The market outlook for Multifamily “continues to be positive,” and is expected to remain strong “for several more years,” according to Freddie Mac’s latest projections.

The multifamily rental market is in its sixth year of robust growth. And there are several reasons for optimism about the sector’s near-term future, says Steve Guggenmos, an economist and Senior Director of Multifamily Investments and Research with Freddie Mac. For one thing, “growing demand continues to put pressure on multifamily occupancy rates and rent growth.” Occupancy rate in the second quarter of this year, at 4.2%, fell to a 14-year low. Meanwhile, rent growth expanded by 3.7%.

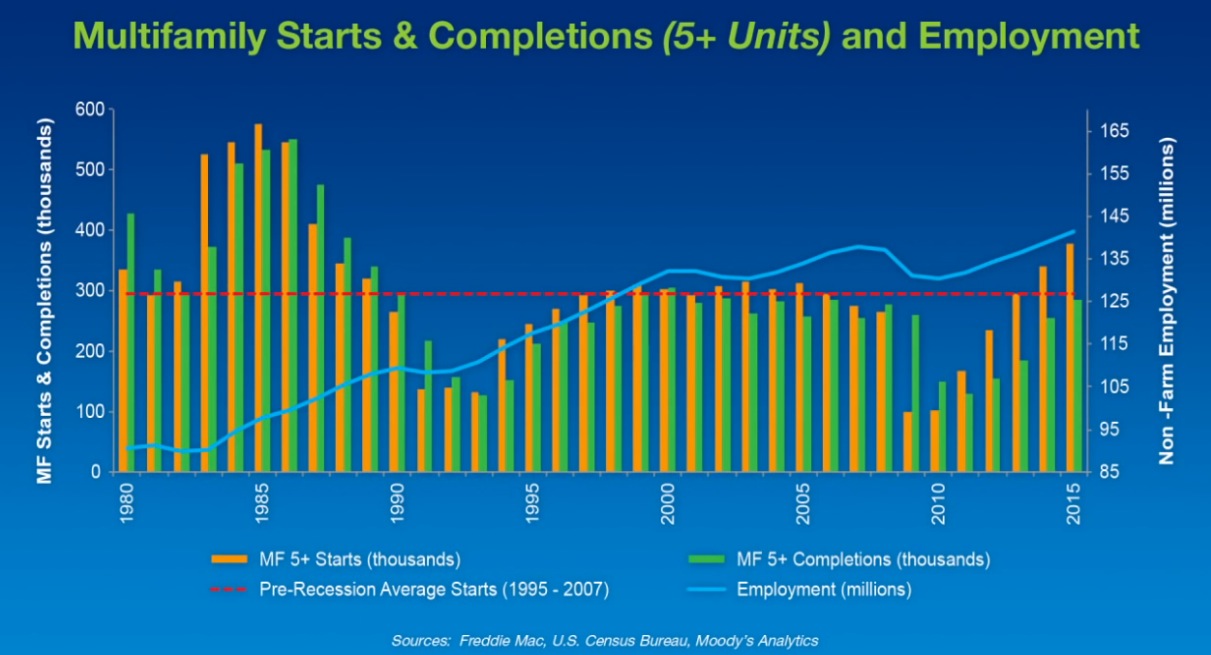

The supply side “is just starting to catch up” with demand, and in the second quarter hit the highest level of completions—an annualized 285,000—since the 1980s. Newsday reported last week that demand for multifamily housing on Long Island, N.Y., pushed the number of local construction jobs—80,500 in August—to its highest level in at least a quarter century.

While completions nationwide could remain elevated over the next few years, demand should be able to absorb most of that supply, keeping vacancy rates down.

The multifamily sector is definitely benefiting from an improving economy that has released pent-up demand, says Guggenmos. Labor markets are growing (the unemployment rate stood at 5.1% in September, according to the Bureau of Labor Statistics). And Freddie expects the country to add more than 2.5 million new jobs in 2015. However, full employment “remains elusive,” and the one negative has been wage growth, which only now is starting to pick up but still lags rent growth.

Since the end of 2014, household formations have continued to rise, and the majority of those formations chose rental housing. Freddie expects that pattern to continue, for three reasons: the economy will get even better, Millennials are moving into adulthood, and positive net migration.

Guggenmos also cites the “strong appetite” among investors for multifamily properties, “especially in major markets.” And he expects origination volumes to remain on the upswing into 2016 because of favorable loan rates, property cash flows, evaluations, and increasing loan maturities.

Freddie foresees rent growth moderating to 2.9% in 2015, and to keep retreating to 2.4% in 2016, as vacancies (which it forecasts to inch up nationally to 4.9% in 2016) and rents converge to “a historic norm.” Freddie sees only three metros—Washington D.C., Austin, and Norfolk, Va.—where vacancy rates might be “meaningfully” higher than the long-run average in 2016. Conversely, Freddie sees Houston’s multifamily market is among those that are at the greatest risk of economic impact from low oil prices.

Related Stories

Multifamily Housing | May 8, 2019

Multifamily visionary: AvalonBay’s relentless attention to detail

The nation's fourth-largest owner of apartments holds more than 85,000 apartments in 291 communities.

| Apr 28, 2019

New York Is NOT Most Expensive City for Apartment Sales Transactions

Data from Marcus & Millichap 2019 U.S. Multifamily Investment Forecast on Average Price/Dwelling Unit in apartment transactions.

Multifamily Housing | Apr 27, 2019

5 noteworthy multifamily developments

Special-needs housing in West Hollywood, Calif., and a warehouse-turned-apartments in the Twin Cities are among the notable multifamily projects to open recently.

| Apr 26, 2019

Organized Living Offers ‘Century Gray’ Product Finish for Multifamily Storage Systems

Organized Living releases new color option for apartment and condominium storage systems.

Multifamily Housing | Apr 23, 2019

Recharging Edison’s batteries

America’s greatest inventor would have appreciated this project team’s ingenuity and persistence.

Multifamily Housing | Apr 17, 2019

Multifamily real estate trends for 2019 and beyond

Boomers are on the move and Millennials are seeing upward mobility, but issues with affordability and housing product mix persist.

Multifamily Housing | Apr 16, 2019

Multifamily rentals are still alive and kickin’

Apartments are being built, and in goodly number. But not enough of it is affordable.

Multifamily Housing | Apr 12, 2019

NYC officials partner with nonprofit to build modular affordable housing

Thorobird and BACDYS partner with Brooklyn’s FullStack Modular on project.

Multifamily Housing | Apr 11, 2019

St. Augustine Terrace brings affordable housing to the Bronx

Magnusson Architecture + Planning designed the building.

Multifamily Housing | Apr 8, 2019

Priced to sell: DUMBO condo development offers starter units in luxury setting

Designed by ODA New York, 98 Front Street will be loaded with amenities like a salt water pool, co-working spaces, and indoor and outdoor fitness centers.