Despite facing a litany of market impediments—the still-sluggish economy, construction labor shortages, the slow-to-recover education and healthcare markets—the majority of AEC firms saw revenues grow in 2015, and an even greater number expect earnings to rise in 2016, according to a survey of 337 AEC professionals by Building Design+Construction.

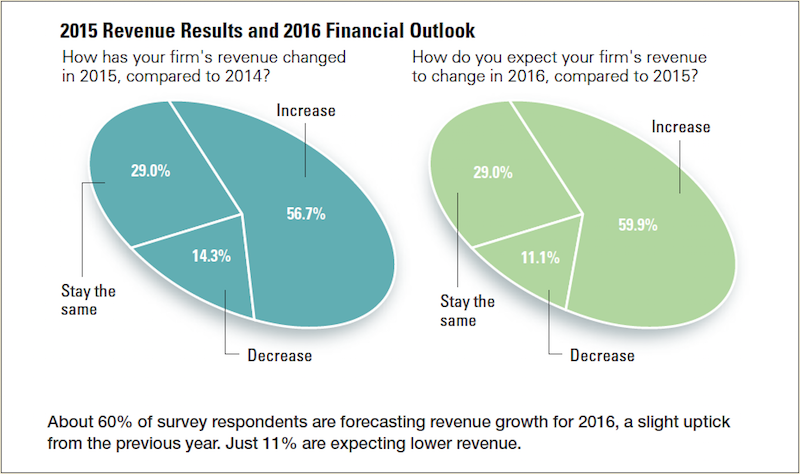

Nearly six out of 10 survey respondents (56.7%) indicated that revenues had increased at their firms in 2015, and 59.9% expect income from nonresidential building work to rise this year. This represents a slight uptick from 2014’s survey, when 54.4% reported higher revenue for the year.

About half of the respondents (45.7%) rated their firm’s 2015 business year as either “excellent” or “very good,” and just 2.1% said it was a “poor” year. Looking to 2016, 52.7% believe it will be “excellent” or “very good” from a revenue standpoint. Nearly three-quarters (71.4%) rated the overall health of their firm either “very good” or “good.”

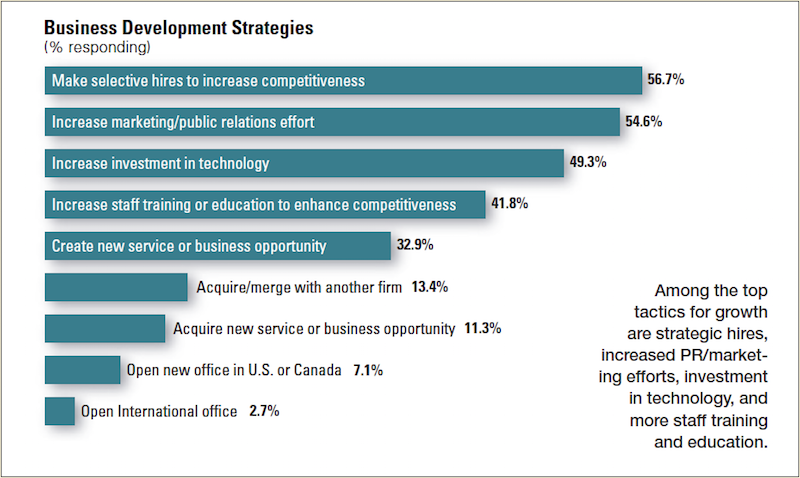

Asked to rate their firm’s top business development tactics for 2016, strategic hiring (56.7% rated it as a top tactic for growth), marketing/public relations (54.6%), and technology upgrades (49.3%) topped the list. Other popular growth strategies include staff training/education (41.8%), a new service/business opportunity (32.9%), and a firm merger/acquisition (13.4%).

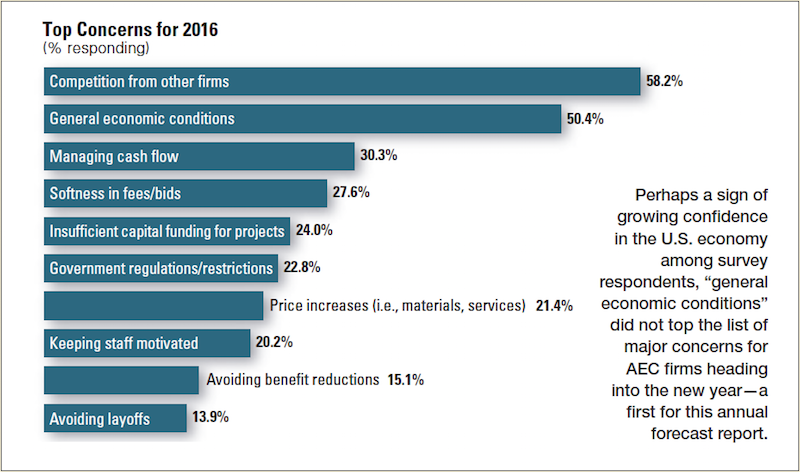

Among the top concerns for AEC firms are competition from other firms (58.2% ranked it as a top-three concern), general economic conditions (50.4%), managing cash flow (30.3%), and softness in fees/bids (27.6%).

HEALTHCARE SECTOR starting to REBOUND

Respondents were asked to rate their firms’ prospects in specific construction sectors on a five-point scale from “excellent” to “very weak.” Among the findings:

The multifamily boom continues, as the Millennials and Baby Boomers gravitate to rental housing and an urban lifestyle. Multifamily ranked as the most active sector, with 69.7% of respondents rating it in the good/excellent category, up from 62.3% last year and 56.1% in 2013.

The healthcare market is starting to stabilize and grow, as hospitals and healthcare providers adjust to the post-Affordable Care Act world. The sector ranked as the second most active; 68.0% gave it a good/excellent rating, up from 63.6% in 2014 and 62.5% the previous year.

Other active sectors include senior/assisted living (63.1% rated it in the good/excellent category), office interiors/fitouts (62.4%), data centers/mission critical (59.3%), higher education (48.6%), industrial/warehouse (46.7%), retail (44.9%), and government/military (42.5%).

Respondents to the BD+C survey include architect/designers (52.2%), engineers (19.6%), contractors (18.4%), consultants (5.0%), owner/developers (1.2%), and facility managers (1.0%).

BIM/VDC TAKES HOLD

The adoption of building information modeling and virtual design and construction tools and processes continues to grow in the AEC marketplace. More than eight in 10 respondents (82.1%) said their firm uses BIM/VDC tools on at least some of its projects, up from 80.0% in 2014 and 77.3% in 2013. About a fifth (20.3%) said their firm uses BIM/VDC on more than 75% of projects, up from 17.3% last year and 12.2% in 2013.

Respondents to the BD+C survey include architect/designers (52.2%), engineers (19.6%), contractors (18.4%), consultants (5.0%), owner/developers (1.2%), and facility managers (1.0%).

Related Stories

Market Data | Jul 8, 2021

Encouraging construction cost trends are emerging

In its latest quarterly report, Rider Levett Bucknall states that contractors’ most critical choice will be selecting which building sectors to target.

Multifamily Housing | Jul 7, 2021

Make sure to get your multifamily amenities mix right

One of the hardest decisions multifamily developers and their design teams have to make is what mix of amenities they’re going to put into each project. A lot of squiggly factors go into that decision: the type of community, the geographic market, local recreation preferences, climate/weather conditions, physical parameters, and of course the budget. The permutations are mind-boggling.

Market Data | Jul 7, 2021

Construction employment declines by 7,000 in June

Nonresidential firms struggle to find workers and materials to complete projects.

Market Data | Jun 30, 2021

Construction employment in May trails pre-covid levels in 91 metro areas

Firms struggle to cope with materials, labor challenges.

Market Data | Jun 23, 2021

Construction employment declines in 40 states between April and May

Soaring material costs, supply-chain disruptions impede recovery.

Market Data | Jun 22, 2021

Architecture billings continue historic rebound

AIA’s Architecture Billings Index (ABI) score for May rose to 58.5 compared to 57.9 in April.

Market Data | Jun 17, 2021

Commercial construction contractors upbeat on outlook despite worsening material shortages, worker shortages

88% indicate difficulty in finding skilled workers; of those, 35% have turned down work because of it.

Market Data | Jun 16, 2021

Construction input prices rise 4.6% in May; softwood lumber prices up 154% from a year ago

Construction input prices are 24.3% higher than a year ago, while nonresidential construction input prices increased 23.9% over that span.

Market Data | Jun 16, 2021

Producer prices for construction materials and services jump 24% over 12 months

The 24.3% increase in prices for materials used in construction from May 2020 to last month was nearly twice as great as in any previous year

Market Data | Jun 15, 2021

ABC’s Construction Backlog inches higher in May

Materials and labor shortages suppress contractor confidence.