A PDF of the Annual Roofing Survey can be downloaded at the bottom of this page.

Key findings of the roofing survey

- Respondents named metal (56%) and EPDM (50%) as the roofing systems they (or their firms) employed most in projects. However, the results show that they used a wide variety of roofing types, including built-up, shakes and shingles, modified bitumen, TPO, PVC, and tiles.

- Insulation choice was also spread among several product categories, with polyisocyanurate leading the way (62%) and EPS, XPS, and sprayed polyurethane foam also showing support.

- More than half of respondents (53%) said their roofing projects were essentially all low-slope jobs (2/12 rise or less), but nearly a third (31%) said steep-slope roofs (>2/12 rise) comprised all or almost all of their roofing-related projects.

- New construction and retrofits were fairly evenly split among respondents’ roofing-related projects over the last couple of years.

- Initial cost is not the most important factor in choosing a roofing system. That honor went to durability and reliability, at least from the experience of respondents and their perception of their clients’ priorities.

- In a related finding, it is not surprising that “leaks or failures” (42%) was the single biggest concern or worry expressed by respondents, along with such related factors as “quality/performance” (17%) and “incorrect installation” (11%). Again, cost was not the key concern, with only 13% of respondents checking it as their number one worry.

- In terms of “green” factors, energy efficiency (52%) is far and away the crucial component of a roofing system, followed distantly by life cycle cost (25%).

- Building information modeling is still largely in its infancy in respondents’ roofing-related projects, with less than one-third (32%) saying that they used BIM. However, the use of BIM is expected to grow to about 59% over the next two years or so.

- Only a small percentage of respondents (4%) said they (or their firms) have made extensive use of photovoltaics on roofs in the last two years, but three in 10 (30%) had used PVs in a few projects. The upside is that 57% plan to do so in the next 18-24 months.

- Similarly, the extensive use of green vegetative roofs is limited (2%), but 23% of respondents (or their firms) have tried them in at least a few projects in the last two years, and 38% said they intend to do so in the next 18-24 months.

Survey Methodology

The survey was emailed to a representative sample of BD+C’s subscriber list. No incentive was offered; 263 qualified returns were obtained. The majority of responses (52%) came from architects and designers, a group that represents half of BD+C’s subscriber base; however, respondents were spread across the professions and included nearly one-fifth (18%) from among owners and facilities directors. In terms of location, respondents’ roofing-related projects covered the entire U.S. (and a bit in Canada), although the Mid-Atlantic region may have been underrepresented (8%). A margin of error of 6-7% at the 95% confidence level can be applied in most cases.

Note: Some of the tables refer to “Top % rank,” the percentage of respondents who rated the factor as their single most important factor. “Weighted score” was calculated by tripling the number of respondents who rated the factor #1, doubling those who rated the factor #2 by 2, multiplying by one those who rated the factor #3 by 1, and dividing the sum by three to obtain the average.

Download a PDF of the Annual Roofing Survey below

Related Stories

Market Data | Feb 7, 2024

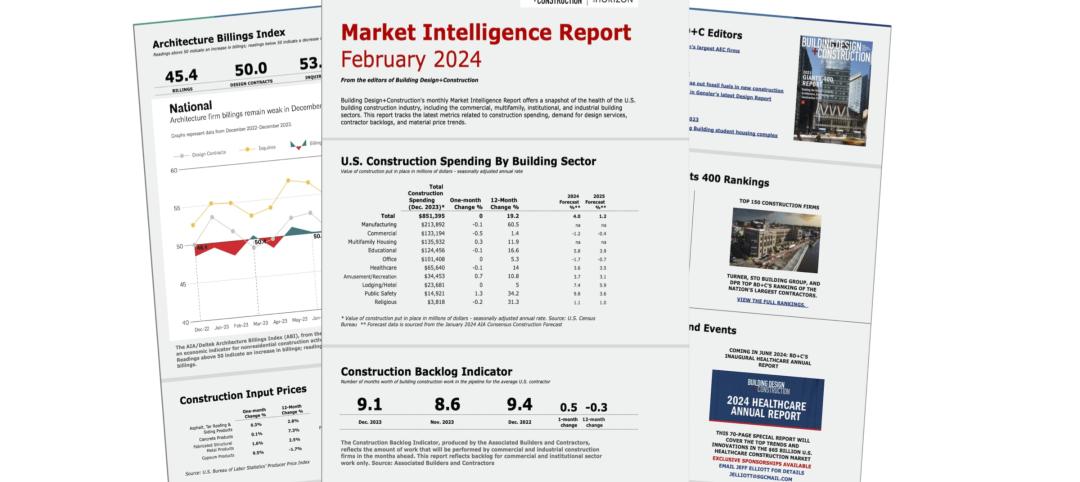

New download: BD+C's February 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Giants 400 | Feb 6, 2024

Top 80 Religious Facility Architecture Firms for 2023

Parkhill, FGM Architects, GFF, Gensler, and HOK top BD+C's ranking of the nation's largest religious facility architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

Modular Building | Feb 6, 2024

Modular fire station allows for possible future reconfigurations

A fire station in Southern California leveraged prefab, modular construction for faster completion and future reconfiguration.

Giants 400 | Feb 5, 2024

Top 30 Entertainment Center, Cineplex, and Theme Park Architecture Firms for 2023

Gensler, JLL, Nelson Worldwide, AO, and Stantec top BD+C's ranking of the nation's largest entertainment center, cineplex, and theme park architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

Urban Planning | Feb 5, 2024

Lessons learned from 70 years of building cities

As Sasaki looks back on 70 years of practice, we’re also looking to the future of cities. While we can’t predict what will be, we do know the needs of cities are as diverse as their scale, climate, economy, governance, and culture.

Giants 400 | Feb 5, 2024

Top 90 Shopping Mall, Big Box Store, and Strip Center Architecture Firms for 2023

Gensler, Arcadis North America, Core States Group, WD Partners, and MBH Architects top BD+C's ranking of the nation's largest shopping mall, big box store, and strip center architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

Laboratories | Feb 5, 2024

DOE selects design-build team for laboratory focused on clean energy innovation

JE Dunn Construction and SmithGroup will construct the 127,000-sf Energy Materials and Processing at Scale (EMAPS) clean energy laboratory in Colorado to create a direct path from lab-scale innovations to pilot-scale production.

Architects | Feb 2, 2024

SRG Partnership joins CannonDesign to form 1,300-person design giant across 18 offices

SRG Partnership, a dynamic architecture, interiors and planning firm with studios in Portland, Oregon, and Seattle, Washington, has joined CannonDesign. This merger represents not only a fusion of businesses but a powerhouse union of two firms committed to making a profound difference through design.

Giants 400 | Feb 1, 2024

Top 90 Restaurant Architecture Firms for 2023

Chipman Design Architecture, WD Partners, Greenberg Farrow, GPD Group, and Core States Group top BD+C's ranking of the nation's largest restaurant architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

Standards | Feb 1, 2024

Prioritizing water quality with the WELL Building Standard

In this edition of Building WELLness, DC WELL Accredited Professionals Hannah Arthur and Alex Kircher highlight an important item of the WELL Building Standard: water.