Nonresidential building is on track to achieve a “breakout year” in 2015, during which spending growth could exceed 20%, according to projections by construction giant Gilbane in its Summer 2015 Construction Economics Report, “Building for the Future.”

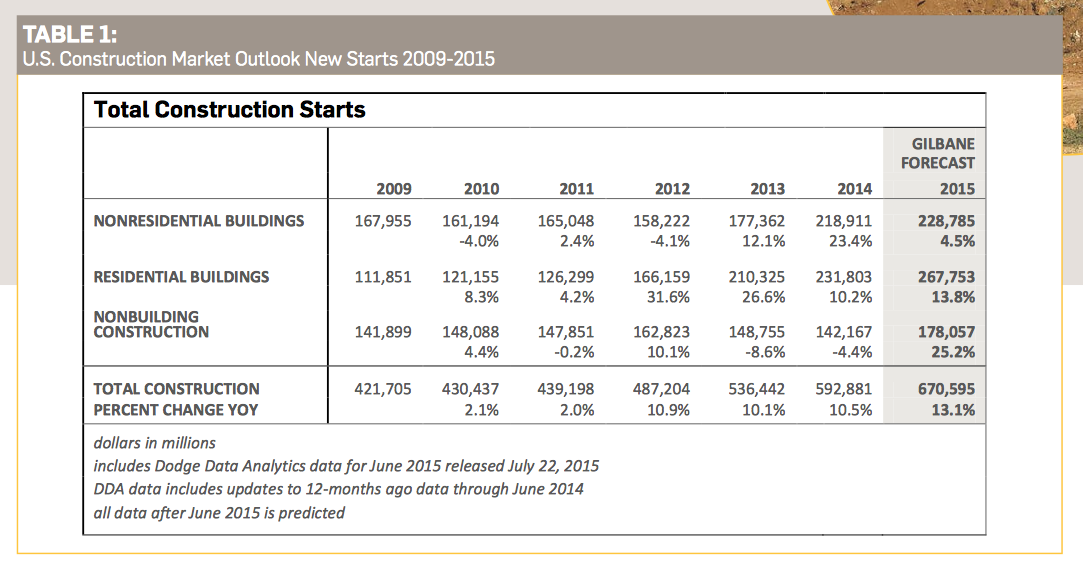

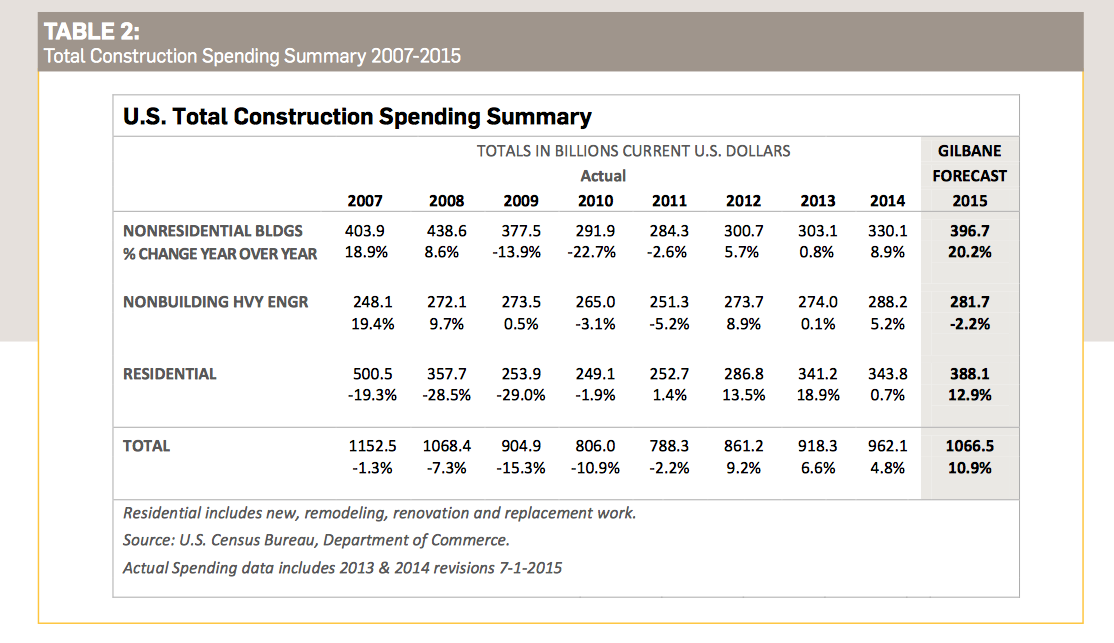

Through the first six months of the year, construction spending for residential, nonresidential building, and nonbuilding structures was increasing at the fastest pace since 2004-2005. On that basis, Gilbane expects total construction spending to expand by 10.9% to $1.067 trillion this year (the second-highest growth total ever recorded), and by more than 8% in 2016. Construction starts are expected to be up by 13.1% to 670,595 units this year.

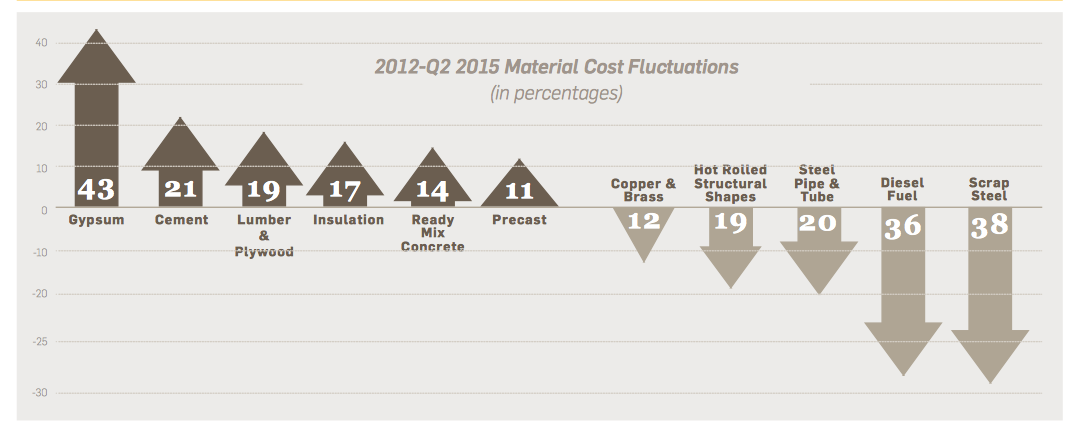

Nonresidential building starts, which hit a 10-year low in 2012, have been increasing at an average of 17% per year. Nonresidential buildings starts since March 2014 posted the best five quarters since the third quarter of 2008. Although growth should continue, expect it to do so at a more moderate rate, says Gilbane, which predicts those starts to increase this year by only 4.5% to 228,785 units. That construction activity, however, has been driving spending, which Gilbane predicts will increase by 20.2% to $396.7 billion this year. “Escalation will climb to levels typical of rapidly growing markets,” Gilbane observes.

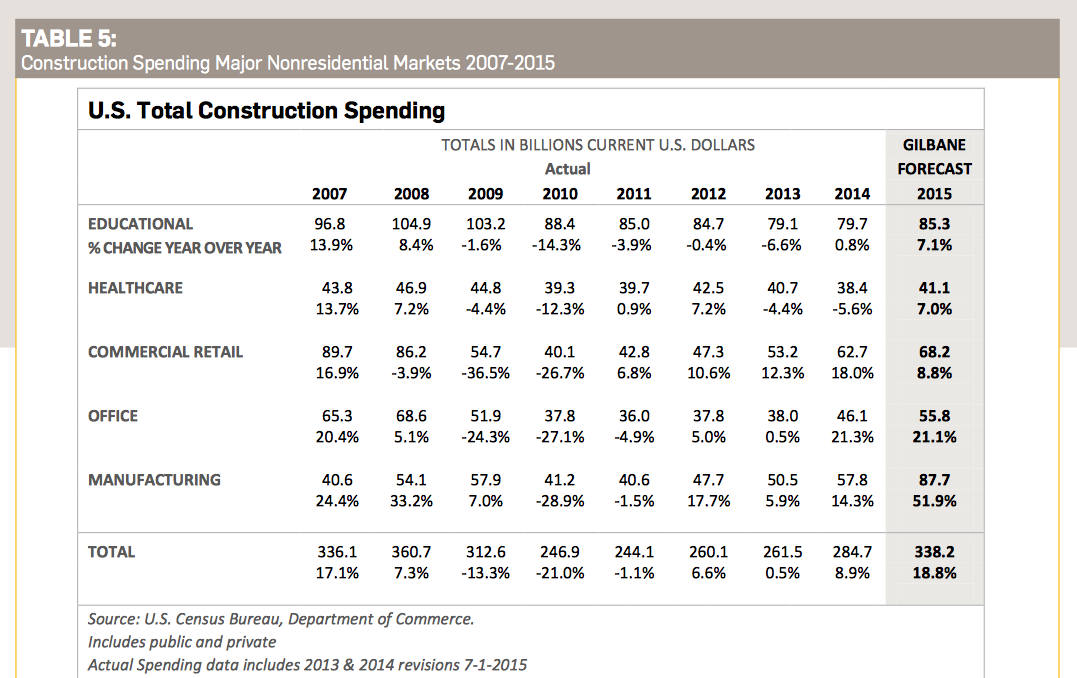

But nonres building’s strengths vary markedly by sector:

- Total spending for manufacturing buildings in 2015 will reach $86.4 billion, up nearly 50% from 2014. No market sector has ever before recorded a 50% year-over-year increase, and manufacturing could replace perennial leader Education as nonres building’s biggest contributing sector. Gilbane foresees spending in this sector cooling off a bit next year to a still-strong 9% increase. Gilbane points out that the manufacturing sector, through the first half of 2015, accounted for 50% of total private construction spending, which is expected to increase this year by 14.5% to $781 billion.

- Spending for educational buildings in 2015 will total $85.3 billion, a 7.1% increase from 2014, the sector’s first substantial increase since 2008. After hitting a low in the fourth quarter of 2013 not seen since 2004, educational spending has rebounded steadily. Gilbane forecasts a 6% gain in 2016.

- Total spending for healthcare construction in 2015 should be up 7% to $41.1 billion. Healthcare spending is slowly recovering after descending to an eight-year low in the fourth quarter 2014. Spending is expected to rise by 6% in 2016.

- Spending for commercial/retail buildings—which was nonres’ strongest growth market in 2012 through 2014—is projected to jump by 8.8% to $68.2 billion this year. Gilbane notes that this sector. Commercial retail is expected to realize a gain of 5.4% in 2016.

- Office building spending in 2015 is on pace to grow by 21.2% to $55.8 billion this year, on top of a 21.3% increase in 2014. Office spending will maintain upward momentum in 2016 but at a slower pace, to 8.4%.

In its report, Gilbane discusses spending for residential construction, which it expects to grow this year by 12.9% to $388 billion, and then to taper off to a 0.7% increase in 2016. “In fact, from the fourth quarter of 2013 through March 2015, new housing starts practically stalled and the rate of residential spending declined,” Gilbane states.

Gilbane is skeptical—to say the least—about other forecasts that project housing starts to reach between 1.3 million and 1.5 million units this year, which would be twice to three times historical growth rates.

The Commerce Department’s estimates for July show housing starts rose by 0.2% to a seasonally adjusted annualized rate of 1.119 million units. Multifamily starts, which over the past few years have fueled housing’s growth, were off 17% to an annualized rate of 413,000 units.

In all construction sectors, the biggest potential constraint to growth continues to be the availability of labor. Gilbane notes that the number of unfilled positions on the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey for the construction industry has been over 100,000 for 26 of the 28 months through June 2015, and has been trending up since 2012.

“As work volume begins to increase over the next few years, expect productivity to decline,” Gilbane cautions.

Related Stories

| Sep 30, 2022

Lab-grown bricks offer potential low-carbon building material

A team of students at the University of Waterloo in Canada have developed a process to grow bricks using bacteria.

| Sep 29, 2022

FitzGerald establishes Denver office

The new location bolsters FitzGerald’s nationwide reach and capitalizes on local expertise and boots-on-the-ground to serve new and existing clients seeking to do business in Denver and the Front Range, as well as the Southwest United States, California, and Texas.

| Sep 28, 2022

New digital platform to foster construction supply chains free of forced labor

Design for Freedom by Grace Farms and the U.S. Coalition on Sustainability formed a partnership to advance shared goals regarding sustainable and ethical building material supply chains that are free of forced labor.

| Sep 27, 2022

New Buildings Institute released the Existing Building Decarbonization Code

New Buildings Institute (NBI) has released the Existing Building Decarbonization Code.

| Sep 23, 2022

High projected demand for new housing prompts debate on best climate-friendly materials

The number of people living in cities could increase to 80% of the total population by 2100. That could require more new construction between now and 2050 than all the construction done since the start of the industrial revolution.

| Sep 23, 2022

Central offices making a comeback after pandemic

In the early stages of the Covid pandemic, commercial real estate industry experts predicted that businesses would increasingly move toward a hub-and-spoke office model.

| Sep 22, 2022

Gainesville, Fla., ordinance requires Home Energy Score during rental inspections

The city of Gainesville, Florida was recently recognized by the U.S. Dept. of Energy for an adopted ordinance that requires rental housing to receive a Home Energy Score during rental inspections.

| Sep 21, 2022

New California law creates incentive for installing outdoor dining safety barriers

A new California law provides an incentive for commercial property owners to install barriers to protect outdoor diners.

| Sep 21, 2022

Demand for design services accelerates

Demand for design services from U.S. architecture firms grew at an accelerated pace in August, according to a new report today from The American Institute of Architects (AIA).

| Sep 20, 2022

NIBS develops implementation plan for digital transformation of built environment

The National Institute of Building Sciences (NIBS) says it has developed an implementation and launch plan for a sweeping digital transformation of the built environment.