March student housing preleasing in line with last year

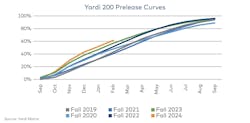

The 2024–2025 leasing season is starting to look more like last year, according to the March 2024 Matrix Student Housing National Report. However, preleasing is still increasing at a historically fast pace, surpassing 61% in February 2024. This marks a 4.5% increase year-over-year (YOY) and is well ahead of the five-year average of 48% in February.

The Yardi Matrix report provides insights from 178 schools with preleasing data. Today’s numbers show that preleasing trends are more than 10% ahead of the average from 2019–2022.

Student Housing Market Preleasing Trends

In February, 42 schools were more than 70% preleased, compared to only 29 at the same time last year. Just 35 schools were less than 40% preleased last month, compared to 47 in February 2023.

A few markets that failed to reach 90% occupancy last year—including the University of Southern California, Illinois State, Johns Hopkins, and Mississippi State—are now more than 10% ahead on preleasing this year.

Increasing from last month is the number of markets that are more than 10% behind last year’s pace. These twenty markets include Tennessee-Knoxville, ASU, and CU-Boulder.

RELATED:

- Student housing market expected to improve in 2024

- October had fastest start ever for student housing preleasing

- 9 exemplary student housing projects in 2022

A dozen universities have surpassed a 15% YOY growth in prelease percentage. Topping the list is the University of Mississippi (32.8% growth in percentage preleased), followed by the University of Missouri (22.4%), Central Michigan (20.7%), and Bowling Green State (20.2%).

Rent Growth and Bed Construction

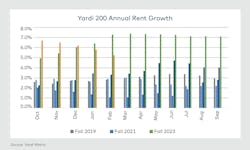

As rent growth and demand has stayed solid, “student housing is outperforming nearly every asset class,” according to the report. Up 5.2% YOY is the average rent per bed, sitting at $883 in February 2024. This is the 33rd month in a row that rent has increased month-over-month.

Thirty-two schools posted double-digit rent growth in February while 26 markets have a rent decline. The Matrix report finds that many of the markets reporting double-digit rent growth are the same ones with a majority of beds preleased for the 2024–2025 school year.

Schools with less beds preleased such as UC-Berkeley, Washington State, and Nevada-Reno have also faced enrollment and/or supply issues. These markets averaged 43% preleased in February—20 points below the national average.

Bed Construction

Yardi Matrix’s supply forecast projects 46,285 new beds will be delivered this year. This is a sharp increase from the 35,610 delivered in 2023. Universities with the most beds under construction include:

- University of Tennessee: 3,961 beds under construction; 8,220 completed. Preleased at 88% with rent per bed at $1,136

- University of Texas: 3,460 beds under construction; 21,038 completed. Preleased at 71% with rent per bed at $1,161

- Florida State University: 3,167 beds under construction; 26,859 completed. Preleased at 69% with rent per bed at $840

- University of Minnesota: 2,709 beds under construction; 12,722 completed. Preleased at 53% with rent per bed at $1,024

- University of Georgia: 2,445 beds under construction; 12,903 completed. Preleased at 71% with rent per bed at $877