Jacobs Engineering Group has entered into a definitive agreement to acquire the outstanding shares of CH2M Hill Companies, an Englewood, Colo.-based consulting and program management firm that is a leader in infrastructure, environmental, and government sectors.

Dallas-based Jacobs will finance this deal, valued at $3.27 billion (including assumption of $416 million of CH2M debt), with 60% cash and 40% stock. The firm has secured financing, including a $1.2 billion three-year term loan.

The acquisition is expected to close by the first quarter of 2018. It is subject to approval by CH2M’s shareholders that would own 15% of Jacobs’ stock upon consummation.

Jacobs is already a major player in the oil and chemicals sectors as a consultant, engineer, and project manager. Its other specialties include construction, aerospace, and defense.

In CH2M, Jacobs is acquiring a 71-year-old firm that is a leader in such areas as water infrastructure, transportation, industrial manufacturing, and environmental services.

CH2M, with more than 20,000 associates, is employee owned. It generates about $4.4 billion in annual revenue, with 73% of its business coming from consulting and program management. More than 70% of its clientele is local, state, or federal governments. Its adjusted cash flow, as of June 2017, was $323 million.

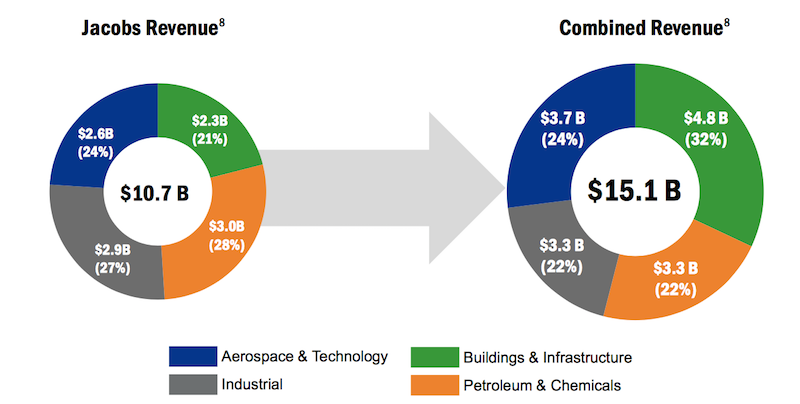

The combined company’s $15.1 billion in revenue could challenge AECOM as the world’s largest engineering firm, at a time when the Trump Administration has proposed, in general terms, an infrastructure construction and repair program in the U.S. that would include $1 trillion in public and private funding over a decade.

The combined company would be more heavily weighted toward building and infrastructure than Jacobs is currently. And the combination would surpass AECOM in global design revenue ($10 billion vs. $7.4 billion).

Buildings & Infratstructure would be a bigger part of Jacobs' portfolio if its merger with CH2M goes through. Image: Jacobs

“This is a major milestone for Jacobs and the industry,” proclaimed Steve Demetriou, Jacobs’ Chairman and CEO, during a webcast to provide analysts with details about the agreement. Demetriou was joined by Bob Pragada, President of Jacobs’ Buildings and Infrastructure & Industrial business unit; and Kevin Berryman, the firm’s EVP and CFO.

None of CH2M’s corporate officials participated in the webcast, and it’s not clear who from CH2M’s C-Suite would be staying on, or whether Jacobs intended to use CH2M’s brand for marketing purposes.

Demetriou did say, though, that one of Jacobs’ top priorities is “retaining talent,” and that the combination would create “career development opportunities” for the combined company’s employees. He also stated that it was not Jacobs’ intention to simply fold CH2M into its operations, but to take advantage of each company’s strengths to become “a premier end-to-end global solutions provider.”

Jacobs has formed an Integration Management Office, led by Gary Mandel and Lisa Glatch, EVPs with Jacobs and CH2M, respectively. The firm has also hired an outside consultant (which it did not identify during the webcast) to assist the merger. Demetriou will chair an executive steering committee set up to ensure a smooth transition and integration.

Another priority is to deliver cost and cost synergies. Jacobs executives made the point several times that there is minimal overlap in Jacobs’ and CH2M’s clientele and markets, and that both companies have pursued relatively low-risk business strategies that focus on profitability and margins. Pragada pointed specifically to Buildings, Infrastructure, Aerospace, and Technology as “higher margin” sectors that the combined company would pursue.

However, there will be streamlining if this deal goes through. Berryman said Jacobs projects this combination to produce $150 million in annual cost savings by its second full year. Berryman said “at least” 50 of the two firms’ locations worldwide present “combination opportunities.”

During the webcast, some analysts expressed skepticism about this merger, based on past AEC deals that didn't pan out as advertised, and on the fact that this deal makes Jacobs more design oriented.

Executives at Jacobs—which during its history has acquired more than 70 companies—countered that this deal has undergone extensive due diligence of all of CH2M’s projects. More to the point, they said the acquisition is a good fit for Jacobs’ broader three-year strategic growth initiative that began last year.

Demetriou assured analysts that his company has “the accountable leadership in place” to execute the CH2M deal, and to “create a new industry leader and stronger partner.”

Related Stories

Giants 400 | Aug 25, 2021

Top 95 Architecture/Engineering Firms for 2021

Stantec, HDR, HOK, and SOM top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential and multifamily buildings work, as reported in Building Design+Construction's 2021 Giants 400 Report.

Sports and Recreational Facilities | Aug 25, 2021

The rise of entertainment districts and the inside-out stadium

Fiserv Forum, home to the 2021 NBA Champion Milwaukee Bucks, proved that the design of the space outside a stadium is just as important as inside.

Architects | Aug 19, 2021

BD+C Events

Building Design+Construction's annual events include the Women in Design+Construction conference and the ProConnect meeting series.

Multifamily Housing | Aug 19, 2021

Multifamily emerges strong from the pandemic, with Yardi Matrix's Doug Ressler

Yardi Matrix's Doug Ressler discusses his firm's latest assessment of multifamily sales and rent growth for 2021.

Resiliency | Aug 19, 2021

White paper outlines cost-effective flood protection approaches for building owners

A new white paper from Walter P Moore offers an in-depth review of the flood protection process and proven approaches.

Resiliency | Aug 19, 2021

White paper outlines cost-effective flood protection approaches for building owners

A new white paper from Walter P Moore offers an in-depth review of the flood protection process and proven approaches.

Urban Planning | Aug 16, 2021

Building with bikes in mind: How cities can capitalize on the pandemic’s ‘bike boom’ to make streets safer for everyone

Since early 2020, Americans have been forced to sequester themselves in their homes with outdoor activities, in most cases, being the sole respite for social distancing. And many of people are going back to the basics with a quintessential outdoor activity: biking. Bike sales absolutely skyrocketed during the pandemic, growing by 69% in 2020.

Contractors | Jul 23, 2021

The aggressive growth of Salas O'Brien, with CEO Darin Anderson

Engineering firm Salas O'Brien has made multiple acquisitions over the past two years to achieve its Be Local Everywhere business model. In this exclusive interview for HorizonTV, BD+C's John Caulfield sits down with the firm's Chairman and CEO, Darin Anderson, to discuss its business model.

Wood | Jul 16, 2021

The future of mass timber construction, with Swinerton's Timberlab

In this exclusive for HorizonTV, BD+C's John Caulfield sat down with three Timberlab leaders to discuss the launch of the firm and what factors will lead to greater mass timber demand.

Multifamily Housing | Jul 15, 2021

Economic rebound leads to record increase in multifamily asking rents

Across the country, multifamily rents have skyrocketed. Year-over-year rents are up by double digits in nine of the top 30 markets, while national YoY rent growth is up 6.3%. Emerging from the pandemic, a perfect storm of migration, enhanced government stimulus and a hot housing market, among other factors, has enabled this extremely strong growth.