Of the 553 AEC firms to participate in Building Design+Construction’s 2023 Giants 400 survey, 394 companies reported revenue from designing or building multifamily housing projects, including apartments, condominiums, senior living facilities, and student housing complexes.

Collectively, the 2023 Multifamily Giants were responsible for more than half of all U.S. multifamily construction work in 2022—possibly upwards of 60% of the U.S. market. The 120 construction firms alone reported $28.34 billion in revenue (i.e., construction value put in place) from multifamily work, or about a quarter of all multifamily construction work last year.

In all, the 274 design firms (architects, engineers, AEs, and EAs) reported just shy of $3 billion in revenue from multifamily buildings work, which represents anywhere from $35 billion to $40 billion in construction value put in place, depending on the design fees.

Needless to say, the Multifamily Giants have a sizable footprint in the multifamily housing market. Here’s a look at the top innovations reported by the 2023 Multifamily Giants:

Arcadis North America launched its Radius concept for senior living developments. The approach utilizes emerging technologies like artificial intelligence, the Internet of Things, sensors, 5G technology, and nano technology to provide 360-degree care to individuals in the privacy and comfort of their own home. “Through the seamless implementation of a home health ‘kit of parts’ into an adaptable universal floor plan, Radius allows space for dignity, aging in place, and independence for a population that is traditionally reliant on in-person appointments, bedside nursing, and medication management,” according to the firm.

BAR Architects & Interiors partnered with Holmes (structural and fire/life safety engineer), Interface Engineering (MEP), TBD Consultants (cost), and Plant Construction to develop Office 2 Housing Research, a report that explores opportunities and challenges in converting office buildings to housing. The research evaluates five existing buildings of different eras, locations, and construction types to assess the pros and cons of adaptive reuse for housing.

Related content: 2023 Multifamily Housing Design and Construction Giants Rankings:

Multifamily — All Multifamily Facilities Work

Top 190 Multifamily Sector Architecture and AE Firms — All Multifamily Facilities Work

Top 75 Multifamily Sector Engineering and EA Firms — All Multifamily Facilities Work

Top 115 Multifamily Sector Contractors and CM Firms — All Multifamily Facilities Work

Multifamily — Apartments, Condominiums

Top 160 Multifamily Sector Architecture and AE Firms — Apartments, Condominiums Work

Top 70 Multifamily Sector Engineering and EA Firms — Apartments, Condominiums Work

Top 100 Multifamily Sector Contractors and CM Firms — Apartments, Condominiums Work

Multifamily — Senior Living Facilities

Top 80 Multifamily Sector Architecture and AE Firms — Senior Living Facilities

Top 40 Multifamily Sector Engineering and EA Firms — Senior Living Facilities

Top 60 Multifamily Sector Contractors and CM Firms — Senior Living Facilities

Multifamily — Student Housing Facilities

Top 90 Multifamily Sector Architecture and AE Firms — Student Housing Facilities

Top 30 Multifamily Sector Engineering and EA Firms — Student Housing Facilities

Top 40 Multifamily Sector Contractors and CM Firms — Student Housing Facilities

BASE4 has introduced Design PLUS, an “all-services-in-house where we’ll help the client evaluate the best way to build, what materials are the best fit, which prefab applications are appropriate, and more,” according to the firm, which specializes in prefab construction methods for multifamily and hotel projects.

In Philadelphia, BKV Group employed light gauge metal prefab construction for the Northern Liberties mixed-use/multifamily development. The approach reduced construction time by 10-15% and helped achieve a density of 300 units per acre at a lower cost per unit when compared to traditional construction techniques, according to the firm.

To help mitigate the impacts from material price volatility and supply chain issues, Bozzuto Construction employs warehousing of materials and systems on select projects. It has also worked to condense the buyout phase from 270 days to 60 days. “We expect high material volatility to continue for at least the next eight months, so we are continuously identifying and evaluating other innovative strategies that we can implement to execute buyout with the highest efficiency,” says the firm.

CetraRuddy Architecture is designing the nation’s largest-ever commercial-to-residential conversion: the 1.1 million-sf 25 Water Street project in Manhattan’s Financial District. Dealing with large floor plates is one of the toughest challenges when converting office space to multifamily housing. For this 1,300-unit project, the project team is cutting two courtyards into the center of the building and removing floor area, which is redistributed to the top of the structure.

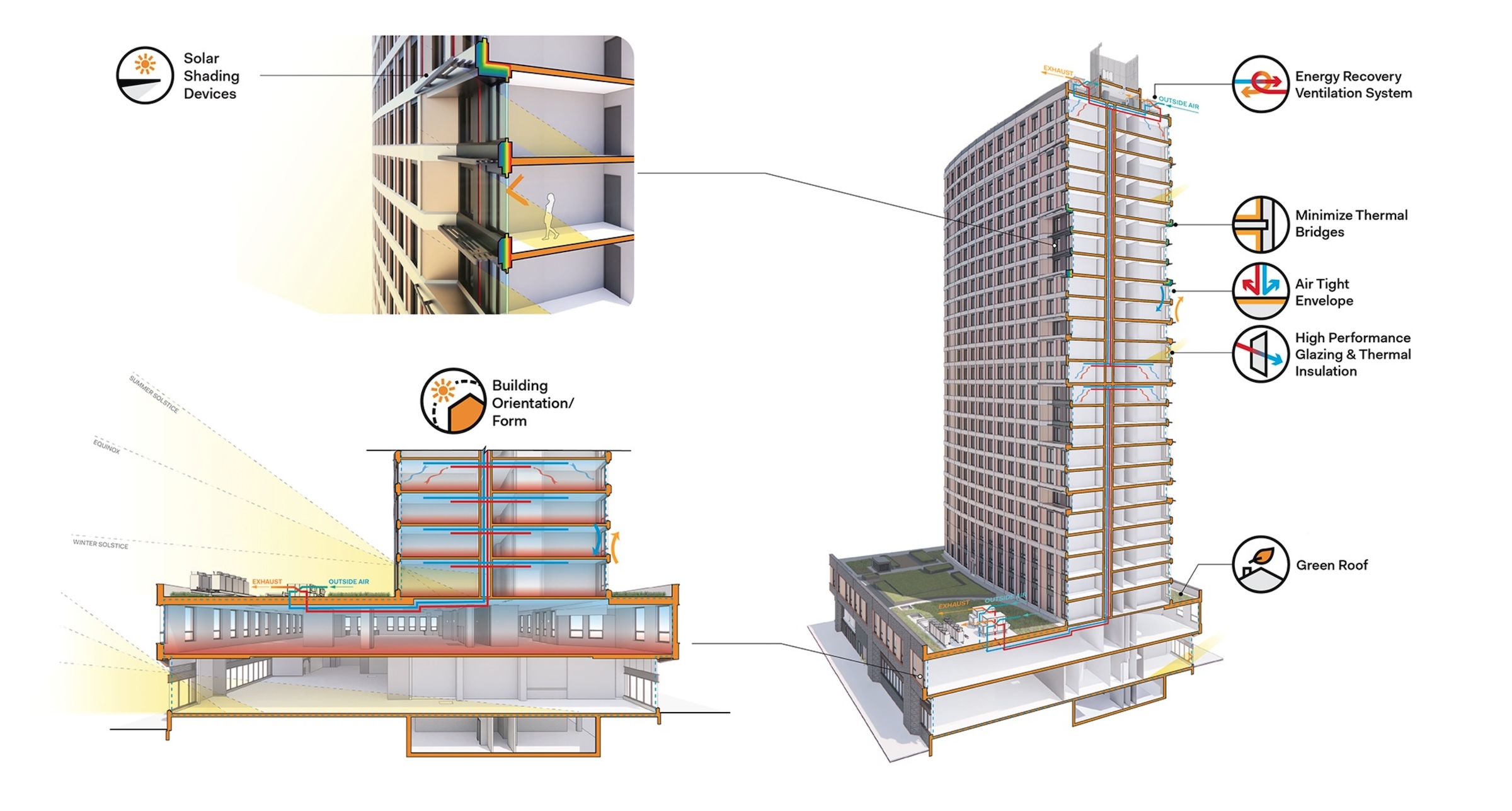

Curtis + Ginsberg Architects is steering multifamily clients toward all-electric, electric-ready, and Passive House projects, to help reduce the use of fossil fuels and carbon footprint, and as a hedge against future energy cost increases. This push includes the electrification of large existing multifamily developments, ranging in size from 12- to 200-unit buildings throughout New York City. As a result, some 5,400 units have been converted to all-electric and/or Passive House so far, says the firm.

Dattner Architects is pushing the boundaries of Passive House design for multifamily work. The firm had four projects receive Passive House Certification in 2022, including the 26-story, 300,000-sf 425 Grand Concourse in the Bronx, N.Y., one of the largest Passive House projects in North America to date. “This benchmark sustainable project provides a model for healthy living environments in a district with one of the worst childhood asthma rates in the country. Each apartments’ living rooms and bedrooms directly receives filtered, ventilated air, increasing interior comfort and air quality,” say the firm. Expansive windows provide a generous amount of daylight into the apartments while balancing the window to wall ratio that is critical to achieving Passive House performance levels.

To help its developer clients build market rate and affordable housing in an economy with with ever-rising construction costs and interest rates, Dwell Design Studio is using prototyping to streamline the design and development process, and to create highly efficient designs that can be adapted to a variety of sites and circumstances. The firm is laser focused on designing highly efficient floor plates that maximize the building footprint allowable within building code limitations across the country, and streamlining residential unit designs with standardized kitchen and bathroom layouts. The result: 85-90% building efficiency on its recent multifamily projects.

Humphreys and Partners Architects delivered its most efficient housing product to date, a micro-unit community situated on 0.54 acres in Nashville, Tenn. The short-term rental community caters to an emerging demographic of traveling professionals who need the comforts of home without the additional square footage. The development offers residents ultra-efficient studio floor plans ranging from 378 sf to 433 sf, with a thoughtful interior design with custom flush cabinetry, nimble bedrooms, and blended kitchen and living room space.

On the affordable housing front, KGD Architecture has developed design and delivery solutions that allow its developer clients to utilize both low-income housing tax credits and tax-exempt private-activity bonds to finance new construction and rehab projects. Case in point: Dominion Square, the first 100%-affordable housing multifamily development in Tysons, Va., providing 500-plus units affordable to households earning 60% of the area median income or less. The project includes a multilevel community center that will enable its residents to benefit directly from the county’s own community services for their health and well-being.

Mortenson continues to push the limits of offsite construction for multifamily projects. The construction giant partnered with its subsidiary manufacturing company, BLUvera, on the eight-story, 200-unit Revival on Platte project in Denver. The project features panels that arrived on site with roughed-in plumbing, mechanical, and finished exterior façades. “While we have many completed cold-formed steel projects, this integration of plumbing, mechanical, and exterior façade represents a significant leap forward in our quest to design and manufacture full building and enclosure systems in a factory setting,” according to the firm.

Related Stories

Multifamily Housing | Mar 24, 2023

Average size of new apartments dropped sharply in 2022

The average size of new apartments in 2022 dropped sharply in 2022, as tracked by RentCafe. Across the U.S., the average new apartment size was 887 sf, down 30 sf from 2021, which was the largest year-over-year decrease.

Self-Storage Facilities | Dec 16, 2022

Self-storage development booms in high multifamily construction areas

A 2022 RentCafe analysis finds that self-storage units swelled in conjunction with metros’ growth in apartment complexes.

Multifamily Housing | Jun 30, 2021

A post-pandemic ‘new normal’ for apartment buildings

Grimm + Parker’s vision foresees buildings with rentable offices and refrigerated package storage.