Nonresidential building is on track to achieve a “breakout year” in 2015, during which spending growth could exceed 20%, according to projections by construction giant Gilbane in its Summer 2015 Construction Economics Report, “Building for the Future.”

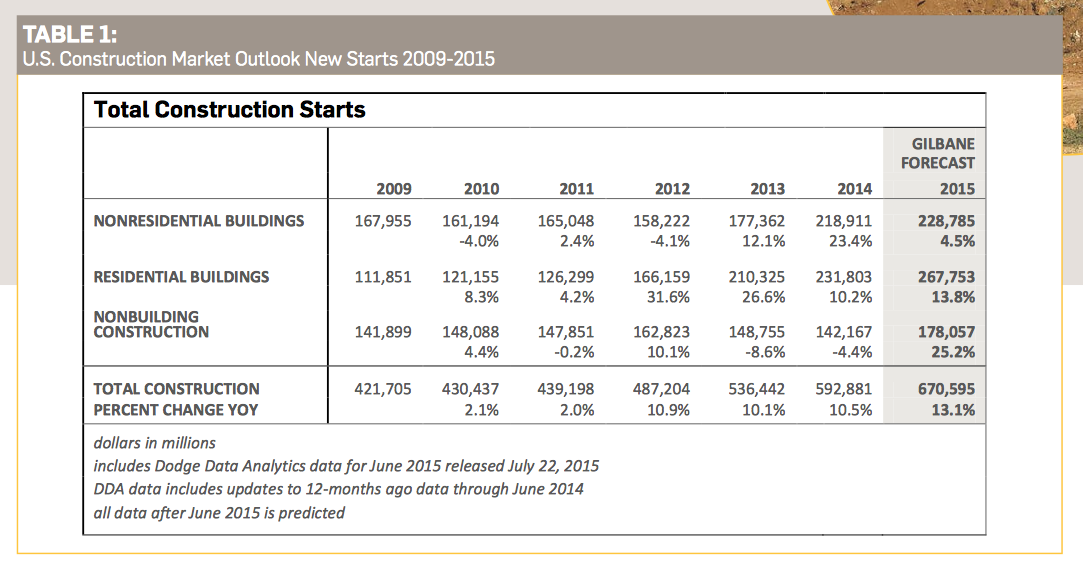

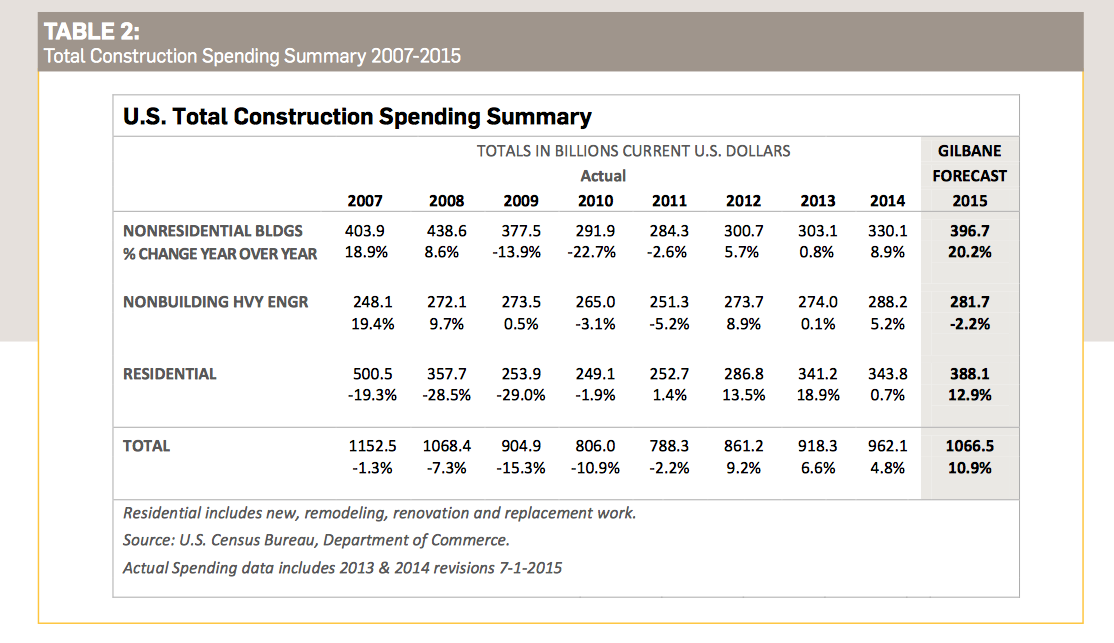

Through the first six months of the year, construction spending for residential, nonresidential building, and nonbuilding structures was increasing at the fastest pace since 2004-2005. On that basis, Gilbane expects total construction spending to expand by 10.9% to $1.067 trillion this year (the second-highest growth total ever recorded), and by more than 8% in 2016. Construction starts are expected to be up by 13.1% to 670,595 units this year.

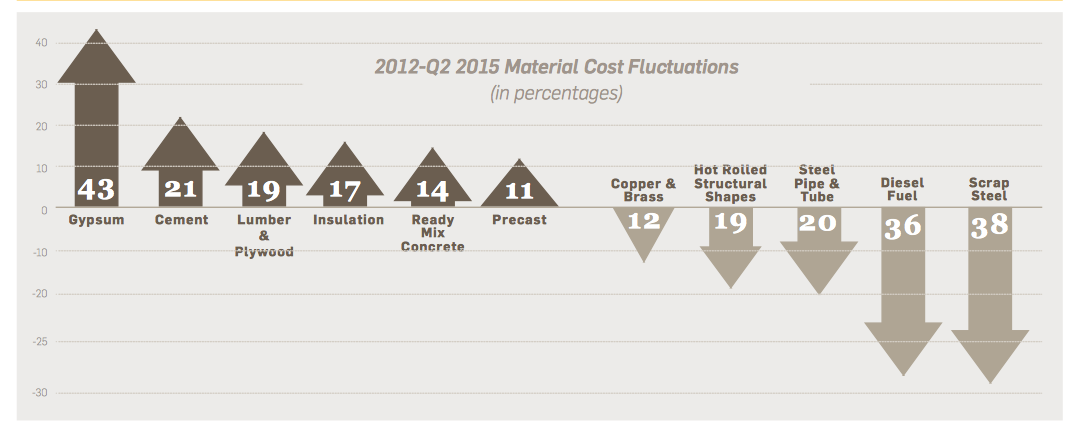

Nonresidential building starts, which hit a 10-year low in 2012, have been increasing at an average of 17% per year. Nonresidential buildings starts since March 2014 posted the best five quarters since the third quarter of 2008. Although growth should continue, expect it to do so at a more moderate rate, says Gilbane, which predicts those starts to increase this year by only 4.5% to 228,785 units. That construction activity, however, has been driving spending, which Gilbane predicts will increase by 20.2% to $396.7 billion this year. “Escalation will climb to levels typical of rapidly growing markets,” Gilbane observes.

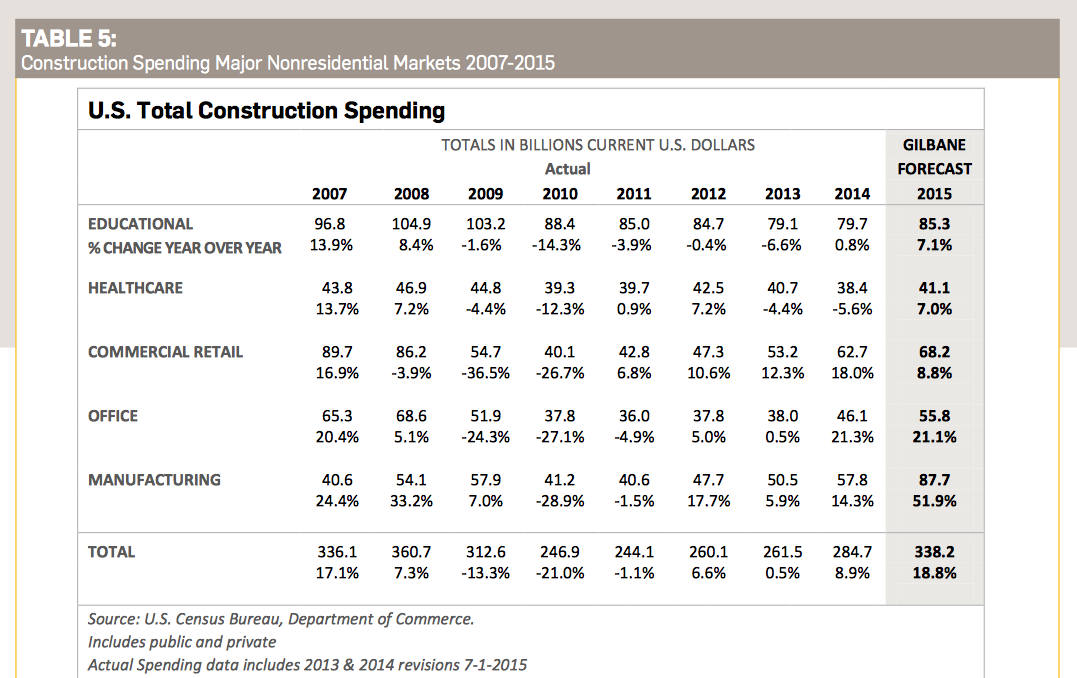

But nonres building’s strengths vary markedly by sector:

- Total spending for manufacturing buildings in 2015 will reach $86.4 billion, up nearly 50% from 2014. No market sector has ever before recorded a 50% year-over-year increase, and manufacturing could replace perennial leader Education as nonres building’s biggest contributing sector. Gilbane foresees spending in this sector cooling off a bit next year to a still-strong 9% increase. Gilbane points out that the manufacturing sector, through the first half of 2015, accounted for 50% of total private construction spending, which is expected to increase this year by 14.5% to $781 billion.

- Spending for educational buildings in 2015 will total $85.3 billion, a 7.1% increase from 2014, the sector’s first substantial increase since 2008. After hitting a low in the fourth quarter of 2013 not seen since 2004, educational spending has rebounded steadily. Gilbane forecasts a 6% gain in 2016.

- Total spending for healthcare construction in 2015 should be up 7% to $41.1 billion. Healthcare spending is slowly recovering after descending to an eight-year low in the fourth quarter 2014. Spending is expected to rise by 6% in 2016.

- Spending for commercial/retail buildings—which was nonres’ strongest growth market in 2012 through 2014—is projected to jump by 8.8% to $68.2 billion this year. Gilbane notes that this sector. Commercial retail is expected to realize a gain of 5.4% in 2016.

- Office building spending in 2015 is on pace to grow by 21.2% to $55.8 billion this year, on top of a 21.3% increase in 2014. Office spending will maintain upward momentum in 2016 but at a slower pace, to 8.4%.

In its report, Gilbane discusses spending for residential construction, which it expects to grow this year by 12.9% to $388 billion, and then to taper off to a 0.7% increase in 2016. “In fact, from the fourth quarter of 2013 through March 2015, new housing starts practically stalled and the rate of residential spending declined,” Gilbane states.

Gilbane is skeptical—to say the least—about other forecasts that project housing starts to reach between 1.3 million and 1.5 million units this year, which would be twice to three times historical growth rates.

The Commerce Department’s estimates for July show housing starts rose by 0.2% to a seasonally adjusted annualized rate of 1.119 million units. Multifamily starts, which over the past few years have fueled housing’s growth, were off 17% to an annualized rate of 413,000 units.

In all construction sectors, the biggest potential constraint to growth continues to be the availability of labor. Gilbane notes that the number of unfilled positions on the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey for the construction industry has been over 100,000 for 26 of the 28 months through June 2015, and has been trending up since 2012.

“As work volume begins to increase over the next few years, expect productivity to decline,” Gilbane cautions.

Related Stories

| May 25, 2011

Developers push Manhattan office construction

Manhattan developers are planning the city's biggest decade of office construction since the 1980s, betting on rising demand for modern space even with tenants unsigned and the availability of financing more limited. More than 25 million sf of projects are under construction or may be built in the next nine years.

| May 25, 2011

Olympic site spurs green building movement in UK

London's environmentally friendly 2012 Olympic venues are fuelling a green building movement in Britain.

| May 19, 2011

BD+C’s "40 Under 40" winners for 2011

The 40 individuals profiled here are some of the brightest stars in the AEC universe—and they’re under the age of 40. These young architects, engineers, contractors, designers, and developers stood out among a group of 164 outstanding entrants in our sixth annual “40 Under 40” competition.

| May 18, 2011

Stone Construction acquires Harden Constructors

The design-build firm Stone Construction LLC has acquired Harden Constructors Inc. The two companies have merged their full-service project design and construction capabilities to assist owners of office, industrial, manufacturing, warehouse, retail, educational and religious facilities, and developers of such facilities in prime office parks.

| May 18, 2011

8 Tips for Designing Wood Trusses

Successful metal-plate-connected wood truss projects require careful attention to detail from Building Team members.

| May 18, 2011

Major Trends in University Residence Halls

They’re not ‘dorms’ anymore. Today’s collegiate housing facilities are lively, state-of-the-art, and green—and a growing sector for Building Teams to explore.

| May 18, 2011

Former Bronx railyard redeveloped as shared education campus

Four schools find strength in numbers at the new 2,310-student Mott Haven Campus in New York City. The schools—three high schools and a K-4 elementary school—coexist on the 6.5-acre South Bronx campus, which was once a railyard.

| May 18, 2011

Eco-friendly San Antonio school combines history and sustainability

The 113,000-sf Rolling Meadows Elementary School in San Antonio is the Judson Independent School District’s first sustainable facility, with green features such as vented roofs for rainwater collection and regionally sourced materials.

| May 18, 2011

New Reform Jewish Independent school opens outside Boston

The Rashi School, one of only 17 Reform Jewish independent schools in North American and Israel, opened a new $30 million facility on a 166-acre campus shared with the Hebrew SeniorLife community on the Charles River in Dedham, Mass.

| May 18, 2011

Lab personnel find comfort in former Winchester gun factory

The former Winchester Repeating Arms Factory in New Haven, Conn., is the new home of PepsiCo’s Biology Innovation Research Laboratory.