Nonresidential building is on track to achieve a “breakout year” in 2015, during which spending growth could exceed 20%, according to projections by construction giant Gilbane in its Summer 2015 Construction Economics Report, “Building for the Future.”

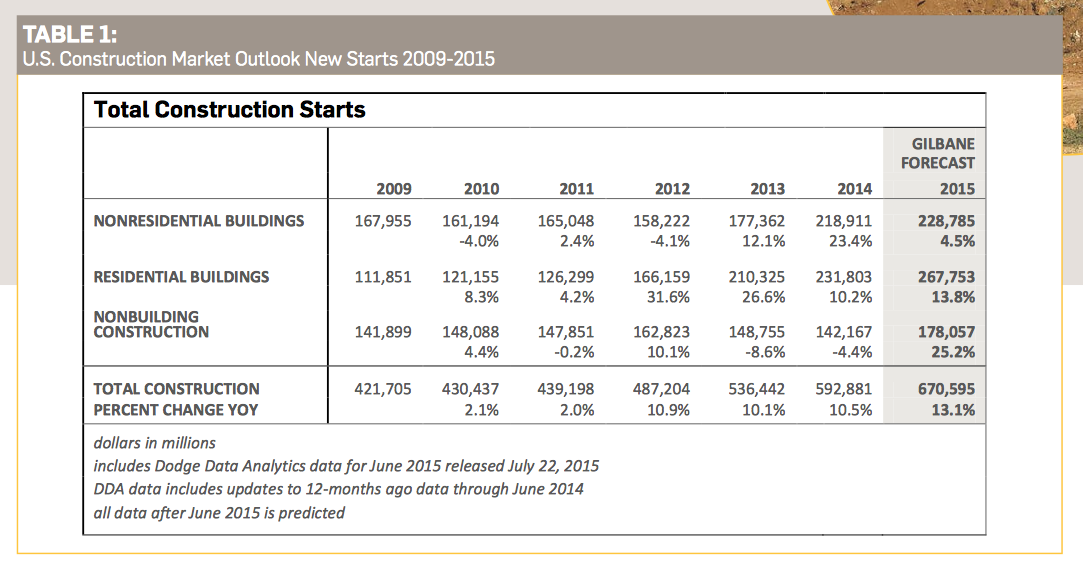

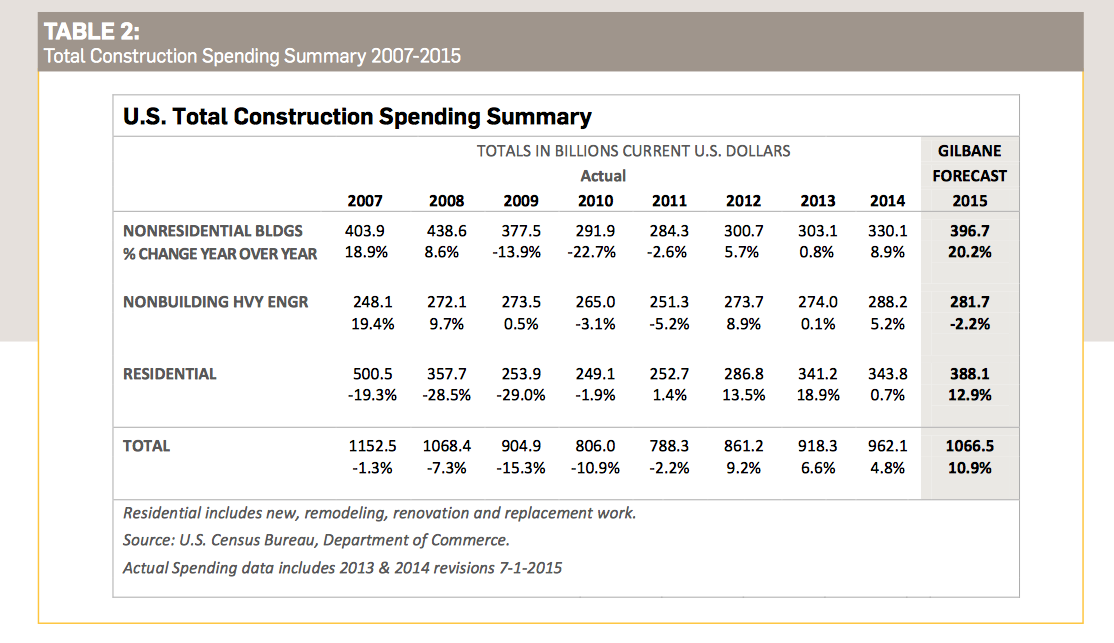

Through the first six months of the year, construction spending for residential, nonresidential building, and nonbuilding structures was increasing at the fastest pace since 2004-2005. On that basis, Gilbane expects total construction spending to expand by 10.9% to $1.067 trillion this year (the second-highest growth total ever recorded), and by more than 8% in 2016. Construction starts are expected to be up by 13.1% to 670,595 units this year.

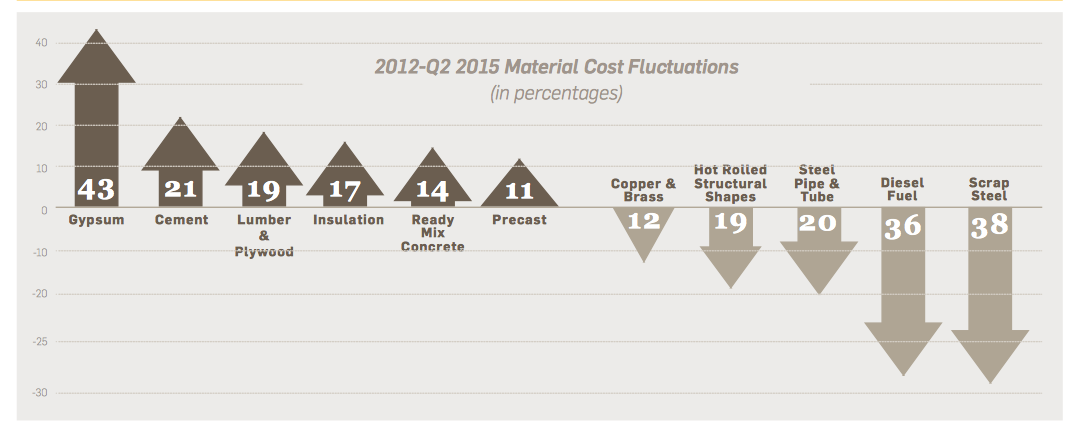

Nonresidential building starts, which hit a 10-year low in 2012, have been increasing at an average of 17% per year. Nonresidential buildings starts since March 2014 posted the best five quarters since the third quarter of 2008. Although growth should continue, expect it to do so at a more moderate rate, says Gilbane, which predicts those starts to increase this year by only 4.5% to 228,785 units. That construction activity, however, has been driving spending, which Gilbane predicts will increase by 20.2% to $396.7 billion this year. “Escalation will climb to levels typical of rapidly growing markets,” Gilbane observes.

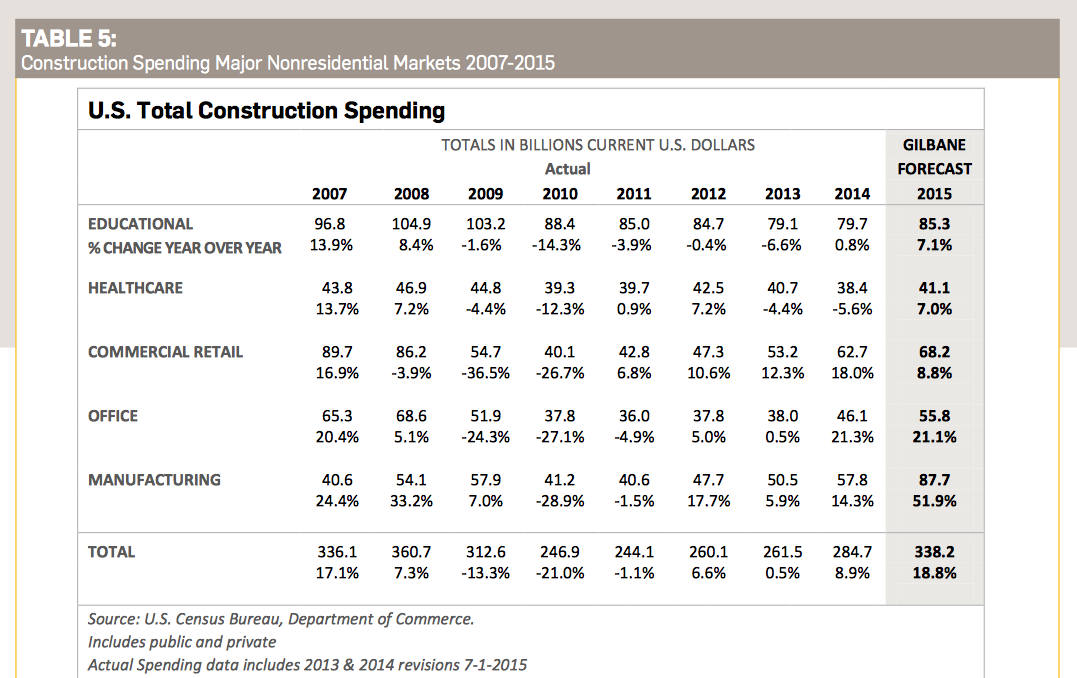

But nonres building’s strengths vary markedly by sector:

- Total spending for manufacturing buildings in 2015 will reach $86.4 billion, up nearly 50% from 2014. No market sector has ever before recorded a 50% year-over-year increase, and manufacturing could replace perennial leader Education as nonres building’s biggest contributing sector. Gilbane foresees spending in this sector cooling off a bit next year to a still-strong 9% increase. Gilbane points out that the manufacturing sector, through the first half of 2015, accounted for 50% of total private construction spending, which is expected to increase this year by 14.5% to $781 billion.

- Spending for educational buildings in 2015 will total $85.3 billion, a 7.1% increase from 2014, the sector’s first substantial increase since 2008. After hitting a low in the fourth quarter of 2013 not seen since 2004, educational spending has rebounded steadily. Gilbane forecasts a 6% gain in 2016.

- Total spending for healthcare construction in 2015 should be up 7% to $41.1 billion. Healthcare spending is slowly recovering after descending to an eight-year low in the fourth quarter 2014. Spending is expected to rise by 6% in 2016.

- Spending for commercial/retail buildings—which was nonres’ strongest growth market in 2012 through 2014—is projected to jump by 8.8% to $68.2 billion this year. Gilbane notes that this sector. Commercial retail is expected to realize a gain of 5.4% in 2016.

- Office building spending in 2015 is on pace to grow by 21.2% to $55.8 billion this year, on top of a 21.3% increase in 2014. Office spending will maintain upward momentum in 2016 but at a slower pace, to 8.4%.

In its report, Gilbane discusses spending for residential construction, which it expects to grow this year by 12.9% to $388 billion, and then to taper off to a 0.7% increase in 2016. “In fact, from the fourth quarter of 2013 through March 2015, new housing starts practically stalled and the rate of residential spending declined,” Gilbane states.

Gilbane is skeptical—to say the least—about other forecasts that project housing starts to reach between 1.3 million and 1.5 million units this year, which would be twice to three times historical growth rates.

The Commerce Department’s estimates for July show housing starts rose by 0.2% to a seasonally adjusted annualized rate of 1.119 million units. Multifamily starts, which over the past few years have fueled housing’s growth, were off 17% to an annualized rate of 413,000 units.

In all construction sectors, the biggest potential constraint to growth continues to be the availability of labor. Gilbane notes that the number of unfilled positions on the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey for the construction industry has been over 100,000 for 26 of the 28 months through June 2015, and has been trending up since 2012.

“As work volume begins to increase over the next few years, expect productivity to decline,” Gilbane cautions.

Related Stories

Multifamily Housing | May 25, 2022

9 noteworthy multifamily developments to debut in 2022

A 1980s-era shopping mall turned mixed-use housing and a mid-rise multifamily tower with unusual rowhomes highlight the innovative multifamily developments to debut recently.

Coronavirus | May 20, 2022

Center for Green Schools says U.S. schools need more support to fight COVID-19

The Center for Green Schools at the U.S. Green Building Council released a new report detailing how school districts around the country have managed air quality within their buildings during the second year of the COVID-19 pandemic.

Regulations | May 20, 2022

Biden’s Clean Air in Buildings Challenge aims to reduce COVID-19 spread

The Biden Administration recently launched the Clean Air in Buildings Challenge that calls on all building owners and operators, schools, colleges and universities, and organizations to adopt strategies to improve indoor air quality in their buildings and reduce the spread of COVID-19.

Building Team | May 20, 2022

Caltech breaks ground on a new center to study climate and sustainability

The California Institute of Technology (Caltech) recently broke ground on its Resnick Sustainability Resource Center.

Laboratories | May 20, 2022

Brutalist former Berkeley Art Museum transformed into modern life science lab

After extensive renovation and an addition, the former Berkeley Art Museum and Pacific Film Archive at the University of California, Berkeley campus reopened in May 2022 as a modern life science lab building.

Sports and Recreational Facilities | May 19, 2022

Northern Arizona University opens a new training center for its student athletes

In Flagstaff, Ariz. Northern Arizona University (NAU) has opened its new Student-Athlete High Performance Center.

Energy-Efficient Design | May 19, 2022

Shipping containers used to build Research Triangle Park’s first community gathering space

Shipping containers were the prominent building material used to construct Boxyard RTP, the first public community and gathering place in North Carolina’s Research Triangle Park (RTP).

Mixed-Use | May 19, 2022

Seattle-area project will turn mall into residential neighborhood

A recently unveiled plan will transform a 463,000 sf mall into a mixed-use destination site in the Seattle suburb of Bellevue, Wash.

Codes and Standards | May 19, 2022

JLL launches non-profit aiming to mitigate climate change

Real estate and investment management firm JLL recently launched JLL Foundation, a non-profit dedicated to making a long-term impact on environmental sustainability.

Office Buildings | May 19, 2022

JLL releases its 2022 Office Fit Out Guide

JLL’s 2022 Office Fit Out Guide report provides benchmark costs to build out a range of office types across major markets in the United States and Canada.