Architects

M&A activity down in 2013 among architecture, engineering firms: Report

By Morrissey Goodale

Feb. 5, 2014

2 min read

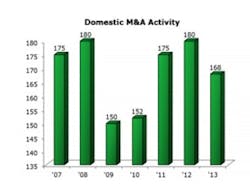

In 2013, consultant Morrissey Goodale observed 168 sales of U.S.-based architecture and engineering (“A/E”) firms – down nearly 7% from the record 180 sales of U.S.-based A/E firms in 2012. Similarly, just 107 international A/E firms sold in 2013, a drop of more than 20% from the 135 deals in 2012. Yet 2013 was anticipated by many to be another break-neck, record-setting year for A/E industry M&A. The economy continued to recover, performance at many firms climbed back to pre-recession levels, and things were looking up for a year of rapid deal-making. So what caused industry dealmakers to slow down after living 2012 in the fast lane?

· Owners rode the (modest) wave. As the economy persisted to creep toward respectability in 2013 and value continued to build in A/E firms, prospective sellers showed an increasing reluctance to jump at offers. Instead, they were inclined to take the longer view of building a track record of solid performance, desiring to sell at the high (or at least higher) water mark that many A/E firm leaders believe is still on the horizon.

· Tax-driven deal spike late in 2012. U.S. sellers seemed to be certain they needed to sell in 2012 to minimize capital gains which were anticipated to climb in 2013. We observed an unusually high flurry of deal activity in late 2012, seemingly driven by a desire to get deals done by year end. With tax rates steady for the foreseeable future, we anticipate the competitive environment, age, ownership and leadership transition, and other factors will drive owners’ desires to sell their firms.

· Large firms took a breather in 2013. Many of the firms that have traditionally been the most active buyers in the industry spent 2013 mostly on the sidelines. Firms like AECOM, SNC-Lavalin, Genivar (now WSP Global), IBI Group, ARCADIS, and URS, among others, slowed or stopped their M&A programs in 2013. This decline may be attributable to the need to integrate the firms they acquired over the last few years, work on internal initiatives, or simply being unable to find and close deals that met their strategic needs at appropriate valuations in 2013.

About Morrissey Goodale LLC

Based in Newton, Mass., Morrissey Goodale LLC is a leading management consulting and research firm serving the architecture, engineering, and Construction (AEC) industry.

Sign up for Building Design+Construction Newsletters