More contractors are turning to offsite production for speed and quality

By John Caulfield, Senior Editor

The jobsite is very tight for the 11-story, 625,000-sf Medical University of South Carolina’s Shawn Jenkins Children’s Hospital and Women’s Pavilion, which is under construction in Charleston.

The $385 million project, scheduled for completion in April 2019, required an offsite delivery point for materials. But Robins & Morton, the CM at Risk, also had to contend with local workforce shortages and rising construction costs. On top of that, the market wanted this facility sooner than later for its critical healthcare needs.

So the contractor leased an 80,000-sf high-bay warehouse 15 miles from the jobsite, which served not only for delivery and storage, but also for component fabrication via the contractor’s Third-Party Logistics (3PL) initiative, which combined the project’s BIM model with logistics software.

Trades could access drawings needed to build their assigned products. More than 75% of the hospital’s mechanicals, plumbing, electrical, lighting, and window elements were prefabricated at this shop. Steve Wiley, Robins & Morton’s Senior Project Manager, says that at one point there were 11 subcontractor crews working in the warehouse.

The third-party schedule for this project, originally projected for 42 months, is now pegged at less than 31 months. And transportation costs ultimately could be reduced by as much as 35%. Prefabrication “gave us a lot more control over tracking inventory,” says Wiley.

Offsite manufacturing has steadily seeped into nonresidential and multifamily construction, to the point where a number of general contractors have set up temporary or permanent factories for prefabricating components or for producing modules that can be delivered, virtually complete, to jobsites for quick final assembly and utility hookups.

Last month, the technology and construction firm Katerra announced that it would build a 577,000-sf advanced manufacturing plant in Tracy, Calif., that when fully operational next year would employ 500 people and be able to pump out 12,500 multifamily modules per year. Katerra is also building three more component plants, and a 250,000-sf mass timber plant in Spokane, Wash., that will produce cross-laminated wall panels and floor systems. Katerra is planning another mass timber plant for somewhere in the Southeastern U.S.

The general contractor Skender disclosed last month that it had leased a 105,560-sf industrial building on the southwest side of Chicago, where in November the company will start operating an advanced manufacturing facility that produces modular buildings for the multifamily, healthcare, and commercial sectors. Skender will hire 100 employees for this plant over the next 18 months, and expects it to produce 1,000 modules in its first full year of operation. (The division already has booked a multifamily and healthcare project, says Mark Skender, the company’s CEO.)

Katerra and Skender each can stir design into its modular formula. Over the past several months, Katerra has acquired three architectural firms, and in March Skender bought the 10-person firm Ingenious Architecture, and hired former CannonDesign exec Tim Swanson as its Chief Design Officer.

SEIZING THE MOMENT

Island Exterior Fabricators' Megapanel facility, which is part of its seven-building 50-acre complex in Calverton, N.Y., that the company is in the process of expanding to 350,000 sf. Image: Urban View Photo.

Offsite production is alluring to AEC firms and their clients at a time when the industry is struggling with scarce skilled labor and building material cost escalation.

“We’re at an inflection point, where there’s more pressure to find alternative ways to build,” says Steve Glenn, CEO of Plant Prefab, an offshoot of the design/development company LivingHomes. Since May 2016, Plant Prefab has been producing single- and multifamily modules from its 62,000-sf plant in Rialto, Calif.

“Prefabrication has made strong inroads on the building envelope side of the industry,” states Ed Harms, Managing Partner with Island Exterior Fabricators, a Boston-based façade subcontractor. Harms has also seen more demand for “plug and play” mechanical components and bathroom modules made offsite.

Island is adding 100,000 sf to its factory in Calverton, N.Y., for a total of 350,000 sf on 50 acres. That seven-building plant has the capacity to produce 1 million sf of façade annually.

The Calverton facility recently fabricated 92 panels—made from a combination of steel, glass, aluminum, and brick with three finishes—that cover a 12-story, 25,000-sf boutique hotel at 54 Devonshire Street in Boston. (Magna Hospitality is the client.) “The skin went up in only 13 days,” says David Bois, AIA, Principal with Arrowstreet, the design architect on this project. (Consigli Construction is the GC.) “There was no scaffolding, no sidewalk rentals; it was like a kit of parts. And the quality of the detailing was much higher” than could have been achieved with onsite construction.

For a seven-story addition to the 40 Water Street office building at Boston's Congress Square, the architectural firm Arrowstreet worked with the fabricator Kreysler to come up with a customized soffit system. Image: Courtesy Arrowstreet

Arrowstreet has been investigating prefab and modular processes for at least a decade, says Bois. And that exploration continues: Arrowstreet worked with the fabricator Kreysler on creating a soffit system for a seven-story addition to the 40 Water Street office building in Boston. The architect is also working with Netherlands-based supplier Jan Snel to evaluate a module with a concrete floor, wood roof, and steel connectors, and compare that with standard stick-framed construction for a five-over-two building. The goal, says Bois, is test the economic feasibility of taller modular buildings.

A TREND WITH HEADWINDS

But let’s take a step back, especially about modular, whose portion of the housing and nonresidential construction markets remains minuscule. And while 35 states regulate prefabrication and modular construction, the words “offsite” and “modular” have yet to appear in any national code standard.

But there are signs of growth and acceptance. Permanent modular construction increased by 2.1% to 23,286 units in 2017, according to the latest estimates by the Modular Building Institute (MBI), which shared a draft of its new report with BD+C. (That number represents labeled units, not the total, as several states don’t have labeling programs.)

The Southeast, Midwest, and Southwest regions of the country all saw double-digit increases in modular demand. And the value of modular building construction projects for 2017 rose to $7.2 billion, from about $6 billion in 2016.

“Our members can’t keep up with demand,” says Tom Hardiman, MBI’s Executive Director “We could easily use 50 to 100 more manufacturing plants out there.”

One of the country’s leading suppliers, Guerdon Modular Buildings, told the Daily Breeze newspaper in March that it had a pipeline of 30 projects in California alone. They include the $86 million Marriott Townplace Suites in Hawthorne, Calif., for which Guerdon is providing 354 modules that are arriving on the jobsite complete with furniture and appliances installed.

While office buildings and schools represent the largest markets for advanced manufacturing, the fastest-growing sector is hospitality/hotels, which expanded by 31.3% to 1,989 rooms last year, according to MBI. Guerdon—whose 125,000-sf plant in Boise, Idaho, has a capacity to produce 1 million sf of modules annually—and Champion Home Builders—which can produce modules from 22 of its 28 factories—have found hospitality to be fertile ground for their products.

Guerdon is also supplying Second Street Studios, a 135-unit affordable housing project in San Jose, Calif., that will start accepting occupants in November. Some industry watchers see modular construction as playing a role in ameliorating America’s affordable housing crisis. Last year, the startup manufacturer Factory_OS took its first order from Google’s owner Alphabet Inc. to provide 300 prefabricated apartment units, at a reported cost of $30 million, for temporary housing for employees working at the tech giant’s Mountain View, Calif., campus.

COPING WITH FEWER TRADES

Z Modular is supplying steel modules for Cheatham Street Flats, off-campus student housing for Texas State University. The building will have 143 units and 234 beds, and Z Moldular is producing rooms with cabinets, plumbing, furniture, and tile installed. Images: Forge Craft Architecture + Design

There is agreement among suppliers and AEC firms that the industry’s dearth of available skilled labor, if it continues, could make offsite manufacturing not just a choice, but a necessity.

“The trades’ workforce is getting older and is not being replaced by a younger generation,” observes Rich Rozycki, Senior Vice President of Z Modular, a steel-module manufacturer that is a subsidiary of Zekelman Industries, the largest independent producer of steel pipe and tubing.

Z Modular opened its 125,000-sf plant in Birmingham, Ala., in October 2017, and based on its first nine months of production Rozycki estimates that its annual capacity is around 800,000 sf. The company will open a second, 200,000-sf plant in Austin in early 2019.

One of Z Modular’s current projects is Cheatham Street Flats, off-campus housing for Texas State University in San Marcos. The project, which includes 143 units with 234 beds within 192,506 sf on five stories, is scheduled for a total of 48 install days. Rozycki says conventional onsite construction would have taken another three to four months.

Z Modular uses a patented, pre-engineered steel connection system called VectorBloc, which allows for installation tolerances plus or minus 1/16th of an inch. Those tolerances let Z Modular build in its factory such components as stairwells and elevator shifts that, otherwise, would have been constructed onsite, says Rozycki.

“Owners love [modular construction] because it gives them more control of the project,” says David Goujon, AIA, Project Architect for Forge Craft Architecture + Design in Austin, the interior designer of Cheatham Street Flats. He says Z Modular is providing modules that come with cabinets, plumbing, tile, wall-mounted TVs, beds, and other furniture. For the building’s podium and garage, Z Modular deployed a steel structural framing system from Diversakore whose columns and beams are produced offsite.

“What we’ve been learning is how modular [construction] can be more efficient, and how the quality of the product is superior and can be controlled from module to module,” says Goujon.

Mark Skender, CEO of the general contractor Skender, which in November hopes to start producing modules for healthcare, multifamily, and commercial projects from a factory it is setting up in Chicago. Image: Skender

Mark Skender, CEO of the eponymous Chicago-based contractor, says his firm has been tracking modular and prefab trends for two decades. But he really got interested five years ago, when he was trying to build a high-performance house during the winter months in Michigan. “I said to myself ‘this is ridiculous’ and that there had to be a more efficient way to do this.”

The first project for which Skender will deliver modules from its factory is a six-story, 110-unit, 80,000-sf multifamily building within Chicago’s West Loop. Factory production could begin in November or December, and assembly onto a one-story structural steel podium is expected to start by next February and take eight weeks to complete. The entire building should be substantially done by next July, which Skender claims would be 30% to 40% faster than conventional construction. Total project development costs would be reduced by 10% to 20%.

PROS AND CONS OF A ‘FULL MODULAR’ APPROACH

Skendar and Swanson say that their company’s goal is to deliver modules that are at least 90% complete, with interior fits and finishes in place. “There’s no reason we can’t apply the principles of advanced product design to buildings,” says Peter Murray, President of Skender Manufacturing.

However, not everyone around the industry is fully on board the modular train yet, or at least not to the extent that prefabrication has gained wider acceptance. Some wonder if the demand for offsite modular construction is as robust as some proponents think. Others question whether offsite construction can ever allow for the design flexibility that many developers and AEC partners insist upon for their buildings.

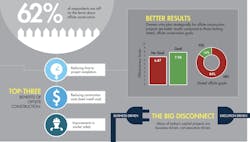

FMI recently surveyed 100 construction companies and found that more than three-fifths aren't completely confident about offsite construction as a delivery method for their projects. About the same portion of respondents, however, concede that market conditions today are dictating alternative ways to build beyond conventional onsite construction. Image: FMI/CURT/CII 2018 Owner Survey of Offsite Construction

Last fall and winter, the management consulting firm FMI polled 100 owner-members of the Construction Users Roundtable and the Construction Industry Institute, whose companies have been involved with offsite construction. The survey found 62% of respondents were still “on the fence” about offsite construction, even while acknowledging that it can reduce the time it takes to complete a project, reduce construction costs, and improve worker safety. Only 38% of respondents said there is a “high acceptance” of offsite construction methods within their organizations.

“One of the biggest barriers to change and transformation as it relates to offsite construction is not technology; it’s culture,” the report states. “Getting people to embrace new ways of thinking and doing work differently is one of the most challenging aspects of organizational change.”

Anyone asking how extensively modular manufacturing will be called upon for nonresidential or multifamily construction might find the experience of Ramtech Building Systems instructive.

Ramtech has been in business since 1982, during which it has completed around 4,000 projects in Texas and eight surrounding states. This vertically integrated contractor offers design services, advanced manufacturing (its plant is in Mansfield, Texas), and three types of construction services (slab-on-grade, pier and beam, and relocatable).

One of its recent projects is a slab-on-grade, two-story, 40,000-sf school in Beaumont, Texas, for which it is providing 17 modules. But only 30% of that building will be fabricated in the company’s factory, with the rest being site-built. That’s pretty typical of projects the company supplies in Texas, says Roland Brown, Ramtech’s Vice President of Design.

Brown notes that his company has “multiple ways we can build,” and is keeping its options open as preferences for delivery methods ebb and flow. He doesn’t think market demand warrants expanding Ramtech’s module production capacity, especially if that meant taking on more debt.

Brown also cautions suppliers against becoming overly dependent on automation, which is great for producing iterative products, but may be less suitable for developers and owners “who still want their buildings to be unique.”

Harms of Island Exterior Fabricators also thinks that a full modular solution would require “too many design compromises.” Component prefabrication, on the other hand, lends itself better to those “dense” construction elements that involve multiple subcontractors. Island’s preferred M.O., he says, is to have its 100 architects and engineers on staff find and work with AEC partners on projects.

PCL Constructors is Canada’s largest general contractor. About six years ago, the firm formed PCL Agile, a prefabrication group that self performs about 65% of what it produces from its 65,000-sf shop in Ontario. Last week, BD+C spoke with Troy Galvin, PE, Agile’s manager. The shop was working on several jobs, including 300 prefab washroom pods, and 2,000 intake and duct systems.

Modular installation requires cranes that need room and clearance within a jobsite to maneuver. Image: Courtesy of Plant Prefab

Galvin says that producing a complete and ready-to-install room offsite is “certainly feasible.” But, he warns, “you have to ask what your constraints are. What’s the laydown area? Is the site big enough to operate cranes?” He advises as well that prefabrication and advanced manufacturing “need to be thought about at the estimating stage, and the scope needs to be locked in.”

Despite these caveats, a contingent of executives in the nonresidential space seem convinced that offsite manufacturing—be it for components or full rooms—is bound for bigger things in the future. “The construction industry must and will move in this direction, as other industries have,” predicts MBI’s Hardiman.

From what Bois of Arrowstreet says he’s been hearing from his firm’s contractor partners, “the labor shortage is real. And if the [offsite] process can be systematized, that will be a benefit for everyone.”