Despite facing a litany of market impediments—the still-sluggish economy, construction labor shortages, the slow-to-recover education and healthcare markets—the majority of AEC firms saw revenues grow in 2015, and an even greater number expect earnings to rise in 2016, according to a survey of 337 AEC professionals by Building Design+Construction.

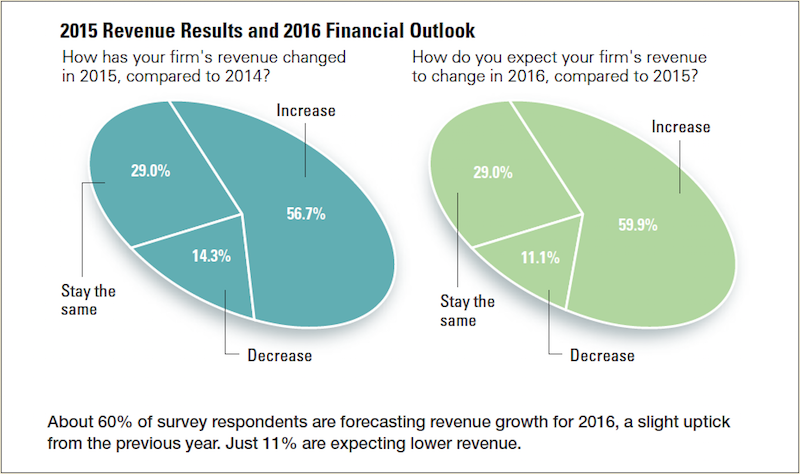

Nearly six out of 10 survey respondents (56.7%) indicated that revenues had increased at their firms in 2015, and 59.9% expect income from nonresidential building work to rise this year. This represents a slight uptick from 2014’s survey, when 54.4% reported higher revenue for the year.

About half of the respondents (45.7%) rated their firm’s 2015 business year as either “excellent” or “very good,” and just 2.1% said it was a “poor” year. Looking to 2016, 52.7% believe it will be “excellent” or “very good” from a revenue standpoint. Nearly three-quarters (71.4%) rated the overall health of their firm either “very good” or “good.”

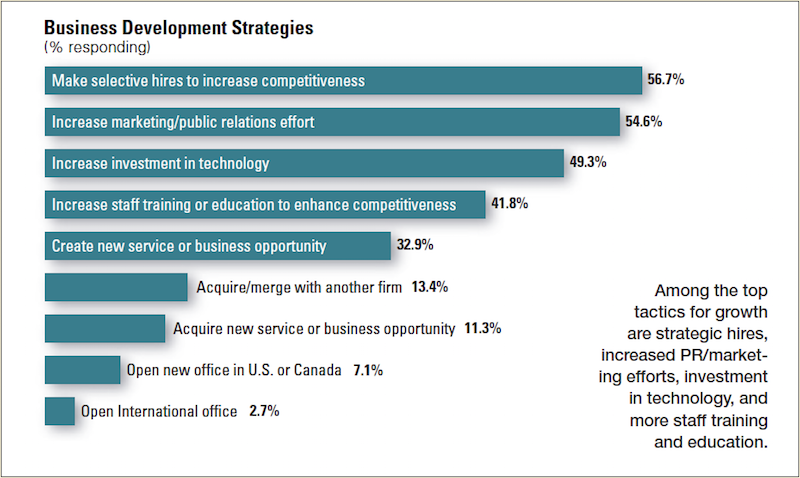

Asked to rate their firm’s top business development tactics for 2016, strategic hiring (56.7% rated it as a top tactic for growth), marketing/public relations (54.6%), and technology upgrades (49.3%) topped the list. Other popular growth strategies include staff training/education (41.8%), a new service/business opportunity (32.9%), and a firm merger/acquisition (13.4%).

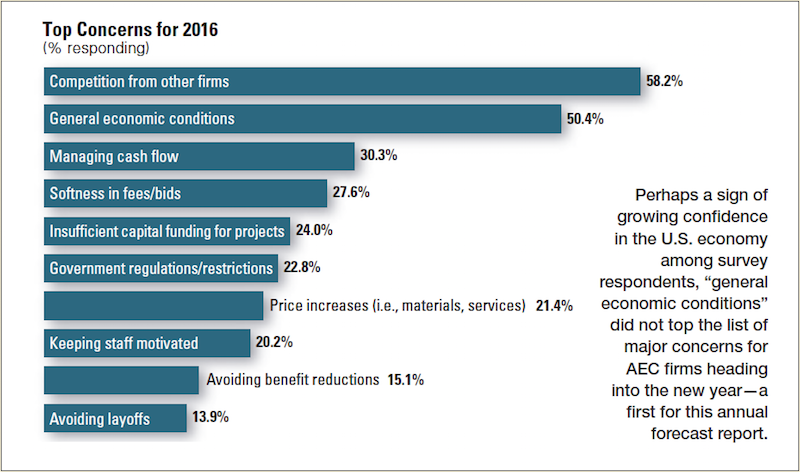

Among the top concerns for AEC firms are competition from other firms (58.2% ranked it as a top-three concern), general economic conditions (50.4%), managing cash flow (30.3%), and softness in fees/bids (27.6%).

HEALTHCARE SECTOR starting to REBOUND

Respondents were asked to rate their firms’ prospects in specific construction sectors on a five-point scale from “excellent” to “very weak.” Among the findings:

The multifamily boom continues, as the Millennials and Baby Boomers gravitate to rental housing and an urban lifestyle. Multifamily ranked as the most active sector, with 69.7% of respondents rating it in the good/excellent category, up from 62.3% last year and 56.1% in 2013.

The healthcare market is starting to stabilize and grow, as hospitals and healthcare providers adjust to the post-Affordable Care Act world. The sector ranked as the second most active; 68.0% gave it a good/excellent rating, up from 63.6% in 2014 and 62.5% the previous year.

Other active sectors include senior/assisted living (63.1% rated it in the good/excellent category), office interiors/fitouts (62.4%), data centers/mission critical (59.3%), higher education (48.6%), industrial/warehouse (46.7%), retail (44.9%), and government/military (42.5%).

Respondents to the BD+C survey include architect/designers (52.2%), engineers (19.6%), contractors (18.4%), consultants (5.0%), owner/developers (1.2%), and facility managers (1.0%).

BIM/VDC TAKES HOLD

The adoption of building information modeling and virtual design and construction tools and processes continues to grow in the AEC marketplace. More than eight in 10 respondents (82.1%) said their firm uses BIM/VDC tools on at least some of its projects, up from 80.0% in 2014 and 77.3% in 2013. About a fifth (20.3%) said their firm uses BIM/VDC on more than 75% of projects, up from 17.3% last year and 12.2% in 2013.

Respondents to the BD+C survey include architect/designers (52.2%), engineers (19.6%), contractors (18.4%), consultants (5.0%), owner/developers (1.2%), and facility managers (1.0%).

Related Stories

Market Data | Dec 17, 2021

Construction jobs exceed pre-pandemic level in 18 states and D.C.

Firms struggle to find qualified workers to keep up with demand.

Market Data | Dec 15, 2021

Widespread steep increases in materials costs in November outrun prices for construction projects

Construction officials say efforts to address supply chain challenges have been insufficient.

Market Data | Dec 15, 2021

Demand for design services continues to grow

Changing conditions could be on the horizon.

Market Data | Dec 5, 2021

Construction adds 31,000 jobs in November

Gains were in all segments, but the industry will need even more workers as demand accelerates.

Market Data | Dec 5, 2021

Construction spending rebounds in October

Growth in most public and private nonresidential types is offsetting the decline in residential work.

Market Data | Dec 5, 2021

Nonresidential construction spending increases nearly 1% in October

Spending was up on a monthly basis in 13 of the 16 nonresidential subcategories.

Market Data | Nov 30, 2021

Two-thirds of metro areas add construction jobs from October 2020 to October 2021

The pandemic and supply chain woes may limit gains.

Market Data | Nov 22, 2021

Only 16 states and D.C. added construction jobs since the pandemic began

Texas, Wyoming have worst job losses since February 2020, while Utah, South Dakota add the most.

Market Data | Nov 10, 2021

Construction input prices see largest monthly increase since June

Construction input prices are 21.1% higher than in October 2020.

Market Data | Nov 9, 2021

Continued increases in construction materials prices starting to drive up price of construction projects

Supply chain and labor woes continue.