Nonresidential building is on track to achieve a “breakout year” in 2015, during which spending growth could exceed 20%, according to projections by construction giant Gilbane in its Summer 2015 Construction Economics Report, “Building for the Future.”

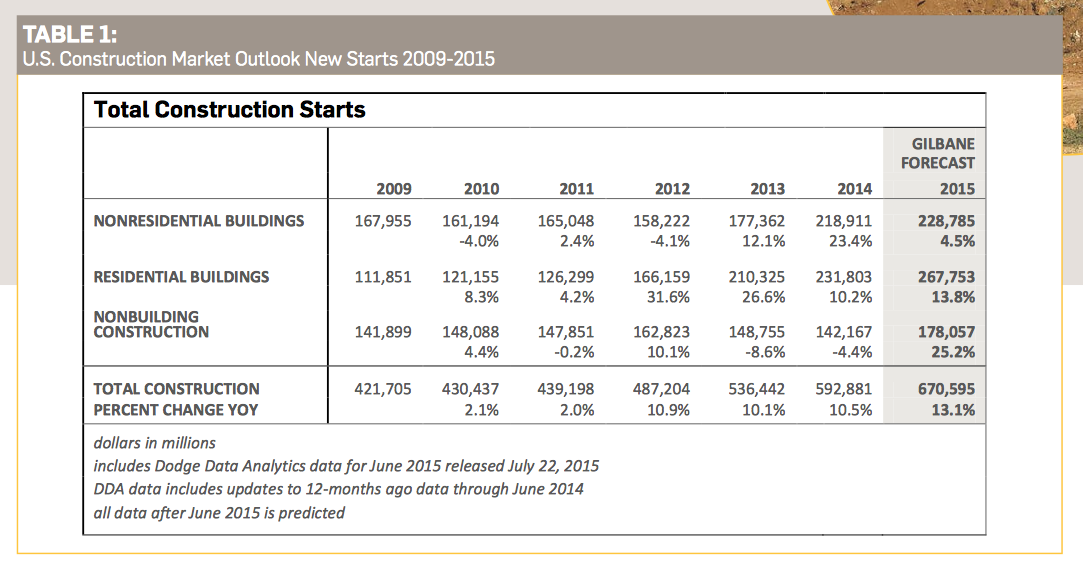

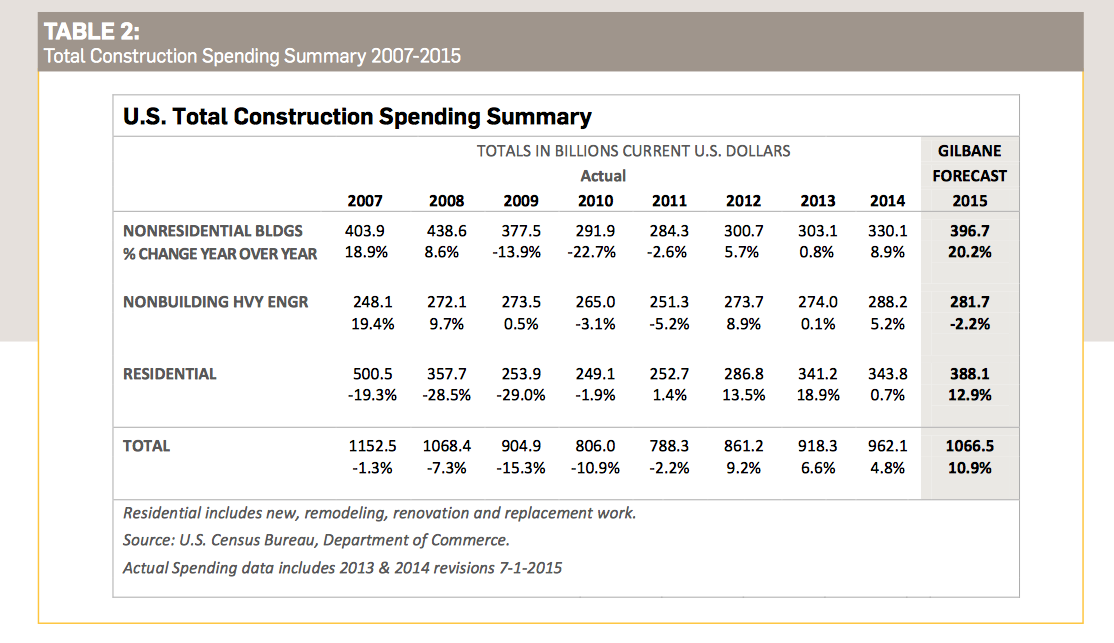

Through the first six months of the year, construction spending for residential, nonresidential building, and nonbuilding structures was increasing at the fastest pace since 2004-2005. On that basis, Gilbane expects total construction spending to expand by 10.9% to $1.067 trillion this year (the second-highest growth total ever recorded), and by more than 8% in 2016. Construction starts are expected to be up by 13.1% to 670,595 units this year.

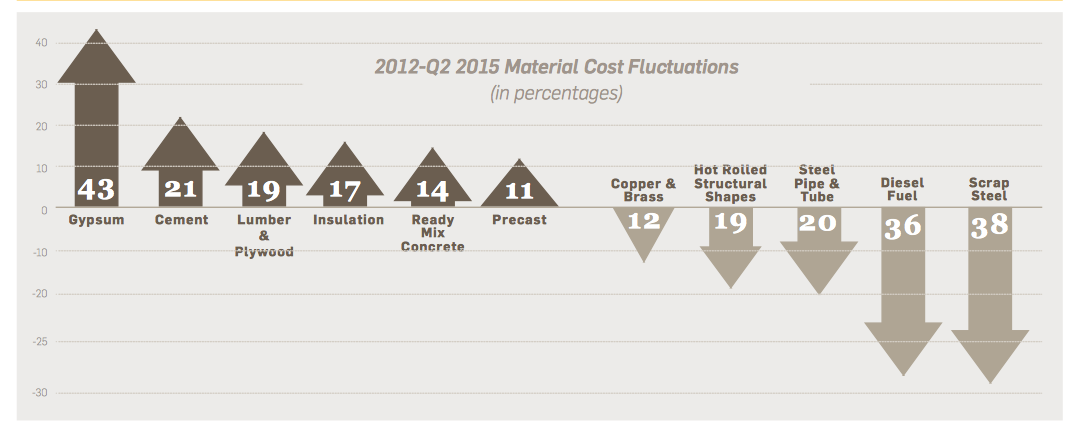

Nonresidential building starts, which hit a 10-year low in 2012, have been increasing at an average of 17% per year. Nonresidential buildings starts since March 2014 posted the best five quarters since the third quarter of 2008. Although growth should continue, expect it to do so at a more moderate rate, says Gilbane, which predicts those starts to increase this year by only 4.5% to 228,785 units. That construction activity, however, has been driving spending, which Gilbane predicts will increase by 20.2% to $396.7 billion this year. “Escalation will climb to levels typical of rapidly growing markets,” Gilbane observes.

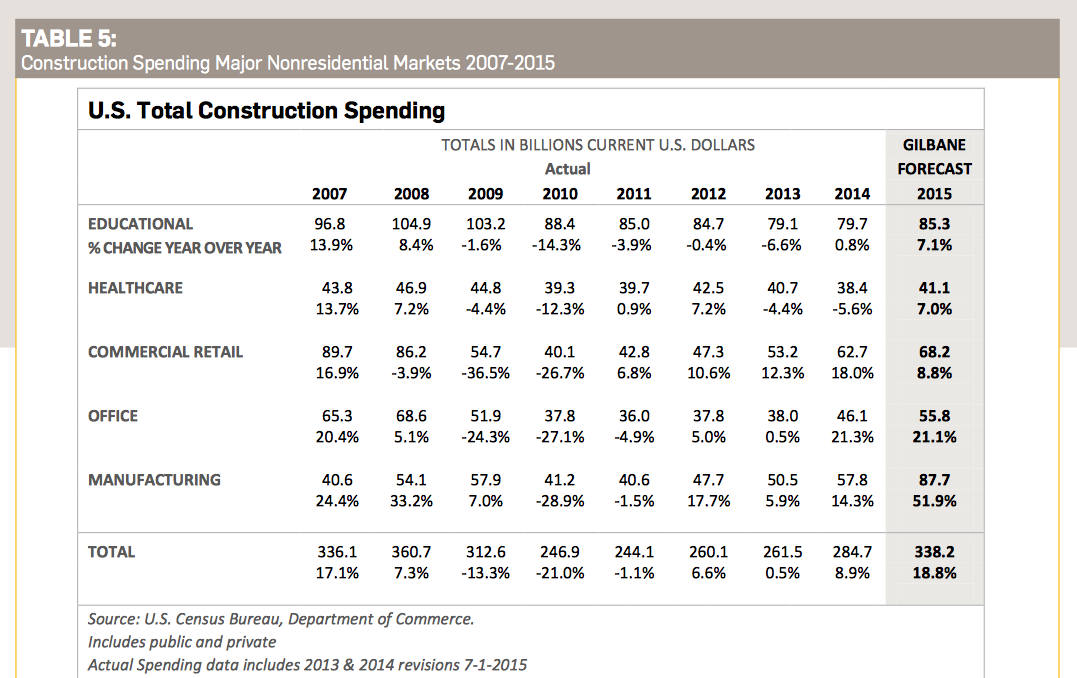

But nonres building’s strengths vary markedly by sector:

- Total spending for manufacturing buildings in 2015 will reach $86.4 billion, up nearly 50% from 2014. No market sector has ever before recorded a 50% year-over-year increase, and manufacturing could replace perennial leader Education as nonres building’s biggest contributing sector. Gilbane foresees spending in this sector cooling off a bit next year to a still-strong 9% increase. Gilbane points out that the manufacturing sector, through the first half of 2015, accounted for 50% of total private construction spending, which is expected to increase this year by 14.5% to $781 billion.

- Spending for educational buildings in 2015 will total $85.3 billion, a 7.1% increase from 2014, the sector’s first substantial increase since 2008. After hitting a low in the fourth quarter of 2013 not seen since 2004, educational spending has rebounded steadily. Gilbane forecasts a 6% gain in 2016.

- Total spending for healthcare construction in 2015 should be up 7% to $41.1 billion. Healthcare spending is slowly recovering after descending to an eight-year low in the fourth quarter 2014. Spending is expected to rise by 6% in 2016.

- Spending for commercial/retail buildings—which was nonres’ strongest growth market in 2012 through 2014—is projected to jump by 8.8% to $68.2 billion this year. Gilbane notes that this sector. Commercial retail is expected to realize a gain of 5.4% in 2016.

- Office building spending in 2015 is on pace to grow by 21.2% to $55.8 billion this year, on top of a 21.3% increase in 2014. Office spending will maintain upward momentum in 2016 but at a slower pace, to 8.4%.

In its report, Gilbane discusses spending for residential construction, which it expects to grow this year by 12.9% to $388 billion, and then to taper off to a 0.7% increase in 2016. “In fact, from the fourth quarter of 2013 through March 2015, new housing starts practically stalled and the rate of residential spending declined,” Gilbane states.

Gilbane is skeptical—to say the least—about other forecasts that project housing starts to reach between 1.3 million and 1.5 million units this year, which would be twice to three times historical growth rates.

The Commerce Department’s estimates for July show housing starts rose by 0.2% to a seasonally adjusted annualized rate of 1.119 million units. Multifamily starts, which over the past few years have fueled housing’s growth, were off 17% to an annualized rate of 413,000 units.

In all construction sectors, the biggest potential constraint to growth continues to be the availability of labor. Gilbane notes that the number of unfilled positions on the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey for the construction industry has been over 100,000 for 26 of the 28 months through June 2015, and has been trending up since 2012.

“As work volume begins to increase over the next few years, expect productivity to decline,” Gilbane cautions.

Related Stories

Green | Aug 7, 2023

Rooftop photovoltaic panels credited with propelling solar energy output to record high

Solar provided a record-high 7.3% of U.S. electrical generation in May, “driven in large part by growth in ‘estimated’ small-scale (e.g., rooftop) solar PV whose output increased by 25.6% and accounted for nearly a third (31.9%) of total solar production,” according to a report by the U.S. Energy Information Administration.

Government Buildings | Aug 7, 2023

Nearly $1 billion earmarked for energy efficiency upgrades to federal buildings

The U.S. General Services Administration (GSA) recently announced plans to use $975 million in Inflation Reduction Act funding for energy efficiency and clean energy upgrades to federal buildings across the country. The investment will impact about 40 million sf, or about 20% of GSA’s federal buildings portfolio.

Government Buildings | Aug 2, 2023

A historic courthouse in Charlotte is updated and expanded by Robert A.M. Stern Architects

Robert A.M. Stern Architects’ design retains the original building’s look and presence.

Hotel Facilities | Aug 2, 2023

Top 5 markets for hotel construction

According to the United States Construction Pipeline Trend Report by Lodging Econometrics (LE) for Q2 2023, the five markets with the largest hotel construction pipelines are Dallas with a record-high 184 projects/21,501 rooms, Atlanta with 141 projects/17,993 rooms, Phoenix with 119 projects/16,107 rooms, Nashville with 116 projects/15,346 rooms, and Los Angeles with 112 projects/17,797 rooms.

Market Data | Aug 1, 2023

Nonresidential construction spending increases slightly in June

National nonresidential construction spending increased 0.1% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. Spending is up 18% over the past 12 months. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.07 trillion in June.

Healthcare Facilities | Aug 1, 2023

Top 10 healthcare design projects for 2023

The HKS-designed Allegheny Health Network Wexford (Pa.) Hospital and Flad Architects' Sarasota Memorial Hospital - Venice (Fla.) highlight 10 projects to win 2023 Healthcare Design Awards from the American Institute of Architects Academy of Architecture for Health.

Digital Twin | Jul 31, 2023

Creating the foundation for a Digital Twin

Aligning the BIM model with the owner’s asset management system is the crucial first step in creating a Digital Twin. By following these guidelines, organizations can harness the power of Digital Twins to optimize facility management, maintenance planning, and decision-making throughout the building’s lifecycle.

K-12 Schools | Jul 31, 2023

Austin’s new Rosedale School serves students with special needs aged 3 to 22

In Austin, the Rosedale School has opened for students with special needs aged 3 to 22. The new facility features sensory rooms, fully accessible playgrounds and gardens, community meeting spaces, and an on-site clinic. The school serves 100 learners with special needs from across Austin Independent School District (ISD).

MFPRO+ New Projects | Jul 27, 2023

OMA, Beyer Blinder Belle design a pair of sculptural residential towers in Brooklyn

Eagle + West, composed of two sculptural residential towers with complementary shapes, have added 745 rental units to a post-industrial waterfront in Brooklyn, N.Y. Rising from a mixed-use podium on an expansive site, the towers include luxury penthouses on the top floors, numerous market rate rental units, and 30% of units designated for affordable housing.

Affordable Housing | Jul 27, 2023

Houston to soon have 50 new residential units for youth leaving foster care

Houston will soon have 50 new residential units for youth leaving the foster care system and entering adulthood. The Houston Alumni and Youth (HAY) Center has broken ground on its 59,000-sf campus, with completion expected by July 2024. The HAY Center is a nonprofit program of Harris County Resources for Children and Adults and for foster youth ages 14-25 transitioning to adulthood in the Houston community.