Although 2013 isn’t likely to be anyone’s idea of a blockbuster year for real estate performance, landlords across an array of commercial property types are gaining pricing control and increased rental income from their assets. Keys to the equation for property types other than apartments are construction volumes near 40-year lows and incremental job gains from a handful of growth sectors, including energy and technology.

“The lack of new construction has been a saving grace since the beginning of the recession,” said Jay Koster, Americas President for Capital Markets at Jones Lang LaSalle. “We’re also seeing accelerated obsolescence among older buildings as tenants upgrade to higher quality and more efficient space, and that is helping to fill marketable properties and drive up rents, even with only slow underlying growth.”

Multifamily retains strength: Rental apartments, by contrast, have far surpassed other property types in the development cycle and are approaching peak performance levels in many markets, according to Jones Lang LaSalle’s First Quarter 2013 Cross Sector Outlook, distributed today during the Urban Land Institute’s 2013 Spring Meeting, in San Diego, May 14-17th. The report tracks and compares the relative health of property sectors nationally and by local markets.

“Multifamily rents across the U.S. climbed to historic highs at the end of 2012, up 4.4 percent year-over-year,” said Marisha Clinton, Director of Capital Markets Research at Jones Lang LaSalle and one of the report’s authors. “Short-term setbacks may occur, particularly in overbuilt submarkets, but we believe demand from an expanding renter population will keep apartment fundamentals strong into 2017.”

Retail improving: Even the retail sector, which is more of a “wild card” and appears to be bottoming out, has been weighed down by constrained consumer spending and competition with online retailers but has showed slight net absorption in the first quarter. That means that the leased portion of available space across the nation increased by 0.3 percent.

Retail tenants are soaking up available space fastest in a handful of markets, most of which enjoy either a booming energy sector or a recovering housing market. Markets to watch include Broward County, Tampa and Orlando in Florida; Charlotte and Raleigh in North Carolina; Dallas and Houston in Texas; Minneapolis, and Seattle.

Retail construction volume will remain low for the next few years as investors focus on redevelopment of existing properties in order to attract and retain tenants. As with all property types, low interest rates have enabled more investors to afford acquisitions and retail investment sales volumes have risen steadily over the past 12 months. Private investors and real estate investment trusts (REITs) accounted for more than 68 percent of acquisitions in that period.

Anita Kramer, vice president at the ULI Center for Capital Markets and Real Estate, says retailer performance as a whole will continue to drag as long as unemployment is high and consumer spending is constrained, with only slow increases in retail demand to serve a growing population.

“We’re all hoping retail will make a comeback, but there’s really concern about whether consumers are loosening up,” Kramer said. “There are clearly a lot of people out there that aren’t spending. When they start spending, that’s when we will have an incremental kick to retail.”

Investors follow the big picture

Real estate investors need to consider cross-sector performance measures because the strengths and weaknesses of one sector can affect properties of another type, Kramer observed. She points out that a mixed-use development will typically begin with a single use, such as retail, that provides a draw for other uses to be developed in later phases, perhaps adding multifamily or office space.

The same relationships exist between individual projects in many submarkets, particularly in central business districts that are enjoying an inflow of employers and workers with a strong desire for rental housing, dining and entertainment nearby. In those cases, a stronghold in one property type may create opportunities in other sectors down the road.

“Anybody who is thoughtfully in any sector of real estate at this point needs to monitor all sectors,” Kramer said.

Additional First Quarter 2013 Cross Sector Outlook highlights:

- Strong hotel sector performance underpins a buoyant transactions market. Hotel property sales are on track to reach $17 billion in 2013, up from $16.4 billion in 2012.

- The national office market was markedly healthier in the first quarter from a year ago, with a dramatic decline in sublease space, increase in occupancy, and rent growth in more than 80 percent of major markets.

- Modern, functionally superior industrial space is in high demand, with occupancy at post-recession highs. Look for demand to broaden as mid-sized tenants return to the market.

Jones Lang LaSalle Capital Markets is a full-service global provider of capital solutions for real estate investors and occupiers. The firm’s in-depth local market and global investor knowledge delivers the best-in-class solutions for clients — whether a sale, financing, repositioning, advisory or recapitalization execution. In 2012 alone, Jones Lang LaSalle Capital Markets completed $63 billion in investment sale and debt and equity transactions globally. The firm’s dealmakers completed $60 billion in global investment sales and buy-side transactions, equating to nearly $240 million of investment trades completed every working day around the globe. The firm’s Capital Markets team comprises more than 1,300 specialists, operating all over the globe.

For more news, videos and research resources on Jones Lang LaSalle, please visit the firm’s U.S. media center Web page. Bookmark it here: http://www.us.am.joneslanglasalle.com/UnitedStates/EN-US/Pages/News.aspx

About Jones Lang LaSalle

Jones Lang LaSalle (NYSE:JLL) is a professional services and investment management firm offering specialized real estate services to clients seeking increased value by owning, occupying and investing in real estate. With annual revenue of $3.9 billion, Jones Lang LaSale operates in 70 countries from more than 1,000 locations worldwide. On behalf of its clients, the firm provides management and real estate outsourcing services to a property portfolio of 2.6 billion square feet and completed $63 billion in sales, acquisitions and finance transactions in 2012. Its investment management business, LaSalle Investment Management, has $47.7 billion of real estate assets under management. For further information, visit www.jll.com.

Related Stories

Architects | Jul 21, 2015

Architecture Billings Index at highest mark since 2007

This is the first month in 2015 that all regions are reporting positive business conditions, said AIA Chief Economist Kermit Baker.

BIM and Information Technology | Jul 20, 2015

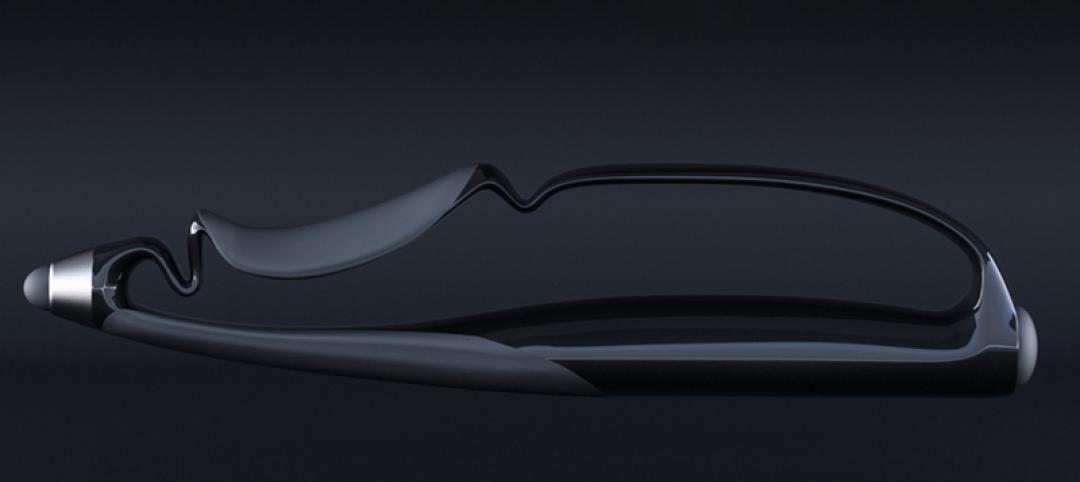

New stylus brings digital sketching to the next level

Without buttons, users can change the weight of the stylus’ stroke.

Architects | Jul 20, 2015

New York design competition looks to shed the sidewalk shed

New York, which has nearly 200 total miles of sidewalk sheds, is seeking a concept that is practical but that also looks good.

Cultural Facilities | Jul 19, 2015

SET Architects wins design competition for Holocaust Memorial

The design for the memorial in Bologna, Italy, is dominated by two large metal monolithic structures that represent the oppressive wooden bunks in concentration camps in Germany during World War II.

Sports and Recreational Facilities | Jul 17, 2015

Japan scraps Zaha Hadid's Tokyo Olympic Stadium project

The rising price tag was one of the downfalls of the 70-meter-tall, 290,000-sm stadium. In 2014, the cost of the project was 163 billion yen, but that rose to 252 billion yen this year.

Cultural Facilities | Jul 16, 2015

Louisville group plans to build world's largest disco ball

The sphere would more than double the size of the current record holder.

Education Facilities | Jul 14, 2015

Chile selects architects for Subantarctic research center

Promoting ecological tourism is one of this facility’s goals

BIM and Information Technology | Jul 14, 2015

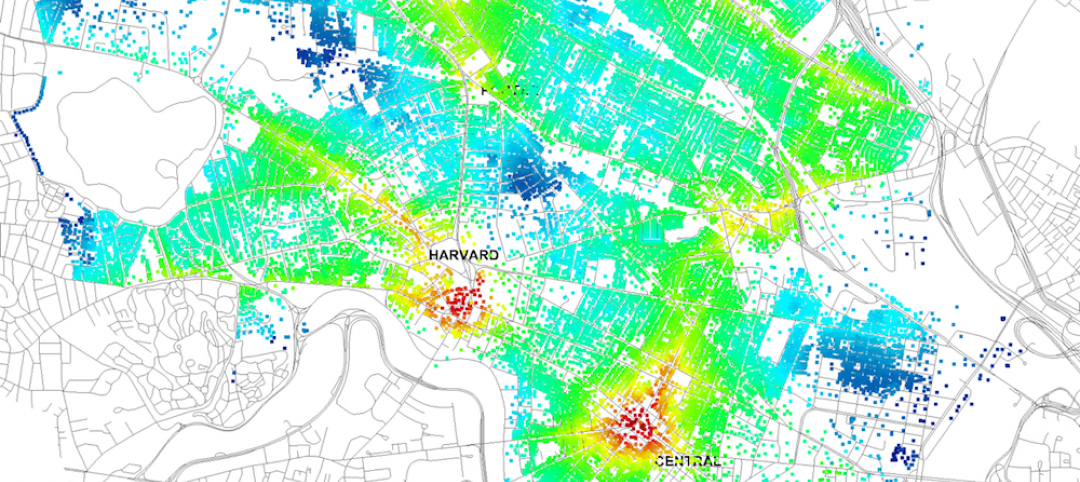

New city-modeling software quantifies the movement of urban dwellers

UNA for Rhino 3D helps determine the impact that urban design can have on where pedestrians go.

Industrial Facilities | Jul 14, 2015

Tesla may seek to double size of Gigafactory in Nevada

Tesla Motors purchased an additional 1,200 acres next to the Gigafactory and is looking to buy an additional 350 acres.

BIM and Information Technology | Jul 14, 2015

Nation’s first 'drone park' breaks ground in North Dakota

This is one of six testing sites around the country that are developing flight standards and evaluating the utility of drones for different tasks.