As the 1990s were drawing to a close, Jesse Devitte wasn’t sure there was much of a future investing in the tech-averse AEC world. He had formed that opinion after stints as President of the AutoCAD software startup Softdesk, which went public in 1994; and then as Vice President of Autodesk’s AEC Market Group after Autodesk paid $90 million to acquire Softdesk in 1996.

But soon after leaving that latter post in 1998, Devitte got a phone call from Brad Schell, Co-founder of the Boulder, Colo.-based startup @Last Software. Schell and his partner, Joe Esch, were about to launch a 3D drawing application called SketchUp, and he wanted to know if Devitte was interested in getting in on the action. Devitte ultimately became an investor in and director for @Last Software from 2003 to 2006, the year it hit the jackpot when Google bought that company for somewhere between $15 million and $45 million, according to analysts’ estimates.

During the past 18 years, the 57-year-old Devitte has raised three venture capital funds totaling around $75 million under the auspices of Borealis Ventures, which he founded in 2001. Devitte launched a second investment entity, Building Ventures, late last year.

See Also: Sports teams get in the game: Mixed-use developments are using sports stadiums as their anchors

With that capital, Devitte took stakes in some of the better-known construction technology startups targeting the AEC sector, including View Software (facilities management), Envista (map-based coordination, whose founders included execs from Bentley Systems and Infrasoft), Fieldlens (jobsite communications, which WeWork acquired in 2017), Newforma (project file management), Flux (design), Smartvid.io (image management via machine learning), and Blokable (prefab affordable homebuilding management).

According to BuiltWorlds, which tracks VC investment and M&A activity, more than 20 of Devitte’s 74 investments through 2018 were in the built space, as well as 10 of his 26 successful exits.

Cash pours into the sector

Devitte is among the coterie of savvy venture capitalists who saw gold in those AEC hills. McKinsey & Company estimates that investors pumped more than $10 billion into “contech” startups between 2000 and 2017. BuiltWorlds’ Research Manager Matt Gagne says that the number of contech investment deals rose to 102 in 2017, from only two in 2008.

JLL estimates that $4.34 billion was invested in 478 deals from 2009 through the first half of 2018. Crunchbase’s tally for 2018 alone is just shy of $3.1 billion. One deal—the $865 million that the prefabrication technology company Katerra hauled in from an investment group led by SoftBank Vision Fund—outflanked the total amount of all contech investments the previous year.

“It was a perfect storm in 2016 to 2018,” says Gagne. “There was a lot of investor interest in new technologies, and plenty of new technologies to invest in.” Michael Seibel, CEO of the startup accelerator Y Combinator, told TechCrunch last September (tcrn.ch/2R6GXUt) that the availability of capital for contech startups “has never been more abundant.” (To compete with the sizes of early-stage funding rounds, Y Combinator has increased the size of its investments to $150,000 in exchange for 7% equity, a $30,000 jump.)

This surge in VC funding, though, still seems at odds with the persistent resistance to all things tech that continues to define some AEC quarters. For example, 46% of the 2,825 respondents to JBKnowledge’s 2018 Construction Technology Report (most of whom work for GCs, CMs, or subcontractors) said that their companies spend less than 1% of their annual revenue on IT. Another 18% said their companies spend no more than 1%.

In a fourth quarter 2018 report, FMI tried to explain this tech phobia by noting that rolling out new technologies across multiple offsite construction projects “is downright difficult.” FMI also observed that small subcontractors that comprise a large portion of the industry “lack the scale to invest in technology that may not realize returns for some time.”

Even Devitte acknowledges that the AEC industry is tough for startups to crack into. “It’s fragmented, and there’s not a lot of transparency, which startups thrive on,” he says. But three or four years ago, he started seeing a “new type” of AEC firm emerge, which was more receptive to adopting technology.

What prompted this change? Labor shortages, for one thing. Urbanization, for another. It became increasingly harder for AEC firms to keep their clients’ projects on schedule and on budget without some kind of technological assistance. Devitte notes, too, that AEC firms are under more pressure than ever to deliver projects that perform better over their life cycles, with sustainability, resilience, and wellness now more than just catchphrases.

These are only some of the factors that have conspired to force the construction sector into the 21st century and explore how technology could improve the performance of their workers, the quality of their work, their competitiveness, and their financial viability.

“2018 was an inflection point for the construction tech industry,” Jerry Chen, a Partner with the VC firm Greylock Partners, told Crunchbase in February (bit.ly/2BBLyb9).

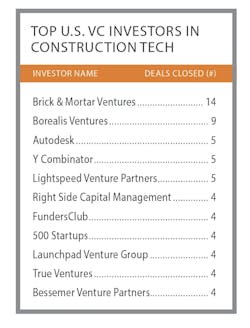

“We’re betting it is the right time” to invest in the built environment, said Darren Bechtel, Founder and Managing Director of Brick & Mortar Ventures, a building industry tech-focused VC firm, in an interview with BuiltWorlds last September (bit.ly/2U78wye). “It is the first time that a number of 100-plus-year-old construction firms are waking up in a cold sweat and saying, ‘We might get Uber’d.’ Instead of innovating to improve productivity, there is a sense of urgency and need to innovate to survive, let alone thrive.”

A contech advisory network

What VC investors are betting on these days seems to point toward three specific types of products, says FMI: collaborative software, physical construction (from prefab to robotics), and data analytics/Internet of Things. FMI notes that investors are attracted to technology with an “as a service” model, which often comes in the form of software licensing agreements.

“We’re excited about this new emphasis on collaboration,” said Bechtel, especially as it lends itself to generating the data needed to advance jobsite automation. “You need to have all of the stakeholders weighing in, collaborating, and contributing to each other throughout the project life cycle.”

The AEC industry’s more ardent embrace of technology is what led Devitte’s Building Ventures to launch its Built Environment Innovation Fund, which in December closed at $53 million.

“There is a critical need to rethink how we design, build, operate, and experience the built work, and to address that opportunity we created a fund dedicated to helping shape the digital transformation of the built environment,” says Devitte.

What’s unusual about this fund is that its investors include about a dozen AEC firms, such as Gilbane, Mortensen, Thornton Tomasetti, DPR, and the Japan-based construction firm Obayashi. In conjunction with this fund, Devitte initiated a Built Environment Innovation Network, consisting of more than 50 senior executives from such firms as Perkins+Will, EYP, and KPFF, as well as from Autodesk, Oracle, Trimble, and Procore (see the network’s full roster: bit.ly/2NqJRSC). Devitte envisions this network serving as both a sounding board for ideas and a search engine for startups and products into which the fund might invest.

“They are our eyes and ears, and a great resource for real-life feedback,” he explains.

Investing in people, not just products

Devitte says he’s always on the lookout for new technology “that lets stakeholders make decisions earlier.” He points specifically to one of his investments, Measurabl, a sustainability management tool that has been attracting developers. (On January 19, Measurabl announced it had raised $18.7 million in new funding to expand its environmental, social, and governance, or ESG, data management platform for commercial real estate.)

Devitte’s investment strategy is pretty basic: he seeks out entrepreneurs and teams that are interested in building a larger company, and for which venture capital is their “fuel.”

He compares his vetting process to surfing: the surfer represents the people involved in the startup. “Who are they? Why are they here?” The surfboard is the product or service. “Is it differentiated, disruptive, or just an incremental improvement?” And the wave is the industry. “What is the problem being solved, who cares, and what will they pay for a solution?”

Devitte says his approach—which in the past has included serving as a director or even chairman for the startups he’s invested in—is to be as supportive as possible. “For early-stage companies, more goes wrong than right, so who’s in the room when that happens is important.” He wants to see that, during trying times, a startup team that’s fully committed to building the company. His role is not to tell them what to do. “But we’ve seen this movie before, so we try to help where we can.”

One of the hardest things for entrepreneurs to know is whether the market is ready for their product. “That’s where we can lend some objectivity,” says Devitte.

AI is attracting more investors

What 2019’s hot product or category will be “is a bit of a mystery,” says Gagne of BuiltWorlds. He notes that certain technologies catch on in different years: drones in 2017; virtual, augmented, and mixed reality in 2018. Gagne expects a “big push” among investors to find the latest and greatest in artificial intelligence.

“The construction industry has decades of data just sitting around that no one is using,” says Gagne. “We are using machines to capture as much information as possible. So if you could prove that, by using machine learning, you can be more predictive and accurate, why wouldn’t you use it?”

Devitte, like most investors, prefers seeing the glass at least half full, and he isn’t overly concerned about an economic downturn, because “there are too many avenues for new growth.”

A startup he thinks AEC firms should keep an eye on is Blokable, one of his investments since 2017. Last summer, that company’s Vancouver, Wash., plant unveiled its model for providing prefabricated affordable housing as a service, where Blokable manages the entire turnkey process from design to construction. (One of Blokable’s CEOs, Aaron Holm, was once a product manager for Amazon.)

“Three years ago, they couldn’t get permits anywhere,” says Devitte. “Now, cities are calling them because their housing needs are so great.”

Contech Investment Deals Closed in 2018

JANUARY 2018

• Katerra raises $865M in a funding round led by SoftBank

• zlien, a construction payment “ecosystem,” raises $10M, led by S3 Ventures

FEBRUARY 2018

• Trimble pays $500M for CM software provider eBuilder

• Goldman Sachs leads an investment group that provides $8M in financing for Rabbet, an automated computer invoicing platform that uses machine learning for document sharing

APRIL 2018

• Trimble acquires Viewpoint Construction Software for $1.2B

• AI platform VEERUM raises $3.9M in seed money led by Brick & Mortar Ventures

JULY 2018

• Autodesk acquires Assemble Systems for more than $90M in cash and stock. Autodesk is integrating Assemble into its BIM 360 project management platform.

• Prescient, a BIM-driven offsite framing manufacturer, closes $50M led by Eldridge Industries

AUGUST 2018

• JDM Technology Group acquires MicroMain and Applied Computer Systems

• Autodesk leads an $8M financing round for Rhumbix, a mobile-first platform for jobsite data

DECEMBER 2018

• Autodesk acquires PlanGrid ($875M) and Building Connected ($275M)

• Brick & Mortar Ventures leads a $4.5M financing round for Cumulus Digital Systems

• Tiger Global Management leads a $75M funding round for Procore Technologies