Skilled labor shortages continue to make off-site fabrication and construction attractive

By John Caulfield, Senior Editor

A recent survey of AEC firms and real estate owners and developers found a strong majority that had deployed off-site construction in the previous 12 months and planned to utilize it to a greater extent going forward.

The Off-Site Construction Council of the National Institute of Building Sciences in Washington, D.C. conducted its 2018 Off-Site Construction Industry Survey as a follow-up to a 2014 survey to gauge the industry’s interest in off-site construction, which it defines as the planning, design, fabrication, and assembly of building elements at a location other than their final point of assembly onsite.

Ryan Smith of Washington State University and Kambaja Tarr of the University of Utah conducted and compiled the latest survey for NIBS.

“With the ongoing shortage of skilled craft workers (which exceeded two million in 2017), prefabrication in a controlled, off-site environment may become a necessity for many U.S. contractors attempting to remain competitive with a lower-skilled workforce,” the survey states. But as with any new process or technology innovation, and despite growing demand, ”uncertainties accompany the utilization of off-site construction.”

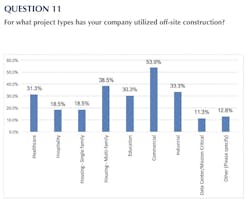

The commercial, multifamily and healthcare sectors are where off-site construction has been finding its greatest demand. Image: NIBS

A total of 205 participants responded to the 2018 Off-Site Construction Industry survey, versus 312 respondents to the 2014 poll. The participating companies provide a variety of different services, including construction management/general contracting (24.75% in 2018; 46.7% in 2014), engineering (21.72% and 38.3%), trade contracting (2.53% and 27.3%), architecture (87.88% and 15%), and owners/developers (10.1% and 8.3%).

Nearly nine of 10 respondents to the 2018 survey (87.72%) had used off-site fabricated components to some degree over the previous 12 months, and more than eight in 10 (81.63%) expected to engage off-site construction more often or the same amount in the following 12 months. (Both percentages were down slightly from the 2014 survey.)

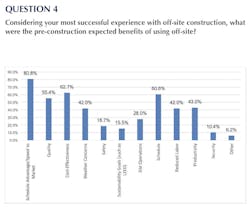

The primary benefit identified in both surveys is a reduced overall project schedule, specifically the duration of the construction phase.

For more than three fifths of respondents (63.22%) designers, architects and engineers were the primary decision makers about when off-site construction is implemented, followed by construction managers or general contractors (47.67%), clients (41.97%), and others, primarily subcontractors (21.24%).

Keeping projects on schedule is where companies that deploy off-site construction have been seeing the greatest benefit. Image: NIBS

Interestingly, however, respondents stated that the most significant barrier to off-site construction is the culture of design and construction in general. Comments indicated that late design changes, lack of collaboration and an adversarial climate for project delivery leads to difficulties in realizing the benefits of off-site construction.

The survey notes that the building component fabrication industry is still maturing and needs more time to integrate effectively with site-built work. In addition, contractors are still learning how to manage off-site products for assembly on-site.

Transportation is another significant barrier: specifically, how far away a factory is located from the construction site.

Respondents in both surveys qualitatively noted that some projects, particularly those with long spans, may not be suited for the use of pre-fabricated elements, and that each project has unique requirements that must be met through an appropriate technical solution.