Despite facing a litany of market impediments—the still-sluggish economy, construction labor shortages, the slow-to-recover education and healthcare markets—the majority of AEC firms saw revenues grow in 2015, and an even greater number expect earnings to rise in 2016, according to a survey of 337 AEC professionals by Building Design+Construction.

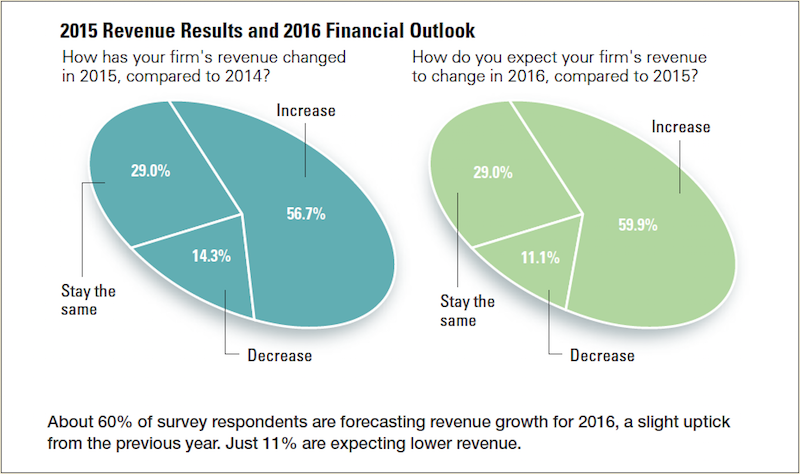

Nearly six out of 10 survey respondents (56.7%) indicated that revenues had increased at their firms in 2015, and 59.9% expect income from nonresidential building work to rise this year. This represents a slight uptick from 2014’s survey, when 54.4% reported higher revenue for the year.

About half of the respondents (45.7%) rated their firm’s 2015 business year as either “excellent” or “very good,” and just 2.1% said it was a “poor” year. Looking to 2016, 52.7% believe it will be “excellent” or “very good” from a revenue standpoint. Nearly three-quarters (71.4%) rated the overall health of their firm either “very good” or “good.”

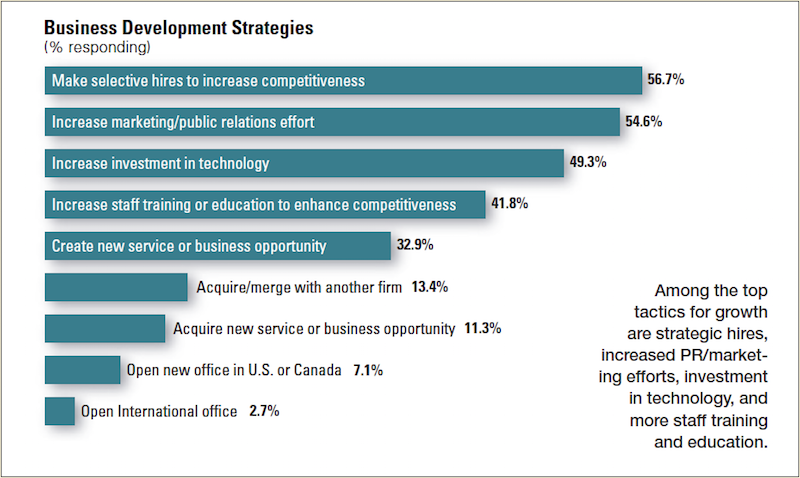

Asked to rate their firm’s top business development tactics for 2016, strategic hiring (56.7% rated it as a top tactic for growth), marketing/public relations (54.6%), and technology upgrades (49.3%) topped the list. Other popular growth strategies include staff training/education (41.8%), a new service/business opportunity (32.9%), and a firm merger/acquisition (13.4%).

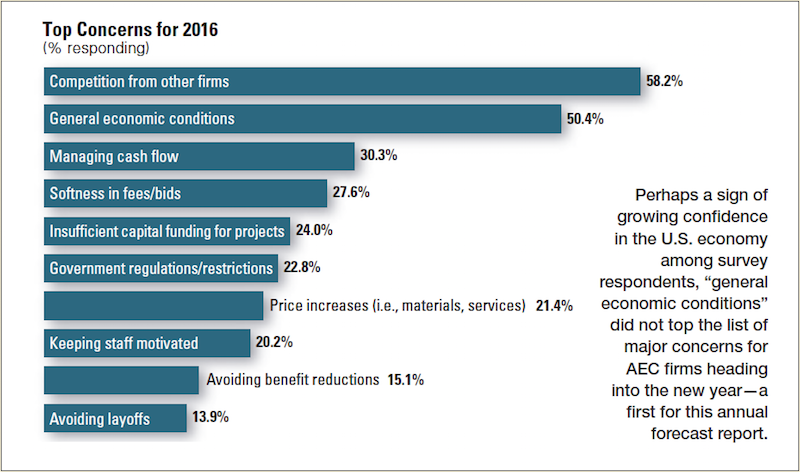

Among the top concerns for AEC firms are competition from other firms (58.2% ranked it as a top-three concern), general economic conditions (50.4%), managing cash flow (30.3%), and softness in fees/bids (27.6%).

HEALTHCARE SECTOR starting to REBOUND

Respondents were asked to rate their firms’ prospects in specific construction sectors on a five-point scale from “excellent” to “very weak.” Among the findings:

The multifamily boom continues, as the Millennials and Baby Boomers gravitate to rental housing and an urban lifestyle. Multifamily ranked as the most active sector, with 69.7% of respondents rating it in the good/excellent category, up from 62.3% last year and 56.1% in 2013.

The healthcare market is starting to stabilize and grow, as hospitals and healthcare providers adjust to the post-Affordable Care Act world. The sector ranked as the second most active; 68.0% gave it a good/excellent rating, up from 63.6% in 2014 and 62.5% the previous year.

Other active sectors include senior/assisted living (63.1% rated it in the good/excellent category), office interiors/fitouts (62.4%), data centers/mission critical (59.3%), higher education (48.6%), industrial/warehouse (46.7%), retail (44.9%), and government/military (42.5%).

Respondents to the BD+C survey include architect/designers (52.2%), engineers (19.6%), contractors (18.4%), consultants (5.0%), owner/developers (1.2%), and facility managers (1.0%).

BIM/VDC TAKES HOLD

The adoption of building information modeling and virtual design and construction tools and processes continues to grow in the AEC marketplace. More than eight in 10 respondents (82.1%) said their firm uses BIM/VDC tools on at least some of its projects, up from 80.0% in 2014 and 77.3% in 2013. About a fifth (20.3%) said their firm uses BIM/VDC on more than 75% of projects, up from 17.3% last year and 12.2% in 2013.

Respondents to the BD+C survey include architect/designers (52.2%), engineers (19.6%), contractors (18.4%), consultants (5.0%), owner/developers (1.2%), and facility managers (1.0%).

Related Stories

Market Data | Sep 18, 2018

Altus Group report reveals shifts in trade policy, technology, and financing are disrupting global real estate development industry

International trade uncertainty, widespread construction skills shortage creating perfect storm for escalating project costs; property development leaders split on potential impact of emerging technologies.

Market Data | Sep 17, 2018

ABC’s Construction Backlog Indicator hits a new high in second quarter of 2018

Backlog is up 12.2% from the first quarter and 14% compared to the same time last year.

Market Data | Sep 12, 2018

Construction material prices fall in August

Softwood lumber prices plummeted 9.6% in August yet are up 5% on a yearly basis (down from a 19.5% increase year-over-year in July).

Market Data | Sep 7, 2018

Safety risks in commercial construction industry exacerbated by workforce shortages

The report revealed 88% of contractors expect to feel at least a moderate impact from the workforce shortages in the next three years.

Market Data | Sep 5, 2018

Public nonresidential construction up in July

Private nonresidential spending fell 1% in July, while public nonresidential spending expanded 0.7%.

Market Data | Aug 30, 2018

Construction in ASEAN region to grow by over 6% annually over next five years

Although there are disparities in the pace of growth in construction output among the ASEAN member states, the region’s construction industry as a whole will grow by 6.1% on an annual average basis in the next five years.

Market Data | Aug 22, 2018

July architecture firm billings remain positive despite growth slowing

Architecture firms located in the South remain especially strong.

Market Data | Aug 15, 2018

National asking rents for office space rise again

The rise in rental rates marks the 21st consecutive quarterly increase.

Market Data | Aug 13, 2018

First Half 2018 commercial and multifamily construction starts show mixed performance across top metropolitan areas

Gains reported in five of the top ten markets.