The war in Ukraine, global port congestion, and the persistent spread of COVID variants will conspire to raise prices on equipment and key building products by 7-9 percent this year, according to the general contractor Consigli’s latest market update, which it released a few days ago.

Authors Peter Capone and Jared Lachapelle, Consigli’s director of construction and vice president of preconstruction, respectively, wrote that while the nonresidential construction industry continues to be resilient, it can’t completely alleviate forces that are reducing or delaying the supply of raw materials and finished goods.

Russia’s invasion of Ukraine has reduced the supply of manufacturing materials such as aluminum and copper, and is putting a strain on production and delivery across Europe. Meanwhile shipping congestion “is showing little sign of improvement” worldwide, especially at ports in Asia.

Other factors contributing to rising construction prices include spikes in fuel costs, and wage increases that are jacking up labor costs. “Acquiring workforce, [in] the Northeast in particular, remains an area of concern,” the authors state. Union and non-union subcontractors “are booking up to capacity for 2022,” and are already focused on next year and beyond.

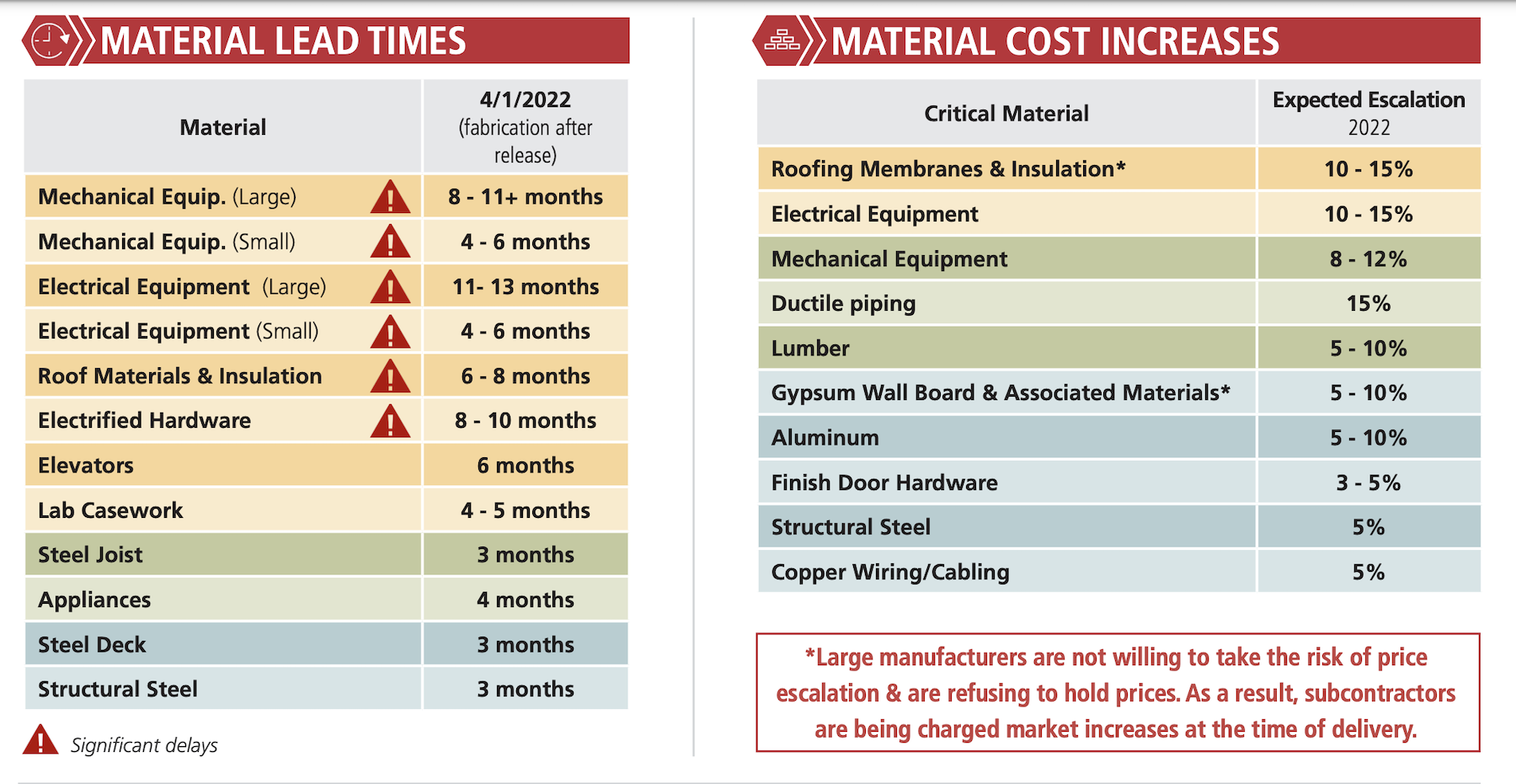

Electrical equipment and hardware, and roofing materials, are stalled in long lead times. As a result, price inflation for these products is expected to be double digit this year.

Consigli is also keeping an eye on a few things that could affect prices, such as contract negotiations with the International Longshoreman Warehouse Union that are scheduled for this July and will impact 22,000 workers at 79 ports.

The federal infrastructure bill, as it rolls out, will place more stress on an already tight labor market. Consigli notes that half of its larger subcontractors have secured 85 percent of their backlog for this year, and are “quickly filling” their projected backlog for 2023.

Related Stories

Market Data | Dec 2, 2020

New Passive House standards offers prescriptive path that reduces costs

Eliminates requirement for a Passive House consultant and attendant modeling.

Market Data | Dec 2, 2020

Nonresidential construction spending remains flat in October

Residential construction expands as many commercial projects languish.

Market Data | Nov 30, 2020

New FEMA study projects implementing I-Codes could save $600 billion by 2060

International Code Council and FLASH celebrate the most comprehensive study conducted around hazard-resilient building codes to-date.

Market Data | Nov 23, 2020

Construction employment is down in three-fourths of states since February

This news comes even after 36 states added construction jobs in October.

Market Data | Nov 18, 2020

Architecture billings remained stalled in October

The pace of decline during October remained at about the same level as in September.

Market Data | Nov 17, 2020

Architects face data, culture gaps in fighting climate change

New study outlines how building product manufacturers can best support architects in climate action.

Market Data | Nov 10, 2020

Construction association ready to work with president-elect Biden to prepare significant new infrastructure and recovery measures

Incoming president and congress should focus on enacting measures to rebuild infrastructure and revive the economy.

Market Data | Nov 9, 2020

Construction sector adds 84,000 workers in October

A growing number of project cancellations risks undermining future industry job gains.

Market Data | Nov 4, 2020

Drop in nonresidential construction offsets most residential spending gains as growing number of contractors report cancelled projects

Association officials warn that demand for nonresidential construction will slide further without new federal relief measures.

Market Data | Nov 2, 2020

Nonresidential construction spending declines further in September

Among the sixteen nonresidential subcategories, thirteen were down on a monthly basis.