Nonresidential building is on track to achieve a “breakout year” in 2015, during which spending growth could exceed 20%, according to projections by construction giant Gilbane in its Summer 2015 Construction Economics Report, “Building for the Future.”

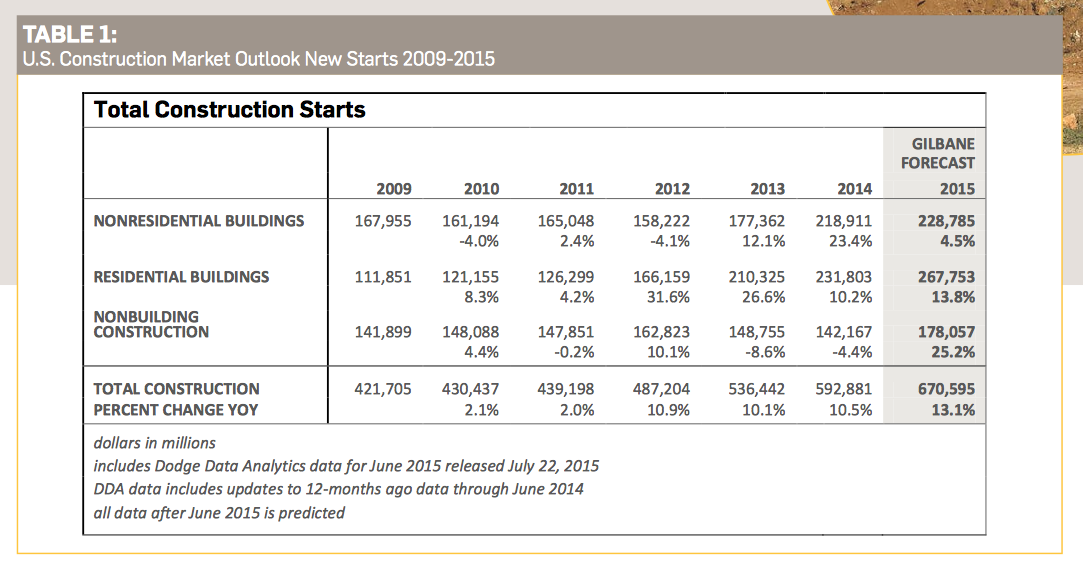

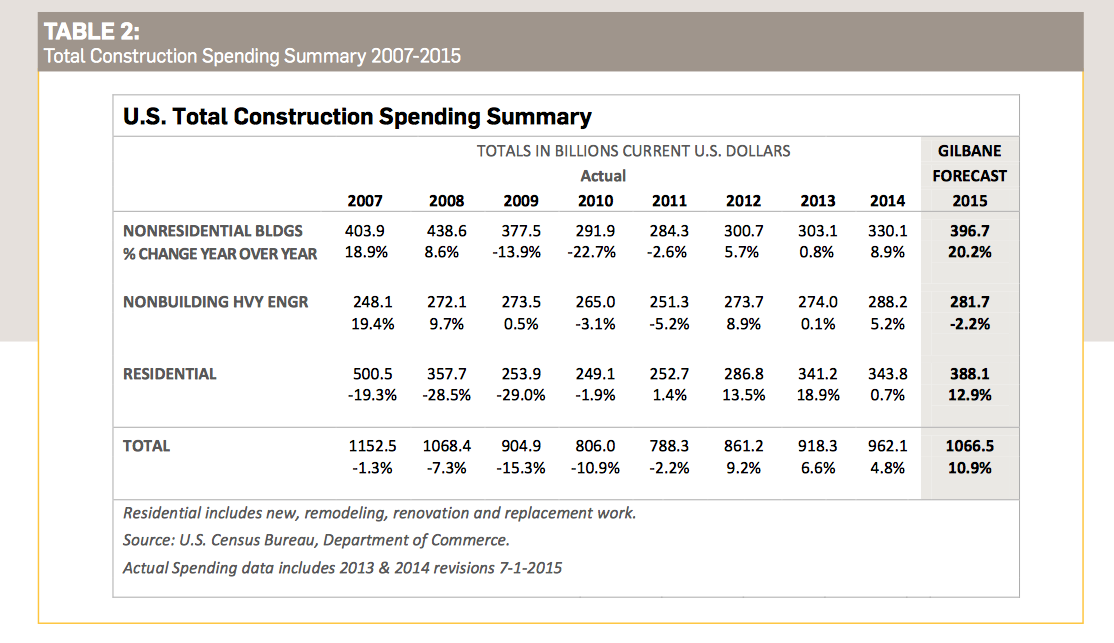

Through the first six months of the year, construction spending for residential, nonresidential building, and nonbuilding structures was increasing at the fastest pace since 2004-2005. On that basis, Gilbane expects total construction spending to expand by 10.9% to $1.067 trillion this year (the second-highest growth total ever recorded), and by more than 8% in 2016. Construction starts are expected to be up by 13.1% to 670,595 units this year.

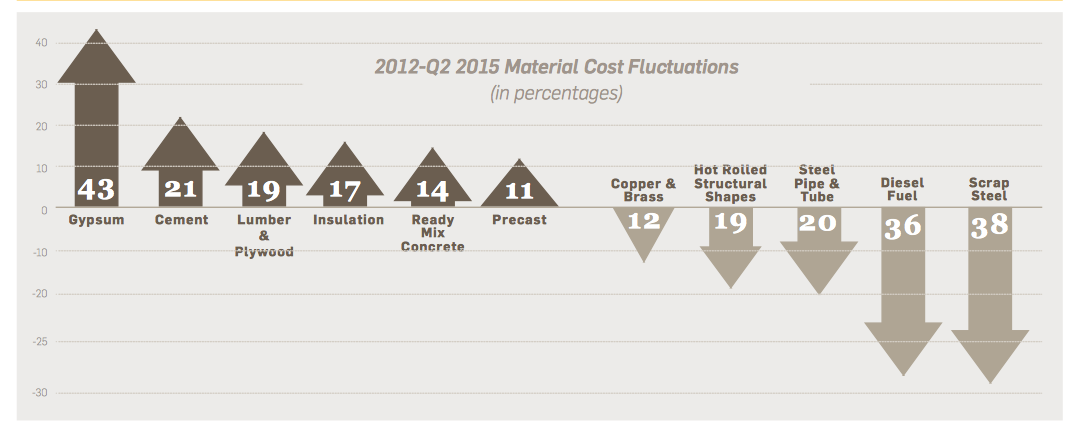

Nonresidential building starts, which hit a 10-year low in 2012, have been increasing at an average of 17% per year. Nonresidential buildings starts since March 2014 posted the best five quarters since the third quarter of 2008. Although growth should continue, expect it to do so at a more moderate rate, says Gilbane, which predicts those starts to increase this year by only 4.5% to 228,785 units. That construction activity, however, has been driving spending, which Gilbane predicts will increase by 20.2% to $396.7 billion this year. “Escalation will climb to levels typical of rapidly growing markets,” Gilbane observes.

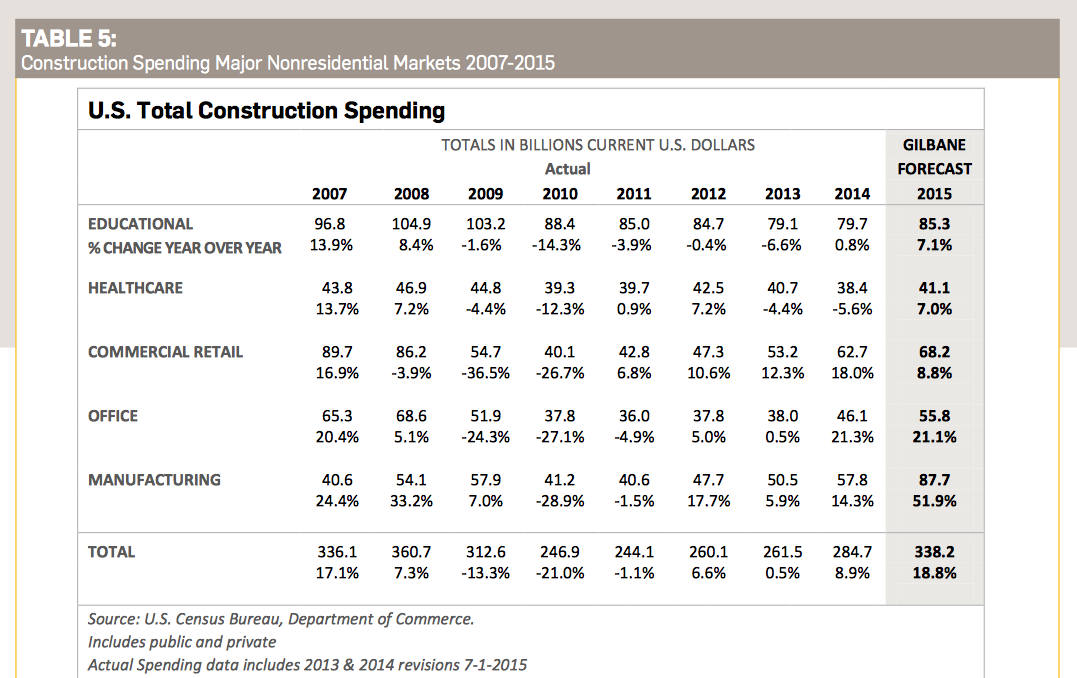

But nonres building’s strengths vary markedly by sector:

- Total spending for manufacturing buildings in 2015 will reach $86.4 billion, up nearly 50% from 2014. No market sector has ever before recorded a 50% year-over-year increase, and manufacturing could replace perennial leader Education as nonres building’s biggest contributing sector. Gilbane foresees spending in this sector cooling off a bit next year to a still-strong 9% increase. Gilbane points out that the manufacturing sector, through the first half of 2015, accounted for 50% of total private construction spending, which is expected to increase this year by 14.5% to $781 billion.

- Spending for educational buildings in 2015 will total $85.3 billion, a 7.1% increase from 2014, the sector’s first substantial increase since 2008. After hitting a low in the fourth quarter of 2013 not seen since 2004, educational spending has rebounded steadily. Gilbane forecasts a 6% gain in 2016.

- Total spending for healthcare construction in 2015 should be up 7% to $41.1 billion. Healthcare spending is slowly recovering after descending to an eight-year low in the fourth quarter 2014. Spending is expected to rise by 6% in 2016.

- Spending for commercial/retail buildings—which was nonres’ strongest growth market in 2012 through 2014—is projected to jump by 8.8% to $68.2 billion this year. Gilbane notes that this sector. Commercial retail is expected to realize a gain of 5.4% in 2016.

- Office building spending in 2015 is on pace to grow by 21.2% to $55.8 billion this year, on top of a 21.3% increase in 2014. Office spending will maintain upward momentum in 2016 but at a slower pace, to 8.4%.

In its report, Gilbane discusses spending for residential construction, which it expects to grow this year by 12.9% to $388 billion, and then to taper off to a 0.7% increase in 2016. “In fact, from the fourth quarter of 2013 through March 2015, new housing starts practically stalled and the rate of residential spending declined,” Gilbane states.

Gilbane is skeptical—to say the least—about other forecasts that project housing starts to reach between 1.3 million and 1.5 million units this year, which would be twice to three times historical growth rates.

The Commerce Department’s estimates for July show housing starts rose by 0.2% to a seasonally adjusted annualized rate of 1.119 million units. Multifamily starts, which over the past few years have fueled housing’s growth, were off 17% to an annualized rate of 413,000 units.

In all construction sectors, the biggest potential constraint to growth continues to be the availability of labor. Gilbane notes that the number of unfilled positions on the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey for the construction industry has been over 100,000 for 26 of the 28 months through June 2015, and has been trending up since 2012.

“As work volume begins to increase over the next few years, expect productivity to decline,” Gilbane cautions.

Related Stories

| Dec 7, 2010

10 megacities of the near future

With Beijing, Shanghai, and Mumbai already on the global radar, where can the next wave of construction be found? Far beyond China, India, and even Brazil it’s predicted. The world’s next future megacities could include Istanbul, Turkey; Ho Chi Minh City, Vietnam; and Khartoum, Sudan, among others. Read about these emerging and little-known behemoths.

| Dec 7, 2010

Product of the Week: Petersen Aluminum’s column covers used in IBM’S new offices

IBM’s new offices at Dulles Station West in Herndon, Va., utilized Petersen’s PAC-1000 F Flush Series column covers. The columns are within the office’s Mobility Area, which is designed for a mobile workforce looking for quick in-and-out work space. The majority of workspaces in the office are unassigned and intended to be used on a temporary basis.

| Dec 6, 2010

Construction unemployment rate jumps to 18.8% between October and November

The construction unemployment rate jumped to 18.8% in November as the sector lost another 5,000 jobs since October, according to an analysis of new federal employment data released today by the Associated General Contractors of America. The data indicates that the construction sector has suffered more than any other industry during the economic downturn, association officials said.

| Dec 6, 2010

Honeywell survey

Rising energy costs and a tough economic climate have forced the nation’s school districts to defer facility maintenance and delay construction projects, but they have also encouraged districts to pursue green initiatives, according to Honeywell’s second annual “School Energy and Environment Survey.”

| Dec 2, 2010

GKV Architects wins best guest room design award for Park Hyatt Istanbul

Gerner Kronick + Valcarcel, Architects, PC won the prestigious Gold Key Award for Excellence in Hospitality Design for best guest room, Park Hyatt Macka Palas, Istanbul, Turkey. Park Hyatt Maçka Palace marries historic and exotic elements with modern and luxurious, creating a unique space perpetuating Istanbul’s current culture. In addition to the façade restoration, GKV Architects designed 85 guestrooms, five penthouse suites, an ultra-hip rooftop bar, and a first-of-its-kind for Istanbul – a steakhouse, for the luxury hotel.

| Dec 2, 2010

U.S Energy Secretary Chu announces $21 Million to improve energy use in commercial buildings

U.S. Energy Secretary Steven Chu announced that 24 projects are receiving a total of $21 million in technical assistance to dramatically reduce the energy used in their commercial buildings. This initiative will connect commercial building owners and operators with multidisciplinary teams including researchers at DOE's National Laboratories and private sector building experts. The teams will design, construct, measure, and test low-energy building plans, and will help accelerate the deployment of cost-effective energy-saving measures in commercial buildings across the United States.

| Nov 29, 2010

Data Centers: Keeping Energy, Security in Check

Power consumption for data centers doubled from 2000 and 2006, and it is anticipated to double again by 2011, making these mission-critical facilities the nation’s largest commercial user of electric power. Major technology companies, notably Hewlett-Packard, Cisco Systems, and International Business Machines, are investing heavily in new data centers. HP, which acquired technology services provider EDS in 2008, announced in June that it would be closing many of its older data centers and would be building new, more highly optimized centers around the world.

| Nov 29, 2010

New Design Concepts for Elementary and Secondary Schools

Hard hit by the economy, new construction in the K-12 sector has slowed considerably over the past year. Yet innovation has continued, along with renovations and expansions. Today, Building Teams are showing a keener focus on sustainable design, as well as ways to improve indoor environmental quality (IEQ), daylighting, and low-maintenance finishes such as flooring.