About Morrissey Goodale LLC

Based in Newton, Mass., Morrissey Goodale LLC is a leading management consulting and research firm serving the architecture, engineering, and Construction (AEC) industry.

Related Stories

| Aug 8, 2013

Top Science and Technology Sector Engineering Firms [2013 Giants 300 Report]

Affiliated Engineers, Middough, URS top Building Design+Construction's 2013 ranking of the largest science and technology sector engineering and engineering/architecture firms in the U.S.

| Aug 8, 2013

Top Science and Technology Sector Architecture Firms [2013 Giants 300 Report]

HDR, Perkins+Will, HOK top Building Design+Construction's 2013 ranking of the largest science and technology sector architecture and architecture/engineering firms in the U.S.

| Aug 8, 2013

Top Science and Technology Sector Construction Firms [2013 Giants 300 Report]

Skanska, DPR, Suffolk top Building Design+Construction's 2013 ranking of the largest science and technology sector contractors and construction management firms in the U.S.

| Aug 8, 2013

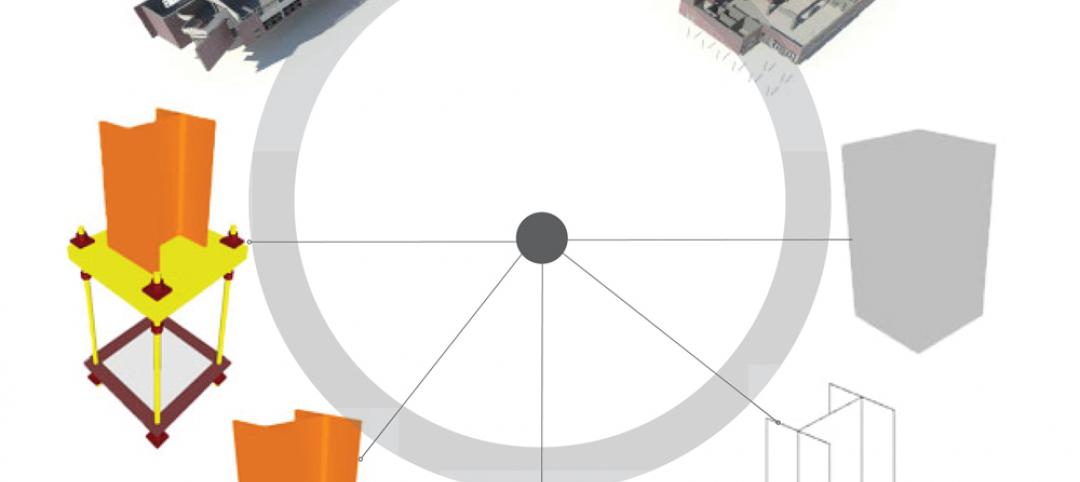

Level of Development: Will a new standard bring clarity to BIM model detail?

The newly released LOD Specification document allows Building Teams to understand exactly what’s in the BIM model they’re being handed.

| Aug 8, 2013

Vertegy spins off to form independent green consultancy

St. Louis-based Vertegy has announced the formation of Vertegy, LLC, transitioning into an independent company separate from the Alberici Enterprise. The new company was officially unveiled Aug. 1, 2013

| Aug 5, 2013

Top Retail Architecture Firms [2013 Giants 300 Report]

Callison, Stantec, Gensler top Building Design+Construction's 2013 ranking of the largest retail architecture and architecture/engineering firms in the United States.

| Aug 5, 2013

Top Retail Engineering Firms [2013 Giants 300 Report]

Jacobs, AECOM, Henderson Engineers top Building Design+Construction's 2013 ranking of the largest retail engineering and engineering/architecture firms in the United States.

| Aug 5, 2013

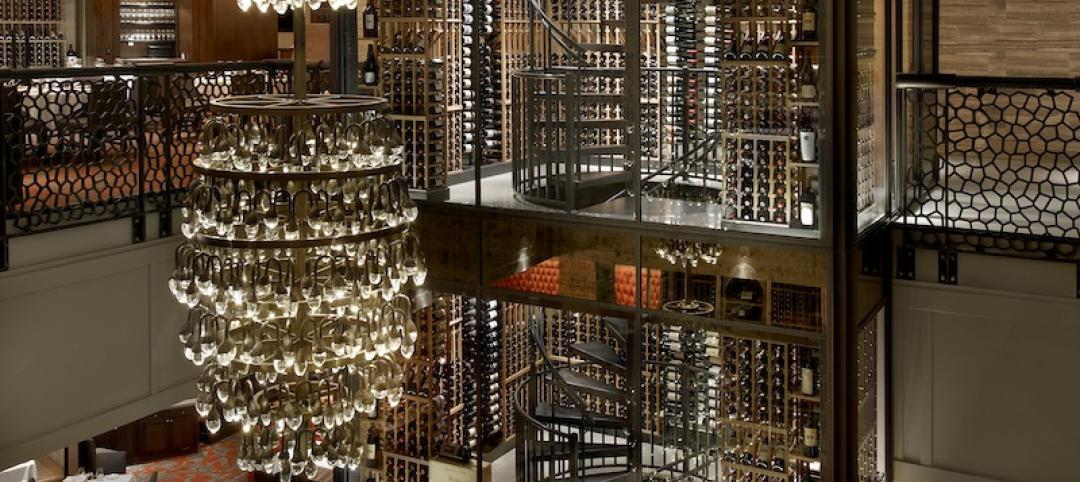

Retail market shows signs of life [2013 Giants 300 Report]

Retail rentals and occupancy are finally on the rise after a long stretch in the doldrums.

| Aug 5, 2013

Top Retail Construction Firms [2013 Giants 300 Report]

Shawmut, Whiting-Turner, PCL top Building Design+Construction's 2013 ranking of the largest retail contractor and construction management firms in the United States.

| Aug 2, 2013

Michael Baker Corp. agrees to be acquired by Integrated Mission Solutions

Michael Baker Corporation (“Baker”) (NYSE MKT:BKR) announced today that it has entered into a definitive merger agreement to be acquired by Integrated Mission Solutions, LLC (“IMS”), an affiliate of DC Capital Partners, LLC (“DC Capital”).