The market outlook for Multifamily “continues to be positive,” and is expected to remain strong “for several more years,” according to Freddie Mac’s latest projections.

The multifamily rental market is in its sixth year of robust growth. And there are several reasons for optimism about the sector’s near-term future, says Steve Guggenmos, an economist and Senior Director of Multifamily Investments and Research with Freddie Mac. For one thing, “growing demand continues to put pressure on multifamily occupancy rates and rent growth.” Occupancy rate in the second quarter of this year, at 4.2%, fell to a 14-year low. Meanwhile, rent growth expanded by 3.7%.

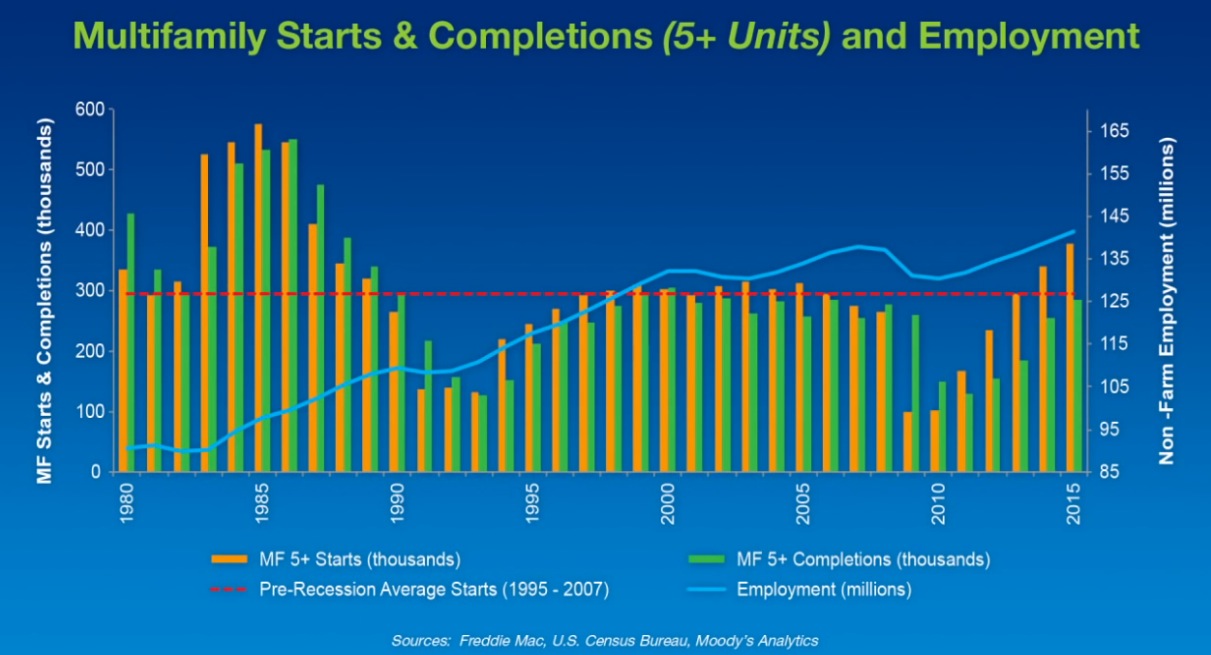

The supply side “is just starting to catch up” with demand, and in the second quarter hit the highest level of completions—an annualized 285,000—since the 1980s. Newsday reported last week that demand for multifamily housing on Long Island, N.Y., pushed the number of local construction jobs—80,500 in August—to its highest level in at least a quarter century.

While completions nationwide could remain elevated over the next few years, demand should be able to absorb most of that supply, keeping vacancy rates down.

The multifamily sector is definitely benefiting from an improving economy that has released pent-up demand, says Guggenmos. Labor markets are growing (the unemployment rate stood at 5.1% in September, according to the Bureau of Labor Statistics). And Freddie expects the country to add more than 2.5 million new jobs in 2015. However, full employment “remains elusive,” and the one negative has been wage growth, which only now is starting to pick up but still lags rent growth.

Since the end of 2014, household formations have continued to rise, and the majority of those formations chose rental housing. Freddie expects that pattern to continue, for three reasons: the economy will get even better, Millennials are moving into adulthood, and positive net migration.

Guggenmos also cites the “strong appetite” among investors for multifamily properties, “especially in major markets.” And he expects origination volumes to remain on the upswing into 2016 because of favorable loan rates, property cash flows, evaluations, and increasing loan maturities.

Freddie foresees rent growth moderating to 2.9% in 2015, and to keep retreating to 2.4% in 2016, as vacancies (which it forecasts to inch up nationally to 4.9% in 2016) and rents converge to “a historic norm.” Freddie sees only three metros—Washington D.C., Austin, and Norfolk, Va.—where vacancy rates might be “meaningfully” higher than the long-run average in 2016. Conversely, Freddie sees Houston’s multifamily market is among those that are at the greatest risk of economic impact from low oil prices.

Related Stories

Multifamily Housing | Nov 7, 2019

Multifamily construction market remains strong heading into 2020

Fewer than one in 10 AEC firms doing multifamily work reported a decrease in proposal activity in Q3 2019, according to a PSMJ report.

| Nov 6, 2019

Solomon Cordwell Buenz opens Seattle office, headed by Nolan Sit

National design firm brings residential high-rise expertise to the Pacific Northwest

| Nov 6, 2019

Passive House senior high-rise uses structural thermal breaks to insulate steel penetrations

Built to International Passive House standards, the Corona Senior Residence in Queens, N.Y., prevents thermal bridging between interior and exterior steel structures by insulating canopies and rooftop supports where they penetrate the building envelope.

Multifamily Housing | Nov 5, 2019

The Collective Paper Factory is the co-living company’s first U.S. location

The building offers a stay model ranging from one night to 29 days.

Multifamily Housing | Nov 4, 2019

A historic ice cream factory now provides Milwaukee with affordable housing

Thanks to projects like this, the Lindsay Heights neighborhood is definitely on the upswing.

Multifamily Housing | Oct 31, 2019

Soltra at SanTan Village breaks ground in Arizona

Todd & Associates designed the project.

| Oct 30, 2019

James McHugh Construction breaks ground on 1000M, Michigan Avenue’s tallest tower to be

McHugh will start work on the 832-foot-tall residential 1000M tower in December 2019.

| Oct 30, 2019

The Beach Company acquires land for multifamily community in Chattanooga

River Rock project will add 163 apartments near the Tennessee River in Chattanooga’s downtown riverfront district.

Multifamily Housing | Oct 30, 2019

Techno-magnet: Multifamily development attracts top tech workers, students

Proto Kendall Square is wooing grad students and millennial STEM workers from what’s arguably ‘the most innovative square mile on the planet.’

Multifamily Housing | Oct 25, 2019

Chicago’s long-gestating luxury condo tower nears construction

Helmut Jahn designed the project.