Nonresidential building is on track to achieve a “breakout year” in 2015, during which spending growth could exceed 20%, according to projections by construction giant Gilbane in its Summer 2015 Construction Economics Report, “Building for the Future.”

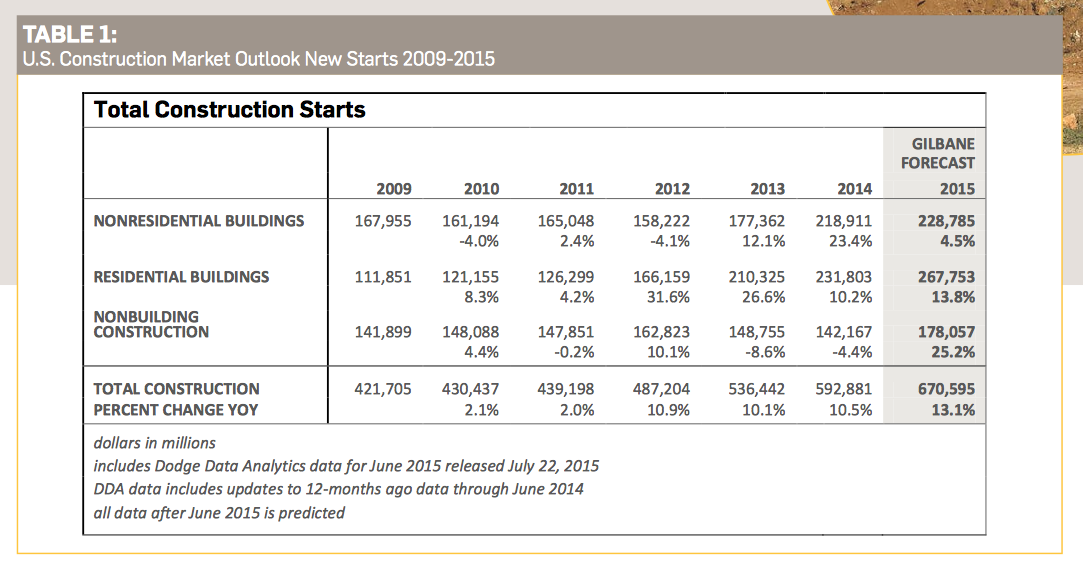

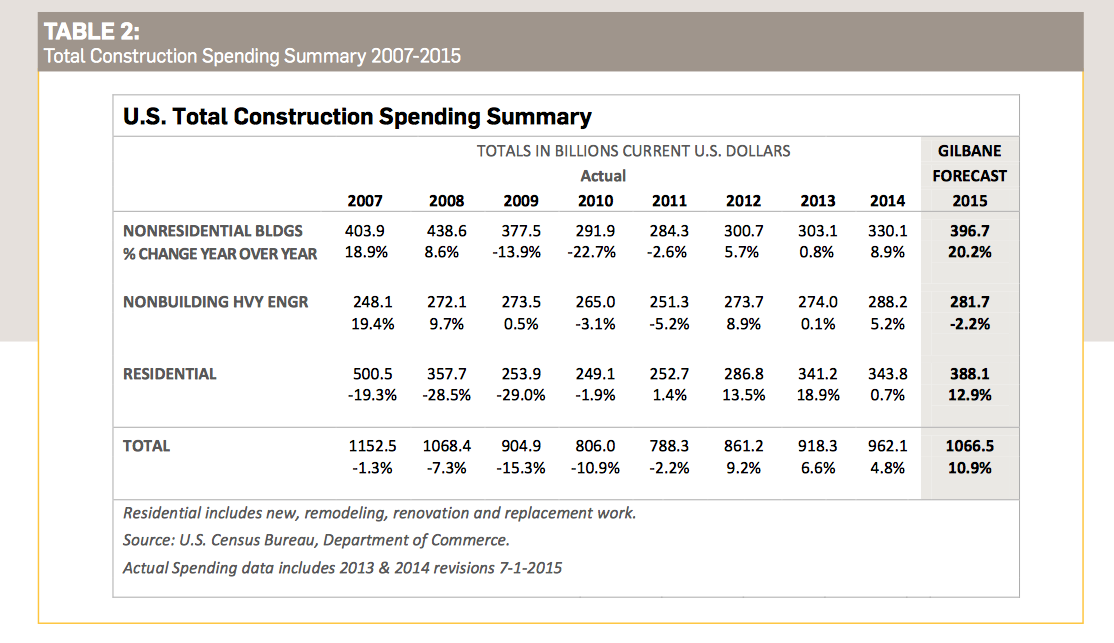

Through the first six months of the year, construction spending for residential, nonresidential building, and nonbuilding structures was increasing at the fastest pace since 2004-2005. On that basis, Gilbane expects total construction spending to expand by 10.9% to $1.067 trillion this year (the second-highest growth total ever recorded), and by more than 8% in 2016. Construction starts are expected to be up by 13.1% to 670,595 units this year.

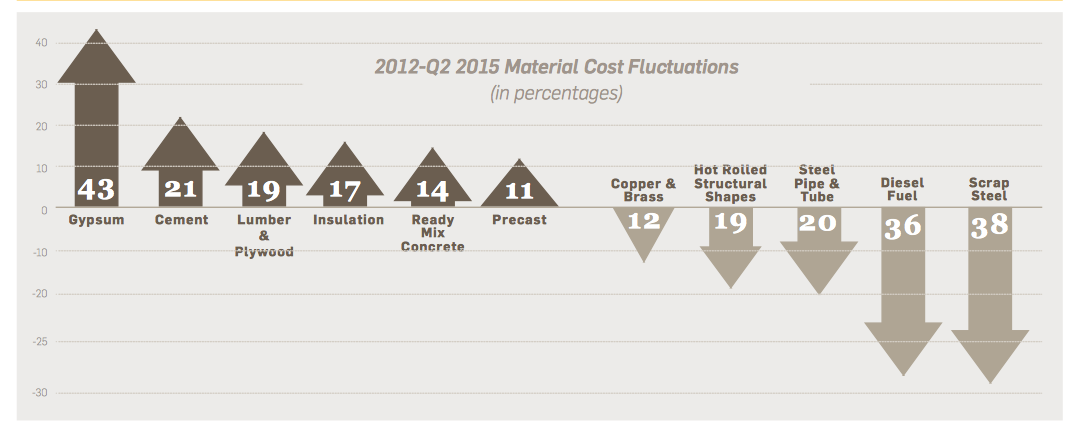

Nonresidential building starts, which hit a 10-year low in 2012, have been increasing at an average of 17% per year. Nonresidential buildings starts since March 2014 posted the best five quarters since the third quarter of 2008. Although growth should continue, expect it to do so at a more moderate rate, says Gilbane, which predicts those starts to increase this year by only 4.5% to 228,785 units. That construction activity, however, has been driving spending, which Gilbane predicts will increase by 20.2% to $396.7 billion this year. “Escalation will climb to levels typical of rapidly growing markets,” Gilbane observes.

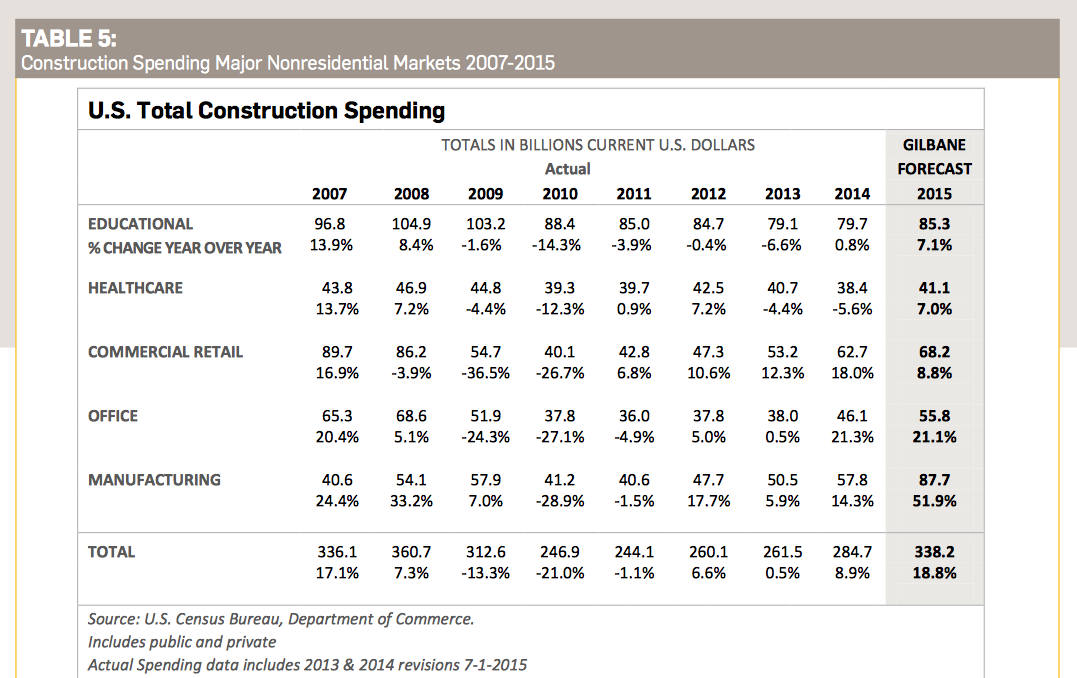

But nonres building’s strengths vary markedly by sector:

- Total spending for manufacturing buildings in 2015 will reach $86.4 billion, up nearly 50% from 2014. No market sector has ever before recorded a 50% year-over-year increase, and manufacturing could replace perennial leader Education as nonres building’s biggest contributing sector. Gilbane foresees spending in this sector cooling off a bit next year to a still-strong 9% increase. Gilbane points out that the manufacturing sector, through the first half of 2015, accounted for 50% of total private construction spending, which is expected to increase this year by 14.5% to $781 billion.

- Spending for educational buildings in 2015 will total $85.3 billion, a 7.1% increase from 2014, the sector’s first substantial increase since 2008. After hitting a low in the fourth quarter of 2013 not seen since 2004, educational spending has rebounded steadily. Gilbane forecasts a 6% gain in 2016.

- Total spending for healthcare construction in 2015 should be up 7% to $41.1 billion. Healthcare spending is slowly recovering after descending to an eight-year low in the fourth quarter 2014. Spending is expected to rise by 6% in 2016.

- Spending for commercial/retail buildings—which was nonres’ strongest growth market in 2012 through 2014—is projected to jump by 8.8% to $68.2 billion this year. Gilbane notes that this sector. Commercial retail is expected to realize a gain of 5.4% in 2016.

- Office building spending in 2015 is on pace to grow by 21.2% to $55.8 billion this year, on top of a 21.3% increase in 2014. Office spending will maintain upward momentum in 2016 but at a slower pace, to 8.4%.

In its report, Gilbane discusses spending for residential construction, which it expects to grow this year by 12.9% to $388 billion, and then to taper off to a 0.7% increase in 2016. “In fact, from the fourth quarter of 2013 through March 2015, new housing starts practically stalled and the rate of residential spending declined,” Gilbane states.

Gilbane is skeptical—to say the least—about other forecasts that project housing starts to reach between 1.3 million and 1.5 million units this year, which would be twice to three times historical growth rates.

The Commerce Department’s estimates for July show housing starts rose by 0.2% to a seasonally adjusted annualized rate of 1.119 million units. Multifamily starts, which over the past few years have fueled housing’s growth, were off 17% to an annualized rate of 413,000 units.

In all construction sectors, the biggest potential constraint to growth continues to be the availability of labor. Gilbane notes that the number of unfilled positions on the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey for the construction industry has been over 100,000 for 26 of the 28 months through June 2015, and has been trending up since 2012.

“As work volume begins to increase over the next few years, expect productivity to decline,” Gilbane cautions.

Related Stories

| Oct 7, 2011

GREENBUILD 2011: Demand response partnership program announced at Greenbuild 2011

Program will use USGBC’s newly revised LEED Demand Response credit as an implementation guideline and leverage its relationships with the building community to foster adoption and participation in existing utility and solution provider demand response offerings.

| Oct 7, 2011

GREENBUILD 2011: Otis Elevator announces new contracts for sustainable building projects

Wins reinforce Otis’ position as leader in energy-efficient products.

| Oct 7, 2011

GREENBUILD 2011: UL Environment releases industry-wide sustainability requirements for doors

ASSA ABLOY Trio-E door is the first to be certified to these sustainability requirements.

| Oct 7, 2011

GREENBUILD 2011: Otis Elevator introduces energy-efficient escalator

The energy-efficient NCE escalator from Otis offers customers substantial “green” benefits.

| Oct 7, 2011

GREENBUILD 2011: Schools program receives grant to track student conservation results

To track results, schools will use the newly developed Sustainability Dashboard, a unique web-based service that makes tracking sustainability initiatives affordable and easy.

| Oct 7, 2011

GREENBUILD 2011: Transparent concrete makes its North American debut at Greenbuild

The panels allow interior lights to filter through, from inside.

| Oct 6, 2011

GREENBUILD 2011: Growing green building market supports 661,000 green jobs in the U.S.

Green jobs are already an important part of the construction labor workforce, and signs are that they will become industry standard.

| Oct 6, 2011

GREENBUILD 2011: NEXT Living EcoSuite showcased

Tridel teams up with Cisco and Control4 to unveil the future of green condo living in Canada.

| Oct 6, 2011

GREENBUILD 2011: Kingspan Insulated Panels spotlights first-of-its-kind Environmental Product Declaration

Updates to Path to NetZero.

| Oct 5, 2011

GREENBUILD 2011: Johnson Controls announces Panoptix, a new approach to building efficiency

Panoptix combines latest technology, new business model and industry-leading expertise to make building efficiency easier and more accessible to a broader market.