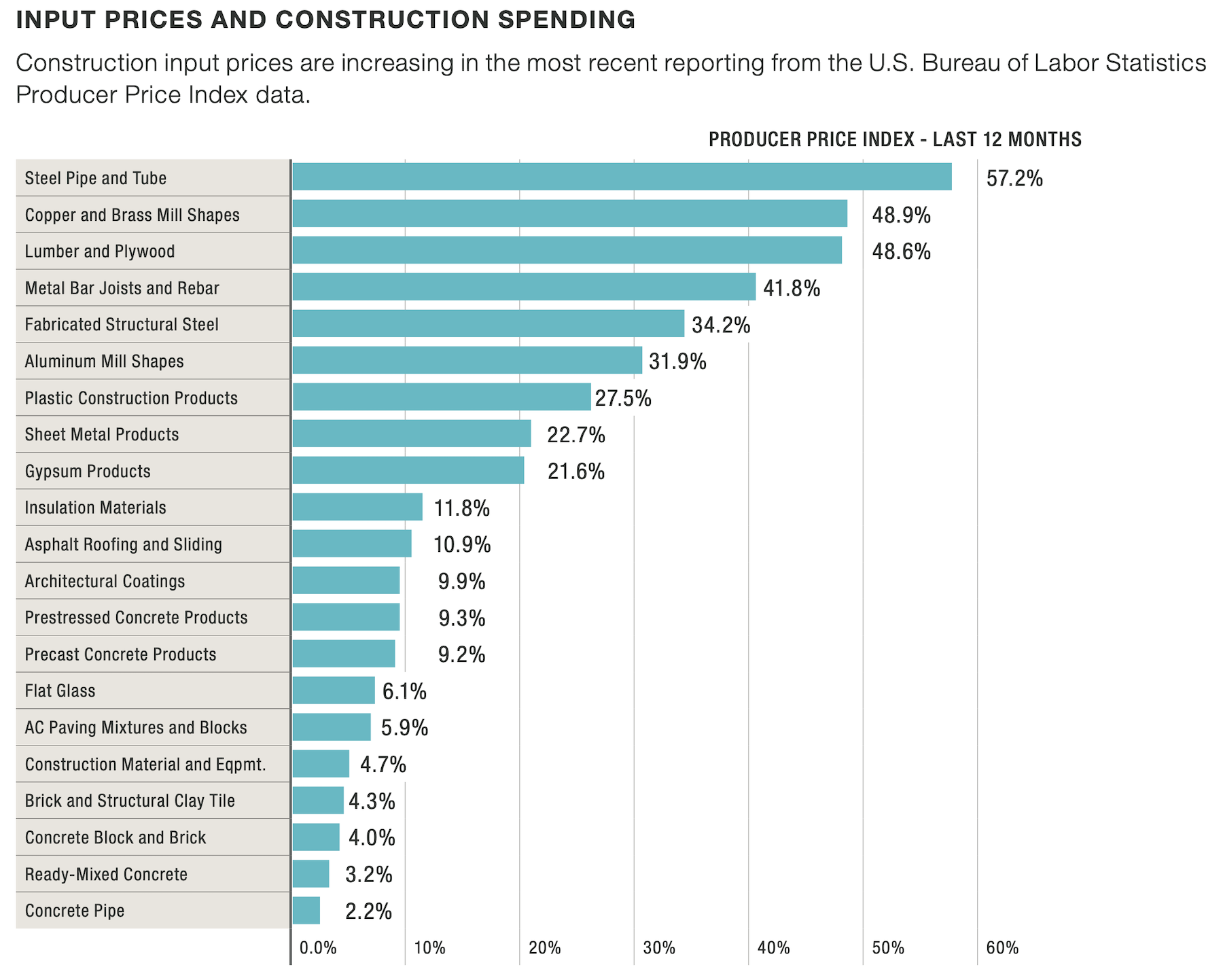

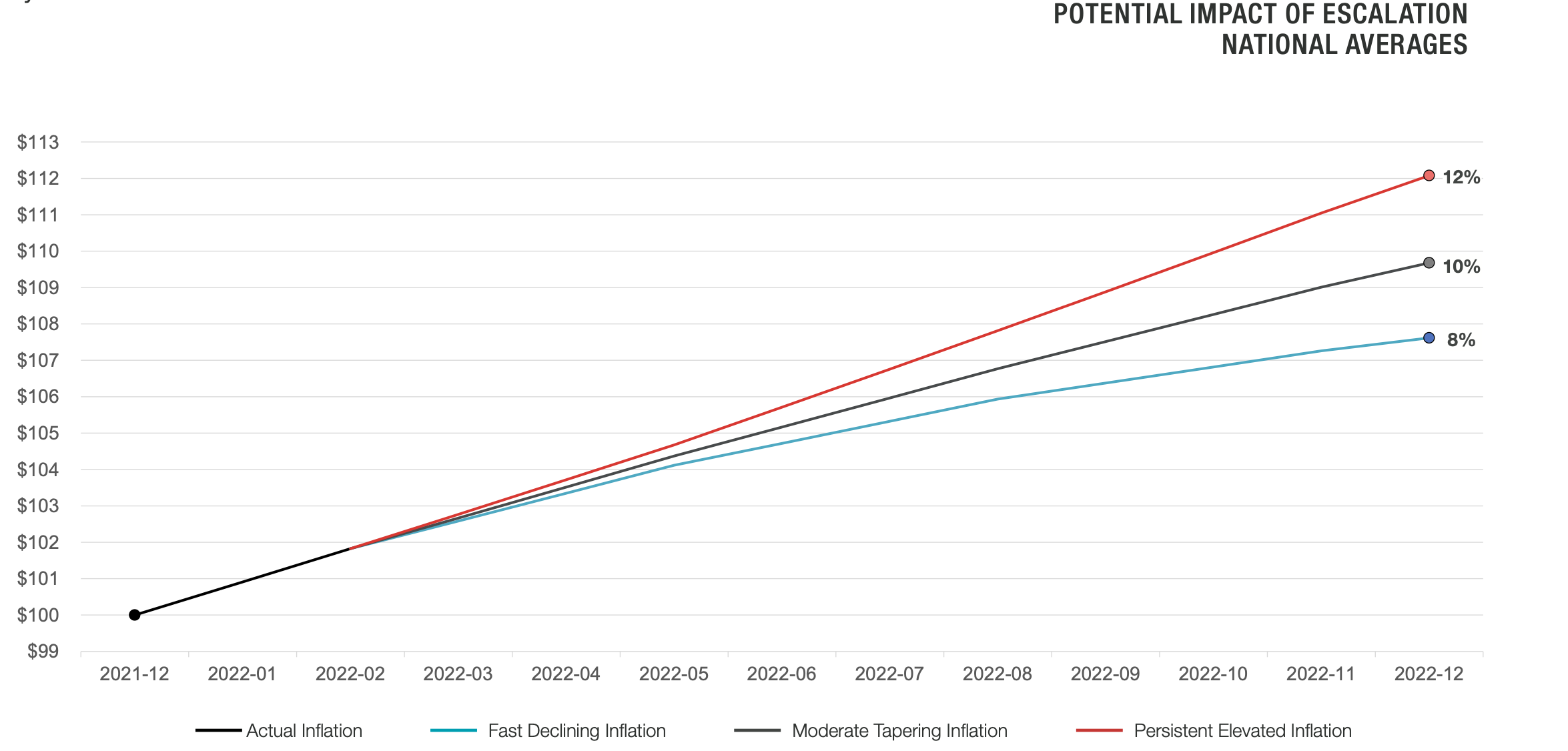

In the first six months of 2022, quarter-to-quarter inflation for construction materials showed signs of easing, but only slightly. “It’s important to clarify that costs are not decreasing; a more accurate description is that [they are] getting expensive less quickly,” stated Dallas-based architecture and construction firm The Beck Group, in its Summer 2022 Biannual Cost Report, which Beck released this week.

Covering January through June of this year, the report combines market data from a variety of sources—including AIA, FMI, McKinsey & Company, Autodesk, Cumming, the Urban Land Institute, and Associated General Contractors of America—with insights from the firm’s preconstruction teams in six markets: Atlanta, Austin, Charlotte, Dallas-Fort Worth, Denver, and the state of Florida.

Market conditions remain challenging nearly everywhere. “Schedule-related constraints are a new norm in today’s market,” The Beck Group contends. “Construction firms are in the middle of suppliers who can’t or won’t commit to pricing longer than 10 days and owners with historically prolonged approval processes. This reality conflicts with the past when it was still possible to hold pricing for upwards of 60 days.”

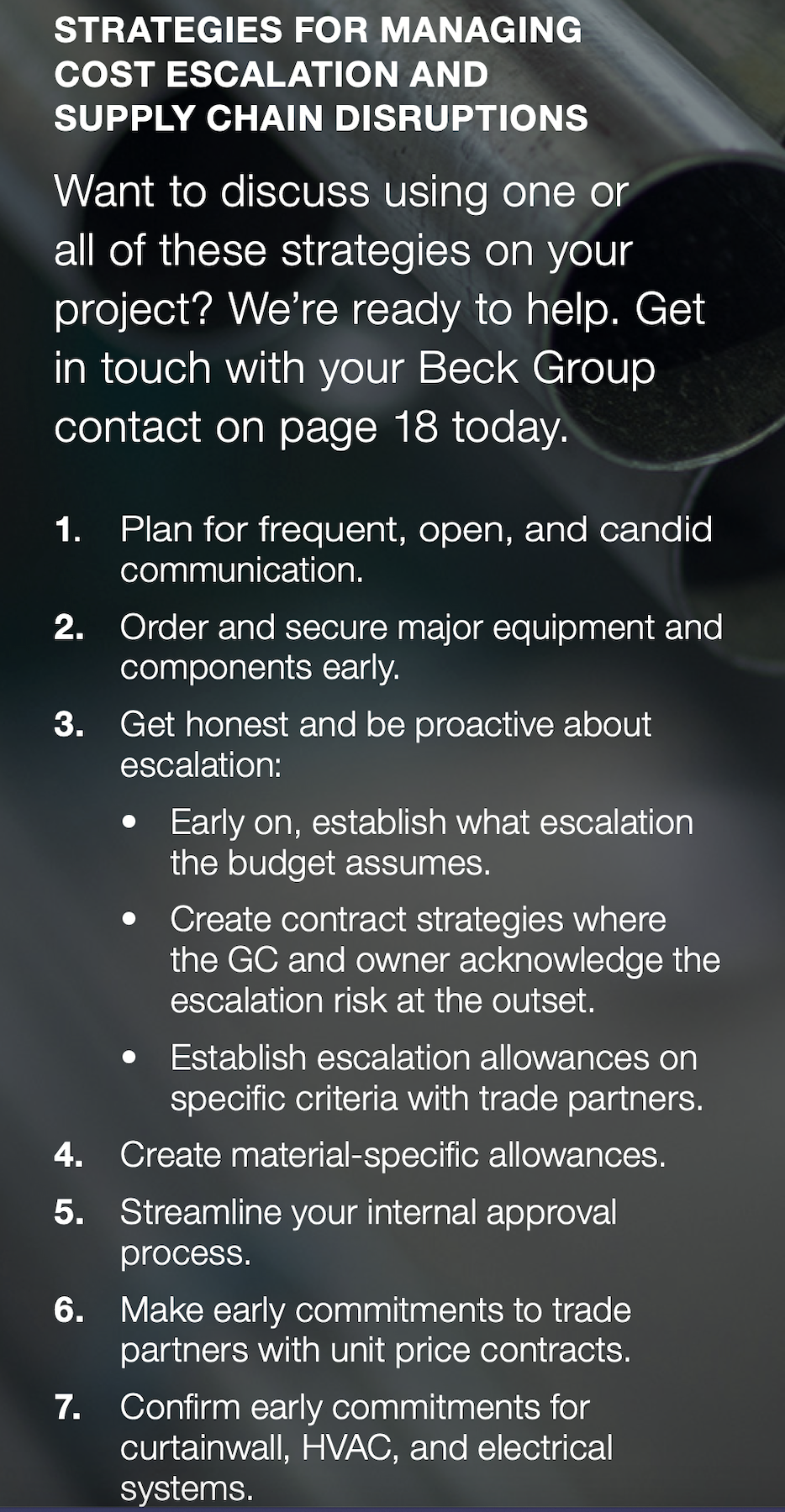

That being said, The Beck Group claims that the industry is on the cusp of a “new era in collaboration to manage costs and schedules.” That is especially true for developers and owners that bring their AEC partners into projects as early as possible. In its report, The Beck Group offers a list of strategies for managing inflation and supply-chain disruptions that mostly revolve around earlier procurement (see box).

Beck itself creates procurement packages for its clients to secure materials and equipment, a service that involves the firm’s design and construction teams.

DENVER AN EXPENSIVE PLACE TO BUILD IN

On the whole, The Beck Group is seeing significant demand and construction activities in the Sun Belt, in line with the “constant migration” of people and businesses to that region. (It points out, for example, that 43 high-rise towers are under development or construction in Austin.) To keep up with that demand, subcontractors in Texas must rely on imported cement (which, ironically, is among the construction materials least affected by current inflation).

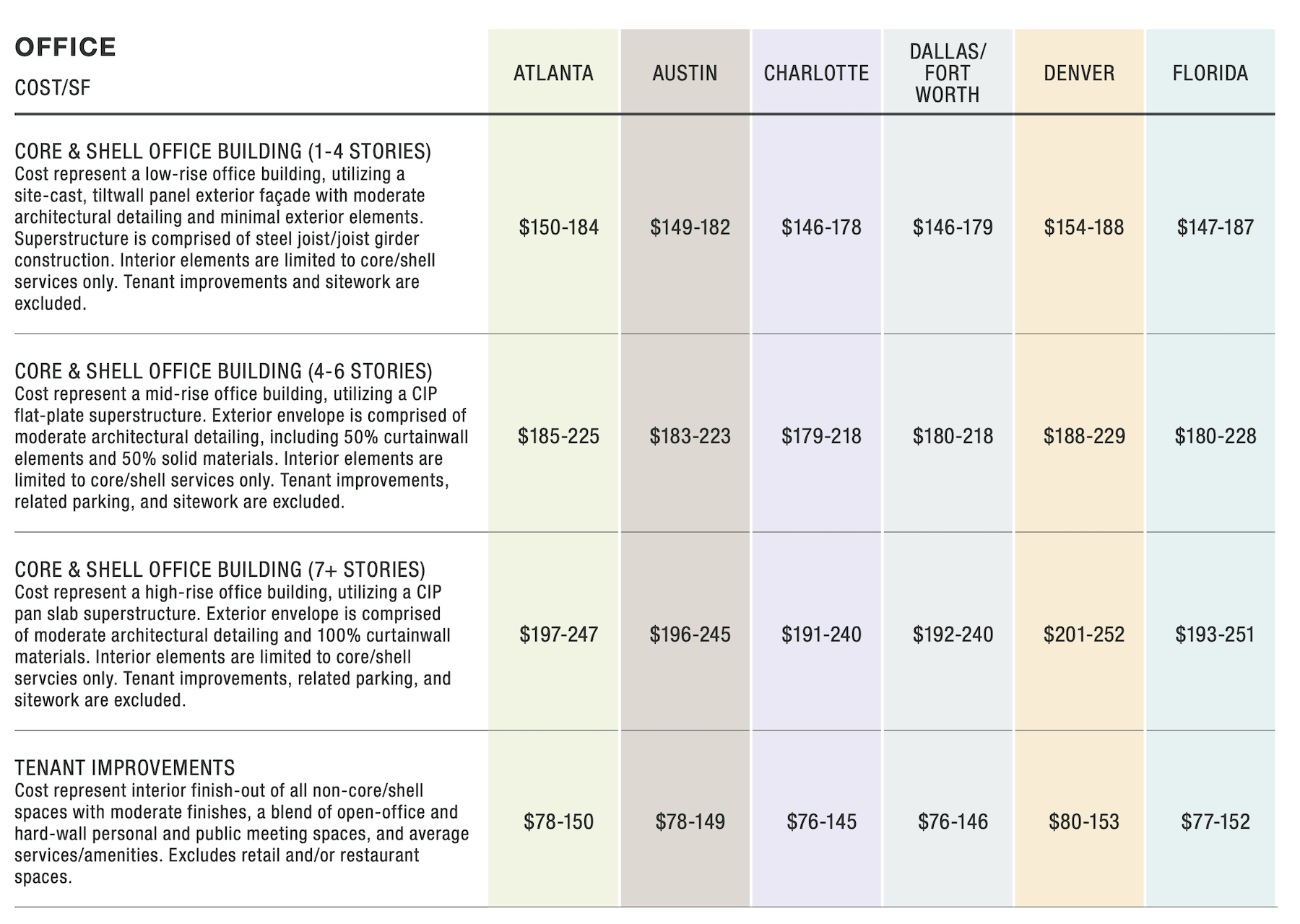

The report takes a deeper dive into the six Sun Belt markets mentioned above, and breaks down project costs by building types—office, healthcare, higher education, faith-based, hospitality, parking, and site work—and their respective sub niches.

The Denver metro is experiencing high demand for multifamily and mixed-use projects. Existing and planned projects are plentiful in the Atlanta market, and subcontractors report substantial backlogs. Building activity in the Florida market remains healthy, bolstered by the state’s economy that is expected to expand by 4 percent between now and 2024. The most significant demand for construction is education, healthcare, and aviation.

Across all building types, it costs more to build or renovate in Denver than in the other five markets, albeit only marginally so in several cases. For example, in healthcare, Denver’s costs per sf for ambulatory surgery centers—ranging from $477 to $583—were around $10 to $25 higher than the other metros. Science and lab buildings cost from $650 to $901 per sf to construct in Denver, versus $631 to $885 in Austin, another S+T hotbed.

The report also compares the cost per key to build or renovate hotels in these six markets, as well as the cost per space for parking and the cost per acre for site development.

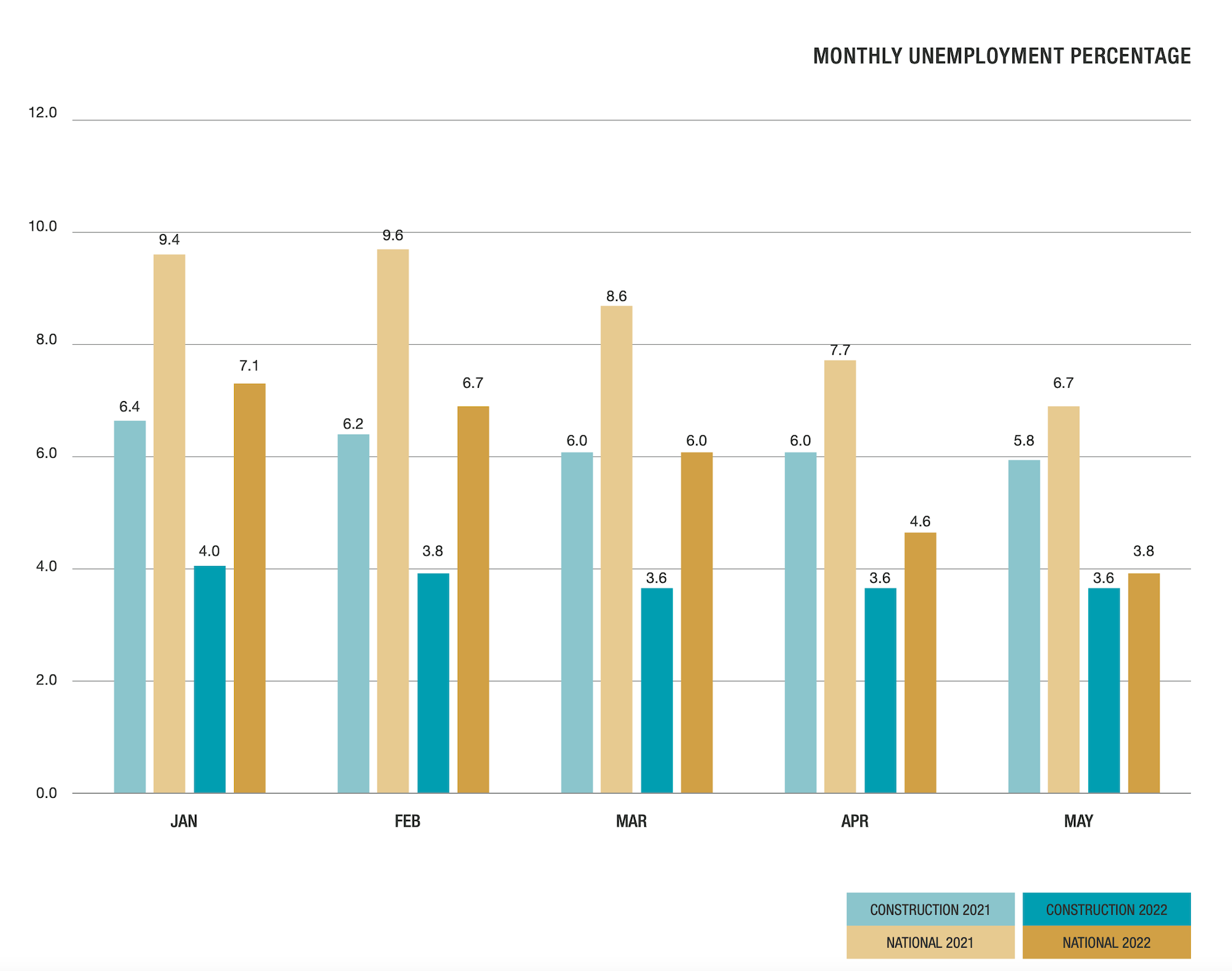

CONSTRUCTION EMPLOYMENT STRENGTHENING

The Beck Group report corroborates what other recent studies have been finding: that the construction employment market, nationally, is improving. Beck predicts this trend to continue as higher wages lure more people into the profession. The employment situation might also explain the slight bump in industry confidence that was evident in the first half of the year.

Related Stories

Market Data | Mar 16, 2021

Construction employment in January lags pre-pandemic mark in 42 states

Canceled projects, supply-chain woes threaten future jobs.

Market Data | Mar 15, 2021

Rising materials prices and supply chain disruptions are hurting many construction firms

The same firms are already struggling to cope with pandemic impacts.

Market Data | Mar 11, 2021

Soaring materials costs, supply-chain problems, and project cancellations continue to impact construction industry

Costs and delayed deliveries of materials, parts, and supplies are vexing many contractors.

Market Data | Mar 8, 2021

Construction employment declines by 61,000 in February

Association officials urge congress and Biden administration to focus on new infrastructure funding.

Market Data | Mar 2, 2021

Construction spending rises in January as private nonresidential sector stages rare gain

Private nonresidential market shrinks 10% since January 2020 with declines in all 11 segments.

Market Data | Feb 24, 2021

2021 won’t be a growth year for construction spending, says latest JLL forecast

Predicts second-half improvement toward normalization next year.

Market Data | Feb 23, 2021

Architectural billings continue to contract in 2021

AIA’s Architecture Billings Index (ABI) score for January was 44.9 compared to 42.3 in December.

Healthcare Facilities | Feb 18, 2021

The Weekly show, Feb 18, 2021: What patients want from healthcare facilities, and Post-COVID retail trends

This week on The Weekly show, BD+C editors speak with AEC industry leaders from JLL and Landini Associates about what patients want from healthcare facilities, based on JLL's recent survey of 4,015 patients, and making online sales work for a retail sector recovery.

Market Data | Feb 17, 2021

Soaring prices and delivery delays for lumber and steel squeeze finances for construction firms already hit by pandemic

Association officials call for removing tariffs on key materials to provide immediate relief for hard-hit contractors and exploring ways to expand long-term capacity for steel, lumber and other materials,

Market Data | Feb 9, 2021

Construction Backlog and contractor optimism rise to start 2021, according to ABC member survey

Despite the monthly uptick, backlog is 0.9 months lower than in January 2020.