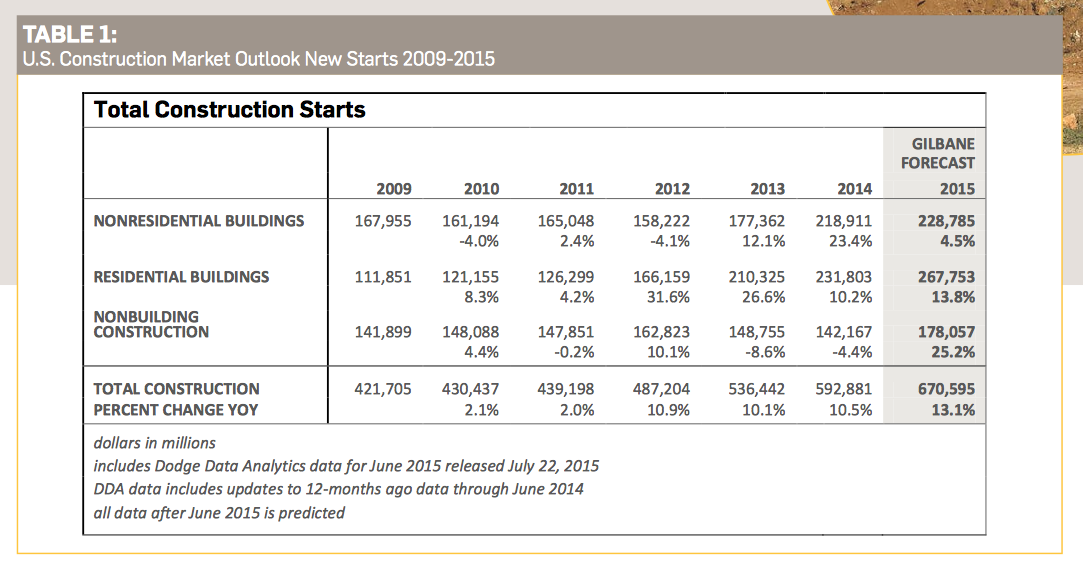

Nonresidential building is on track to achieve a “breakout year” in 2015, during which spending growth could exceed 20%, according to projections by construction giant Gilbane in its Summer 2015 Construction Economics Report, “Building for the Future.”

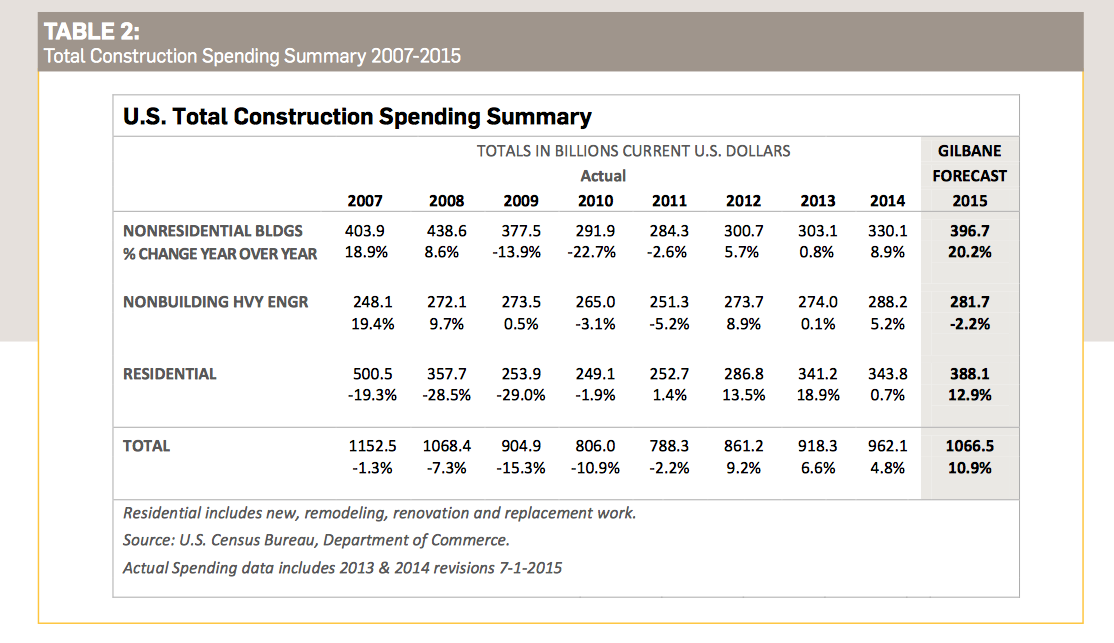

Through the first six months of the year, construction spending for residential, nonresidential building, and nonbuilding structures was increasing at the fastest pace since 2004-2005. On that basis, Gilbane expects total construction spending to expand by 10.9% to $1.067 trillion this year (the second-highest growth total ever recorded), and by more than 8% in 2016. Construction starts are expected to be up by 13.1% to 670,595 units this year.

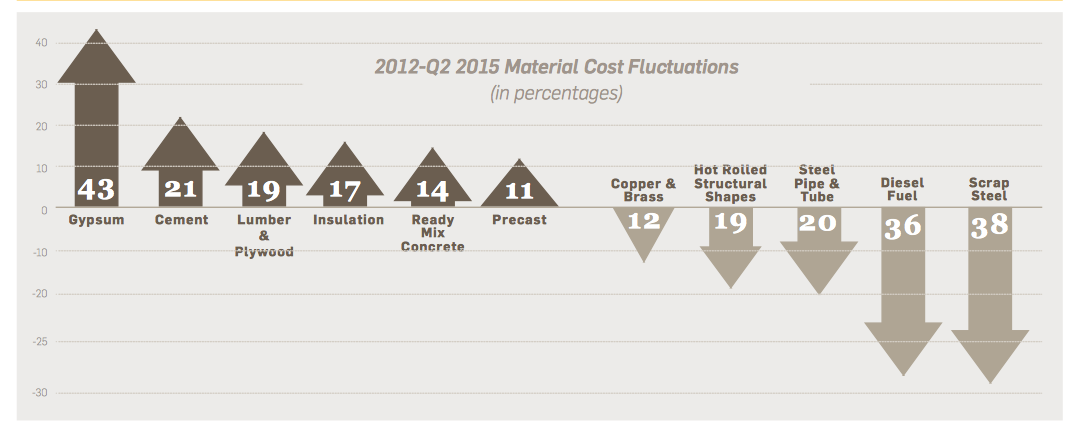

Nonresidential building starts, which hit a 10-year low in 2012, have been increasing at an average of 17% per year. Nonresidential buildings starts since March 2014 posted the best five quarters since the third quarter of 2008. Although growth should continue, expect it to do so at a more moderate rate, says Gilbane, which predicts those starts to increase this year by only 4.5% to 228,785 units. That construction activity, however, has been driving spending, which Gilbane predicts will increase by 20.2% to $396.7 billion this year. “Escalation will climb to levels typical of rapidly growing markets,” Gilbane observes.

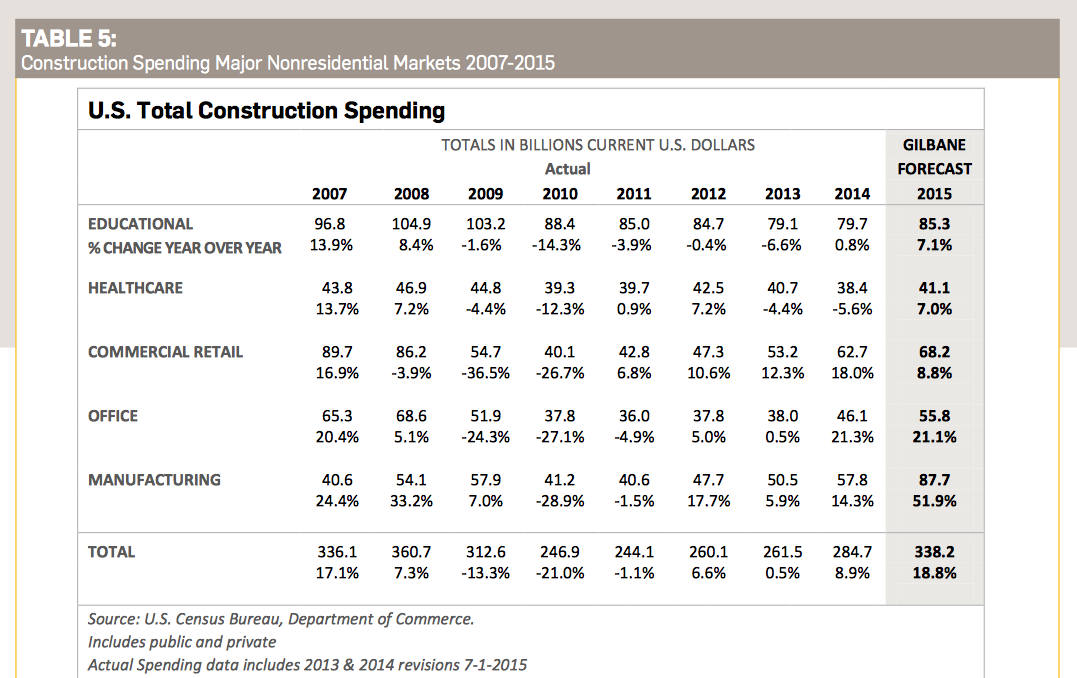

But nonres building’s strengths vary markedly by sector:

- Total spending for manufacturing buildings in 2015 will reach $86.4 billion, up nearly 50% from 2014. No market sector has ever before recorded a 50% year-over-year increase, and manufacturing could replace perennial leader Education as nonres building’s biggest contributing sector. Gilbane foresees spending in this sector cooling off a bit next year to a still-strong 9% increase. Gilbane points out that the manufacturing sector, through the first half of 2015, accounted for 50% of total private construction spending, which is expected to increase this year by 14.5% to $781 billion.

- Spending for educational buildings in 2015 will total $85.3 billion, a 7.1% increase from 2014, the sector’s first substantial increase since 2008. After hitting a low in the fourth quarter of 2013 not seen since 2004, educational spending has rebounded steadily. Gilbane forecasts a 6% gain in 2016.

- Total spending for healthcare construction in 2015 should be up 7% to $41.1 billion. Healthcare spending is slowly recovering after descending to an eight-year low in the fourth quarter 2014. Spending is expected to rise by 6% in 2016.

- Spending for commercial/retail buildings—which was nonres’ strongest growth market in 2012 through 2014—is projected to jump by 8.8% to $68.2 billion this year. Gilbane notes that this sector. Commercial retail is expected to realize a gain of 5.4% in 2016.

- Office building spending in 2015 is on pace to grow by 21.2% to $55.8 billion this year, on top of a 21.3% increase in 2014. Office spending will maintain upward momentum in 2016 but at a slower pace, to 8.4%.

In its report, Gilbane discusses spending for residential construction, which it expects to grow this year by 12.9% to $388 billion, and then to taper off to a 0.7% increase in 2016. “In fact, from the fourth quarter of 2013 through March 2015, new housing starts practically stalled and the rate of residential spending declined,” Gilbane states.

Gilbane is skeptical—to say the least—about other forecasts that project housing starts to reach between 1.3 million and 1.5 million units this year, which would be twice to three times historical growth rates.

The Commerce Department’s estimates for July show housing starts rose by 0.2% to a seasonally adjusted annualized rate of 1.119 million units. Multifamily starts, which over the past few years have fueled housing’s growth, were off 17% to an annualized rate of 413,000 units.

In all construction sectors, the biggest potential constraint to growth continues to be the availability of labor. Gilbane notes that the number of unfilled positions on the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey for the construction industry has been over 100,000 for 26 of the 28 months through June 2015, and has been trending up since 2012.

“As work volume begins to increase over the next few years, expect productivity to decline,” Gilbane cautions.

Related Stories

| Jan 12, 2014

The ‘fuzz factor’ in engineering: when continuous improvement is neither

The biggest threat to human life in a building isn’t the potential of natural disasters, but the threat of human error. I believe it’s a reality that increases in probability every time a code or standard change is proposed.

| Jan 12, 2014

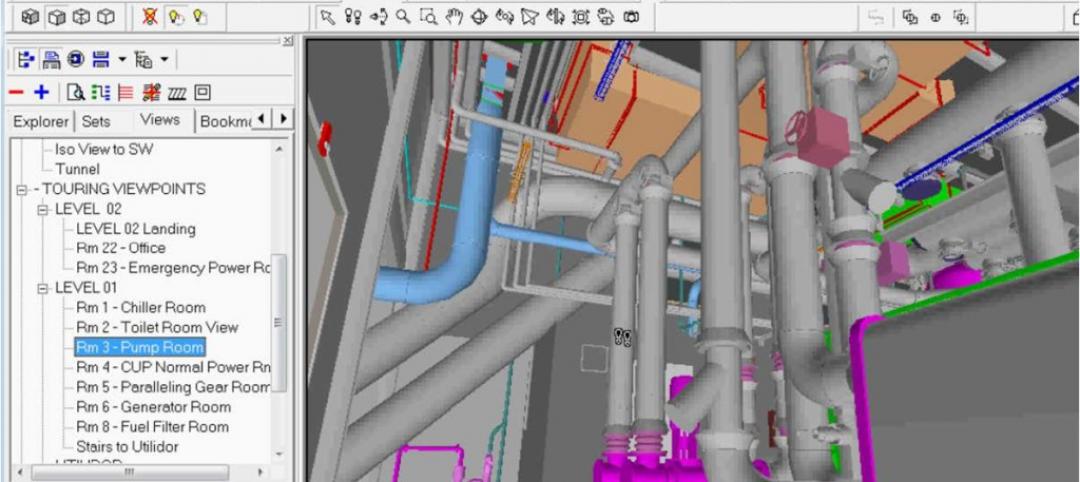

5 ways virtual modeling can improve facilities management

Improved space management, streamlined maintenance, and economical retrofits are among the ways building owners and facility managers can benefit from building information modeling.

| Jan 10, 2014

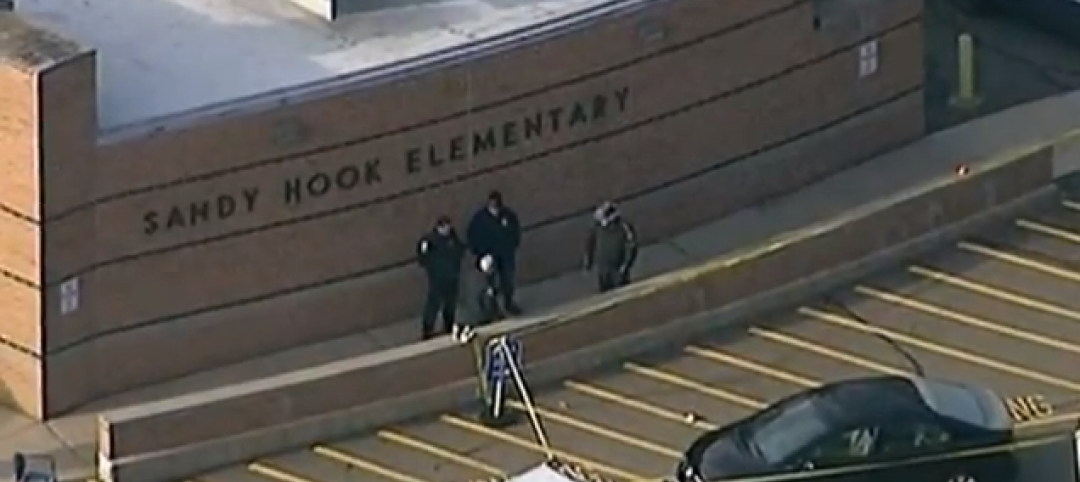

What the states should do to prevent more school shootings

To tell the truth, I didn’t want to write about the terrible events of December 14, 2012, when 20 children and six adults were gunned down at Sandy Hook Elementary School in Newtown, Conn. I figured other media would provide ample coverage, and anything we did would look cheap or inappropriate. But two things turned me around.

| Jan 10, 2014

Special Report: K-12 school security in the wake of Sandy Hook

BD+C's exclusive five-part report on K-12 school security offers proven design advice, technology recommendations, and thoughtful commentary on how Building Teams can help school districts prevent, or at least mitigate, a Sandy Hook on their turf.

| Jan 10, 2014

Resiliency, material health among top AEC focuses for 2014: Perkins+Will survey

Architectural giant Perkins+Will recently surveyed its staff of 1,500 design pros to forcast hot trends in the AEC field for 2014. The resulting Design + Insights Survey reflects a global perspective.

| Jan 9, 2014

How security in schools applies to other building types

Many of the principles and concepts described in our Special Report on K-12 security also apply to other building types and markets.

| Jan 9, 2014

16 recommendations on security technology to take to your K-12 clients

From facial recognition cameras to IP-based door hardware, here are key technology-related considerations you should discuss with your school district clients.

| Jan 7, 2014

Concrete solutions: 9 innovations for a construction essential

BD+C editors offer a roundup of new products and case studies that represent the latest breakthroughs in concrete technology.

| Jan 6, 2014

What is value engineering?

If you had to define value engineering in a single word, you might boil it down to "efficiency." That would be one word, but it wouldn’t be accurate.

| Jan 6, 2014

Green Building Initiative names Jerry Yudelson as new President

The Green Building Initiative announced today that it has named Jerry Yudelson as its president to accelerate growth of the non-profit and further leverage its green building assessment tools, including the highly recognized Green Globes rating system.