After prolonged economic uncertainty, a majority of executives in the global engineering and construction sector have fresh confidence in the growth prospects for the industry, according to KPMG International's 2013 Global Construction Survey.

A general increase in backlogs and margins is giving cause for optimism across the industry, with further growth anticipated. Just over 50 percent of 165 C-level executives from the Americas; Europe, Middle East and Africa (EMEA); and Asia-Pacific (AsPac) regions said their companies experienced an increase in backlogs of at least 5 percent from 2012 to 2013. Moreover, though margins are not rising at the same rate as backlogs, 80 percent said their margins will either remain stable or increase more than 2 percent in the same period.

The Americas region had the highest confidence for growth with 90 percent forecasting margins as stable or increasing by more than 2 percent. By contrast, 28 percent of companies in the AsPac region see margins decreasing by fewer than 2 percent.

"Our 2013 survey shows the overall outlook in the industry is directionally positive," said Geno Armstrong, global leader of KPMG's Engineering and Construction practice. "A higher level of confidence in the Americas, demonstrated by large margin growth, is an indication of greater efficiency and cost management."

Looking at growth forecasts for 2013, optimism pervades with 64 percent expecting growth up to 25 percent. The highest growth is expected in Central and South America, and Africa. KPMG's Armstrong attributes the growth to "favorable trading conditions in the regions, as well as good prospects for mining, oil and natural gas." And, overall, companies with revenues greater than US$5 billion see the greatest potential for growth.

Drivers and Barriers to Growth

Government infrastructure plans (66 percent) were most frequently cited as the leading driver for growth, followed by global economic growth (42 percent) and population growth (38 percent).

In the Americas, privatization efforts via public-private partnerships (48 percent) and access to new energy sources such as natural gas or renewables (42 percent) ranked as the leading drivers for growth behind government infrastructure plans (58 percent).

Even with resurging optimism, many companies maintain a balanced view on what the likely obstacles to growth might be, with budget deficits and public funding shortages being the overwhelming factor, according to 72 percent of executives. Private-sector financing (43 percent) ranked second among respondents.

As companies ramp up for growth, a near consensus (93 percent) said that their risk management programs have improved project performance. Yet, more than three-quarters of respondents said the underlying causes of underperforming projects were project delays, poor estimating practices and failed risk management processes.

Expansion Plans -- New Geographies and Sectors

In anticipation of continued growth, 47 percent of respondents said their companies are making plans for international expansion into new regions. Africa (35 percent), U.S./Canada (28 percent), and the Middle East (22 percent) are the leading regional targets for expansion. Entering new sub-sectors of the industry is also in the works for 44 percent of respondents, with the power sector (54 percent), water-related activities (28 percent), and mining (27 percent) the leading areas for planned investment.

"The power sector is, without question, presently attracting the most interest," said Armstrong. "With the increase in economic activity and the hyper-focus on energy security, it stands to reason that many players will see opportunity in this area. Power, as well as water, mining, and other resources will increasingly become a critical priority of the business agenda in this industry."

About the KPMG Survey

The survey was conducted in early 2013 through face-to-face interviews with 165 senior leaders -- many of them Chief Executive Officers -- from leading engineering and construction companies in 29 countries worldwide. Respondent representation was spread across the Americas (20 percent), EMEA (52 percent), and AsPac (28 percent).

About KPMG LLP

KPMG LLP, the audit, tax and advisory firm (www.kpmg.com/us), is the U.S. member firm of KPMG International Cooperative ("KPMG International"). KPMG International's member firms have 152,000 professionals, including more than 8,600 partners, in 156 countries.

Related Stories

| Jan 13, 2014

6 legislative actions to ignite the construction economy

The American Institute of Architects announced its “punch list” for Congress that, if completed, will ignite the construction economy by spurring much needed improvements in energy efficiency, infrastructure, and resiliency, and create jobs for small business.

| Jan 12, 2014

CES showcases innovations: Can any of these help you do your job better?

The Consumer Electronics Show took place this past week in Las Vegas. Known for launching new products and technologies, many of the products showcased there set the bar for future innovators. The show also signals trends to watch in technology applicable to the design and building industry.

| Jan 12, 2014

The ‘fuzz factor’ in engineering: when continuous improvement is neither

The biggest threat to human life in a building isn’t the potential of natural disasters, but the threat of human error. I believe it’s a reality that increases in probability every time a code or standard change is proposed.

| Jan 12, 2014

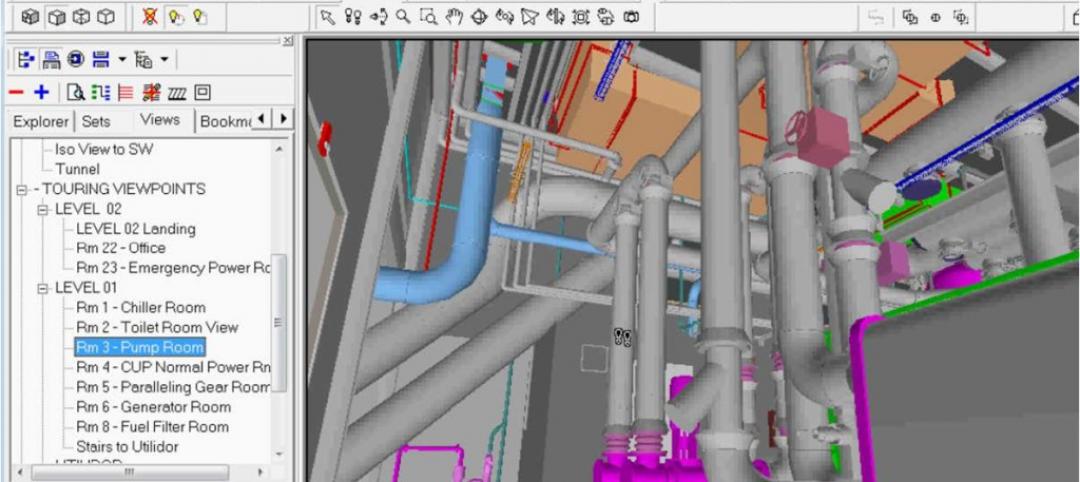

5 ways virtual modeling can improve facilities management

Improved space management, streamlined maintenance, and economical retrofits are among the ways building owners and facility managers can benefit from building information modeling.

| Jan 11, 2014

Getting to net-zero energy with brick masonry construction [AIA course]

When targeting net-zero energy performance, AEC professionals are advised to tackle energy demand first. This AIA course covers brick masonry's role in reducing energy consumption in buildings.

| Jan 10, 2014

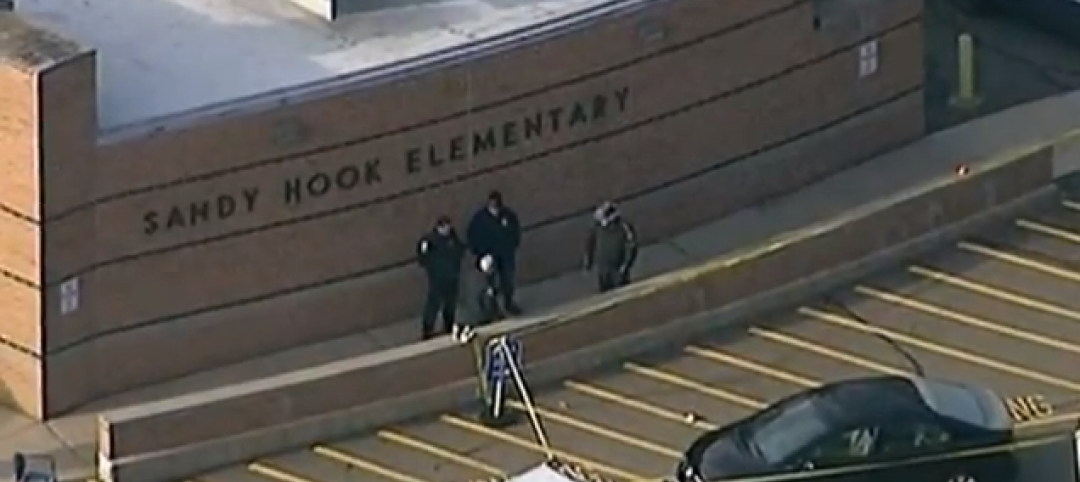

What the states should do to prevent more school shootings

To tell the truth, I didn’t want to write about the terrible events of December 14, 2012, when 20 children and six adults were gunned down at Sandy Hook Elementary School in Newtown, Conn. I figured other media would provide ample coverage, and anything we did would look cheap or inappropriate. But two things turned me around.

| Jan 10, 2014

Special Report: K-12 school security in the wake of Sandy Hook

BD+C's exclusive five-part report on K-12 school security offers proven design advice, technology recommendations, and thoughtful commentary on how Building Teams can help school districts prevent, or at least mitigate, a Sandy Hook on their turf.

| Jan 10, 2014

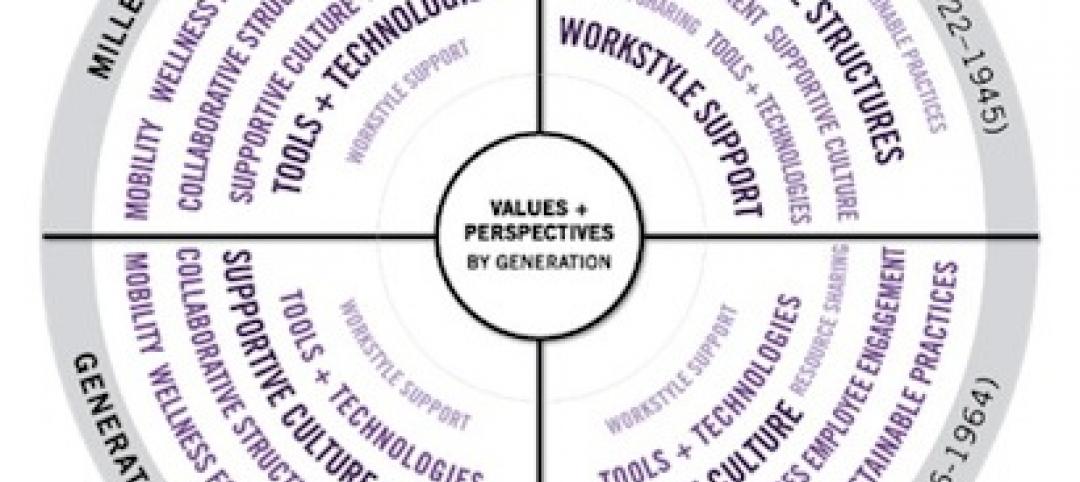

Resiliency, material health among top AEC focuses for 2014: Perkins+Will survey

Architectural giant Perkins+Will recently surveyed its staff of 1,500 design pros to forcast hot trends in the AEC field for 2014. The resulting Design + Insights Survey reflects a global perspective.

| Jan 9, 2014

How security in schools applies to other building types

Many of the principles and concepts described in our Special Report on K-12 security also apply to other building types and markets.

| Jan 9, 2014

16 recommendations on security technology to take to your K-12 clients

From facial recognition cameras to IP-based door hardware, here are key technology-related considerations you should discuss with your school district clients.