Despite a disruptive pandemic, investor demand for multifamily real estate was strong in 2020, according to a newly released Yardi Matrix Bulletin.

Around 252,000 apartment units were absorbed last year. That’s about 1.7% of total market stock and down 12% from the 286,300 apartments purchased in 2019.

“Considering the economic and social calamity that befell the U.S., in many respects due to COVID-19, the fact that demand held up as well as it did is a relief for the apartment industry,” say Matrix analysts.

Net absorption was strongest in 25 of the 30 largest metros, which accounted for 158,300 units absorbed. Dallas, Atlanta and Denver saw the highest absorption rates.

Negative absorption was centralized in key gateway markets hit hard by COVID-19, which also struggled with renter demand and average rents. The worst performers were the Bay Area and New York City, which combined for -22,100 units absorbed in 2020.

Overall, high-cost gateway metros had net absorption of -0.3% (-7,600 units). Demand was better in secondary (154,100 units, or 2.3% of total stock) and tertiary (96,200 units, or 2.0% of stock) markets.

On a regional level, renters continued to flock to the Southeast (96,700 units absorbed, or 2.4% of total stock), the Southwest (56,800 units, 2.1% of stock) and the West (57,100 units, 1.9% of stock). Meanwhile, demand was slightly positive in the Midwest (27,100 units, 1.1% of stock) and the Northeast (4,900 units, 0.2% of stock).

Here are the top 10 markets based on net multifamily absorption in 2020:

1. Dallas: 19,233 units; 2.4% net absorption of total stock; 93.8% occupancy rate in Dec. 2020

2. Atlanta: 12,864; 2.8%; 94.7%

3. Denver: 11,552; 4.0%; 94.5%

4. Phoenix: 10,082; 3.2%; 95.5%

5. Houston: 8,377; 1.3%; 92.1%

6. Austin, Texas: 7,893; 3.1%; 93.3%

7. Miami: 7,721; 2.5%; 94.4%

8. Tampa, Fla.: 6,196; 2.8%; 95.4%

9. Charlotte, N.C.: 6,073; 3.3%; 95.1%

10. San Antonio: 5,836; 2.8%; 93.0%

Related Stories

Market Data | Apr 11, 2023

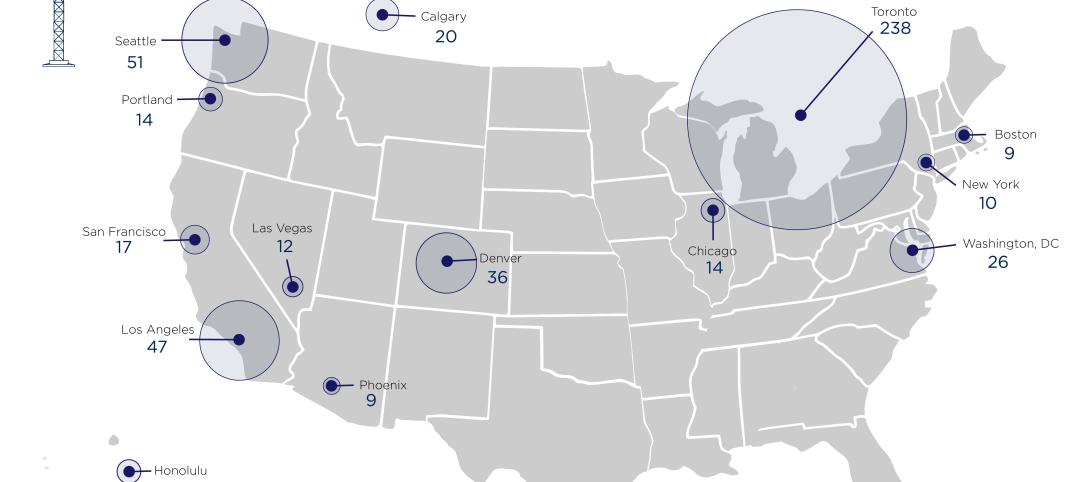

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Contractors | Apr 10, 2023

What makes prefabrication work? Factors every construction project should consider

There are many factors requiring careful consideration when determining whether a project is a good fit for prefabrication. JE Dunn’s Brian Burkett breaks down the most important considerations.

Affordable Housing | Apr 7, 2023

Florida’s affordable housing law expected to fuel multifamily residential projects

Florida Gov. Ron DeSantis recently signed into law affordable housing legislation that includes $711 million for housing programs and tax breaks for developers. The new law will supersede local governments’ zoning, density, and height requirements.

Multifamily Housing | Apr 4, 2023

Acing your multifamily housing amenities for the modern renter

Eighty-seven percent of residents consider amenities when signing or renewing a lease. Here are three essential amenity areas to focus on, according to market research and trends.

Resiliency | Apr 4, 2023

New bill would limit housing sprawl in fire- and flood-prone areas of California

A new bill in the California Assembly would limit housing sprawl in fire- and flood-prone areas across the state. For the last several decades, new housing has spread to more remote areas of the Golden State.

Multifamily Housing | Mar 31, 2023

EV charging stations in multifamily housing

Ryan Gram, PE, EV Charging Practice Leader at engineering firm Kimley-Horn, provides expert advice about the "business side" of installing EV charging stations in apartment and mixed-use communities. Gram speaks with BD+C Executive Editor Robert Cassidy.

Multifamily Housing | Mar 24, 2023

Washington state House passes bill banning single-family zoning

The Washington state House of Representatives recently passed a bill that would legalize duplexes or fourplexes in almost every neighborhood of every city in the state.

Multifamily Housing | Mar 24, 2023

Momentum building for green retrofits in New York City co-ops, condos

Many New York City co-op and condo boards had been resistant to the idea of approving green retrofits and energy-efficiency upgrades, but that reluctance might be in retreat.

Legislation | Mar 24, 2023

New York lawmakers set sights on unsafe lithium-ion batteries used in electric bikes and scooters

Lawmakers in New York City and statewide have moved to quell the growing number of fires caused by lithium-ion batteries used in electric bikes and scooters.

Multifamily Housing | Mar 24, 2023

Multifamily developers offering new car-free projects in car-centric cities

Cities in the South and Southwest have eased zoning rules with parking space mandates in recent years to allow developers to build new housing with less parking.