Nonresidential building is on track to achieve a “breakout year” in 2015, during which spending growth could exceed 20%, according to projections by construction giant Gilbane in its Summer 2015 Construction Economics Report, “Building for the Future.”

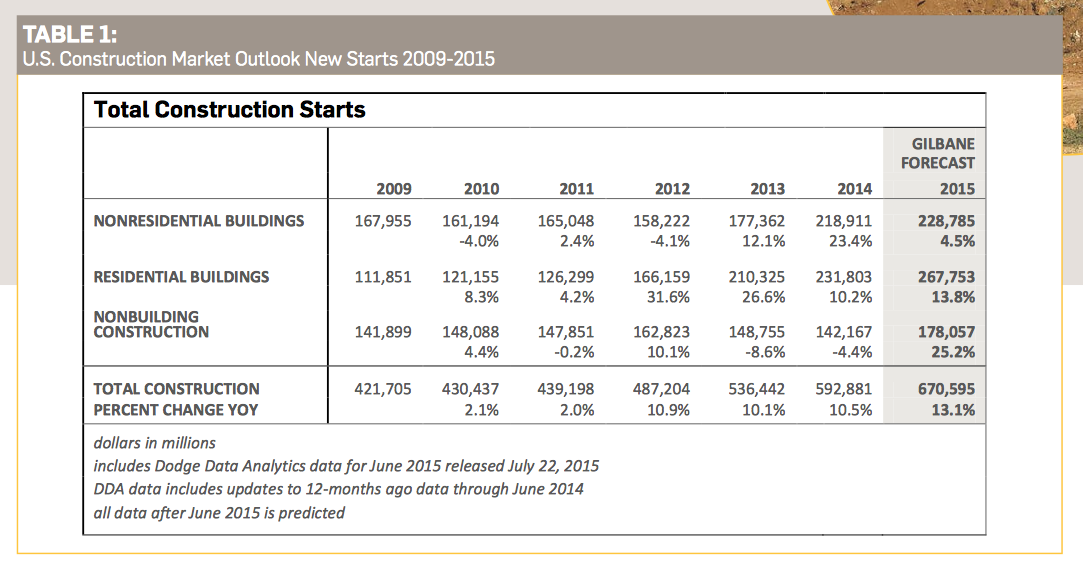

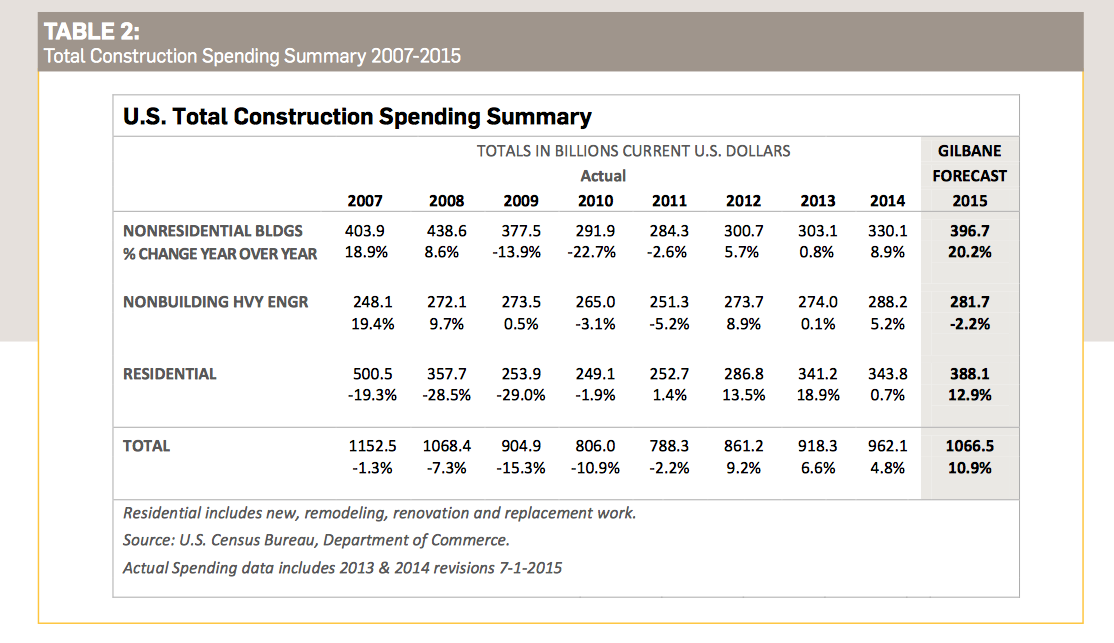

Through the first six months of the year, construction spending for residential, nonresidential building, and nonbuilding structures was increasing at the fastest pace since 2004-2005. On that basis, Gilbane expects total construction spending to expand by 10.9% to $1.067 trillion this year (the second-highest growth total ever recorded), and by more than 8% in 2016. Construction starts are expected to be up by 13.1% to 670,595 units this year.

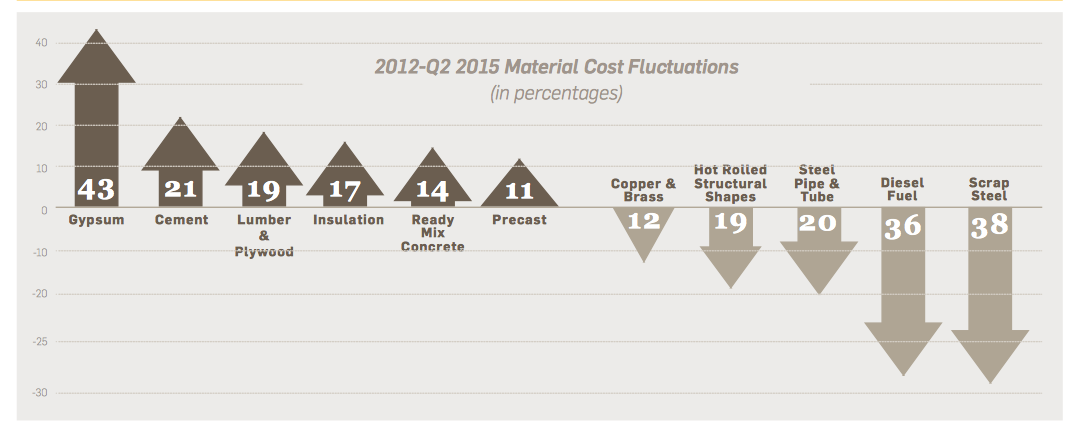

Nonresidential building starts, which hit a 10-year low in 2012, have been increasing at an average of 17% per year. Nonresidential buildings starts since March 2014 posted the best five quarters since the third quarter of 2008. Although growth should continue, expect it to do so at a more moderate rate, says Gilbane, which predicts those starts to increase this year by only 4.5% to 228,785 units. That construction activity, however, has been driving spending, which Gilbane predicts will increase by 20.2% to $396.7 billion this year. “Escalation will climb to levels typical of rapidly growing markets,” Gilbane observes.

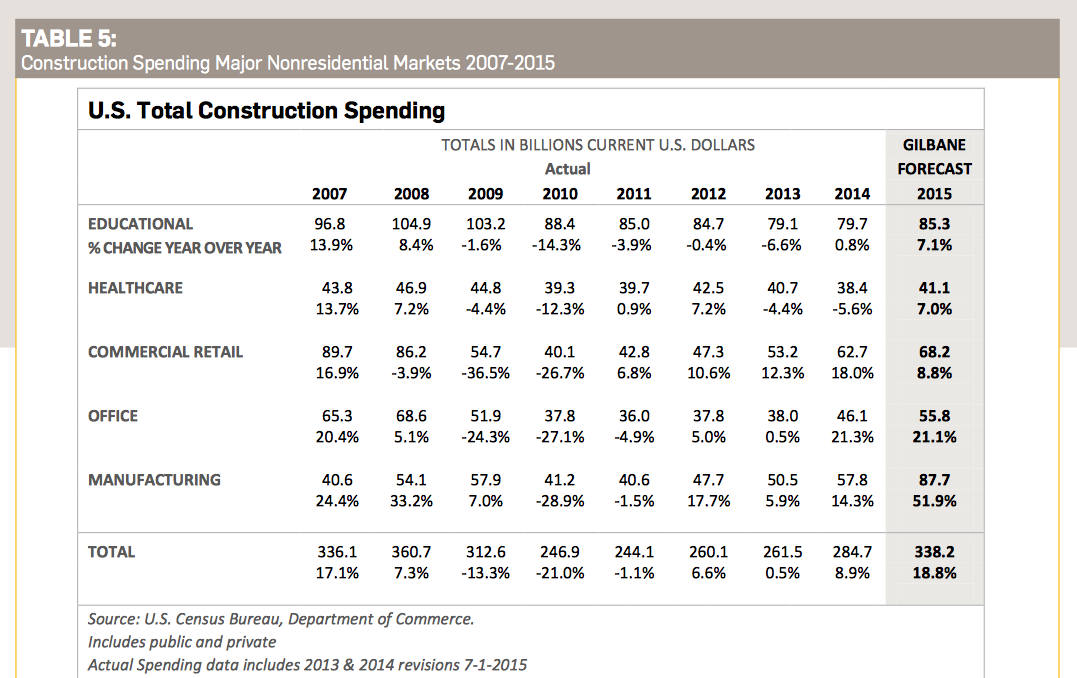

But nonres building’s strengths vary markedly by sector:

- Total spending for manufacturing buildings in 2015 will reach $86.4 billion, up nearly 50% from 2014. No market sector has ever before recorded a 50% year-over-year increase, and manufacturing could replace perennial leader Education as nonres building’s biggest contributing sector. Gilbane foresees spending in this sector cooling off a bit next year to a still-strong 9% increase. Gilbane points out that the manufacturing sector, through the first half of 2015, accounted for 50% of total private construction spending, which is expected to increase this year by 14.5% to $781 billion.

- Spending for educational buildings in 2015 will total $85.3 billion, a 7.1% increase from 2014, the sector’s first substantial increase since 2008. After hitting a low in the fourth quarter of 2013 not seen since 2004, educational spending has rebounded steadily. Gilbane forecasts a 6% gain in 2016.

- Total spending for healthcare construction in 2015 should be up 7% to $41.1 billion. Healthcare spending is slowly recovering after descending to an eight-year low in the fourth quarter 2014. Spending is expected to rise by 6% in 2016.

- Spending for commercial/retail buildings—which was nonres’ strongest growth market in 2012 through 2014—is projected to jump by 8.8% to $68.2 billion this year. Gilbane notes that this sector. Commercial retail is expected to realize a gain of 5.4% in 2016.

- Office building spending in 2015 is on pace to grow by 21.2% to $55.8 billion this year, on top of a 21.3% increase in 2014. Office spending will maintain upward momentum in 2016 but at a slower pace, to 8.4%.

In its report, Gilbane discusses spending for residential construction, which it expects to grow this year by 12.9% to $388 billion, and then to taper off to a 0.7% increase in 2016. “In fact, from the fourth quarter of 2013 through March 2015, new housing starts practically stalled and the rate of residential spending declined,” Gilbane states.

Gilbane is skeptical—to say the least—about other forecasts that project housing starts to reach between 1.3 million and 1.5 million units this year, which would be twice to three times historical growth rates.

The Commerce Department’s estimates for July show housing starts rose by 0.2% to a seasonally adjusted annualized rate of 1.119 million units. Multifamily starts, which over the past few years have fueled housing’s growth, were off 17% to an annualized rate of 413,000 units.

In all construction sectors, the biggest potential constraint to growth continues to be the availability of labor. Gilbane notes that the number of unfilled positions on the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey for the construction industry has been over 100,000 for 26 of the 28 months through June 2015, and has been trending up since 2012.

“As work volume begins to increase over the next few years, expect productivity to decline,” Gilbane cautions.

Related Stories

Contractors | Feb 14, 2023

The average U.S. contractor has nine months worth of construction work in the pipeline

Associated Builders and Contractors reports today that its Construction Backlog Indicator declined 0.2 months to 9.0 in January, according to an ABC member survey conducted Jan. 20 to Feb. 3. The reading is 1.0 month higher than in January 2022.

Contractors | Feb 13, 2023

Webcor names Matt Rossie CEO

Matt Rossie, the President and Chief Operating Officer at San Francisco-based general contractor Webcor, assumed the responsibilities of Chief Executive Officer effective January 1.

Office Buildings | Feb 12, 2023

Smyrna Ready Mix’s new office HQ mimics the patterns in the company’s onsite stone quarry

Designed by EOA Architects to showcase various concrete processes and applications, Smyrna Ready Mix's new office headquarters features vertical layering that mimics the patterns in the company’s stone quarry, located on the opposite end of the campus site. The building’s glass and concrete bands are meant to mirror the quarry’s natural contours and striations.

Multifamily Housing | Feb 10, 2023

Dallas to get a 19-story, 351-unit residential high-rise

In Dallas, work has begun on a new multifamily high-rise called The Oliver. The 19-story, 351-unit apartment building will be located within The Central, a 27-acre mixed-use development near the Knox/Henderson neighborhood north of downtown Dallas.

Sustainability | Feb 9, 2023

New guide for planning, designing, and operating onsite water reuse systems

The Pacific Institute, a global nonpartisan water think tank, has released guidance for developers to plan, design, and operate onsite water reuse systems. The Guide for Developing Onsite Water Systems to Support Regional Water Resilience advances circular, localized approaches to managing water that reduce a site’s water footprint, improve its resilience to water shortage or other disruptions, and provide benefits for local communities and regional water systems.

Office Buildings | Feb 9, 2023

Post-Covid Manhattan office market rebound gaining momentum

Office workers in Manhattan continue to return to their workplaces in sufficient numbers for many of their employers to maintain or expand their footprint in the city, according to a survey of more than 140 major Manhattan office employers conducted in January by The Partnership for New York City.

Giants 400 | Feb 9, 2023

New Giants 400 download: Get the complete at-a-glance 2022 Giants 400 rankings in Excel

See how your architecture, engineering, or construction firm stacks up against the nation's AEC Giants. For more than 45 years, the editors of Building Design+Construction have surveyed the largest AEC firms in the U.S./Canada to create the annual Giants 400 report. This year, a record 519 firms participated in the Giants 400 report. The final report includes 137 rankings across 25 building sectors and specialty categories.

University Buildings | Feb 8, 2023

STEM-focused Kettering University opens Stantec-designed Learning Commons

In Flint, Mich., Kettering University opened its new $63 million Learning Commons, designed by Stantec. The new facility will support collaboration, ideation, and digital technology for the STEM-focused higher learning institution.

Sustainability | Feb 8, 2023

A wind energy system—without the blades—can be placed on commercial building rooftops

Aeromine Technologies’ bladeless system captures and amplifies a building’s airflow like airfoils on a race car.

Codes and Standards | Feb 8, 2023

GSA releases draft of federal low embodied carbon material standards

The General Services Administration recently released a document that outlines standards for low embodied carbon materials and products to be used on federal construction projects.