Monthly construction spending in September rose to a seasonally adjusted annualized rate of $2.149 trillion, a 4.6% gain over the same month in 2023, according to Commerce Department estimates. During the first nine months of 2024, construction spending, on an unadjusted basis, stood at $1.6 trillion, up 7%.

Those gains exceeded most expectations, but they aren’t likely to carry over with the same force into the early months of next year, according to Jones Lang Lasalle (JLL), whose 2025 U.S. Construction Outlook forecasts modest real growth by the end of that year.

“As we reflect on the construction industry’s journey through 2024, we find ourselves at a unique crossroads” driven by politics, “unprecedented” natural disasters, and economic uncertainties, the Outlook’s authors write. The current building pipeline is delivering limited starts to backfill, and the construction industry is now in need of “the next round of ground breakings to land smoothly and keep momentum up for the ongoing energy, tech, manufacturing, and economic transformation we’re in,” states Andrew Volz, JLL’s Research Manager for Project and Development Services.

In such a complex landscape, the value of real estate, states JLL, lies in its ability to drive organizational value through strategic space utilization, technological integration, and sustainable practices.

To achieve measured growth, developers and builders will need to adapt to the shifting economic and political landscapes. JLL anticipates a “return to fundamentals” that will propel growth in key sectors.

The ability to foresee and respond to market trends will increasingly determine a project’s success. JLL singles out three areas that commercial real estate stakeholders need to focus on:

•Getting ahead of the curve, by adapting to evolving economic conditions, regulatory changes, and market dynamics;

•Critically embracing sustainability and innovation at a time when “AI, IoT, and Digital Twin are reshaping” design, construction, and building management; and

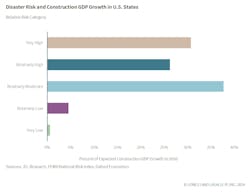

•Building for people and resilience. Compounding climate

risks may alter existing patterns of growth, and the industry must navigate new policy priorities while managing a transition into the 5th industrial revolution.

Costs will increase on several fronts

Construction stakeholders must be ready for volatility. JLL predicts a late-2025 surge in construction spending if interest rates are cut and loan originations increase. But federal policy changes remain unpredictable. “Economic, political and environmental factors on project feasibility across diverse regional markets are changing rapidly.”

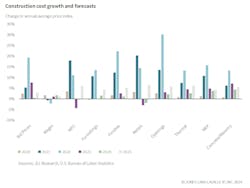

Construction cost growth has been nearly flat in 2024, but that’s not going to remain constant, says JLL, which expects cost growth next year to range between 5% and 7%. Those increases will signal “a pivotal moment for commercial real estate decision-makers.”

The push for green building practices, energy efficiency and reduced carbon footprints will continue shaping project requirements through local regulations and client targets. Data centers, healthcare and advanced manufacturing have embraced sustainability as integral to growth, putting extensive pressure on related materials. And the “unprecedented” acceleration and ferocity of natural disasters are creating “demand shocks” that invariably will impact supplies and prices across a broad range of inputs that include materials and wages.

Resilience is not a luxury

Supporting this uneven pattern of growth is an ongoing challenge, especially as the construction industry continues to face structural reconfigurations with labor, compounding climate risks, and revised policy objective. “CRE leaders should focus on existing and future resilience of their assets and the surrounding regions. They need to be prepared for the impact of infrastructure investments and be ready to leverage the interconnected nature of development, where one resilient project can spur resilience across a city.”

JLL concludes that stakeholders’ growth aspirations can be met only when they balance short-term operational efficiency with long-term goals. The developers and owners that strike that balance “will thrive.”

About the Author

John Caulfield

John Caulfield is Senior Editor with Building Design + Construction Magazine.