On March 29, Cushman & Wakefield brokered the $14.7 million sale of a two-story, 24,600-sf medical building in North Hills, N.Y., which traded at a 6% cap rate. Around the same time, an affiliate of Inland Real Estate Acquisitions sold four newly constructed medical buildings totaling 119,000 sf in the Houston, Raleigh, N.C., and Salt Lake City markets. And early this month in Scottsdale, Ariz., Helix Properties sold two Class A medical offices totaling 42,183 sf for $12.13 million.

The market for quality healthcare-related buildings remains robust. A recent poll found the majority of real estate investors and developers expect to be “net buyers” of medical office buildings in 2017, and many believe health systems’ development requests for proposals would be higher this year than in 2016.

Those are some of the findings from a just-released 2017 Healthcare Real Estate Investor and Developer Survey conducted by CBRE’s U.S. Healthcare Capital Markets Group. The results of the 27-question survey are based on a total of 91 respondents.

Sixty three of those firms say they’ve allocated an aggregate of $14.9 billion in equity for healthcare real estate investment and development this year. That total represents about a 3% increase over what respondents said they allocated in 2016.

However, the survey notes that this sector’s supply-demand imbalance would continue this year, “as the total allocation of funds to purchase medical office buildings is far greater than the available supply.” Respondents expect that demand and supply for every healthcare real estate asset type would remain relatively the same in 2017. (At the time of the survey, 57% of respondents said the occupancy rates in their healthcare portfolios were about level with a year ago.)

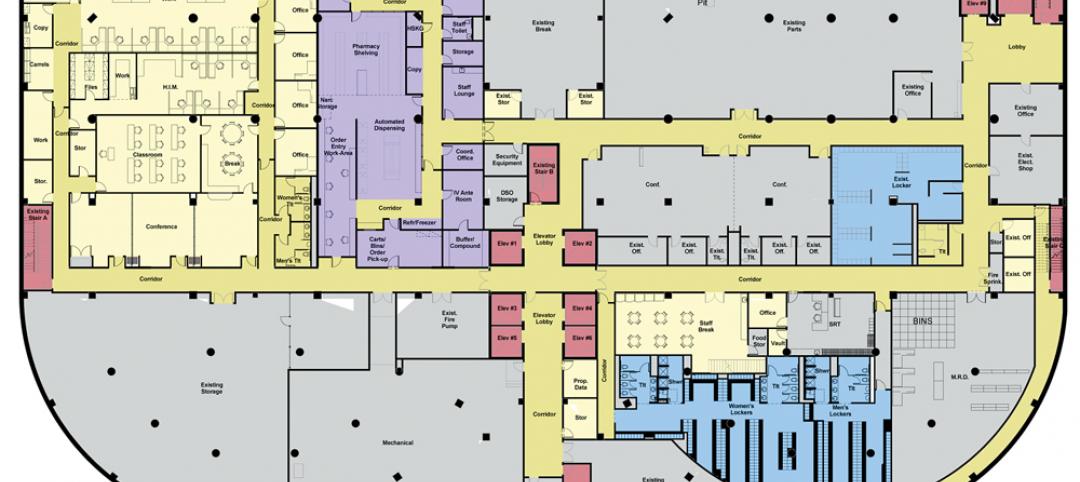

Investors and developers surveyed by CBRE expect supply of quality healthcare facilities for purchase will continue to fall short of the capital available for purchases in 2017. Image: CBRE 2017 Healthcare Real Estate Investor and Developer Survey

Investors and developers surveyed by CBRE expect supply of quality healthcare facilities for purchase will continue to fall short of the capital available for purchases in 2017. Image: CBRE 2017 Healthcare Real Estate Investor and Developer Survey

The preferred transaction size for a sizable majority of respondents—72%—falls somewhere between $10 million and $50 million. Nearly all of the respondents indicated they were most interested in MOBs, followed by Ambulatory Surgery Centers (80%), Wellness Centers (36%), and Freestanding Emergency Departments (35%).

More than three-quarters of respondents rely on bank debt to finance their transactions, although nearly two fifths (39%) said they’d pay for purchases with cash exclusively.

Retention plans vary markedly, as 29% said they expected to hold onto their healthcare purchases for 5-7 years, whereas 28% would retain the asset for more than 10 years (that percentage goes up to 60% among healthcare REITs that responded to the survey).

The survey takes investors’ and developers’ pulses on their Internal Rate of Return requirements by product type. (For example, 42% indicated their target all-cash IRR this year ranges from 7% to 9.49%.)

Value for core product—namely, Class “A” on-campus medical office buildings—continues to be high, with 49% of the survey respondents projecting cap rates below 6%.

Single-tenant medical office buildings are being priced the most aggressively again this year, with the largest group of survey respondents (39%) indicating a cap rate range of between 6% and 6.49%. Ambulatory Surgery Centers followed medical office buildings, but respondents expressed a wide variety of expectations, with 26% projecting a cap rate between 6% and 6.49%, 26% of respondents projecting a cap rate in the range of 6.5% to 6.99%, and 28% of respondents projecting a cap rate between 7% and 7.49%.

More than two-fifths of respondents expect MOB lease rates to increase 1-2% this year, compared to 26% that predicted that rate level in 2016. There was also a drop—to 55% from 60%—of respondents to this year’s survey from last year’s that thought lease rates would increase 2-3%

Nearly 90% of respondents said the minimum lease term they would accept for a sale-leaseback by a healthcare system would be at least 10 years (it’s 10-14 years for 70%). More than two-fifths of respondents—42%—said the minimum annual rental rate hike they’d consider for a sale-leaseback would be 2-2.49%

The highest percentage of respondents said the minimum hospital credit rating they’d consider investing in would be BBB- to BBB+. Sixteen percent, though, said they wouldn’t go below A- to A+.

The vast majority of investors and developers polled will be buyers of healthcare-related assets this year. Image: CBRE

The vast majority of investors and developers polled will be buyers of healthcare-related assets this year. Image: CBRE

Twenty-seven percent said that 60-69 years was the minimum ground lease they would consider for investment, compared to a 50-59 year threshold that 35% responding to the 2016 survey would accept. When structuring a ground lease with a hospital for an MOB, 48% of respondents said a fair land value to use in the calculation to determine rent is 5-6%.

CBRE conducted this survey before Republicans pulled their bill to repeal and replace the Affordable Care Act. But developers and investors were asked to predict what they thought would happen, and majorities expected a repeal of the individual mandate for insurance coverage, a repeal of state and federal insurance marketplace exchanges, and a rollback of Medicaid funding.

They also predicted that health insurers would be allowed to sell policies across state borders; that the Trump administration would favor the expansion of Health Savings Accounts; and that insurers would funnel their most expensive patients into subsidized high-risk pools.

Related Stories

| Dec 30, 2014

The future of healthcare facilities: new products, changing delivery models, and strategic relationships

Healthcare continues to shift toward Madison Avenue and Silicon Valley as it revamps business practices to focus on consumerism and efficiency, writes CBRE Healthcare's Patrick Duke.

| Dec 29, 2014

HDR and Hill International to turn three floors of a jail into a modern, secure healthcare center [BD+C's 2014 Great Solutions Report]

By bringing healthcare services in house, Dallas County Jail will greatly minimize the security risk and added cost of transferring ill or injured prisoners to a nearby hospital. The project was named a 2014 Great Solution by the editors of Building Design+Construction.

| Dec 29, 2014

New mobile unit takes the worry out of equipment sterilization during healthcare construction [BD+C's 2014 Great Solutions Report]

Infection control, a constant worry for hospital administrators and clinical staffs, is heightened when the hospital is undergoing a major construction project. Mobile Sterilization Solutions, a mobile sterile-processing department, is designed to simplify the task. The technology was named a 2014 Great Solution by the editors of Building Design+Construction.

| Dec 29, 2014

HealthSpot station merges personalized healthcare with videoconferencing [BD+C's 2014 Great Solutions Report]

The HealthSpot station is an 8x5-foot, ADA-compliant mobile kiosk that lets patients access a network of board-certified physicians through interactive videoconferencing and medical devices. It was named a 2014 Great Solution by the editors of Building Design+Construction.

BIM and Information Technology | Dec 28, 2014

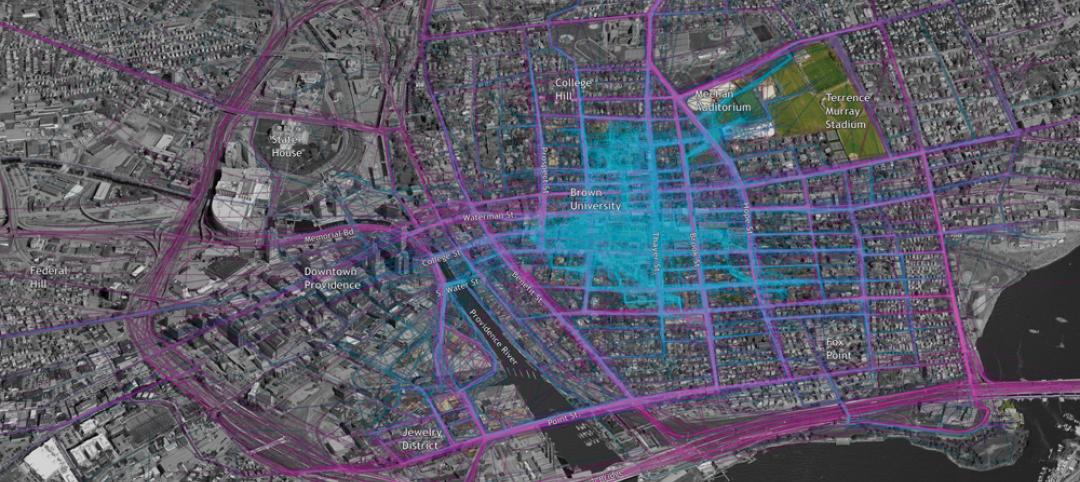

The Big Data revolution: How data-driven design is transforming project planning

There are literally hundreds of applications for deep analytics in planning and design projects, not to mention the many benefits for construction teams, building owners, and facility managers. We profile some early successful applications.

| Dec 28, 2014

AIA course: Enhancing interior comfort while improving overall building efficacy

Providing more comfortable conditions to building occupants has become a top priority in today’s interior designs. This course is worth 1.0 AIA LU/HSW.

| Dec 2, 2014

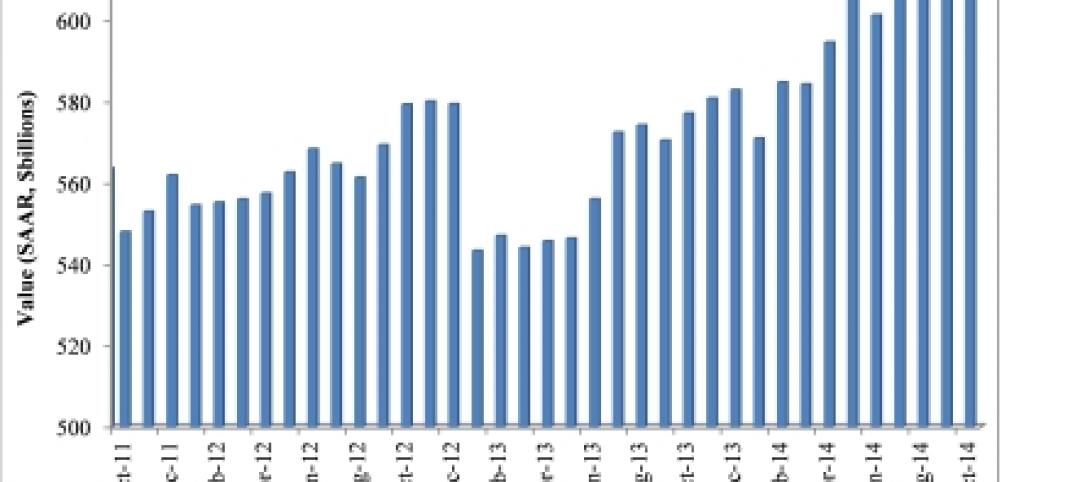

Nonresidential construction spending rebounds in October

This month's increase in nonresidential construction spending is far more consistent with the anecdotal information floating around the industry, says ABC's Chief Economist Anirban Basu.

| Dec 1, 2014

How public-private partnerships can help with public building projects

Minimizing lifecycle costs and transferring risk to the private sector are among the benefits to applying the P3 project delivery model on public building projects, according to experts from Skanska USA.

| Nov 25, 2014

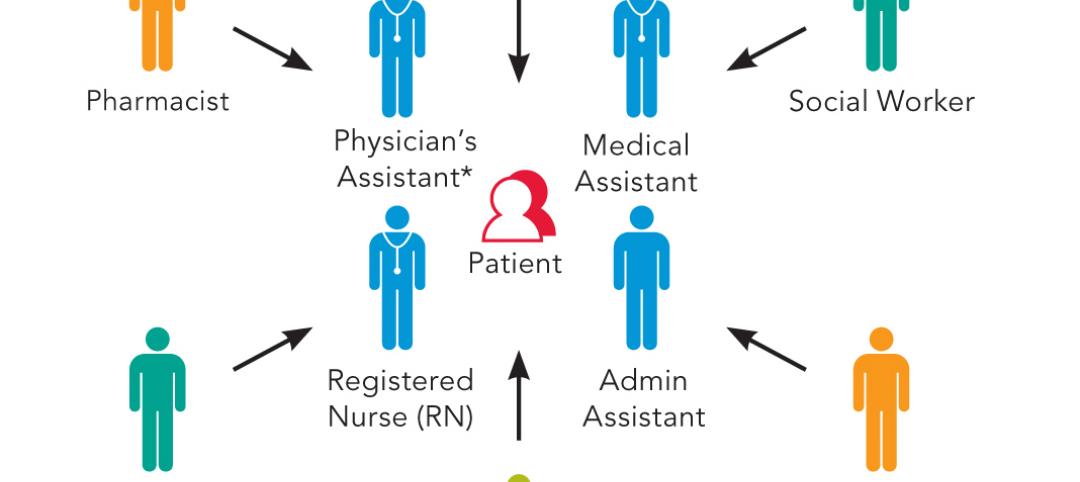

Emerging design and operation strategies for the ambulatory team in transition

As healthcare systems shift their care models to be more responsive to patient-centered care, ambulatory care teams need to be positioned to operate efficiently in their everyday work environments, write CannonDesign Health Practice leaders Tonia Burnette and Mike Pukszta.

| Nov 20, 2014

Lean Led Design: How Building Teams can cut costs, reduce waste in healthcare construction projects

Healthcare organizations are under extreme pressure to reduce costs, writes CBRE Healthcare's Lora Schwartz. Tools like Lean Led Design are helping them cope.