Half-century real estate data shows top cities for multifamily housing, self-storage, and more

By Quinn Purcell, Managing Editor

Over the last 50 years, the U.S. has changed in numerous ways. The rise in technological innovation, population growth, and the constant push for urban development are just a few facets of note.

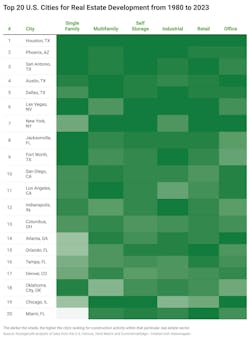

Research platform StorageCafe has conducted an analysis of U.S. real estate activity from 1980 to 2023, focusing on six major sectors: single-family, multifamily, industrial, office, retail, and self-storage. What StorageCafe has dubbed the “construction Olympics,” an analysis of the top 100 cities in the U.S. was conducted to see how the overall development volume has changed over the past 43 years.

Data from the U.S. Census as well as StorageCafe's sister research divisions, Commercial Edge and Yardi Matrix, helped to pinpoint where the most development is happening and what sectors are advancing at a higher pace than others.

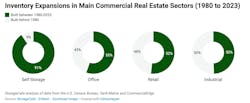

Overall, the single-family, multifamily, self-storage, and industrial sector have grown since the 1980s, while retail and office have taken a dip. Historically, retail and office construction dominated the U.S. real estate landscape as places like shopping malls served as community hubs. However, a notable shift has occurred, with urbanization leading to a surge in multifamily housing, self-storage facilities, and industrial spaces.

“The surge in interest rates has drastically altered the landscape of the U.S. real estate market, after a period of intense development activity post-pandemic,” says Doug Ressler, Business Intelligence Manager, Yardi Matrix. “Real estate developers across the nation are now tapping into unconventional funding sources for their projects, while lenders are exercising increased caution.”

Looking ahead, Ressler emphasized that stakeholders must adapt to the evolving landscape, balancing cautious optimism with strategic planning to seize opportunities in a highly competitive environment.

Multifamily and Self-Storage

The analysis finds that the multifamily sector is “stepping in to fill the gaps left by the slower single family construction, aiming to meet the housing needs of a growing population.”

The past decade has served as the best-performing period for multifamily development among the five decades analyzed. The average number of apartments permitted annually has increased significantly since 2020, reaching approximately 603,000 units. This represents a 56% rise compared to the average rate during the 2010s.

Top Cities for Multifamily Construction

In the U.S., New York, N.Y., leads the country with 680,000 multifamily building permits issued between 1980 and 2023. Los Angeles, Calif., follows closely behind at 365,000, while Houston, Texas (272,000 permits issued), demonstrates strength across multiple real estate sectors.

Texas has excelled on all fronts for real estate growth. Cities like Houston, San Antonio, Austin, Dallas, and Fort Worth have become economic powerhouses, thanks in part to the tech boom, energy sector growth, and health care industry demands.

Growth in Self-Storage Facilities

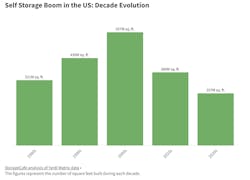

The self-storage industry has experienced rapid growth, with annual completions currently doubling those of the 1980s. Approximately two billion sf of self-storage inventory has been added in the past 44 years.

The 2000s witnessed the peak of self-storage construction nationwide with a total of nearly 557 million sf. The 1990s also contributed significantly, adding 430 million sf of new space. Major urban centers like New York City, Houston, and San Antonio, have been at the forefront of self-storage development.

According to StorageCafe, the 2020s is poised to be a significant decade for self-storage inventory growth. Though the 2000s saw an annual delivery rate of 55 million sf, present-day trends have exceeded that peak with current deliveries surpassing 64 million sf each year.

Industrial

Industrial construction has seen a massive boost as of late, thanks to increased demand for logistics and distribution centers.

Since 1980, approximately half of the nation's industrial real estate has been constructed. The current decade has witnessed a surge in industrial construction, with an average of nearly 516 million sf of new space added annually. This surpasses the average of the 2010s by more than double and is approximately 50% higher than any of the preceding three decades.

Texas cities lead the country in industrial construction (Houston tops the chart here as well, followed by Fort Worth), as well as Phoenix, Ariz.

Office and Retail

Office space construction was at its peak in the 1980s and has been slowly declining since—though it's showing some resilience today. Retail construction shows a similar story.

Office Growth

Over 268 million sf of new office space was delivered annually in the decade of the 1980s. The 1990s and 2000s saw the sector decrease its annual deliveries by nearly half, and the 2010s represented the lowest point in office construction.

Despite the disruptions caused by the pandemic, the office market has demonstrated resilience. During the 2020s, an average of 86 million sf of new office space was delivered annually across the U.S., reflecting a notable recovery and a shift towards flexible, collaborative workspaces that better align with evolving workforce needs.

New York, N.Y., has delivered the most office space in the country over the past half-century. 255 million sf of office space is attributed to the city, followed by Houston, Texas, Atlanta, Ga., and Washington, D.C.

Retail Decline

The retail sector has declined in recent years due to the significantly reduced demand for physical retail spaces. Market consolidation has also moved its focus to more exclusive areas.

Retail construction reached its peak in the 2000s, with annual deliveries of 232 million sf. Today, the pace has significantly slowed, averaging just under 41 million sf per year in the current half of the decade.

Overall Real Estate Development Trends

Southern and southwestern cities dominate the top 20 ranking of the nation's best cities for real estate development, claiming 15 positions.

Houston, Texas, has consistently outperformed other cities over the past 44 years, followed closely by Phoenix, Ariz., and San Antonio, Texas.

To read all the findings from the StorageCafe report, click here.