Over the last 50 years, the U.S. has changed in numerous ways. The rise in technological innovation, population growth, and the constant push for urban development are just a few facets of note.

Research platform StorageCafe has conducted an analysis of U.S. real estate activity from 1980 to 2023, focusing on six major sectors: single-family, multifamily, industrial, office, retail, and self-storage. What StorageCafe has dubbed the “construction Olympics,” an analysis of the top 100 cities in the U.S. was conducted to see how the overall development volume has changed over the past 43 years.

Data from the U.S. Census as well as StorageCafe's sister research divisions, Commercial Edge and Yardi Matrix, helped to pinpoint where the most development is happening and what sectors are advancing at a higher pace than others.

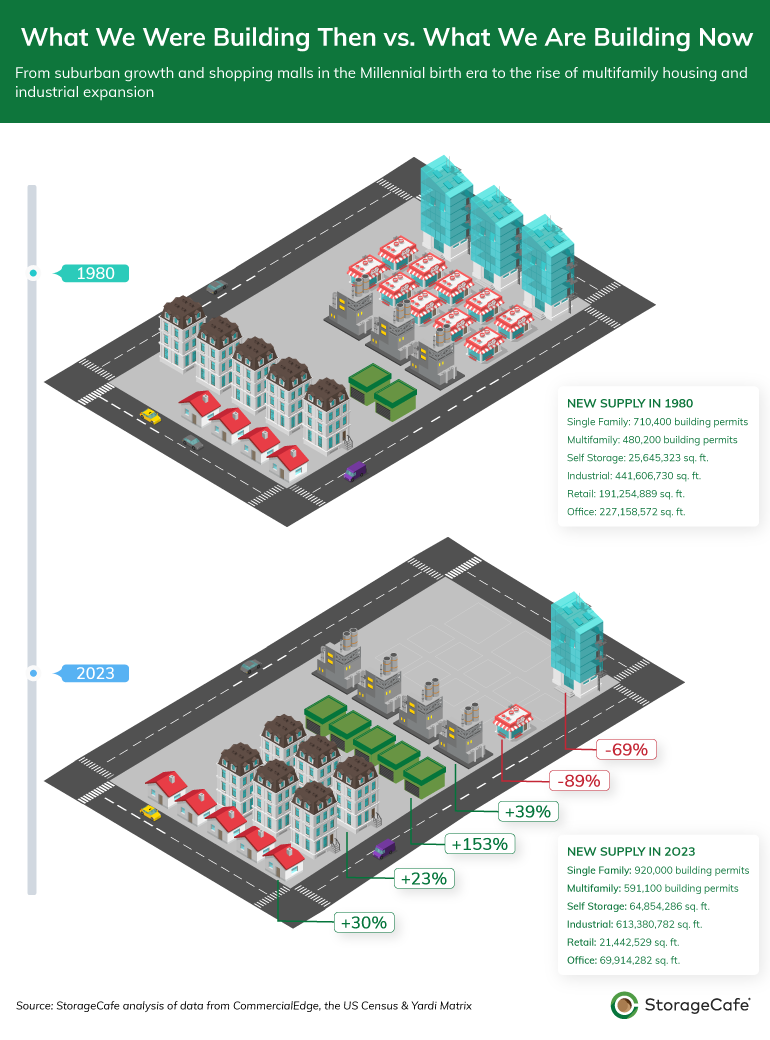

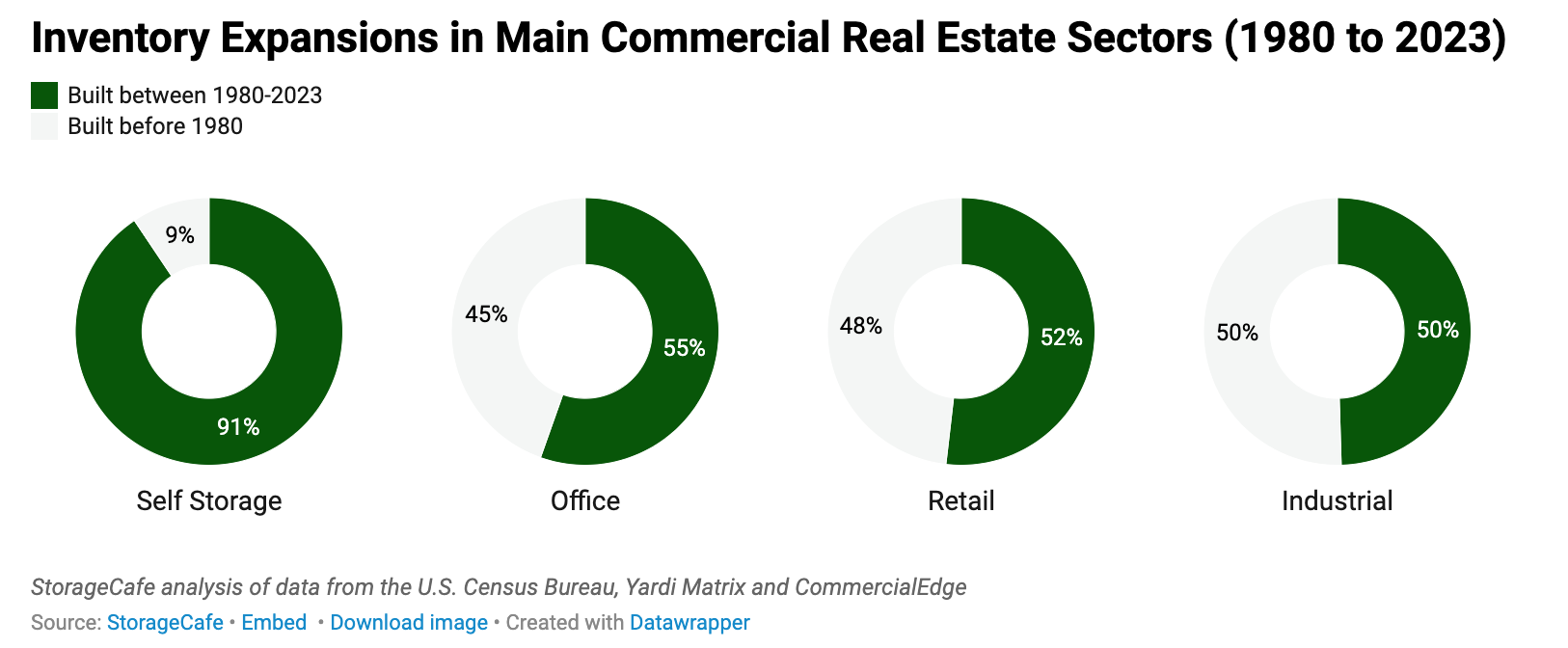

Overall, the single-family, multifamily, self-storage, and industrial sector have grown since the 1980s, while retail and office have taken a dip. Historically, retail and office construction dominated the U.S. real estate landscape as places like shopping malls served as community hubs. However, a notable shift has occurred, with urbanization leading to a surge in multifamily housing, self-storage facilities, and industrial spaces.

“The surge in interest rates has drastically altered the landscape of the U.S. real estate market, after a period of intense development activity post-pandemic,” says Doug Ressler, Business Intelligence Manager, Yardi Matrix. “Real estate developers across the nation are now tapping into unconventional funding sources for their projects, while lenders are exercising increased caution.”

Looking ahead, Ressler emphasized that stakeholders must adapt to the evolving landscape, balancing cautious optimism with strategic planning to seize opportunities in a highly competitive environment.

Multifamily and Self-Storage

The analysis finds that the multifamily sector is “stepping in to fill the gaps left by the slower single family construction, aiming to meet the housing needs of a growing population.”

The past decade has served as the best-performing period for multifamily development among the five decades analyzed. The average number of apartments permitted annually has increased significantly since 2020, reaching approximately 603,000 units. This represents a 56% rise compared to the average rate during the 2010s.

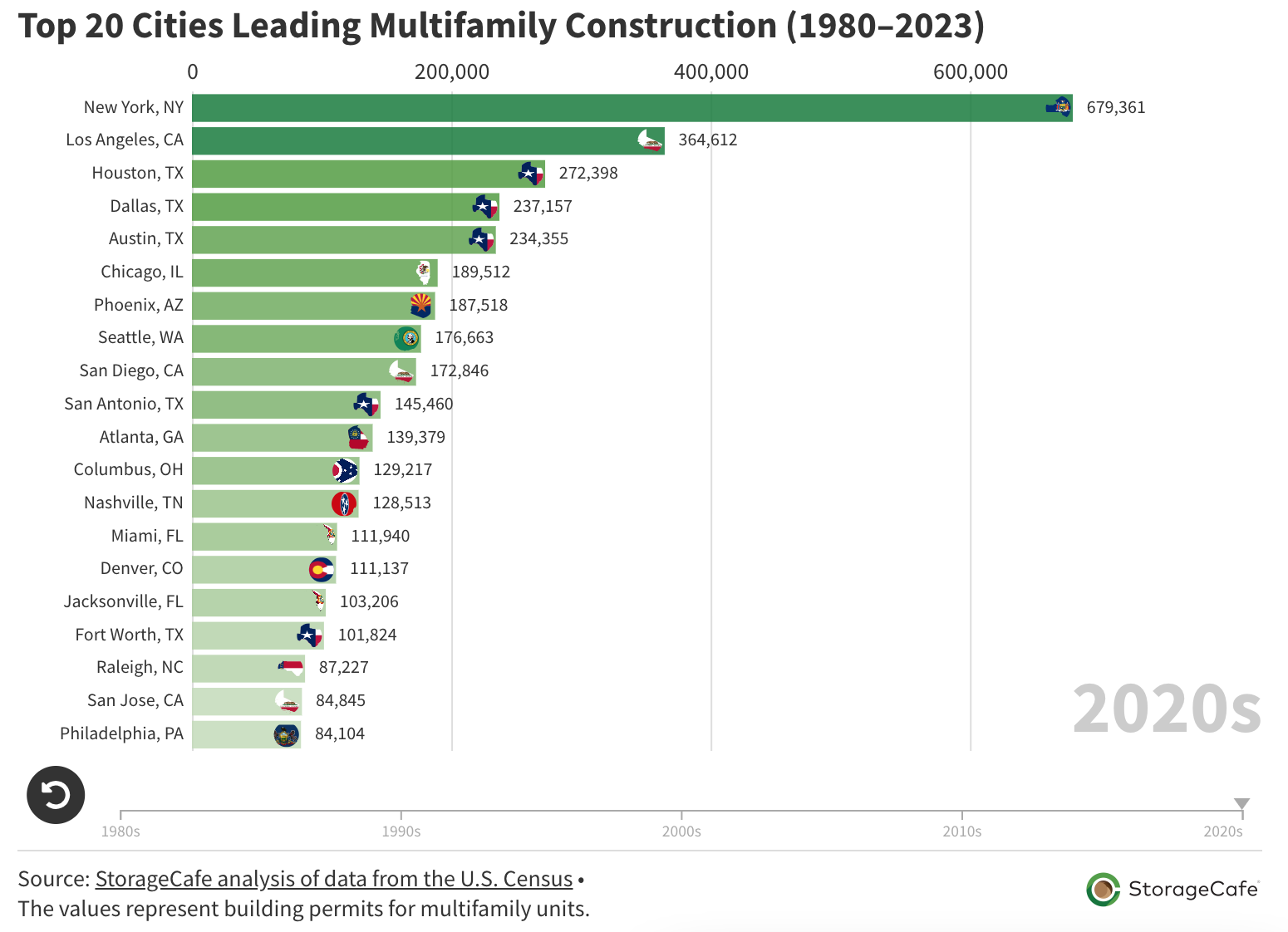

Top Cities for Multifamily Construction

In the U.S., New York, N.Y., leads the country with 680,000 multifamily building permits issued between 1980 and 2023. Los Angeles, Calif., follows closely behind at 365,000, while Houston, Texas (272,000 permits issued), demonstrates strength across multiple real estate sectors.

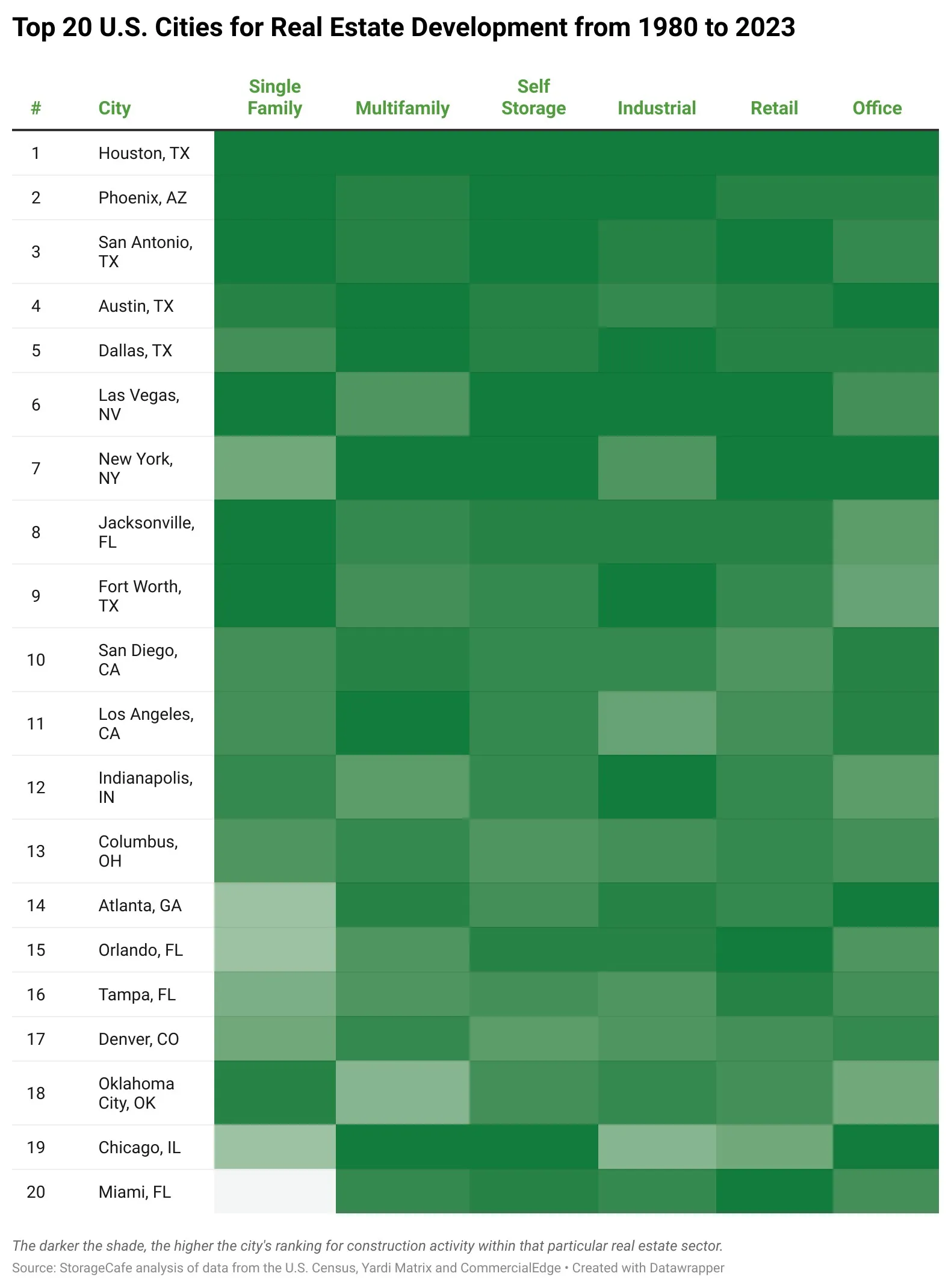

Texas has excelled on all fronts for real estate growth. Cities like Houston, San Antonio, Austin, Dallas, and Fort Worth have become economic powerhouses, thanks in part to the tech boom, energy sector growth, and health care industry demands.

Growth in Self-Storage Facilities

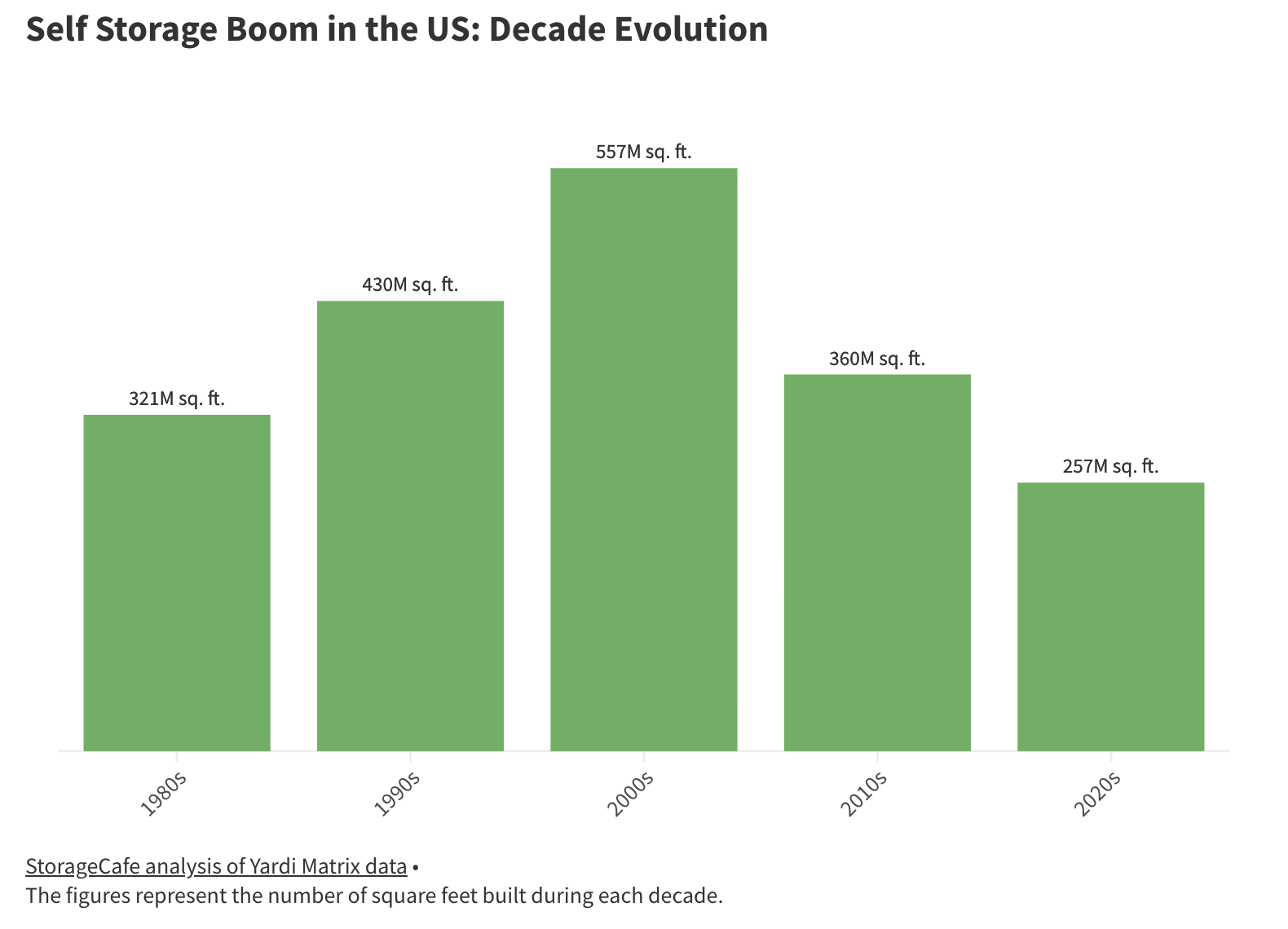

The self-storage industry has experienced rapid growth, with annual completions currently doubling those of the 1980s. Approximately two billion sf of self-storage inventory has been added in the past 44 years.

The 2000s witnessed the peak of self-storage construction nationwide with a total of nearly 557 million sf. The 1990s also contributed significantly, adding 430 million sf of new space. Major urban centers like New York City, Houston, and San Antonio, have been at the forefront of self-storage development.

According to StorageCafe, the 2020s is poised to be a significant decade for self-storage inventory growth. Though the 2000s saw an annual delivery rate of 55 million sf, present-day trends have exceeded that peak with current deliveries surpassing 64 million sf each year.

Industrial

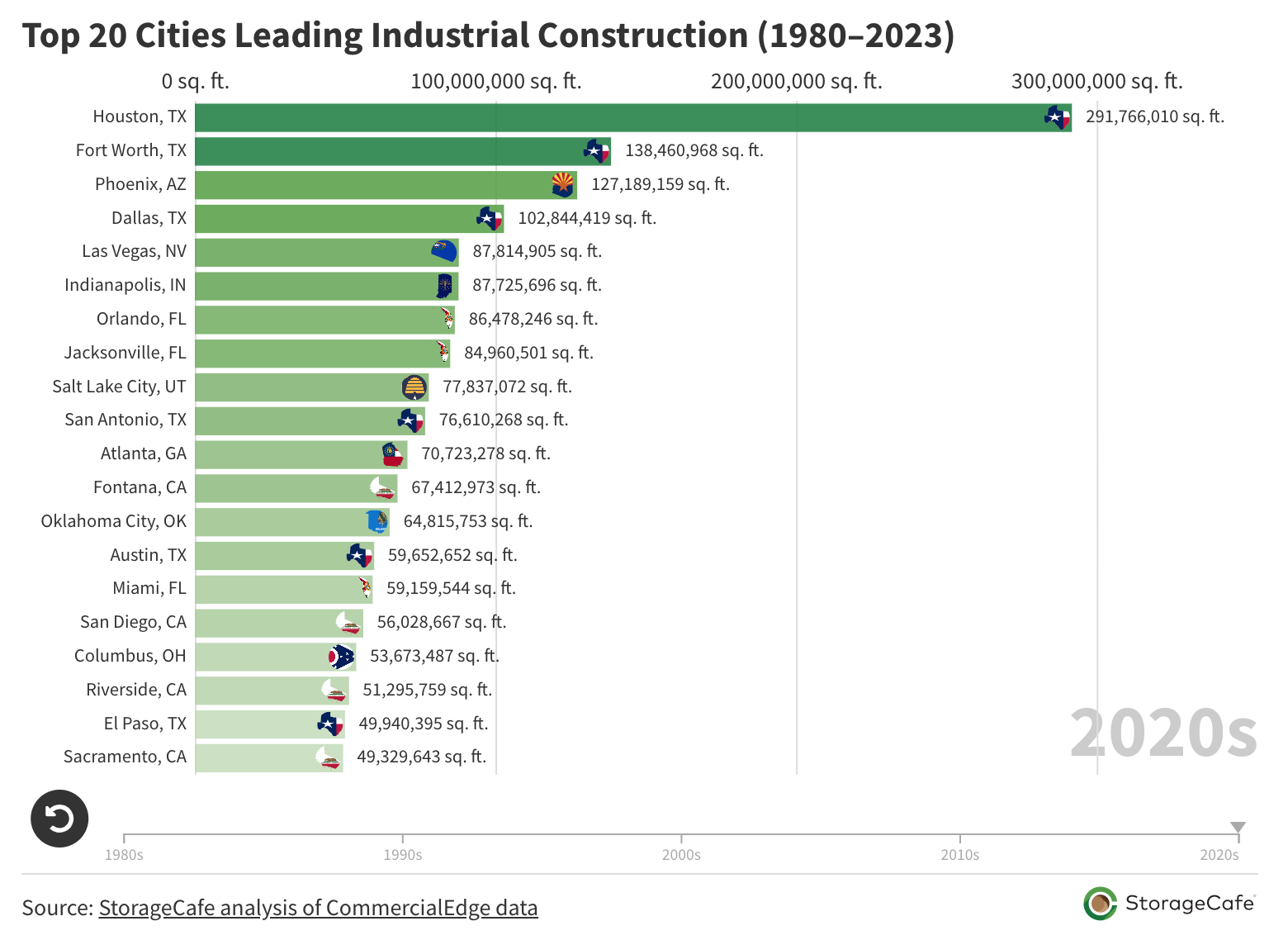

Industrial construction has seen a massive boost as of late, thanks to increased demand for logistics and distribution centers.

Since 1980, approximately half of the nation's industrial real estate has been constructed. The current decade has witnessed a surge in industrial construction, with an average of nearly 516 million sf of new space added annually. This surpasses the average of the 2010s by more than double and is approximately 50% higher than any of the preceding three decades.

Texas cities lead the country in industrial construction (Houston tops the chart here as well, followed by Fort Worth), as well as Phoenix, Ariz.

Office and Retail

Office space construction was at its peak in the 1980s and has been slowly declining since—though it's showing some resilience today. Retail construction shows a similar story.

Office Growth

Over 268 million sf of new office space was delivered annually in the decade of the 1980s. The 1990s and 2000s saw the sector decrease its annual deliveries by nearly half, and the 2010s represented the lowest point in office construction.

Despite the disruptions caused by the pandemic, the office market has demonstrated resilience. During the 2020s, an average of 86 million sf of new office space was delivered annually across the U.S., reflecting a notable recovery and a shift towards flexible, collaborative workspaces that better align with evolving workforce needs.

New York, N.Y., has delivered the most office space in the country over the past half-century. 255 million sf of office space is attributed to the city, followed by Houston, Texas, Atlanta, Ga., and Washington, D.C.

Retail Decline

The retail sector has declined in recent years due to the significantly reduced demand for physical retail spaces. Market consolidation has also moved its focus to more exclusive areas.

Retail construction reached its peak in the 2000s, with annual deliveries of 232 million sf. Today, the pace has significantly slowed, averaging just under 41 million sf per year in the current half of the decade.

Overall Real Estate Development Trends

Southern and southwestern cities dominate the top 20 ranking of the nation's best cities for real estate development, claiming 15 positions.

Houston, Texas, has consistently outperformed other cities over the past 44 years, followed closely by Phoenix, Ariz., and San Antonio, Texas.

To read all the findings from the StorageCafe report, click here.

Related Stories

Adaptive Reuse | Jan 23, 2024

Adaptive reuse report shows 55K impact of office-to-residential conversions

The latest RentCafe annual Adaptive Reuse report shows that there are 55,300 office-to-residential units in the pipeline as of 2024—four times as much compared to 2021.

Multifamily Housing | Jan 15, 2024

Multifamily rent growth rate unchanged at 0.3%

The National Multifamily Report by Yardi Matrix highlights the highs and lows of the multifamily market in 2023. Despite strong demand, rent growth remained unchanged at 0.3 percent.

Apartments | Jan 9, 2024

Apartment developer survey indicates dramatic decrease in starts this year

Over 56 developers, operators, and investors across the country were surveyed in John Burns Research and Consulting's recently-launched Apartment Developer and Investor Survey.

Giants 400 | Jan 8, 2024

Top 60 Senior Living Facility Construction Firms for 2023

Whiting-Turner, Ryan Companies US, Weis Builders, Suffolk Construction, and W.E. O'Neil Construction top BD+C's ranking of the nation's largest senior living facility general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 8, 2024

Top 40 Senior Living Facility Engineering Firms for 2023

Kimley-Horn, Olsson, Tetra Tech, EXP, and IMEG head BD+C's ranking of the nation's largest senior living facility engineering and engineering/architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 8, 2024

Top 80 Senior Living Facility Architecture Firms for 2023

Perkins Eastman, Hord Coplan Macht, Lantz-Boggio Architects, Ryan Companies US, and Moseley Architects top BD+C's ranking of the nation's largest senior living facility architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

MFPRO+ News | Jan 8, 2024

Canada turns to 1940s strategy to speed up housing construction

To address a severe housing shortage, Prime Minister Justin Trudeau’s administration has begun a housing construction strategy pioneered in the years after World War 2. The government aims to use a catalog of pre-approved home designs to reduce the cost and time to construct homes.

Self-Storage Facilities | Jan 5, 2024

The state of self-storage in early 2024

As the housing market cools down, storage facilities suffer from lower occupancy and falling rates, according to the December 2023 Yardi Matrix National Self Storage Report.

MFPRO+ News | Dec 22, 2023

Document offers guidance on heat pump deployment for multifamily housing

ICAST (International Center for Appropriate and Sustainable Technology) has released a resource guide to help multifamily owners and managers, policymakers, utilities, energy efficiency program implementers, and others advance the deployment of VHE heat pump HVAC and water heaters in multifamily housing.

Giants 400 | Dec 20, 2023

Top 100 Apartment and Condominium Construction Firms for 2023

Clark Group, Suffolk Construction, Summit Contracting Group, and McShane Companies top BD+C's ranking of the nation's largest apartment building and condominium general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.