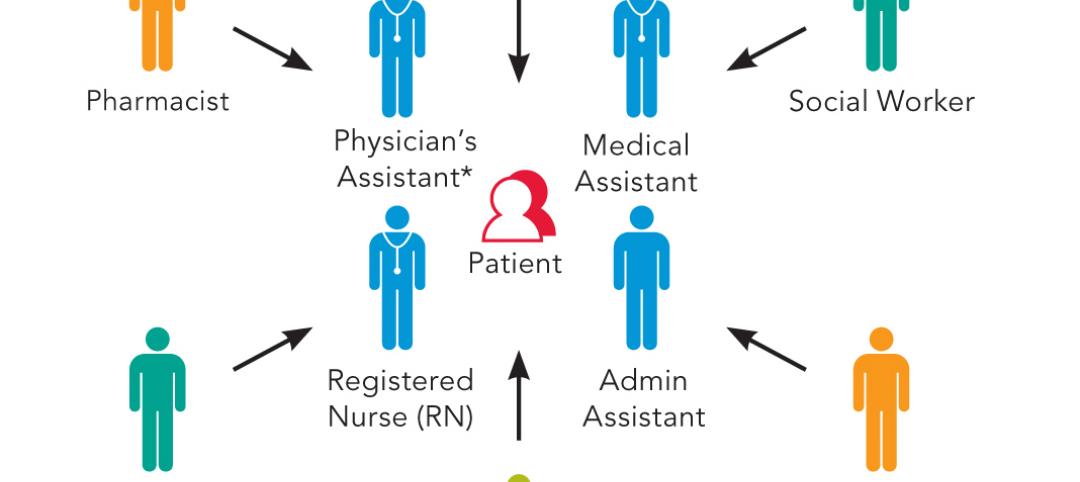

Emerging design and operation strategies for the ambulatory team in transition

As healthcare systems shift their care models to be more responsive to patient-centered care, ambulatory care teams need to be positioned to operate efficiently in their everyday work environments, write CannonDesign Health Practice leaders Tonia Burnette and Mike Pukszta.

| Nov 24, 2014

Midsize construction firms see a brighter business horizon

Uncertainty about government spending clouds an otherwise positive economic outlook among 59 middle market construction firms polled recently by GE Capital.

| Nov 24, 2014

Adrian Smith + Gordon Gill-designed crystalline tower breaks ground in southwestern China

Fitted with an LED façade, the 468-meter Greenland Tower Chengdu will act as a light sculpture for the city of Chengdu.

| Nov 21, 2014

Rental apartment construction soars to 27-year high: WSJ report

The multifamily sector is now outpacing the peak construction rate in the previous housing cycle, in 2006, according to the WSJ.

| Nov 21, 2014

Nelson adds to its stable with EHS Design acquisition

This represents Nelson’s fifth merger or acquisition in 2014, during which the firm’s net fee revenue has increased by 60% to $65 million.

| Nov 21, 2014

Nonresidential Construction Index rises in fourth quarter

There are a number of reasons for optimism among respondents of FMI's quarterly Nonresidential Construction Index survey, including healthier backlogs and low inflation.

| Nov 21, 2014

NCARB: Number of architects in U.S. grows 1.6% in 2014, surpasses 107,500

The architecture profession continues to grow along with a gradually recovering economy, based on the results of the 2014 Survey of Architectural Registration Boards, conducted by the National Council of Architectural Registration Boards.

| Nov 20, 2014

Lean Led Design: How Building Teams can cut costs, reduce waste in healthcare construction projects

Healthcare organizations are under extreme pressure to reduce costs, writes CBRE Healthcare's Lora Schwartz. Tools like Lean Led Design are helping them cope.

| Nov 19, 2014

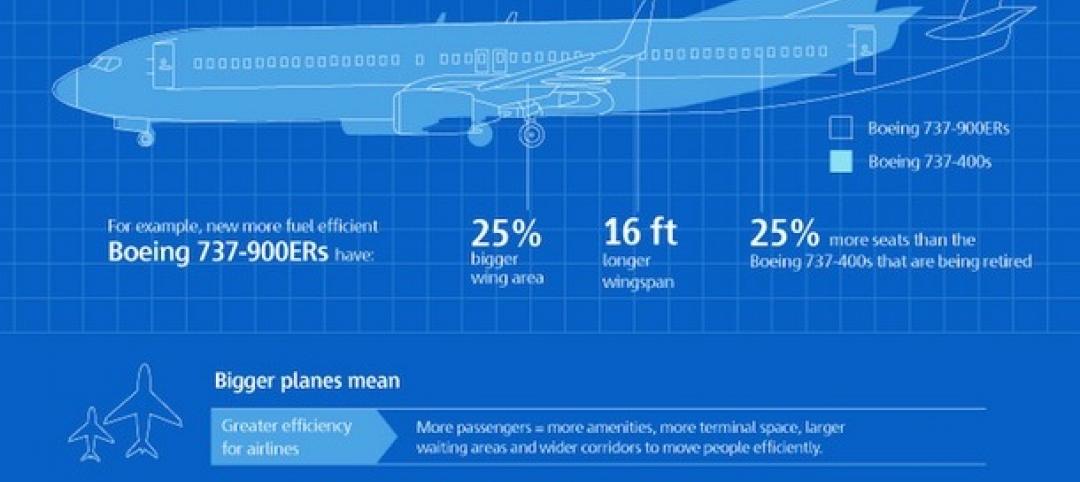

The evolution of airport design and construction [infographic]

Safety, consumer demand, and the new economics of flight are three of the major factors shaping how airlines and airport officials are approaching the need for upgrades and renovations, writes Skanska USA's MacAdam Glinn.

| Nov 19, 2014

Construction unemployment hits eight-year low, some states struggle to find qualified labor

The construction industry, whose workforce was decimated during the last recession, is slowly getting back on its feet. However, in certain markets—especially those where oil drilling and production have been prospering—construction workers can still be scarce.