After prolonged economic uncertainty, a majority of executives in the global engineering and construction sector have fresh confidence in the growth prospects for the industry, according to KPMG International's 2013 Global Construction Survey.

A general increase in backlogs and margins is giving cause for optimism across the industry, with further growth anticipated. Just over 50 percent of 165 C-level executives from the Americas; Europe, Middle East and Africa (EMEA); and Asia-Pacific (AsPac) regions said their companies experienced an increase in backlogs of at least 5 percent from 2012 to 2013. Moreover, though margins are not rising at the same rate as backlogs, 80 percent said their margins will either remain stable or increase more than 2 percent in the same period.

The Americas region had the highest confidence for growth with 90 percent forecasting margins as stable or increasing by more than 2 percent. By contrast, 28 percent of companies in the AsPac region see margins decreasing by fewer than 2 percent.

"Our 2013 survey shows the overall outlook in the industry is directionally positive," said Geno Armstrong, global leader of KPMG's Engineering and Construction practice. "A higher level of confidence in the Americas, demonstrated by large margin growth, is an indication of greater efficiency and cost management."

Looking at growth forecasts for 2013, optimism pervades with 64 percent expecting growth up to 25 percent. The highest growth is expected in Central and South America, and Africa. KPMG's Armstrong attributes the growth to "favorable trading conditions in the regions, as well as good prospects for mining, oil and natural gas." And, overall, companies with revenues greater than US$5 billion see the greatest potential for growth.

Drivers and Barriers to Growth

Government infrastructure plans (66 percent) were most frequently cited as the leading driver for growth, followed by global economic growth (42 percent) and population growth (38 percent).

In the Americas, privatization efforts via public-private partnerships (48 percent) and access to new energy sources such as natural gas or renewables (42 percent) ranked as the leading drivers for growth behind government infrastructure plans (58 percent).

Even with resurging optimism, many companies maintain a balanced view on what the likely obstacles to growth might be, with budget deficits and public funding shortages being the overwhelming factor, according to 72 percent of executives. Private-sector financing (43 percent) ranked second among respondents.

As companies ramp up for growth, a near consensus (93 percent) said that their risk management programs have improved project performance. Yet, more than three-quarters of respondents said the underlying causes of underperforming projects were project delays, poor estimating practices and failed risk management processes.

Expansion Plans -- New Geographies and Sectors

In anticipation of continued growth, 47 percent of respondents said their companies are making plans for international expansion into new regions. Africa (35 percent), U.S./Canada (28 percent), and the Middle East (22 percent) are the leading regional targets for expansion. Entering new sub-sectors of the industry is also in the works for 44 percent of respondents, with the power sector (54 percent), water-related activities (28 percent), and mining (27 percent) the leading areas for planned investment.

"The power sector is, without question, presently attracting the most interest," said Armstrong. "With the increase in economic activity and the hyper-focus on energy security, it stands to reason that many players will see opportunity in this area. Power, as well as water, mining, and other resources will increasingly become a critical priority of the business agenda in this industry."

About the KPMG Survey

The survey was conducted in early 2013 through face-to-face interviews with 165 senior leaders -- many of them Chief Executive Officers -- from leading engineering and construction companies in 29 countries worldwide. Respondent representation was spread across the Americas (20 percent), EMEA (52 percent), and AsPac (28 percent).

About KPMG LLP

KPMG LLP, the audit, tax and advisory firm (www.kpmg.com/us), is the U.S. member firm of KPMG International Cooperative ("KPMG International"). KPMG International's member firms have 152,000 professionals, including more than 8,600 partners, in 156 countries.

Related Stories

| Jul 1, 2013

Elizabeth Chu Richter, FAIA, elected 2015 AIA President

Delegates to the American Institute of Architects (AIA) national convention in Denver elected Elizabeth Chu Richter (AIA Corpus Christi) to serve as the 2014 AIA first vice president/president-elect and 2015 AIA president.

| Jun 28, 2013

Calculating the ROI of building enclosure commissioning

A researcher at Lawrence Berkeley National Laboratory calls building enclosure commissioning “the single-most cost-effective strategy for reducing energy, costs, and greenhouse gas emissions in buildings today.”

| Jun 28, 2013

A brief history of windows in America

Historic window experts from Hoffmann Architects look back at the origin of windows in the U.S.

| Jun 28, 2013

Building owners cite BIM/VDC as 'most exciting trend' in facilities management, says Mortenson report

A recent survey of more than 60 building owners and facility management professionals by Mortenson Construction shows that BIM/VDC is top of mind among owner professionals.

| Jun 27, 2013

Thermal, solar control designs can impact cooling loads by 200%, heating loads by 30%

Underestimating thermal bridging can greatly undermine a building’s performance contributing to heating load variances of up to 30% and cooling load variances of up to 200%, says the MMM Group.

| Jun 26, 2013

New York’s ‘Scaffold Law’ may be altered to place larger burden on workers

New York's Scaffold Law, which “places the burden of responsibility on the contractor to prove that the job site was safe for workers,” could be facing a major change.

| Jun 26, 2013

Commercial real estate execs eye multifamily, retail sectors for growth, says KPMG report

The multifamily, retail, and hospitality sectors are expected to lead commercial building growth, according to the 2013 KPMG Commercial Real Estate Outlook Survey.

| Jun 25, 2013

Mirvish, Gehry revise plans for triad of Toronto towers

A trio of mixed-use towers planned for an urban redevelopment project in Toronto has been redesigned by planners David Mirvish and Frank Gehry. The plan was announced last October but has recently been substantially revised.

| Jun 25, 2013

First look: Herzog & de Meuron's Jade Signature condo tower in Florida

Real estate developer Fortune International has released details of its new Jade Signature property, to be developed in Sunny Isles Beach near Miami. The luxury waterfront condo building will include 192 units in a 57-story building near high-end retail destinations and cultural venues.

| Jun 25, 2013

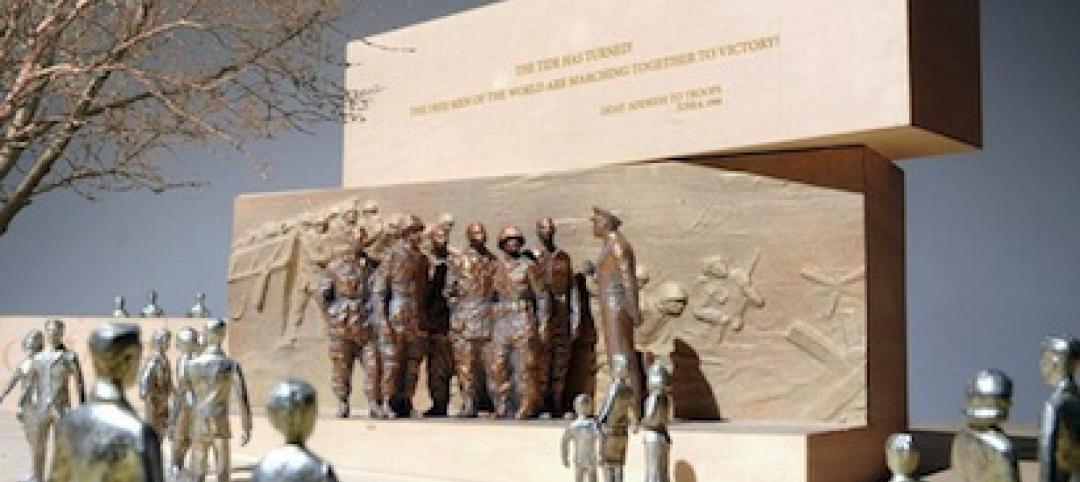

DC commission approves Gehry's redesign for Eisenhower memorial

Frank Gehry's updated for a new Dwight D. Eisenhower memorial in Washington, D.C., has been approved by the Eisenhower Memorial Commission, reports the Washington Post. The commission voted unanimously to approve the $110 million project, which has been gestating for 14 years.