The war in Ukraine, global port congestion, and the persistent spread of COVID variants will conspire to raise prices on equipment and key building products by 7-9 percent this year, according to the general contractor Consigli’s latest market update, which it released a few days ago.

Authors Peter Capone and Jared Lachapelle, Consigli’s director of construction and vice president of preconstruction, respectively, wrote that while the nonresidential construction industry continues to be resilient, it can’t completely alleviate forces that are reducing or delaying the supply of raw materials and finished goods.

Russia’s invasion of Ukraine has reduced the supply of manufacturing materials such as aluminum and copper, and is putting a strain on production and delivery across Europe. Meanwhile shipping congestion “is showing little sign of improvement” worldwide, especially at ports in Asia.

Other factors contributing to rising construction prices include spikes in fuel costs, and wage increases that are jacking up labor costs. “Acquiring workforce, [in] the Northeast in particular, remains an area of concern,” the authors state. Union and non-union subcontractors “are booking up to capacity for 2022,” and are already focused on next year and beyond.

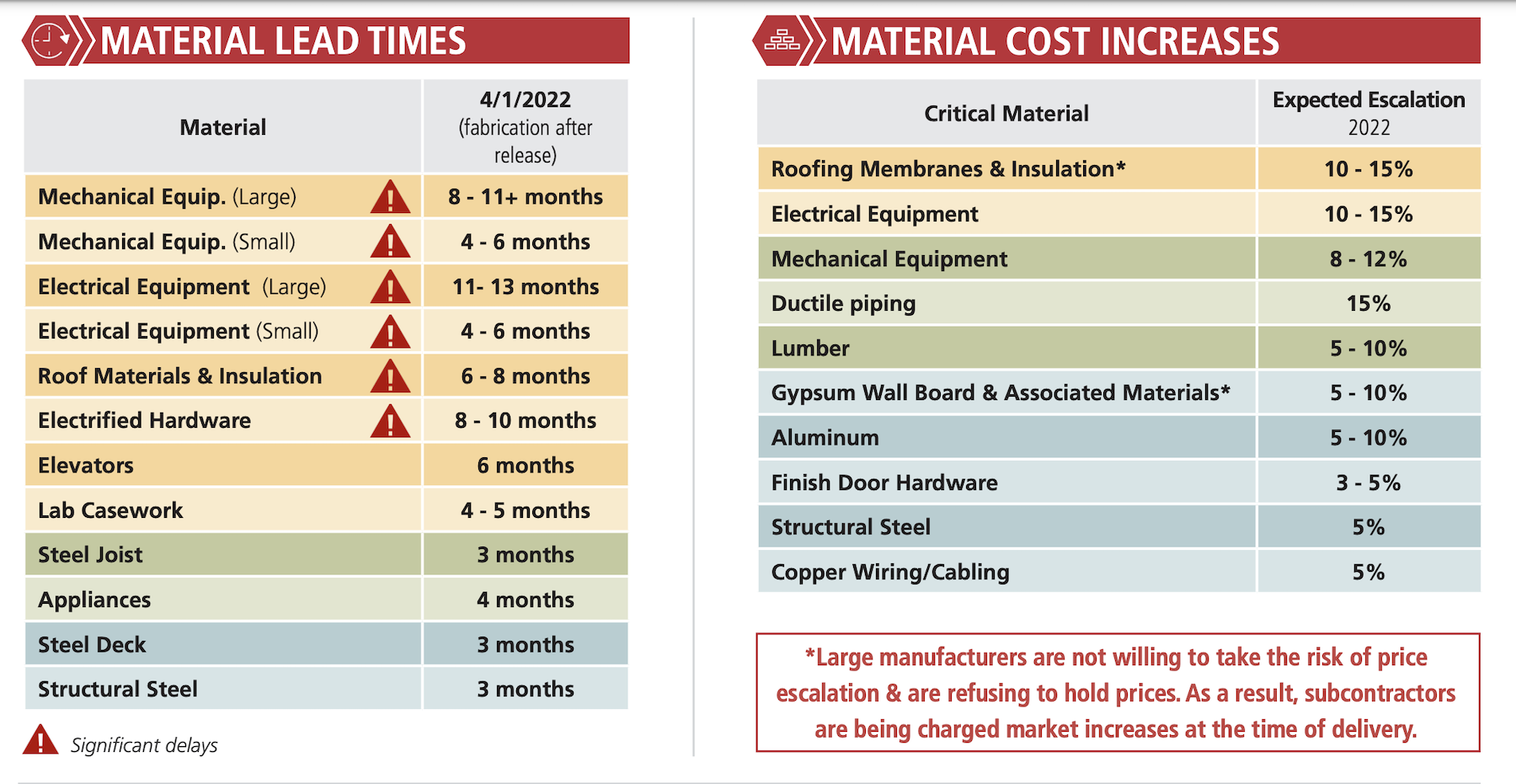

Electrical equipment and hardware, and roofing materials, are stalled in long lead times. As a result, price inflation for these products is expected to be double digit this year.

Consigli is also keeping an eye on a few things that could affect prices, such as contract negotiations with the International Longshoreman Warehouse Union that are scheduled for this July and will impact 22,000 workers at 79 ports.

The federal infrastructure bill, as it rolls out, will place more stress on an already tight labor market. Consigli notes that half of its larger subcontractors have secured 85 percent of their backlog for this year, and are “quickly filling” their projected backlog for 2023.

Related Stories

Market Data | Nov 29, 2016

It’s not just traditional infrastructure that requires investment

A national survey finds strong support for essential community buildings.

Industry Research | Nov 28, 2016

Building America: The Merit Shop Scorecard

ABC releases state rankings on policies affecting construction industry.

Multifamily Housing | Nov 28, 2016

Axiometrics predicts apartment deliveries will peak by mid 2017

New York is projected to lead the nation next year, thanks to construction delays in 2016

Market Data | Nov 22, 2016

Construction activity will slow next year: JLL

Risk, labor, and technology are impacting what gets built.

Market Data | Nov 17, 2016

Architecture Billings Index rebounds after two down months

Decline in new design contracts suggests volatility in design activity to persist.

Market Data | Nov 11, 2016

Brand marketing: Why the B2B world needs to embrace consumers

The relevance of brand recognition has always been debatable in the B2B universe. With notable exceptions like BASF, few manufacturers or industry groups see value in generating top-of-mind awareness for their products and services with consumers.

Industry Research | Nov 8, 2016

Austin, Texas wins ‘Top City’ in the Emerging Trends in Real Estate outlook

Austin was followed on the list by Dallas/Fort Worth, Texas and Portland, Ore.

Market Data | Nov 2, 2016

Nonresidential construction spending down in September, but August data upwardly revised

The government revised the August nonresidential construction spending estimate from $686.6 billion to $696.6 billion.

Market Data | Oct 31, 2016

Nonresidential fixed investment expands again during solid third quarter

The acceleration in real GDP growth was driven by a combination of factors, including an upturn in exports, a smaller decrease in state and local government spending and an upturn in federal government spending, says ABC Chief Economist Anirban Basu.

Market Data | Oct 28, 2016

U.S. construction solid and stable in Q3 of 2016; Presidential election seen as influence on industry for 2017

Rider Levett Bucknall’s Third Quarter 2016 USA Construction Cost Report puts the complete spectrum of construction sectors and markets in perspective as it assesses the current state of the industry.