Retail expectations vs reality in 2021

In the Retailing universe, Experiential Retail has been a buzz phrase for years. Brick-and-mortar stores were going to stave off the rush of customers toward alternative shopping by creating environments and shopping experiences that entertain, that stimulate, that are worth being a part of for their own sake. It made sense, and it was starting to happen. Chains like Target and Costco offered “the treasure hunt,” unique items strategically placed where shoppers can stumble across them. Some malls reinvented themselves as “lifestyle hubs,” incorporating operations like brewpubs, yoga studios, and video gaming parlors.

Yet the collective annual foot traffic for America’s malls continues its multi-decade decline, as does brick-and-mortar overall. COVID-19 has created a step-change in the shift from brick-and-mortar to online, but the underlying trend had been negative for a long time.

Still, according to Neil Stern, a senior partner at retail consultancy McMillanDoolittle, “Physical retail isn’t dying. Bad retail is.”

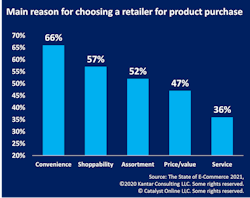

What makes for good retail in 2021? Forget fancy experiences. Calendar 2021 will be the Year of Convenience. In a joint study published by global consultancies Kantar and Catalyst, convenience was the number one reason online purchasers mentioned for choosing a retailer, cited by 66% of survey participants. And convenience often means saving time – ordering online and picking it up as fast as possible.

Target, Starbucks, Costco, and Amazon are retail chains that continue to outpace expectations even during the pandemic, and their embrace of convenience is a big part of the reason. Each has been integrating their physical locations with their online presence to a greater degree, and making that speedy turnaround from ordering-to-picking-up a priority.

First, the context: Consultancy HRC has issued its Retail Predictions for 2021, and the theme is a year with two very different calendar halves. Spending patterns established in 2020 will continue into the first half of 2021, but by mid-year the lid is likely to be blown off all the pent-up demand in categories that suffered the biggest declines last year. Yet HRC feels that new on-line shopping habits will not fade away, keeping the pressure on traditional retail.

Who’s poised to exceed expectations?

Let’s start with Starbucks.

In October, November, and December of 2020 the restaurant industry overall saw sales declines of 14.4%, 16.6%, and 21.2%, respectively. In those same three months, Starbucks could have seen a similar fate, since the chain saw a 21% decrease in the number of comparable-store transactions – but instead Starbucks experienced only a 5% fall-off in comparable-store sales, thanks to a 19% gain in the average ticket. By making it easier to order, visit, pay, and receive their order, Starbucks has encouraged customers to buy more on a given visit.

In 2021 the company will build on this convenience-led strategy by accelerating store formats such as “drive-thru, mobile order only, counter pickup and curbside pickup” Starbucks will also pull out of malls in favor of new locations that complement the indoor experience with drive-thrus. In addition, a new deal with HMS Host will expand the Starbucks mobile order and mobile pay capability to everywhere the former has locations.

The quarter ending in November of 2020 was a particularly good one for Costco, with a sales increase of 16.9%, including same-store growth of 15.4%. Earnings per share easily surpassed analysts’ expectations.

But the chain’s success was more than a matter of being in the right place at the right time to take advantage of consumer budgets that were forcibly redirected to the home. In 2020 Costco rolled out same-day delivery across the U.S. and Canada via a dedicated Costco page on the Instacart website. In 2021 Costco is further leveraging its Instacart relationship to pilot a curbside pickup program for grocery orders in Albuquerque.

Amazon as the 500 pound Gorilla

Of course, it was Amazon who taught Americans to make home delivery a part of their normal routine, but the retail giant has never been one to rest on its laurels. Net sales at the end of 2020 represented a 44% surge over the prior year. The pandemic had a lot to do with it, as did a flurry of new programs designed to further enhance the typical customer’s convenience factor in doing business with Amazon. After that $125 billion quarter, another quarter of $100 billion+ is anticipated for Q1 2021.

Despite a business model built around delivery, Amazon has also been busy integrating digital and brick-and-mortar. Late in 2020 it gave customers the option for convenient pick-up of online orders at either its physical stores or Amazon Hub locations. It has also added features such as Amazon’s Map Tracking, Amazon Share Tracking, Amazon Photo-On-Delivery, and Amazon Estimated Delivery Window.

But as Starbucks and Costco, among others, have made clear, enhancing the convenience of food is the game to win in 2021. Amazon has employed machine learning to make sure that the food its Amazon Fresh stores source from manufacturers, distributors, and local farmers is optimized in every way – in terms of freshness of supply, inventory management, and efficient and timely delivery. And Amazon One contactless payment will become available for anyone who wishes to install it on their mobile device throughout 2021.

Covid-19’s lasting effects may include customers consciously seeking out convenience, and retailers will continue to up the ante on convenience in search of an edge on the competition. At this point you are wondering why a VDC advisory firm is focused on the brick and mortar retail sea change? The drastic brick and mortar portfolio transformation to convenience requires a digital platform to rapidly implement this change – any retailer who experienced 2020 first hand would agree that the speed in adapting to changing consumer preferences was a key driver to success, and the only way to make that happen effectively is through a digital platform.