Design and construction professionals who completed our flooring survey had strong opinions about their preferred flooring type. Typical responses: “Hardwood and porcelain tile are my favorites.” “I prefer carpet.” “I love polished concrete. Price, durability, ease of maintenance—need I say more?” “We have started using recycled rubber flooring and it has been a great success.” “My favorite would be integral color concrete, with options of staining, etching, and sealers or paste wax.”

“We are really sold on carpet tiles,” one respondent enthused. “Eighty percent of the wear is found on 20% of the carpet. I like replacing just 20% every 10 years.” Another respondent said, “Engineered wood looks like the real thing and performs resiliently to all scratches.” This respondent’s faves? Slate and wood: “Aesthetic, cool, and environmentally friendly.” Another’s “three best innovations”: “affordable, high-performance thin-set terrazzo, recyclable carpet, and bamboo.”

Respondents reported a problem with recent disruptions to the supply chain. “The biggest issue is getting the specified products in a timely manner, especially if they are made overseas,” said one. Another cited “availability and transportation costs.”

Maintenance issues also came up. “Many clients do not know how to maintain their floors well at minimal costs,” wrote one respondent. “On the other hand, manufacturers often present maintenance scenarios that are unreal.”

A number of respondents offered practical advice to others in the field. “Installers are a significant part of the equation,” warned one. “Always check your flooring moisture content prior to setting flooring materials,” advised one. Another piece of advice: “Always note the coefficient of friction.” Said another, “Thorough research has always preceded our flooring choices.”

WATER-BASED ADHESIVES AND CONCRETE

Several respondents wrote about the use of water-based adhesives on concrete slabs. “Although they are more eco-friendly with low VOCs, they require the concrete slab to be much drier than can typically be achieved,” said one. “This has prompted a slew of products to seal the concrete before installing the floor covering. Some of these products work and others do not. The manufacturers’ claims are typically not true and there is no standard to compare them.” This writer added that “newer adhesives have come out that can accommodate higher moisture and pH levels in the concrete. I welcome this trend as it greatly simplifies the process and creates less liability for everyone.”

Another got down and dirty on the topic of adhesion of floor coverings when vapor emissions, pH, or relative humidity values of new concrete floor slabs exceed the ranges allowed by the flooring manufacturer for a warrantable installation: “Using a reputable vapor emission control system (and our research has found that there are only a couple of systems that perform as advertised on a consistent basis) definitely helps reduce flooring failures.”

Summing up this moisture/adhesives issues, one AEC professional said, “The flooring industry must develop unified and clearly spelled-out national standards to test and accept relative humidity values. It is a mess right now. It must be thoroughly studied [and] researched, and national guidelines [must] be published.” BD+C

Major Findings of the Flooring Study

1. Ceramic tile was the runaway choice for flooring systems, with 80% of respondents using it in the past 18-24 months.

2. Other strong preferences: broadloom carpet (66%), carpet tile (65%), and VCT–vinyl composition tile and concrete/polished concrete (both 58%).

3. The four most important general factors in choosing flooring systems were initial cost, including installation (69%); durability/reliability (66%); performance/quality (61%;) and aesthetics (59%).

4. In terms of sustainability, life cycle cost/life cycle assessment (60%) and low to no VOC content (59%) finished in a virtual dead heat. Tying for third (given the 6% margin of error): LEED points or other green certification (39%) and recycled content (38%).

5. No certification program, rating system, or industry standard gained a majority of respondents. FSC certification (from the Forest Stewardship Council) for wood flooring came out on top (44%).

6. Nearly three in 10 respondents (29%) said they had no problems in choosing flooring products. Others cited such concerns as reliability of product data (31%), conflicting manufacturer claims and not enough time to research/choose products (both 29%), and false or unsubstantiated claims (28%).

METHODOLOGY

Building Design+Construction surveyed a representative sample of its subscribers via e-mail in late July 2011. An incentive of a $25 Amazon gift certificate was offered to the first 10 respondents; 258 qualified surveys were returned. The approximate margin of error: 6% at the 95% confidence level.

Table 1.

Which of the following flooring systems have you (or your firm) used in the past 18-24 months?

Ceramic tile 80%

Linoleum/linoleum-type flooring 36%

Broadloom carpet 66%

Laminate 33%

Carpet tile 65%

Rubber 32%

Concrete/polished concrete 58%

Composite wood 29%

Vinyl composite tile 58%

Bamboo 26%

Porcelain tile 55%

Terrazzo 26%

Hardwood 51%

Luxury vinyl tile 17%

Marble/stone 40%

Solid vinyl tile 17%

Vinyl sheet 37%

Cork 1%

N = 250 | Note: Respondents could make multiple selections.

The majority of our flooring survey respondents use ceramic tile, broadloom carpet, and carpet tile. Cork received only 22 (or just under 1%) of the 250 responses.

Table 2.

Based upon your experience and that of your clients, which of the following general factors do you find most important in choosing a flooring system?

Cost (initial cost, including installation) 69%

Durability/reliability 66%

Performance/quality 61%

Aesthetics 59%

Ease/cost of maintenance 37%

Acoustics/noise control 15%

Ease of installation 14%

Warranty 11%

Manufacturer’s reputation 10%

Recommendation from colleague or professional 4%

Recommendation from flooring contractor 3%

Recommendation from manufacturer’s technical representative 2%

Third-party rating or certification 2%

N = 252 | Note: Respondents could make multiple selections.

Cost ranked highest, with durability/reliability, performance/quality, and aesthetics following closely behind. Recommendations either from colleagues or professionals, flooring contractors, and a manufacturer’s technical representative garnered the least votes, along with third-party rating or certification.

Table 3.

From your experience and that of your clients, which of the following “green” or sustainability factors do you consider most important in choosing a flooring system?

Life cycle cost/life cycle assessment 60%

Low to no VOC content 59%

LEED points or other green certification 39%

Recycled content 38%

Local sourcing 32%

Recycleability at end of useful life 23%

No PVC 11%

Reduced packaging 7%

Biomimicry of flooring product 5%

N = 245 | Note: Respondents could make multiple selections.

Life cycle cost/life cycle assessment and low to no VOC content ranked highest, followed by LEED points or other green certification and recycled content. A reduction of packaging and biomimicry of flooring products received the fewest responses.

Table 4.

Which of the following certification programs, rating systems, or industry standards have you (or your firm)

used in evaluating, specifying, or using flooring products?

Forest Stewardship Council 44%

Greenguard 34%

Green Label/Green Label Plus 31%

Green Seal 28%

Green Spec Directory 23%

NSF-332 Resilient Floor Coverings Standard 22%

Ecologic 18%

FloorScore 18%

NSF-140 Sustainable Carpet Assessment Standard 16%

C2C Cradle to Cradle 15%

Sustainable Forestry Initiative 14%

Sustainable Choice 10%

Canadian Standards Association 6%

Indoor Advantage/Indoor Advantage Gold 6%

Pharos 3%

N = 202 | Note: Respondents could make multiple selections.

The Forest Stewardship Council, Greenguard, and Green Label/Green Label Plus were the top three certification programs, rating systems, or industry standards recognized by respondents when evaluating, specifying, or using floor products. The top three were followed closely by Green Seal and Green Spec Directory. Pharos only garnered 3% of the 202 total responses.

Table 5.

From your experience, what are the three biggest problems you face (or have faced) in choosing flooring products?

Reliability of product data 31%

Conflicting manufacturer claims 29%

Not enough time to research/choose products 29%

No problems in choosing flooring products 29%

False or unsubstantiated claims 28%

Not enough product data 22%

Too many product choices 15%

Product data not technical enough 13%

Product data too technical/too hard to understand 9%

Not enough product choices 8%

Too much product data 2%

N = 245 | Note: Respondents could make multiple selections.

Reliability of product data represented 31% of the responses, followed by conflicting manufacturer claims, not enough time to research/choose products, no problems in choosing flooring products at 29%, and false or unsubstantiated claims (28%). Only 2% of respondents selected too much product data as one of the biggest problems faced in choosing flooring products.

Related Stories

Smart Buildings | Apr 7, 2023

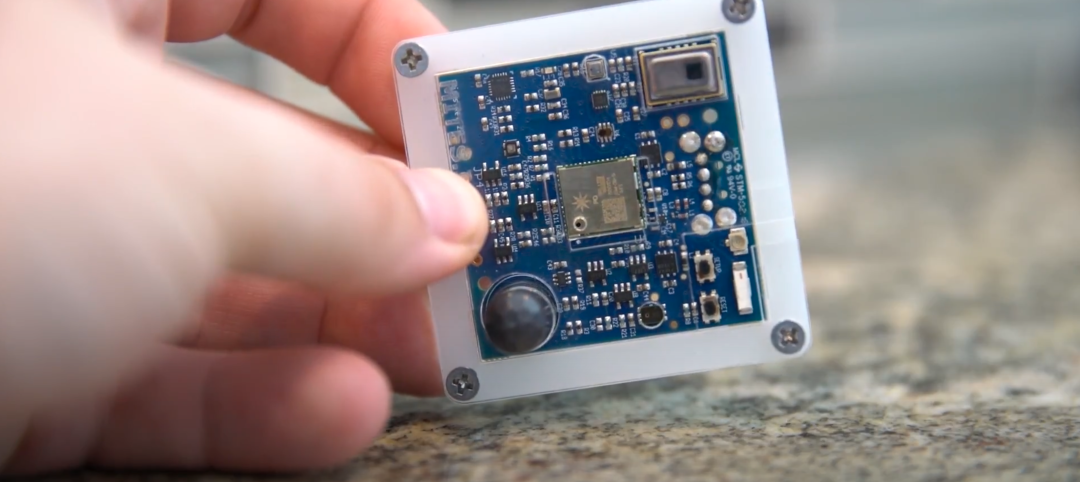

Carnegie Mellon University's research on advanced building sensors provokes heated controversy

A research project to test next-generation building sensors at Carnegie Mellon University provoked intense debate over the privacy implications of widespread deployment of the devices in a new 90,000-sf building. The light-switch-size devices, capable of measuring 12 types of data including motion and sound, were mounted in more than 300 locations throughout the building.

Affordable Housing | Apr 7, 2023

Florida’s affordable housing law expected to fuel multifamily residential projects

Florida Gov. Ron DeSantis recently signed into law affordable housing legislation that includes $711 million for housing programs and tax breaks for developers. The new law will supersede local governments’ zoning, density, and height requirements.

Energy Efficiency | Apr 7, 2023

Department of Energy makes $1 billion available for states, local governments to upgrade building codes

The U.S. Department of Energy is offering funding to help state and local governments upgrade their building codes to boost energy efficiency. The funding will support improved building codes that reduce carbon emissions and improve energy efficiency, according to DOE.

Steel Buildings | Apr 6, 2023

2023 AISC Forge Prize winner envisions the gas station of the future

Forge Prize winner LVL (Level) Studio envisions a place where motorists can relax, work, play, shop, or perhaps even get healthcare while their vehicles charge.

Architects | Apr 6, 2023

New tool from Perkins&Will will make public health data more accessible to designers and architects

Called PRECEDE, the dashboard is an open-source tool developed by Perkins&Will that draws on federal data to identify and assess community health priorities within the U.S. by location. The firm was recently awarded a $30,000 ASID Foundation Grant to enhance the tool.

Architects | Apr 6, 2023

Design for belonging: An introduction to inclusive design

The foundation of modern, formalized inclusive design can be traced back to the Americans with Disabilities Act (ADA) in 1990. The movement has developed beyond the simple rules outlined by ADA regulations resulting in features like mothers’ rooms, prayer rooms, and inclusive restrooms.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

Cladding and Facade Systems | Apr 5, 2023

Façade innovation: University of Stuttgart tests a ‘saturated building skin’ for lessening heat islands

HydroSKIN is a façade made with textiles that stores rainwater and uses it later to cool hot building exteriors. The façade innovation consists of an external, multilayered 3D textile that acts as a water collector and evaporator.

Market Data | Apr 4, 2023

Nonresidential construction spending up 0.4% in February 2023

National nonresidential construction spending increased 0.4% in February, according to an Associated Builders and Contractors analysis of data published by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $982.2 billion for the month, up 16.8% from the previous year.

Sustainability | Apr 4, 2023

ASHRAE releases Building Performance Standards Guide

Building Performance Standards (BPS): A Technical Resource Guide was created to provide a technical basis for policymakers, building owners, practitioners and other stakeholders interested in developing and implementing a BPS policy. The publication is the first in a series of seven guidebooks by ASHRAE on building decarbonization.